In 30 years of meat trading I have never seen such a global protein deficit before, and I know of no other precedent in the last 100 years that rivals the situation brought on by African Swine Fever, independent analyst Simon Quilty writes in his latest ASF update. “To me these are uncharted waters that is likely to see many records broken, whether it’s for protein prices, protein volume flows to certain countries, or changes in consumer buying patterns of proteins. Nothing will ever be quite the same again after August 4 last year when Swine Fever first appeared in China,” he writes.

In 30 years of meat trading I have never seen such a global protein deficit before, and I know of no other precedent in the last 100 years that rivals the situation brought on by African Swine Fever, independent analyst Simon Quilty writes in his latest ASF update. “To me these are uncharted waters that is likely to see many records broken, whether it’s for protein prices, protein volume flows to certain countries, or changes in consumer buying patterns of proteins. Nothing will ever be quite the same again after August 4 last year when Swine Fever first appeared in China,” he writes.

WE are now looking at a critical global protein shortage next year due to the impact of African Swine Fever driven by China, as well as nine other Asian countries which have since contracted the disease.

These nine other countries will add to next year’s genuine global protein shortage. Such shortages are likely to lead to a substantial increase in prices across all proteins, and I see beef, in particular, having the largest price increase globally compared to pork and chicken in 2020.

These nine other countries will add to next year’s genuine global protein shortage. Such shortages are likely to lead to a substantial increase in prices across all proteins, and I see beef, in particular, having the largest price increase globally compared to pork and chicken in 2020.

Last week the USDA released its World Market and Trade Report outlining their outlook on global demand for beef, pork and chicken for 2020. Briefly, USDA is forecasting global beef production to be 1 percent higher in 2020, global pork production to fall 10pc and global chicken production to be 4pc higher next year. In physical meat terms across all three species, this equates to a deficit in 2020 of 6.4 million tonnes (carcase weight) compared to this year. This, I believe, is largely attributed to African Swine Fever’s impact on Asia, and as stated, will no doubt lead to higher global meat prices in 2020.

China engine room

China has clearly become the engine-room of global protein demand, with the USDA’s forecasting global protein exports increasing by 6pc in 2020 or two million tonnes. This clearly falls well short of the 6.4 million tonne global deficit they have forecast. Yet even with this major protein shortfall, I believe the losses in China are likely to be far greater than the USDA’s conservative estimates and that a global protein deficit of 18mt is more likely with little to no ability for global meat production to respond with increased global exports.

Key points:

- Due to African Swine Fever the USDA’s estimate of a global protein shortfall is 6.4mt in 2020. This is based on China’s pork production falling 25pc next year. I think a more realistic fall in China’s pork production in 2020 is 54pc, which would mean a global protein deficit of three times USDA’s estimate equating to an 18mt deficit in 2020.

- China piglet prices continue to surge increasing 151pc compared to this time last year

- China pork carcase prices have spike to a record RMB 39.76/kg, 15.25pc higher than the previous week and 131pc higher than the same time last year. Chinese hog margins are at US$354/head and potentially going higher.

- The number of global China beef-approved export establishments are 285 compared to pork plants approved of 207 since Canada’s delisting, which has seen 39 pork and 13 beef establishments removed. This points to a genuine desire by China to buy more beef globally.

