Just before we get started on today’s latest 100-day grainfed trading budget discussion, we encourage readers to click on the short Youtube video link below, to create an appropriate sense of atmosphere and occasion.

That done, we can announce that there was a record $49 profit recorded in Beef Central’s latest trading budget calculation carried out yesterday.

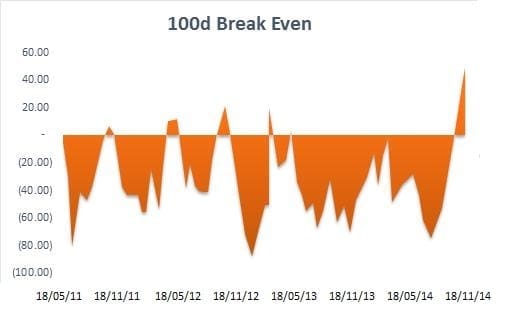

Profits of any size have been rare enough, as the graph below shows, but this one is easily the largest ever recorded in the three-and-a half years that this data has been collected.

It follows a ‘tantalising’ $3.50 profit in our last grainfed breakeven on October 23. Prior to that, it was 18 months ago that we last saw a trading profit on buying a typical feeder steer, placing him on feed at a typical Downs feedlot, and selling him after a typical grainfed export program.

The forecast results are based on our standard, chosen set of variables (see full list at base of page).

As our discussion below outlines, while feedgrain prices have again started to trend upwards, the price of our typical flatback feeder steer 450kg has eased enough recently to push the profit result well into the black, for a program closing-out after 105 days on March 10 next year.

As can be seen in the graph, plotting our 100-day breakeven results since we started this data-set back in May 2011, there hasn’t been a lot of traffic above the zero/breakeven line in the past three and a half years. Perhaps that is about to change.

The last time we saw a profitable trade was in May last year, when feeders were worth just 150c/kg, with forward finished cattle price at 350c/kg. It went close again in March this year when feeders again fell away in value, prior to some rain.

The latest result represents a dramatic $100 turnaround in fortunes from our trading budget calculated back on September 12.

Feeders ease 15c/kg

While there was a minor surge in feeder cattle prices this time a month or so ago, pushing our feeder steer buy-price up to 220c/kg, the continuation of desperately dry conditions heading into summer across Queensland, NSW and parts of Victoria has seen that trend ease again.

Today, Downs feeders hitting our flatback 450kg feeder spec can be had for anything from 200c to 215c/kg. Part of that price drop perhaps reflects a few owners looking at the forecast for attractive profit ahead, and electing to retain ownership and custom-feed, rather than sell. We’ve picked a figure of 205c/kg as representative for today’s breakeven calculation, representing a 15c/kg or $70 a head drop in value since this time a month ago. It values the feeder at $922, down from a record high $990 last time.

The low-point in feeder steer price in this report series came in May last year when it hit 150c/kg briefly ($675), meaning the purchase price has risen $247 a head since.

Despite the growing challenge in finding good heavy feeders, as evidenced by the year-long price trend, downs feedlots remain near full, due to the conditions.

If it rains, a lot of people think feeders will rise in value, perhaps dramatically.

Adding to supply pressure, a lot more Central Queensland cattle are currently heading north for live export, rather than south, because the specs are more accommodating than those offered by feedlots for feeder cattle.

With EU feeders currently at 240c/kg liveweight, and Wagyu feeders at 340c/kg, prices for heavy feeders next year at +300c/kg liveweight and perhaps as high as 350c/kg look very achievable. That applies, especially, given the profitability that continues to be evident at the export stage. Live cattle and domestic meat prices in the US hit all-time record highs again this week.

Supply, rather than price, will inevitably be the limiting factor on feeder steer prices next year, it seems. Rain will determine whether those price levels happen or not, however.

