THE continuing question of what return a rural property can demonstrate has been the source of endless discussions between valuers, investment managers and accountants involved in financial modelling of rural land assets.

The Australian Farm Institute has for its winter edition sought to investigate this question, and I was fortunate enough to be asked to contribute to the discussion.

For those interested in reading the five articles from industry and educational institutions, go to the website www.farminstitute.org.au

The process of writing this article was good, in that it really challenged me to look nationally for information and data to see where the value relationship to land and returns sits, based on settled sales over many years.

Buyer motivation, data access and credibility, and commodity and seasonal fluctuations are among the variables that influence a decision about how much someone will pay for an asset.

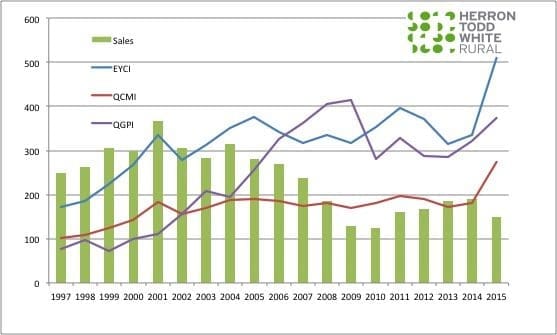

So while a complex calculation may be able to be built I asked our research guy, Rick, if he could simply overlay to Eastern Young Cattle Index (EYCI) and Queensland Cattle Market Index (QCMI) across the Qld Grazing Property index (QGPI) as reported annually by Herron Todd White and see what came up.

The result is presented below, and it reveals an interesting story.

EYCI and QCMI with the QGPI for settled sales over 2000ha

Source: Herron Todd White and RP Data.

For the period 1997–2004, the result reflected that the land values moved inline with, but about six months behind, the underlying commodity movements with a high conviction.

From 2004-2009 however, the value of rural land growth to the peak of the market in 2009 was significant, with values increasing 62 percent on the median price in the five years, while the ECYI decreased 15.5pc and the QCMI decreased 10.6pc.

In other words, the driver of land value was not reflective of the commodity return. This disconnect was also highlighted in the QRAA Rural debt surveys in 2009 and 2011.

From 2009-2013, the connection between land value and commodity return come back into relative alignment, but largely because of the fall in land values, not the rise in commodity prices.

The years 2014 and 2015 then show the impact of the significant shift in the beef pricing and subsequent impact on land values. The rate of growth in the curve for the EYCI and QCMI is as sharp as any point in the last 20 years, which is no surprise for those in the industry. The jump in land values however is possibly more of a surprise.

Is it sustainable?

So the question then moving forward for all stakeholders is, What is the sustainability of the commodity market pricing relative to current saleyard, processor grids and live export pricing?

There are potential risks out there (Indian frozen buffalo meat exports, Brazilian beef exports etc) that could place a cap on prices and possibly see a reduction in the commodity marketplace. If this were to occur, the logical view would be that the land values, if still following the lag period, would adjust accordingly – or at least flatten out.

I have recently presented to a few banks and corporate clients and commented that the rapid rise in land values in some sense has actually in my mind brought time forward. Where we thought the values may get to in say 2018 have been achieved in 2015/16.

The shift has been good for vendors and agents are reporting across the country that it is harder to find or list assets relative to the demand currently. Does the market settle a bit to draw breath or does demand see another level of value shift in land? Only time will tell.

Conclusion: Forecasting the land value movements based on the commodity price overlay which has a six-month lag maybe a good guide to looking at least into the short-term land market values.

This assumes the connection between the commodity outlook and the land values remains high. Of course valuers are not there to forecast or predict the future – they deal with settled sales evidence and hopefully in a consistent manner of analysis so that our clients have a consistent reference for the conclusions drawn.

Tim Lane is National Director – Rural with valuers, Herron Todd White

Tim, what was the correlation table telling you about how the data sets move together? Was it closer to 1 or 0?

With 1 being that commodity prices and rural land value move together strongly; or zero, where they do not move together at all: or somewhere in the middle at the semi-strong or semi-weak range?

Or was it a negative correlation?

Also, was the commodity price data just meat prices; and if so, all data, or just foreign sales?

Was the data gathered, as a look through the cycle, for predictive purposes in valuation of future likely outcomes?

Was multi-variate regression analysis used, or simple with two variables?

Is there a printed report able to be accessed by the public on the research done?

Thank you, Tim

An excellent article, and thank you for the insights.

May I suggest, with all due respect, spot prices in any market are driven by the factors of supply and demand at the macro level, and further factors peculiar to individuals and corporations at the micro level: it could be opportunity that causes a buyer to pay a premium, due to a new market opening-up, or it might be family estate planning issues that cause a purchase or a sale.

However, at the end of the day, any investment must by logic, stand alone in sustainable viability and return on investment; else it is a parasite on the portfolio.

Suggestion: Look at factors of economic and ecological sustainability, like the farm-gate price, and stocking rates, and kilograms per Hectare per mm of rainfall, through the lens of a rolling 10-year cycle, to understand the drivers of value in the rural valuation space.

Once you understand sustainable value, you may then look at the market (spot) price and it’s comparable ‘like a knat on speed’ type behaviours, to see where intrinsic value sits relative to price: and whether you are a buyer or seller, today.

If price is at or above intrinsic value then you might be a seller; and if below you might be a buyer: but you must ‘know’ what intrinsic value is first, and the smart buy-price is usually based on fundamental analysis, and usually at a discount to the intrinsic value, so there is a margin of safety in the investment.

At the moment, everything is red-hot, and reminds me of the early Seventies, when high cattle prices would “… go on forever!” Many did not make it.

Mark my words here; USA has opened the door to Brazil for grinding beef, as their cow herd is markedly down due to drought. But when that changes, and their domestic production is up to speed, that door may close again.

We are about four years behind USA in the drought department; also with a large supply-side problem, and very high prices and close substitutes; and about 7-years in time, is the road back to full production for Australia.

USA will then assert itself in Korea, Japan, and other traditional markets we have made ours; due to their domestic farm policy of subsidisation.

Decisions we make today about our investments will resonate for years to come; so choose wisely.

For an investment to be measurable as one, the Return on Invested Capital must be greater than the Cost of Capital: and looking through the lens of time. That is about revenue, not capital gain.

During times of low inflation, the focus is on revenue and the Profit and Loss Statement: when inflation is high, the focus is on the asset values in the Balance Sheet.

Due to extreme Monetary Policy settings, we have artificially low inflation at the moment; and in some cases negative inflation, causing asset disinflation, and eventually deflation.

Will interest borrowing rates really stay this low for a twenty-year period; or the term of a loan? I think not …

If you buy, stay lean, and throw everything at debt reduction, because when the yield curve changes and turns positive, and it will, you will have to hope that inflation arrives to hold up asset prices; and higher than the purchase cost.

The true drivers of value in the upstream food and fibre game, are production, productivity, and revenue; these are the things that will drive growth: if demand holds strong.

Happy investing …