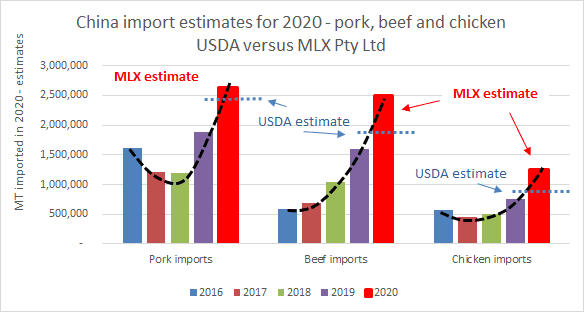

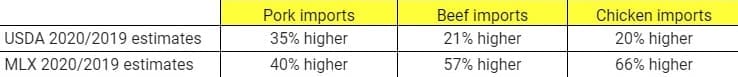

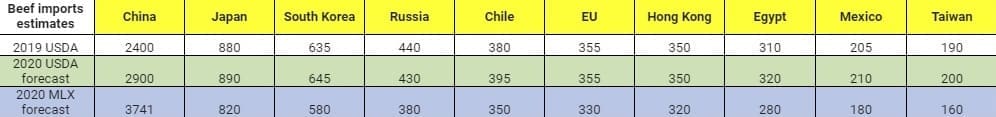

- USDA China’s import estimates in 2020 I believe fall short of what will be done. USDA estimates China pork imports will be up 35pc, beef imports up 21pc and chicken imports up 20pc on this year’s volumes. My estimates are much higher, with pork 40pc higher, beef up 57pc and chicken 66pc. My estimates add another one million tonnes (CW) of imports to China, and yet I believe this still falls short of China’s needs, but does highlight the greater global pressure that will exist for protein next year.

- The net effect of China’s protein deficiency is a 12pc fall in protein consumption or 8.4mt. My own estimates based on larger hog losses and a more aggressive import program results in a 28pc protein loss or a 20.2mt fall in China’s consumption – simply because the meat is not available within China and globally.

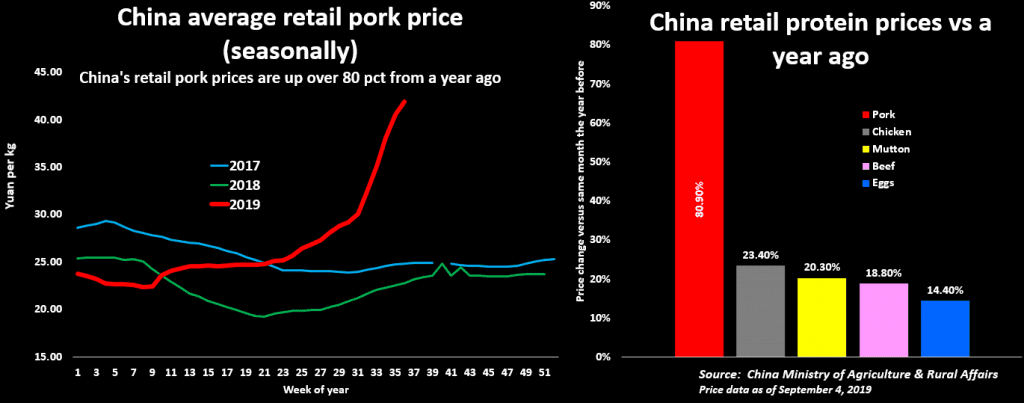

- This year’s estimated 4pc decline in China’s total protein availability has seen an average increase in China’s domestic retail protein prices of 62pc – with China’s retail pork prices up 81pc, beef up 19pc, sheepmeat up 20pc and chicken 23pc higher compared to this time last year.

- In 2020, I have predicted the volume of China’s total beef imports will exceed total pork imports for the first time ever, as the accelerated increase in beef imports continues. This flies in the face of convention, with beef imports worth almost twice as much as pork and chicken and having a much slower production response time.

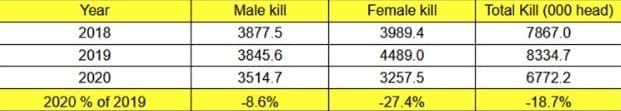

- The tightest global beef item in 2020 will be cow meat, and in particular lean grinding meat as Australia’s cow herd diminishes from the impact of drought with female kills predicted to fall 27pc and Australia’s total export volume to fall 20pc next year.

- Similarly, New Zealand’s role in supplying global grinding meat will diminish next year as the cuts that once were sold as lean hamburger trimmings are now being upgraded to individual cuts into China, which is paying a US10-20c/lb premium for these items over the US, Japan and Korea.

- This trend has been occurring for the last two years, but the volume of cow cuts is now growing dramatically as less Indian buffalo enters the grey channel and as China’s protein deficit gets greater.

