Downs country on Moonby, south of Hughenden

THIS week’s property review shines a spotlight on Queensland’s north and north-west property market showing the long-term investment benefit of grazing assets.

While more sale properties in central and southern areas of the state (and other parts of the country) are being passed in, Herron Todd White director Roger Hill said north and north-west Queensland were not being impacted negatively at this point.

“The region benefited from a really good season at the start of this year with another rain event in June resulting in plenty of grass and some spelling,” he said.

“Surprisingly, there is still a bit of colour in patches of grass indicating there is a good moisture profile heading into the wet season. It won’t take much rain and the grass should respond nicely,” Mr Hill said.

At present, only two holdings in the region are being publicly advertised for sale.

Moonby Station and Ophir Downs (see details below) are experiencing good interest and are benefiting from the fact there is nothing else available on the market.

According to Mr Hill, grazing business fundamentals (cattle prices, operating costs and capital costs) may have changed this year, but it has not diminished the underlying value of cattle station assets at this stage of the cycle.

He said this is confirmed by sale prices in the north and north-west Queensland marketplace.

“In general, property prices for reasonable to good quality country haven’t trended downwards yet and there is plenty of market depth for potential buyers seeking good quality country.”

“In general, property prices for reasonable to good quality country haven’t trended downwards yet and there is plenty of market depth for potential buyers seeking good quality country.”

There may be a reduced pool of potential buyers for cattle stations offered to the market this year, but Mr Hill said locally, there are buyers patiently waiting in the wings.

“Healthy inquiry levels and inspections are being undertaken by under-bidders who missed out at auctions such as Peronne, Camel Creek, Rhonella Park and Nardoo, as well as other private listings over the past five to six years,” he said.

“They have healthy balance sheets and good businesses and would be interested in buying more country if it came onto the market.”

Cattle station sales over 10 years

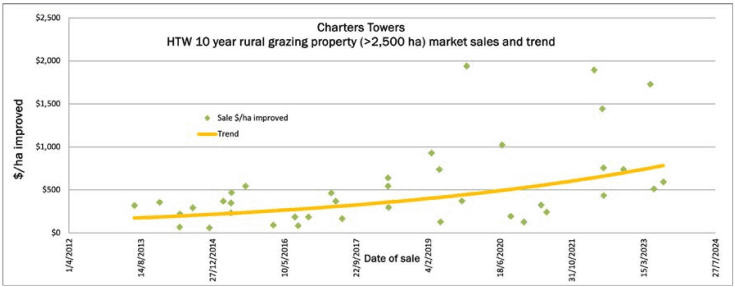

The above graph provides a scattergram of the past ten years of cattle station sales history in the Charters Towers forest country area.

Mr Hill explained that between 2013 to 2018, the sales dollar per hectare rates were tighter than the spread in the market in recent times.

“The trend line indicates a rough factorial movement of 4 to 4.5 times over ten years. This suggests an annual compounding rate of 15.8 percent per annum.”

“The ASX 200 index annual compounding rate over the corresponding period was 4.27pc, which proves the recent grazing property boom has been substantial to say the least,” he said.

This is evidenced by the re-sale history of Pallamana Station at Charters Towers which transacted four times over a six year period.

The 27,600ha breeder property is situated in a 600mm average annual rainfall district, 97km south of Charters Towers.

The resale history indicated the following annual compound growth rates, which Mr Hill attributed to a shortage of northern cattle properties on the market:

- February 2016 – May 2019 showed an annual compounding growth rate of 11pc.

- May 2019 to September 2020 indicated an annual compounding growth rate of 35pc.

- September 2020 to June 2022 – this resale period indicated an annual compounding growth rate of 63pc.

Mr Hill analysed the annual compounding growth rate from the first sale in February 2016 to June 2022 as 28pc per annum.

“In the 2019 to 2022 period, Charters Towers prices galloped along, and while there were a number of contributors, none were perfectly identifiable.”

One contributor was the $70 million spend by the Defence Department to acquire land north-west of Townsville for a multi-billion-dollar defence initiative.

Mr Hill said producers who were bought out sought new country which resulted in a property shortage.

“Interest rates were at record lows, cattle prices were at record highs and southern Queensland buffel and brigalow country was getting expensive, so producers seeking expansion looked north.”

Going long on beef

Mr Hill said unlike commercial assets, where value is almost immediately impacted by a change in profitability, there is a lag (lower volatility) in grazing land asset values.

“Pubs, motels and caravan parks are valued and purchased on their economic worth or business fundamentals and risk profiles of the day. As a result, their values can be quite volatile.”

He said price fluctuations are slower for cattle stations.

“Some property investment analysts call this a hedging position against inflation or national or global economic volatility. Some simply, call it ‘going long’ on beef.”

Mr Hill said throughout the property cycle there was a varied relationship between economic worth and market value due diligence.

“The present economic worth of cattle stations has dropped away based on the combination of cattle prices, interest rates and operating costs. However, longer-term confidence is such that the market is still paying similar value rates to last year’s values.”

“At this stage, they are not following the direction of the economic worth trend line.”

Mr Hill is noticing the buyer spread of potential pricing for a property is widening to as much as 25pc of the eventual purchase price.

“This reflects the variance in due diligence and confidence and may place pressure on existing market values in time.”

What lies ahead?

When asked whether similar property price gains were ‘likely’ or ‘unlikely’ over the coming decade, Mr Hill said it was not for him to say.

“Many producers are aware that storm clouds are on the horizon for the next year and the risks to market values given the deterioration in the trading environment.”

“At this point in time, properties that are selling are achieving similar money to last year and once again, reflecting the longer-term confidence, that is what I call ‘going long’ on beef.”

Properties currently for sale in QLD’s north & north-west

Moonby Station

The 10,312ha exclusion fenced Moonby Station, 37km south-west of Hughenden, west of Charters Towers, is a backgrounding or finishing block set up for either cattle or sheep.

The heavy carrying capacity country is prickly acacia-free and mostly growing with Mitchell and Flinders grasses on soft self-cracking soils.

A feature is the tight gidgee pebbly ridges that fall away to the Wariana Creek.

Moonby is also watered by the Little Wariana Creek, other channels, three bores (two are equipped).

It has good all-weather access on a bitumen road to Hughenden to the north or Winton to the south.

Moonby Staion, south of Hughenden

Ophir Downs

Ophir Downs, a North Queensland finishing depot, has been relisted for $5.7 million. Located 14km from the Richmond Highway, the 9631ha property is near Marathon, 96km from Hughenden and 46km from Richmond.

Ophir is currently destocked but is capable of running up to 600 head in dry years and 1200 head during good rainfall years – averaging 800 head (300kg to 550kg backgrounding weight).

Featuring undulating black soils and to flat downs country with black soils and some red pebbly ridges, Ophir Downs is mostly grassed with Mitchell and Flinders and some buffel.

Recently, 20km of new fencing has been erected. Since 2014 all the internal and boundary fences have been replaced.

Ophir Downs has some seasonal creeks and channel areas and is watered by a capped bore (installed in 2010) supplying a turkey’s nest and tanks, as well as five dams.

Ophir Downs yards

HAVE YOUR SAY