FREIGHT costs continue to dampen Australian agriculture’s competitiveness on international markets according to a new Deloitte Access Economics report commissioned AgriFutures Australia.

The study provides an analysis of transport costs facing Australian food and fibre supply chains when moving commodities from farm to port, and all links in the chain in between.

The report shows that Australia has comparatively higher freight costs for many key farm commodities, including beef, compared to our international competitors.

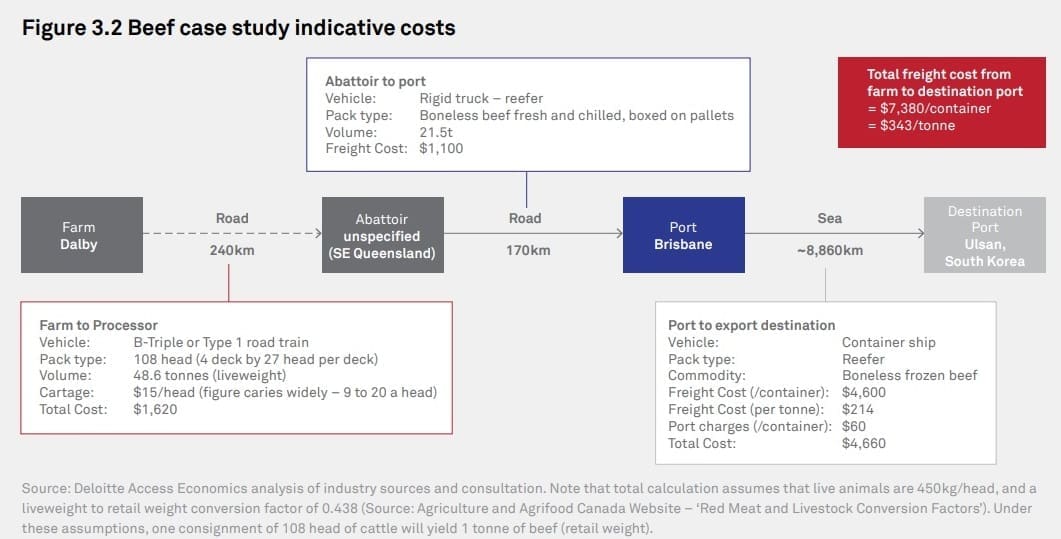

A beef industry case study in the report, based on a cattle property near Dalby, Queensland, supplying an abattoir in southeast Queensland exporting beef through the Port of Brisbane, produced an estimated total freight cost in delivering one container-full of frozen beef to Korea at $7380, or an average cost of $343/tonne. The cost to deliver to port (excluding shipping costs) was $2720 (more details below).

AgriFutures Australia managing director John Harvey said freight costs were critical to maintaining Australia’s global competitiveness and would continue to impact agriculture’s export performance into the future.

In Australia, freight costs were highest for grains at 27.5pc of gross income, with beef at 6.4pc and sheepmeat 5.8pc. Chicken meat was lowest, at 1pc, due to its regional/domestic nature.

“Knowing how much supply chains pay for transporting their produce to consumers is crucial to measure the competitiveness of Australian farm sector and to find out where the transport of agricultural goods faces pinch points and bottlenecks,” Mr Harvey said.

“Strategic planning and regulatory framework are required to ensure infrastructure can be efficiently utilised by industry,” he said.

National Farmers Federation chief executive Tony Mahar said the research provided a benchmark of Australia’s performance and its ability to compete on agricultural transport costs at a global level.

“It gives us solid data about the agricultural sector and challenges faced by different industries,” Mr Mahar said. “It is critical to look beyond the ‘now’ to consider future agricultural freight issues and to highlight possible options for potential improvement in transport infrastructure and regulation within the ag sector.”

Beef case study: Dalby, Queensland to South Korea

A beef industry case study based on a cattle property near Dalby, Queensland, supplying an abattoir in southeast Queensland exporting beef through the Port of Brisbane produced an estimated freight cost in delivering one container-full of frozen beef to Korea at $7380, or an average cost of $343/tonne. The cost to deliver to port (excluding shipping costs) was $2720 (see graphic below).

The study chose a Dalby (Queensland) property exporting beef to Korea via the Port of Brisbane as a ‘fairly typical’ supply chain for Australian boxed beef exports, in terms of the distance travelled, the steps involved (from farm to feedlot to abattoir to port) and the method of transport (containerised, shipped from Brisbane).

It calculated total transport costs at $343/t, representing around 6pc of the export unit value assuming an average export price of $6000/t for boneless frozen beef.

No specific issues were identified by stakeholders involved with this particular supply chain, however public reports have identified some issues impacting transport costs. In particular, road use restrictions and lack of investment in roads and bridges was raised as a barrier to the use of higher-productivity vehicles, which would decrease transport costs.

The case study assumed cattle are transported 240km by road from Dalby to a Southeast Queensland abattoir, and frozen meat is boxed and palletised at the abattoir and loaded into a refrigerated shipping container, which is delivered to Port of Brisbane by road (about 170km) and shipped to South Korea (around 9000 km).

Cattle in the region typically travel in a four-deck, 27-head average per deck unit of movement (the equivalent of a B-Triple or Type 1 road train). Meat travels primarily by road via refrigerated container, with average payloads ranging from 20 to 23t/vehicle movement. Dedicated rail services, known as sea-freighters, are also used in Queensland to move processed meat to markets from abattoirs. These trains can carry standard 20-foot and 40-foot refrigerated containers and have the capacity to move more than 20,000 twenty foot equivalents (TEUs) a year from central and northern Queensland meat processors to Brisbane for export.