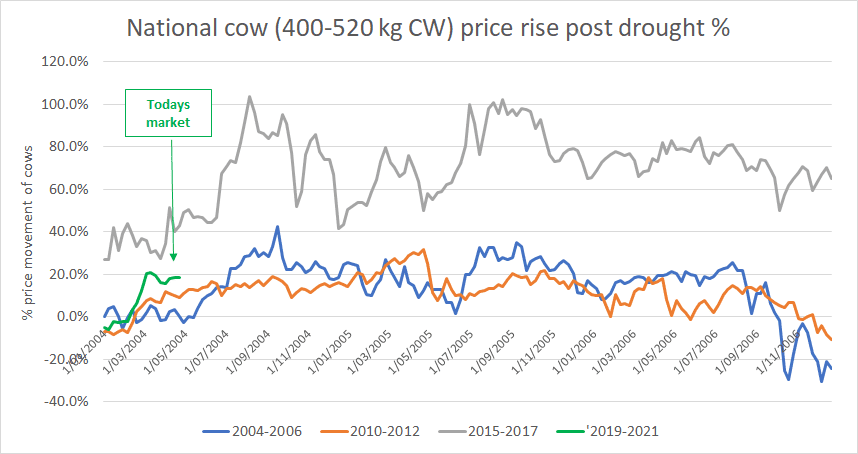

- Australia has entered, I believe, a new cattle price cycle that will last for at least four years and will see cattle prices rise for the next two years. Cow prices will be the first mover due to both the severe liquidation in Australia’s cow herd and the strong global prices for cow meat that will underpin livestock prices in Australia for many years to come.

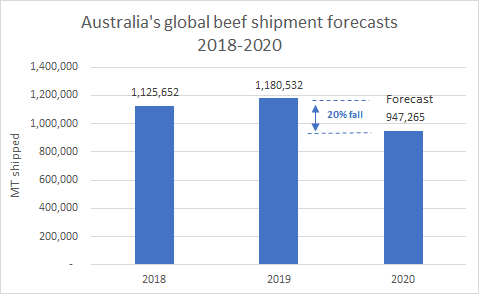

I am forecasting a 20pc fall in Australia’s beef exports in 2020 which will see a dramatic change in volumes that Australia ships to certain markets. I see lower shipments to all key beef markets except China. In short, I am forecasting Australia’s beef exports to Japan to fall 34pc, Korea to fall 30pc and US to fall 24pc next year. China will be the only exception, with beef exports 10pc higher, making China our largest market globally for 2020 by a long shot.

The phenomenon of China bidding-away traditional items from Japan, US and Korea is unlikely to change for many years to come, as beef becomes critical in filling the pork protein deficit caused by African Swine Fever.

China’s losses and needs are greater than USDA’s estimates suggest

The most contentious aspect of the USDA forecast is the fall in pork production for next year which they have at down 25pc on this year’s production and -35pc compared to 2018 production levels.

There is no doubt that the fear of ASF led to a surge in production in China in the first half of this year, as farmers brought their hogs to market early believing it was best to sell them for ‘something’ rather than get ‘nothing’ – which has seen 2019 production higher than expected, but importantly, an emptying pork supply pipeline that has followed.

It is because of the accelerated loss in herd inventory in recent months, the strong anecdotal evidence of large regional losses of greater than 80pc, and high hog prices and piglet prices that I am of the opinion that 70pc inventory loss is a realistic estimate. The ongoing high culling losses in Vietnam validate these figures, with the same accelerated rate of losses occurring. I also appreciate that there will be a strong desire to rebuild in China, but in reality this will be difficult without controlling the disease.

Pork prices rising

Last week, China piglet prices were at RMB 62.90/kg, which is 5pc higher than the previous week and 151pc higher than the same time last year, according to China’s Ministry of Agriculture and Rural Department. At the same time the tightness in China’s pork supply has seen wholesale price of pork carcase spike to a record RMB 39.76/kg, 15.25pc higher than the previous week and 131pc higher than the same time last year, according to Beijing Xinfadi Market, China’s largest northern livestock market.

