Live exporter Wellard Limited has announced a $14.8 million net profit in its full year 2016 results released to the ASX this morning.

Wellard is the largest live exporter of cattle from Australia, and also exports large numbers of livestock around the world.

While a profitable result, the outcome was well below the forecast net profit of $42.4 million Wellard Limited included in its prospectus to shareholders prior to its Initial Public Offering (IPO) in December last year.

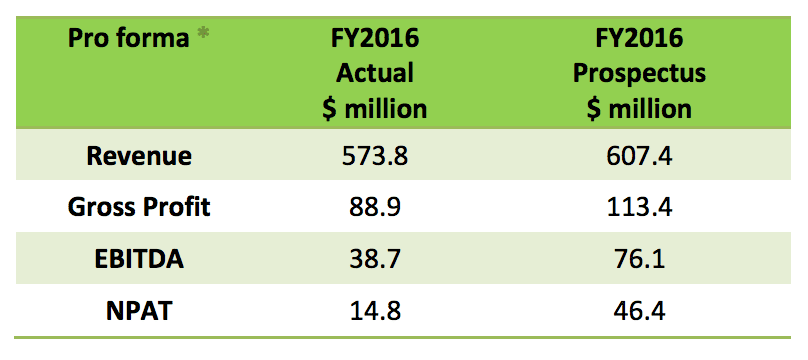

Key figures of the pro forma FY2016 results released this morning, relative to the prospectus forecast for FY 2016, were reported as follows:

The pro forma figures listed above exclude all one-off costs related to Wellard Limited’s IPO in December 2015.

Wellard managing director Mauro Balzarini acknowledged in the statement to the ASX that Wellard and its shareholders had endured a tough start to listed life, and the company did not achieve its prospectus forecasts.

“A sharp reduction in cattle supply in Australia, combined with resultant record high cattle prices, significantly impacted the company’s trading margins,” Mr Balzarini saidt.

“When combined with two vessel breakdowns and the delayed delivery of the M/V Ocean Shearer, it weighed heavily on our financial results.

“Importantly, despite these tough new trading conditions, we still achieved a pro forma NPAT of $14.8m.

“We are now focused on managing the business through the current challenging livestock market landscape so that we are positioned to take advantage of the opportunities that will present themselves to Wellard when livestock prices invariably return to their normal trading range.

“That will be helped by entry of the M/V Ocean Shearer to Wellard’s fleet which occurred in late FY 2016 and the development of our South American operations.”

The Wellard Ltd Board of Directors has decided not to pay a dividend for FY 2016 given the significant variance in profit from the prospectus and the final financial year result, it said.

A number of executive and board changes were also announced this morning’s statement:

- Sharon Warburton resigned as non-executive director of Wellard on Friday, 26 August, 2016

- Non-executive director Philip Clausius, a member of Wellard’s Audit Risk and Compliance Committee, has taken over as chair of the committee.

- Yasmin Broughton, general counsel and company secretary has also tendered her resignation and has agreed to stand down from her roles as the completion of her three-month notice period.

The company said it acknowledged their contributions and wished them well for their future endeavours, and is in the process of finding and appointing suitable replacements.

It would be in the interests of Wellard if management informed the market and the shareholders, that is, the owners of the company, what factors triggered the sudden resignations of a director of the company and the secretary of the company.

I wonder what the result would have been with all the one off costs that were part of the original IPO. Ain’t accountancy a great help.