Woolworths’ Australian food division (supermarkets plus online) reported sales of $25.9 billion for the half-year ended 31 December, up 5.4pc on the same period last year, while pre-tax earnings reached $1.57 billion (up 9.9pc).

The strong supermarket division result comes as both Woolworths and its major national retail competitor Coles face mounting scrutiny over retail food pricing and margins, especially in the face of dramatically lower livestock prices during the back half of 2023.

Brad Banducci

In a major surprise to the market, Woolworths managing director and chief executive Brad Banducci during this morning’s financial reporting announced his retirement. The move appears unrelated to current intense scrutiny into retail supermarket price gouging and market concentration, as a worldwide recruitment process preceded today’s announcement, including his departure, and his replacement.

Woolworths shares immediately fell 5pc on news of his departure.

Taking over from Mr Banducci from September will be Amanda Bardwell, an internal appointment who since 2017 has led Woolworths digital, e-commerce, data, and customer divisions known as WooliesX.

Amanda Bardwell

Ms Bardwell has led WooliesX from its infancy to become a $7 billion annual business (see online trading growth references below).

“The test of any CEO is to leave the business in much better shape than when they started,” Woolworths board chairman Scott Perkins told the market this morning. “On that simple metric, history will judge Brad Banducci to have been one of Woolworths Group’s finest leaders,” he said.

The broader Woolworths company, including New Zealand operations, Big W, and other non-food operations, reported half-year group sales of $34.6 billion, up 4.4pc on the same period last year, pre-tax earnings of $1.692b (+3.3pc) and net profit of $929m (+2.5pc).

Similar market scrutiny will be applied when major national supermarket retail rival, Coles, delivers its half-year results next Tuesday.

Woolworths reported mixed performance across its divisions in the first half, with solid results from Australian supermarkets somewhat offset by the impacts of a very challenging trading environment for New Zealand and BIG W divisions.

“Our customers’ concerns about the cost of living continues to impact our Value for Money scores, which remains our key focus for the second half,” CEO Brad Banducci said.

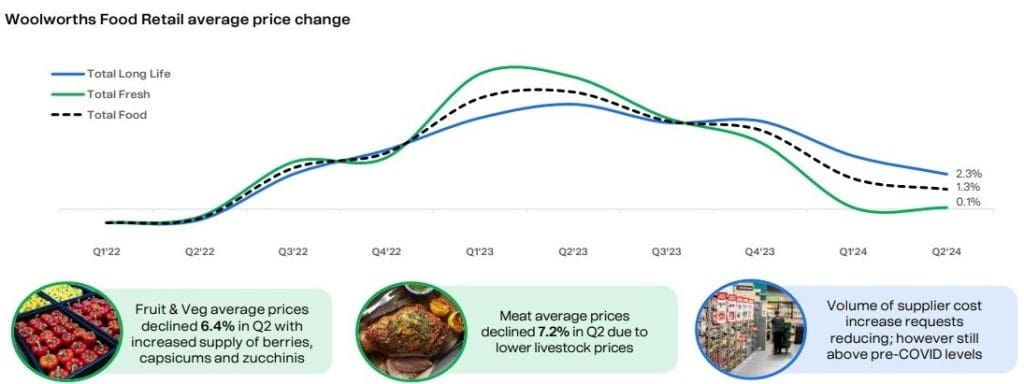

“Importantly, inflation in our food businesses continued to moderate during the last half, as favourable conditions in fruit & vegetables and meat led to price reductions in these categories.”

As part of its half-year presentation, Woolworths presented the graph below on retail average price change since 2022.

The green line shows fresh food (including meat) average price change trending sharply lower since the July quarter last year. Woolworths said average meat prices had declined by 7.2pc in the second quarter (October to December) due to lower livestock prices.

“Across the group, we also helped our customers to spend less through our Low Price and seasonal Prices Dropped programs, personalised member Rewards, affordable Own Brands, digital tools and Weekly Specials,” Mr Banducci said.

Woolworths total food retail (bricks-and-mortar stores and eCommerce) sales increased by 5.2pc in the first half, mainly driven by eCommerce and increased demand for fruit & vegetables and meat due to lower prices and improved shelf availability, the company said.

Woolworths online sales continue to grow rapidly, with one million active customers in December, and total sales for the first half worth $4.1 billion, up 27pc year on year.

On current trading and outlook, the company said sales in the first seven weeks of H2 F24 had continued to moderate, reflecting lower inflation and a more cautious consumer.

In the Australian Food division, Woolworths sales increased by 1.5pc for the first seven weeks of 2024, impacted by a further moderation in inflation and lower item growth.

Woolworths now operates 1534 food retail stores across Australia, an 8.2pc rise on this time last year.

The company reported an interim dividend of 47c per share, up 2.2pc on the prior year.

There are currently six inquiries either active or recently completed looking into supermarket pricing. They include:

- Supermarket Inquiry (ACCC)

- Select Committee on Supermarket Prices (Senate)

- Competition Review (Treasury)

- Australian Government Food and Grocery Code of Conduct Review 2023-24 (Treasury)

- Select Committee on Cost of Living (Senate)

- Inquiry into price gouging and unfair pricing practices (ACTU)

- House of Reps Standing Committee on Economics — inquiry into promoting economic dynamism, competition and business formation.

In Woolies Moro 4L Olive oil used to cost $33.

November 2023 $43.

March 2024 …. $65