As a result Chinese hog margins are at US$354/head and potentially going higher, with tight supplies and high retail prices. What few pigs remain means those that own them are making large profits.

China’s growing demand for beef is the most interesting phenomena in the last 12 months, with the number of global plants approved by China for beef exports is at 285 establishments and is well exceeding global pork approved plants of 207 establishments. China’s approval for global beef plants has increased by 17 and global pork approvals have actually fallen due to Canada’s ban with 39 pork and 13 beef plants being delisted.

As stated earlier, I believe a more realistic loss of 54pc in China’s pork production is more likely, though other market participants talk of 60-70pc losses in 2020. Vice Premier Wu has stated that the deficit by year’s end would be close to 10 million tonnes, and said that pork buying would be restricted for the last quarter of 2019 and the first half of 2020. If I am correct then the realistic shortfall in 2020 could well be closer to 15-20mt.

USDA has estimated China’s import increases for next year as follows: pork imports up 35pc, beef up 21pc and chicken up 20pc on 2019 imports. In contrast my estimates are for imports are pork up 40pc, beef 57pc and chicken 66pc. My estimates add another one million tonnes (CW) of imports to China and yet I believe this will still be well short of China’s needs.

Source: USDA and MLX Pty Ltd

With an additional one million tonnes coming into China, this will see tighter supplies elsewhere as beef, pork and chicken are re-directed from other markets in 2020 into China. The following are my estimates on these revised global beef imports – I have kept global beef availability but refocused on a greater volume of imports into China next year.

The lack of available grinding meat globally I have impacting the US the most, with imports down close to 27pc with Australia and NZ being the countries impacting this the most. I see US beef exports displacing Australian beef into both Japan and Korea as Australia’s exports to China increases by 10pc and falls to all other destinations due to lower production.

A rising tide lifts all boats

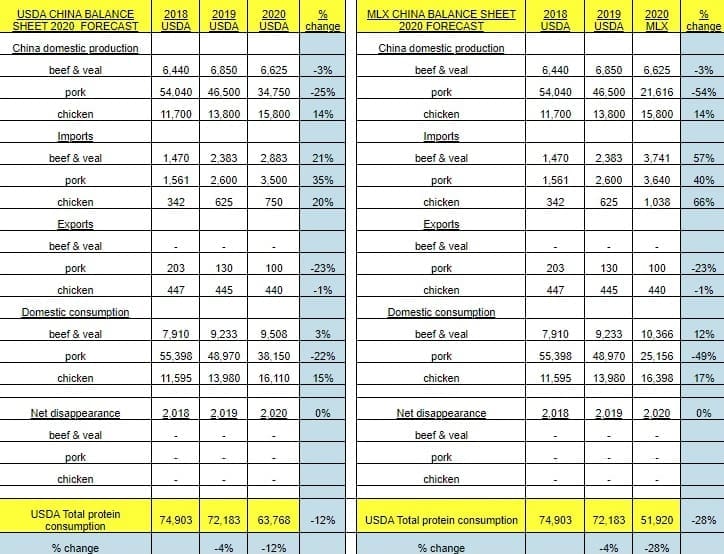

China’s expected high import needs on all proteins will see tightening of pork, beef and chicken globally and rising prices across all protein export markets. I have outlined below my own forecasts versus the USDA with regard to pork shortages in China for 2020 which they put at 35pc for next year compared to 2018 base year and I am working off a 60pc loss for same period – the USDA and my own difference in protein imports I have added to the balance sheet.

The net affect is the USDA China protein balance sheet forecast in 2020 a 12pc fall in protein consumption in China or 8.4 M tonnes, my own estimates based on larger hog losses and a more aggressive import program results in a 28pc protein loss or a 20.2 million protein deficit in China.

Source: USDA, MLX Pty Ltd

A ‘rising tide lifts all boats’, and no matter what figures you look at, my figures or the USDA’s – the dramatic shortfall in 2020 protein will be sizeable and is likely to lift all protein prices as the expression illustrates.

