INDONESIA has emerged as a serious customer for Australian boxed beef exports over the past 18 months, in addition to its long-established dominance as our largest live cattle export customer.

As reported in our recent review of October monthly beef export activity, Indonesia last month set an all-time monthly record for boxed beef volume out of Australia, at 11,026 tonnes. That figure was close to double the volume of trade seen in October last year, and followed on from September’s volume that trended much higher at more than 8500t.

The calendar year-to-date figure to Indonesia is also a record, at 68,494t – up 19pc from the same ten-month period last year, which was already the largest previously seen. The 2024 year-to-date tonnage is up more than 42pc on the past five-year average for the period.

The calendar year-to-date figure to Indonesia is also a record, at 68,494t – up 19pc from the same ten-month period last year, which was already the largest previously seen. The 2024 year-to-date tonnage is up more than 42pc on the past five-year average for the period.

The US Meat Export Federation has also reported rising boxed beef volume into Indonesia in August-September, which it described in a recent trade summary as ‘impressive growth.’

While it’s a figure rarely looked at, if Indonesia’s boxed beef and live cattle imports from Australia are combined, it elevates Indonesia within the top tier of export customer countries for Australian-derived ‘beef’. Add to that list the enormous volumes of Australian edible offal exports, and Indonesia’s significance rises even further, exceeded only by the traditional customer powerhouses of the US, Japan, South Korea and China for export tonnage (or equivalent in live cattle) out of this country.

Beef sales in addition to live exports

Significantly the rise in Australian boxed beef exports to Indonesia does not appear to be coming at the expense of, but in addition to our live cattle exports. While the two were somewhat competitive last year when Australian boxed meat prices were lower, in relative terms, this year the two were not directly in conflict, an Australian trade source said.

Indo live trade in September (October figures yet to be released) totalled 31,099 head, which was 2pc above the five-year average for the month. July and August live export shipments were both up in double digits, compared with last year.

September was a quieter month in general for live exports to Indonesia with many feedlots at full capacity and demand quieter following the busy religious holiday periods of Eid al-Fitr (Ramadan) and Eid al-Adha. However demand is expected to increase in the final three months of the year in preparation for next year’s Lebaran period in March and April 2025. An estimated 60,000 cattle are on floodplains in the Northern Territory in preparation for the November to December wet-season shipping period.

For the spikes in boxed beef export volume seen in September and October (and likely, November), at least four key contributing factors have been put forward by market watchers:

- Additional Indonesian import permits issued in the July-August 2024 period. Around 77,000t of additional allocation has been issued for 40+ companies, with permits valid till the end of the 2024 calendar year.

- Significant delays to cheap Indian buffalo meat imports this year. There were allocations for 100,000t of IBM for calendar year 2024, but contracts were delayed and imports from India only started to grow from July onwards. Boxed beef and live cattle imports are filling in the gaps left by the absence of IBM, and at the same time, IBM has gone up in value this year, making it less cost-competitive. In calendar year 2023 around 90,000t of IBM was imported by Indonesia.

- Indonesian importers have started to stockpile boxed beef supplies, in anticipation of a possible repeat of the lengthy delays in the Indonesian Government’s issuance of both boxed beef and live cattle import permits seen at the start of this year.

- Allied with that are reports that there has been considerable expansion in cold storage capacity in Indonesia in the past year or two. “There’s a lot more new refrigerated cold storage and freezers in Jakarta now than what any of us thought,” one trade source told Beef Central yesterday, indicating the country is now better equipped to handle perishable commodities like beef. Reports suggest there were also significant carry-over stocks of Indian buffalo meat held in cold storage at the start of this year, reducing the need to import in the early stages of 2024.

- Others are uncertain about the volume of 2025 import permits, given the new Indonesian Government, new ministries and new personnel.

Beef Central asked trade sources whether Indonesia’s growing middle class and expanding population were also factors in rising boxed beef sales.

“The growing middle class and income definitely does contribute to the growth and we’ve seen this in the last few years – particularly with the younger generations much more interested in dining out and seeking new experiences, including shopping at modern retail and online,” a Indonesian trade source said.

“The good news is that with the increasing middle income, population growth, nutritious meal program (helping to raise awareness about the importance of proteins), we expect continued demand growth in Indonesia,” the contact said.

“Consistently we have seen growth around 5pc year-on-year in Indonesia’s meat consumption.”

Another trade source noted strong and growing demand for higher-quality Wagyu and marbled grainfed beef in Indonesia – both US-sourced and Australian grainfed. The upper end of the Indonesian economy is said to be ‘in good shape’, with most of the larger volume of higher quality beef bound for the restaurant and hotel trade.

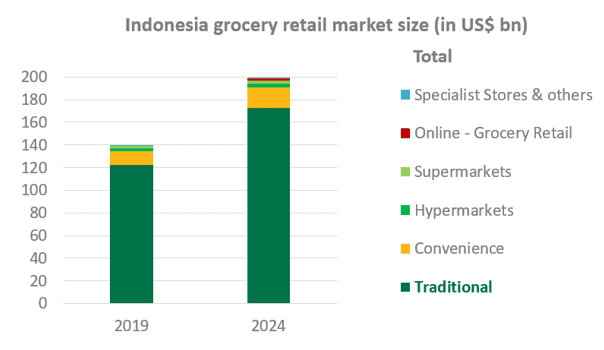

Despite the growth in boxed beef trade seen this year, the graph below shows that the country’s ‘traditional’ retail market channel (in the case of beef, the wet market) has in fact grown significantly over the last five years, since 2019 (dark green bar). Growth in retail via convenience stores, supermarkets and hypermarkets has occurred, but is modest in comparison with the traditional market channel.