Ration prices lift again

For today’s budget, we’ve lifted our typical ration price, ex Darling Downs custom-feedlot, by $15/tonne, taking the figure to $365/t. While it’s rising, due to demand pressure and the grain seasonal outlook, it’s still well short of its recent peak of $385/t.

With most Queensland and Northern NSW feedlots at or very near capacity due to drought pressure, feedgrain demand continues at relentless pace, and it’s being reflected again in grain price. Without any seasonal break, most feedlot commodity managers are staying hard on the buy.

At the assigned ration price $365/t in today’s trading budget, it represents a total feeding cost over a typical 105-day program of $569, up $30 on our previous calculation.

That delivers a total production cost (steer price plus custom feeding price, freight, interest, contingency, levy and induction costs) of $1591, down $46 on last time (which was a record high of $1637/head).

Cost of gain, using our chosen variables (2kg/day ADG, for 210kg gain over 105 days) now sits at 272c/kg, up 11c/kg on the previous budget due to ration price adjustment.

All that delivers a breakeven on today’s budget of 451c/kg, down 13c/kg on last time, which again, was the highest figure Beef Central’s regular report had ever recorded.

Forward pricing for GF ox hits 465c

Based on Southeast Queensland direct consignment processor quotes provided today, our forward price for 100-day flatbacks going on feed now and closing-out on March 10 next year, is at 465c/kg, unchanged from a month ago, but 20c/kg higher than forward pricing seen in mid-September.

Some SEQ specialist grainfed processors are understood to have as much as 470c/kg available for conventional 100-day cattle for kills March next year, and up to 500c/kg for no-pill cattle. Such an attractive number perhaps suggests that SEQ grainfed specialist exporters are seeking to secure every grainfed beast they can, going forward, knowing that there is still plenty of fat left in the system.

The current forward price level for finished grainfed ox at 465c/kg is still only 15-20pc above longer-term historic levels, while any world beef price chart will clearly show price rises of 35-50pc for many export beef segments above long-term averages.

An Aussie dollar this morning at a four-year low of US85.27c, is another motivator for processors to bid-up.

All that, as mentioned in our intro, delivers a record trading budget profit in our latest calculation of $49 per beast. It represents a sharp $100 turnaround from our September 12 budget, when the loss was still minus $52/head.

Already that movement is seeing a fundamental change, with some SEQ yards taking the option to fill pens with cattle they own themselves, rather than custom-fed cattle owned by others. For the past 12 months, at least, there has been considerably more money for lotfeeders to be made in custom-feeding cattle for others, rather than buying feeder cattle and feeding themselves.

Looking back to earlier forward-purchased cattle

Looking back at 100-day cattle that went on feed back in August, for slaughter this week, their forward sale position was around 430c/kg, compared with the spot market for 100-day ox today at the same price. Today’s spot market at 430c/kg perhaps reflects the immense pressure processors are currently under with finding kill space for cattle in the run through to Christmas.

Effectively, it means processors do not have to try too hard to find a kill, and the abundance of cattle out there is putting a dampening effect even on 100-day grainfed values. Without that supply pressure, the market today would probably be more like a 450-455c/kg price, in which case those cattle bought forward back in August would have been 25c/kg in the black.

- Beef Central’s regular 100-day grainfed breakeven scenario is based on a standard set of representative production variables, ex Darling Downs. It is built on a feeder steer of 450kg liveweight, fed 105 days; 356kg dressed weight at slaughter; ADG of 2kg; consumption 15kg/day and a NFE ratio of 7.5:1 (as fed); $25 freight; typical implant program. Bank interest is included. It is important to note that variations exist across production models (feed conversion, daily gain, mortality, morbidity, carcase specification); from feedlot to feedlot; and between mobs of cattle. Equally, there can be considerable variation at any given time in ration costs charged by different custom-feed service feedlots. Click here to view an earlier article on this topic. For a more specific performance assessment on a given mob of cattle, consult with your preferred custom feeder.

HAVE YOUR SAY