China responds with rising retail prices

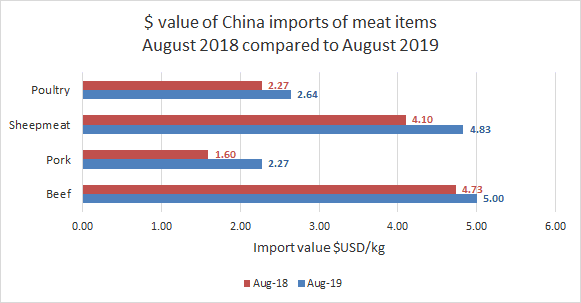

This is best illustrated by this year’s 4pc decline in China’s total protein (as per both tables above). This has seen an average increase in China domestic retail protein prices of 62pc and a 28pc increase across the average of pork, beef and poultry import values. This increase is based on a 4pc deficit. It is hard to imagine what this will look like with a 12pc deficit (USDA) let alone a 28pc deficit (MLX), but higher prices, to me, seem inevitable.

In 2020 I have predicted the volume of imported beef exceeding imported pork even though China’s pork deficit is so much greater than beef and chicken – beef also has the slowest generational production time to respond and is the most expensive to buy of the three proteins.

Why does China have a love affair with beef?

So why China’s love affair with beef?

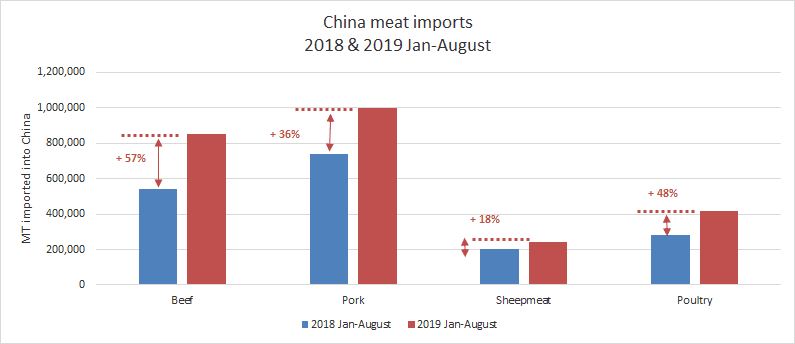

As stated earlier, I have got some very aggressive China import beef figures for 2020, with beef imports increasing by 57pc next year on the back of a 62pc increase this year. I have therefore maintained the trend of this year.

There is no doubt that imported beef is outperforming pork, poultry and sheepmeat in terms of volume percentage increase, but also in terms of sheer volume amount with beef imports up by 310,000mt compared to pork which is 264, 000 higher than last year. I am estimating in 2020 that China beef imports will exceed pork imports for the first time ever.

It should be noted that the value of beef imports on average is almost twice the value of pork and poultry imports, and yet China has a real preference for imported beef even though the other two proteins have a faster production ability and are much better value for money.

So why China’s love affair with beef?

The simple answers I believe are:

An expanding middle class who see beef (and sheepmeat) as a status symbol above pork and poultry. The more beef in China’s diet reinforces an improved standard of living which the Chinese government would want to promote.

China is possibly realising that with ASF spreading globally, that pork and poultry will be in demand within other affected countries, motivating their focus on beef.

The ability for poultry expansion is high internally and therefore the focus is on imported beef

Due to ASF, the demand for pork has fallen, estimates are 15-25pc with beef being consumers’ preferred choice. What is unclear is whether this is a short-term downturn in demand for pork and therefore how sustainable beef imports are at this rate. My thoughts are that beef imports will remain strong for at least five years.

Beef is seen to be less susceptible to diseases globally, with pork and poultry supply often disrupted due to disease outbreaks.

As stated earlier, the number of approved global beef establishments are 285 compared to 207 pork establishments – clearly pointing to a preference for imported beef.

