DRIVEN squarely by business being written into the United States, Australia’s monthly beef exports for October have re-written the record books, hitting an unprecedented 130,048 tonnes.

The monthly volume was a bare 50 tonnes or 0.04pc higher than the previous record set back in July this year, and considerably larger than previous highs set back in 2015 during periods of drought cattle turnoff.

Calendar year-to-date figures have also produced a new record high for accumulated Australian beef exports, reaching an incredible 1.097 million tonnes, with two months of trade remaining for the full year.

For comparison, the January-October export trade volume last year reached 881,880t, representing a massive 215,000t advance this year, up 24.4pc.

The year-to-date trade volume suggests Australian beef exports will easily challenge the full-year record of 1.23 million tonnes, when full-year data is released next January. That’s looking particularly likely, as weekly slaughter volumes have shown a noticeable increase since mid-October, now frequently above 142,000 head according to NLRS national weekly slaughter data.

US headlines performance

As has been the case throughout the back half of 2024, exports into the United States have headlined the nation’s recent beef export trade surge.

Despite earlier challenges surrounding US port disruptions due to waterside strike action, Australia’s exports to the US east and west coast ports during October hit a blistering 45,338t.

That’s the second highest monthly tally on record, exceeded only by a massive +47,000t volume exported in September 2014, when the US industry was in its previous herds rebuilding cycle following drought.

There’s some evidence of skewing towards manufacturing beef into the US as the nation’s herd rebuilding commences, with Australia’s frozen shipments in October accounting for 33,700t of all consignments, representing 75pc of the total.

October trade into the US was up more than 8000t or 22pc on September, and a dramatic 17,700t or 64pc higher than October last year.

For October, the US accounted for almost 35pc of Australia’s total export activity – the highest monthly proportion seen since 2015.

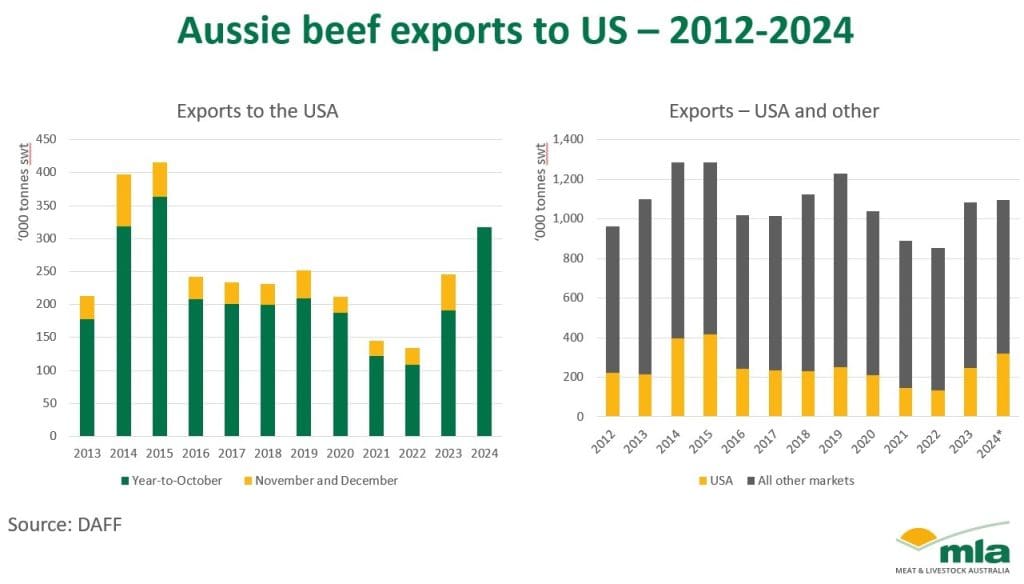

For the 2024 calendar year to date, US trade has reached a colossal 317,532t, a rise of almost 127,000t or 66pc on the same ten months last year.

With Republican Donald Trump looking increasingly likely to grain the US presidency as this item was published today, trade watchers remain concerned that he may revert to previous protectionist tactics and re-impose tariffs on Australian beef exports, despite the existence of a Free Trade Agreement.

Beef Central asked MLA analyst Tim Jackson to prepare the graphs below that tell the story of recent US import trade out of Australia, 2012-2024. Thanks Tim.

Other markets stronger

While the US was the obvious standout in Australia’s October beef trade, other major destinations also performed well, albeit in some cases because of tariff adjustments in the shape of Safeguard provisions.

South Korea, for example, was Australia’s second largest export customer in October, taking a near record 19,733t of Australian beef. The reason? The Safeguard mechanism contained in the Australia-Korea FTA (see details in this earlier story) triggered on 24 October, pushing tariff on all remaining 2024 exports from 10.6pc to 24pc. That caused some panic trading earlier in the month, as importers anticipated the Safeguard triggering, pushing volume sharply higher in the first 23 days of the month.

The previous month of September, Korea took 15,843t, representing a 3900t or 25pc rise, while a year ago, October volumes were at 17,500t.

Calendar year-to-date, Korea has now taken just over 163,000t of Australian beef, up 6pc on last year.

Trade into Japan last month was solid, rather than spectacular, despite the gradual decline in US export shipments to Japan as the US beef industry enters herd rebuilding.

October exports to Japan reached 15,021t, down about 2000t or 12pc on September, and back 1500t or 9pc on October last year.

Calendar year-to-date, Japan has taken 212,007t of Australian beef, around two-thirds of which was in frozen form, down around 42,000t or 25pc on the same period last year. Tight economic conditions and cautionary Japanese consumer spending are contributing factors.

China is another major export market impacted by recent tariff changes caused by Safeguard provisions under FTAs with Australia.

Australian exports last month reached 15,678t, down about 3pc on the previous month, as strong US bidding pushed some Australian export beef in different directions. The triggering of the Safeguard provision with China in early October also changed the trade dynamics, lifting Australia’s tariff from 12pc to 24pc until year’s end.

For the 2024 year-to-date, exports to China + Hong Kong (still reported separately by DAFF) have reached 157,079t, compared with 175,500t last year – a drop of 18,500t or 11pc.

Smaller and emerging markets

Smaller and emerging markets continued to perform strongly for Australian beef exporters, with Indonesia – arguably the best improver of all Australia’s basket of second-tier customer countries – hitting another monthly volume record of 11,026t – up another 2500t or 29pc on September, and a colossal 5360t or 95pc higher than October last year.

Calendar year-to-date, Indo has grown to a volume of 68,500t, up 10,700t or 19pc on the same period last year.

Elsewhere, the Middle East collection of seven countries saw exports climb to 3695t last month, up 25pc on September, and up a similar amount on October last year.

The United Kingdom market remains sluggish, at best, some 15 months after the FTA with Australia was struck, under much fanfare. Trade last month reached just 640t, around twice as much as this time last year, but still small change, on a global scale. For the year to date, exports into the UK are at 5074t, well outside Australia’s 12 largest customers.

European Union trade was a little improved at 1310t last month, up about 35pc on September and this time last year.

Canada has remained a dark horse throughout the year, taking another 3222t of Aussie beef in October, and almost 24,000t for the calendar year to date, as the country recovers from drought and high export demand into the US.