CSIRO study

Analysis of figures from a 2017 CSIRO study indicated that the cost of freight represents approximately 6.4pc of the average value of gross farm production for beef across the 2010-14 period.

It is important to note however, that in the years following that period, cattle prices increased significantly, contributing to a greater value of farm production. As a share of 2014-16 values, cattle transport costs would represent around 4pc of total farm production, the report suggested.

It is important to note however, that in the years following that period, cattle prices increased significantly, contributing to a greater value of farm production. As a share of 2014-16 values, cattle transport costs would represent around 4pc of total farm production, the report suggested.

As a share of final value of beef and cattle (estimated as the combined value of beef exports, live cattle exports and retail value), total transport costs (including beef and cattle) represented 5.7pc of total value over the same period.

In a separate AFI study, the share of transport cost aligned closely with those outlined above.

According to the AFI study, the total cost of transport to port (within Australia) represented 5.1pc, 5.7pc and 8.7pc of the estimated farmgate cattle prices in Victoria, Queensland in Western Australia, respectively.

International comparisons

In comparisons with freight costs in other large beef producing countries like the US and Brazil, labour costs and fuel prices were considerably higher in Australia. Transport infrastructure was lowest in Brazil, but Australia still lagged considerably behind the US.

- Key differences in Australia’s market compared to the US included lower cattle loading capacity by road; lower road infrastructure quality; and higher diesel prices.

- Key differences in Australia’s market compared to Brazil higher cattle loading capacities; higher road infrastructure quality; lower diesel prices; and lower average wages.

Brazil’s poor transport infrastructure is reflected in the World Economic Forum’s global competitiveness report, which ranked Brazil’s transport infrastructure 65th in the world, with Australia 19th and the US 6th.

Barriers to productivity growth

A 2017 report produced for Meat & Livestock Australia identified several red meat freight supply chain issues:

- Barriers to productivity growth – regulatory and investment barriers inhibit the productivity of road freight. High productivity vehicles are not able to be fully utilised on road networks, resulting in a drag on productivity

- Monopoly infrastructure – seaports and the shipping interface are critical infrastructure, but can be subject to monopoly pricing

- Lost productivity – road and rail approaches to seaports constitute the largest single cost to moving a container through the port. Where road freight deliveries to ships do not arrive at optimal weights, significant productivity is lost.

The cost of transporting cattle by road in the US is estimated to be cheaper than in Australia. This mainly reflects a greater loading capacity of trucks, allowing freight costs to be spread across a greater number of, on average, heavier animals. Lower cattle transport costs in the US also likely reflect comparatively better transport infrastructure and lower fuel costs.

Like Australia, beef production in the US and Brazil is geographically dispersed. As such, supply chains in those countries are heavily reliant on long distance freight, with the primary mode being road transport.

Australian cattle typically moved along the supply chain more frequently during their lifetime than cattle in Brazil or the US. This is because Australian cattle farms typically specialise in a single phase of the production system (breeding, backgrounding or finishing), with cattle requiring transport between each phase–on average 2.3 movements per animal. In contrast, Brazilian cattle tend to spend their entire life cycle on a single property, traveling only to processing. In the US, cattle move properties one to two times on average throughout their life, although large volumes of grains are also transported to feedlots to support the US intensive lotfeeding production system.

Australia is more export orientated than Brazil or the US, with beef shipped from ports in most states. In contrast, international exports from the US and Brazil are predominantly shipped through a single port, Los Angeles and Sao Paulo.

Most Australian processing plants are also located in close proximity to ports, meaning beef is generally not transported a significant distance before being shipped overseas.

In contrast, Brazilian and United States processing plants are typically located closer to the supply of cattle for slaughter, with beef transported by road to their large domestic markets.

Click here to view the full report

Being almost 800km from Port of Brisbane, poor road and rail Infrastructure is a big drain on productivity.

Even if the issue of rail height restrictions can be fixed (in QLD, rail cannot accommodate high containers), trust is a big issue for two reasons.

a) Reefer monitoring

b) Hitting vessel receival windows

This forces us into the trucking business in order to deliver our containers to port.

On the roads we face weight restrictions due to inferior roads. For every 40’RE we truck to port, we lose on average 7mt of productivity. Don’t get me started on the 20′ containers.

Let’s put this into perspective. Say we deliver 500 40′ containers to port per year using current restricted loading rates. That’s 250 Road-train trips to the port p/a.

If we could load reefers to their load rating, 500 containers would become 370. Each year that would take 65 Road-trains off the highway.

Savings in freight costs are just monetary. The reduction in risk to lives, alone, has got to be worth it.

Not sure how accurate the freight rates are or the distance estimates.

Dalby is 240Km is used as the distance from Dalby to the abattoir, which virtually gets it to Brisbane.

But the abattoir is 170Kms from the Port.

Even based on the distance to Port, with one container on a truck, the costs used is nearly $3.25/Km, and excluding port related delivery fees, the transport is nearly $2.95/km. Great rates if you can get it.

I don’t think any processor in the South East uses rail to send reefers to the Port of Brisbane. Not all from CQ use rail.

27 head per deck might be an average but a bit low for slaughter weight cattle should be 22 per deck perhaps!

Great article highlighting this massive burden of transport cost.