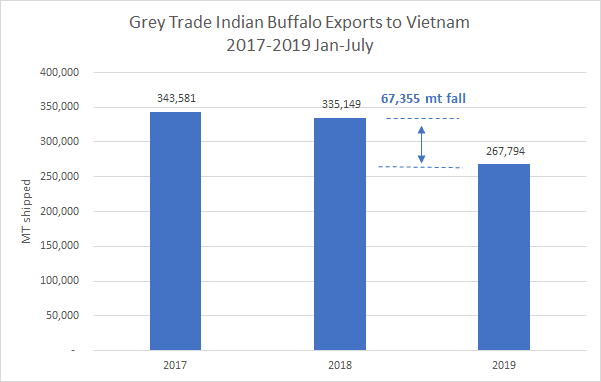

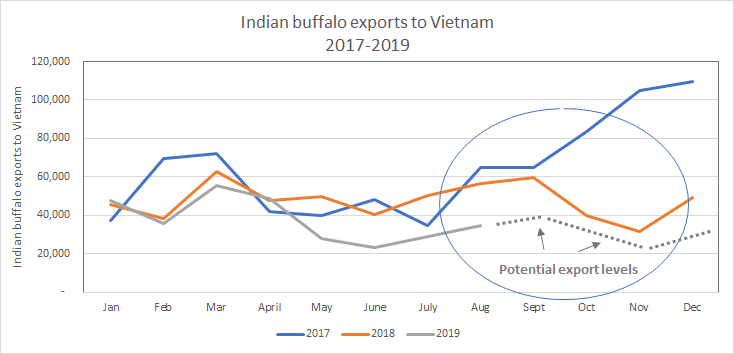

The grey channel on Indian buffalo has slowed and left a deficit of 70,000mt this year so far in China of beef which is adding to the overall beef shortage.

The trend in falling grey trade buffalo imports via Vietnam will be tested over the next 3-4 months as we move into the Chinese New Year buying period (Jan 25, 2020). Last year there was a very apparent step away from buying buffalo beef and if this occurs again I believe the direct imports of cow meat from Australia and NZ will play a crucial role in filling the void left by less buffalo meat.

So far the Indian buffalo shipments to Vietnam are down 20pc y-o-y, but if the exports remain low then I have estimated that overall exports for 2019 to be down 25pc from 2018 or the equivalent of 145,000t which will as stated potentially be filled by cow/bull meat from NZ and Australia over the next 3-4 months at the expense of the US market.

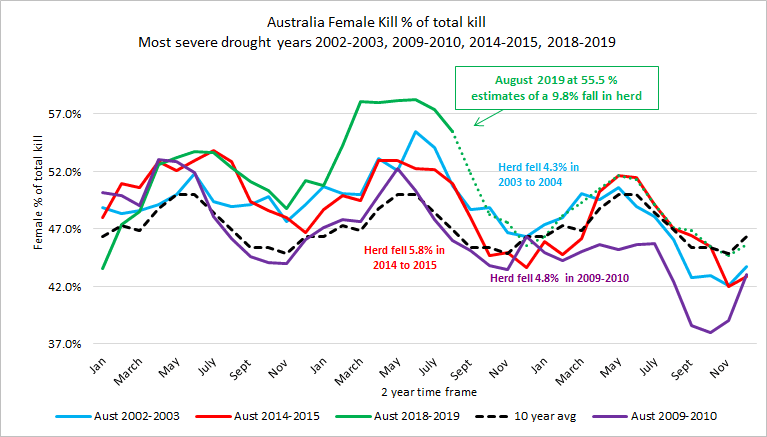

Australia’s cow scarcity in 2020 will add to a global shortage of beef

The drought in Australia is unrelenting with regards the liquidation of the Australian herd, and in particular cows, as Australia’s female kill once again is at a record level of liquidation of 55pc. The percentage is falling in line with a seasonal fall but it does beg the question: What does this mean for 2020 in terms of lower Australian global beef exports and the insatiable demand from China, which all points to potentially a global shortage of beef and in particular, grinding beef.

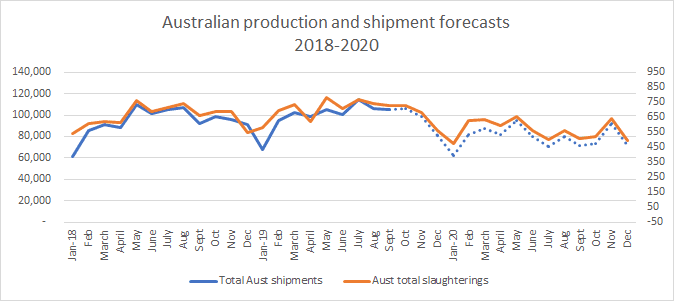

Australian production shortage in 2020

The impact of the high female kill is likely to see female kills in 2020 fall by almost 28pc, male kills fall almost 9pc with a net fall in Australia’s total kill of close to 19pc. This is likely to see a further retraction of Australia’s herd as the market looks to rebuild.

It is not unusual to see fertility rates fall the first year after a drought, but I am of the opinion that these falls in production will occur with or without the drought breaking, due to the critically low herd size that will be close to 24.5 million head by mid-2020 – a 30 year low.

Impact on Australia’s cow prices

The flow-on effect of the drought breaking and strong global markets has been that cow livestock prices are likely to remain strong, and rally even higher, as Australia enters the next cattle price cycle.

Even though it has not rained, the value of cows has started to move higher, and sits 20pc higher today than the average cow price of 2018. We saw a similar phenomenon in 2014 where Australia was in drought and still cattle prices moved higher – this is because the female herd size was at a critical low level, and global meat prices were firm. Demand outstripped supply and saw cow prices go higher with restricted supply and strong global demand – just as we are seeing today.

Low Australian production means low beef exports

Low Australian beef production means beef exports will fall, which I have estimated to be 20pc in 2020, and in particular shipments of lean meat will fall the most as cow slaughterings fall to critically low levels. Lean meat shipments could be more like 30-40pc lower next year particularly when the rain comes.

The lower production and the combined increased demand from China and the inability of others to compete is likely to see a dramatic change next year in shipment volumes and who gets what.

Australia’s beef exports are likely to lose market share (except China) next year – 2020 forecasts

When assessing the impact of the lower shipments, the increase in China demand and the potential displacement by US beef of Australian beef into Japan and Korea, I see almost all Australian beef markets next year falling in terms of market share, with China being the only exception – which I am expecting to be 10pc higher.

The other market which is likely to see displacement also is Indonesia where Brazil beef and Indian buffalo are likely to replace Australian beef.

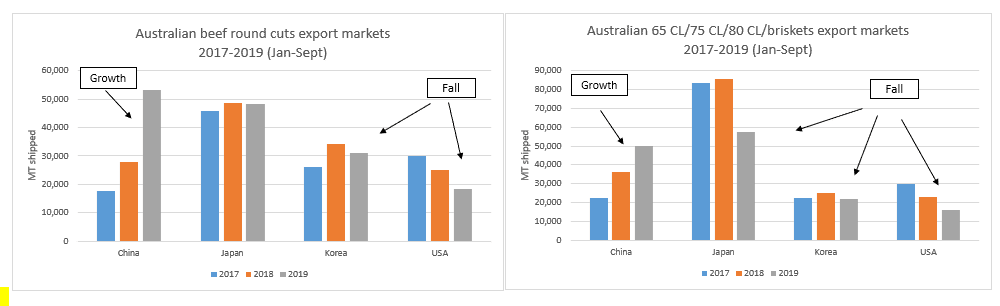

Given the lack of cows being slaughtered in Australia, this will lead to dramatic falls in lean grinding meat in particular. Items like 85 CL, 90 CL and 95 CL I expect will tighten dramatically from Australia. There are two key reasons why this will occur:

- Firstly, falling livestock numbers will mean simply less production, but the biggest loss has been females and with a rebuild these will be tight for many years.

- Secondly, what items are being produced are going to China as whole cuts. Previously, these items would have been sent as trimmings to Japan, US and Korea and used to make ground beef for hamburgers and other similar items. China is now taking them as value-added items as individually wrapped cuts, at significantly higher money than any other market.

China’s influence is on most beef items taking them away from traditional markets in both Australia and NZ.

Australia’s key markets have changed

One of the key concerns for Japan, Korea and the US is that China will take product away from each of these destinations. In the past, many items like round cuts would have gone to the US as grinding meat, but today due to China’s strong demand these cuts are being value-added and resulting in a shortage to the traditional markets such as Japan, Korea and the US.

The following graphs highlight the enormous increase in round cuts to China, namely at the expense of Korea and the US, and also the lower volume of grinding meat that is available due to the upgrading of items from trim to cuts. Note that the majority of growth in the graph of 65CL/75CL/80CL/brisket market has been in the briskets.

New Zealand key markets have changed

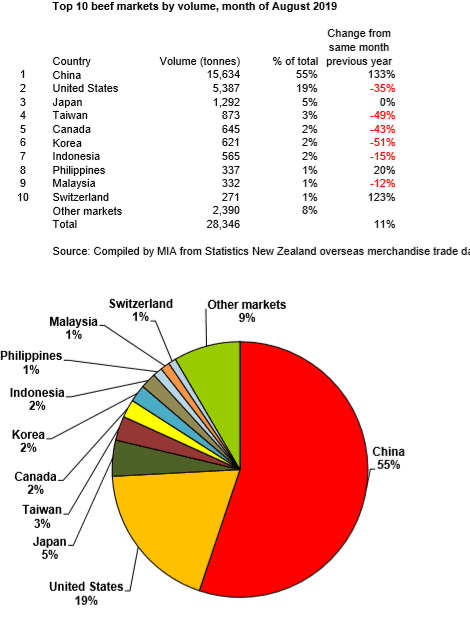

A similar phenomenon is happening out of New Zealand, whereby China is now taking 55pc of NZ beef exports, with the majority of these shipments being cow and bull meat in the form of cuts. What is interesting to note is that China’s market share has gone up 133pc and almost all other markets’ imports have dropped, with the US notably falling 35pc compared to the same month last year losing its status as NZ’s number one export market. Japan is the only exception and has remained at 5pc.

Source: New Zealand MIA

Conclusions

The fact that there is a looming global protein shortage in 2020 I don’t believe is in question. The only uncertainty to me is the size of the deficit with the USDA estimating a 6.4 million tonne shortfall, while I am of the opinion it could be three times greater than that, at close to 18mt globally.

The reason for the discrepancy is how we each interpret the losses in China due to African Swine Fever. The USDA has been conservative since August last year in the impact of the disease, and at times I believe the backdrop of the China/US trade war has made at times the degree of difficulty in analysing so much greater.

I have been of the opinion for the last 12 months that the impact of the disease has been dramatic within China and Asia, and that the losses of surrounding countries such as Vietnam has given us a transparent window into what the real rate of hog losses are within China.

The estimate I give of a 54pc loss in production next year versus the USDA’s 25pc loss is an important difference with enormous ramifications. I truly believe my estimate is more accurate and as a result will have an enormous impact for the global protein balance sheet for 2020 and beyond.

I have so often been asked what will be the impact on export prices due to the protein deficit in 2020, in this paper we have seen the difference in retail prices versus import values which are quite dramatic, and we also know that hog prices in China are three times the value of US hog prices.

So I have given an extremely wide indication of where potential prices will head ranging from 20pc to 150pc higher based on which protein and the time of year.

The issue I have is that I have never in 30 years of trading seen such a global protein deficit before, and I know of no other precedent in the last 100 years that rivals this situation. So to me these are uncharted waters that is likely to see many records broken, whether it’s for protein prices, protein volume flows to certain countries, or changes in consumer buying patterns of proteins. Nothing will ever be quite the same again after August 4 last year when African Swine Fever first appeared in China.

i think what makes this hard to get a grasp on is were dealing with a communist country?and a strong dollar,if poultry was traded on the board i would would b bullish that protein because you can populate them so fast.one last thing with beef it is a rich mans protein minus hamburger.one thing going for beef is its about weather and all that comes with it from calving out west in snow storms to muddy feedlots to hot summers ,our hogs r at least in controled enviroments.(my thoughts)