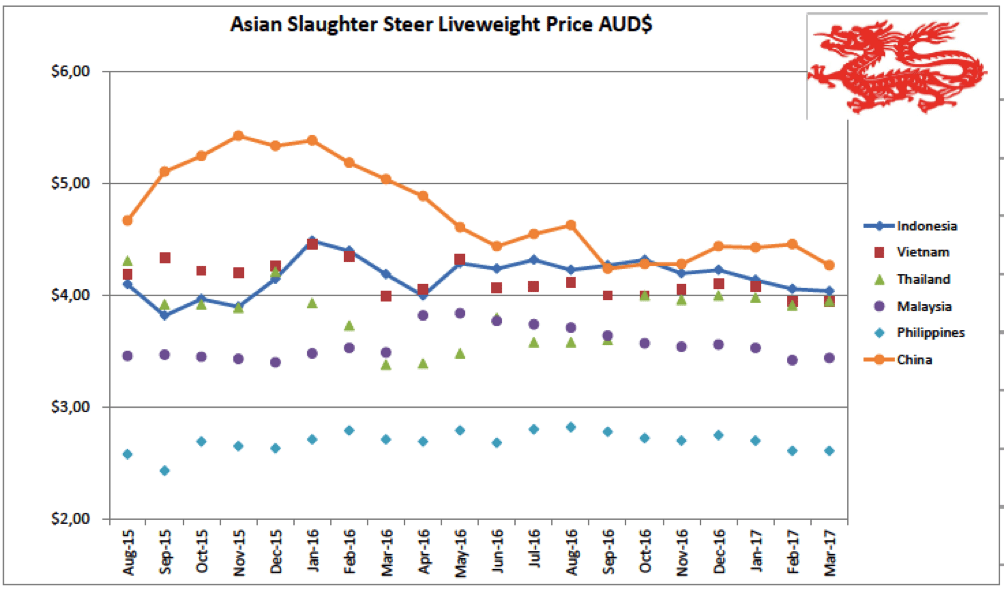

Indonesia: Slaughter Steers AUD $4.04 / kg live weight (Rp 10,150 = $1AUD)

Weak demand is increasing the pressure on Indonesian lot feeders with some discounting of slaughter cattle during March to as low as Rp39,500.

There are also some sales at Rp40k but the average is sitting at about Rp41k which I have used as this month’s indicator price. The Rp has strengthened a little against the AUD so the drop in the price to $4.04 doesn’t look as much as it really is in the local market.

This price is a serious problem for lot feeders with their current buy in price at around Rp43,000 per kg CIF plus plus plus all the arrival expenses, weight losses etc.

In order to achieve a successful value adding process in the feedlot, the animal must not only be fed efficiently, it must be sold at the optimum time in terms of its weight and yield profile.

Indonesian consumers, and therefore the butchers that supply them, do not like fat on their beef. This means that slaughter cattle with higher levels of fat attract higher discounts from the butchers.

Whenever cattle in the feedlot have to be fed on past their optimum weight and fat cover, they usually increase their percentage of fat on the carcase and therefore begin to be discounted.

In the current commercial environment the lot feeder is faced with a classic dilemma. If he sells into this weak market then he will be getting a reduced return and risking making a loss. If he decides not to sell but to keep the animal for a little longer in the hope that the market might recover, the animal will get fatter and attract a discounted price from the butchers. He is in a potential loss making position regardless of which option he takes. To make matters worse, most importers are in a tight cash position as a result of the erratic supply, demand and sales environment over the past six months or more. Shipments of cattle are expensive to buy making the timely repayments through fat cattle sales a vital part of the cash flow cycle. When cash must be raised in order to keep debt levels under control, cattle must be sold regardless of the unpleasant nature of the current price.

Live cattle importers continue to be in a major transition where the market is trying to discover its “new normal” settings of supply and demand.

Indian beef is now a fixed feature of the market and in my opinion will remain so into the future regardless of the recently announced ban on new permits.

The Government continues to pressure them to cut their prices regardless of market reality.

The great irony here, as noted by Beef Central recently, is that the introduction of Indian beef has had a negligible effect on the retail prices of its main end point outlets – bakso balls and low-end food service.

My basic market research indicates that prices in this area are exactly the same as they were before the introduction of Indian product suggesting that all the savings from cheaper wholesale Indian meat are being captured by the traders and retailers.

I am sure it will only be a matter of time before the government of Indonesia develops some policy initiatives to ensure some of the savings are passed on to the public but the sheer size of this market and the enormous number of small enterprises that are involved will make the logistics of achieving this almost impossible even with the best of intentions.

The recent policy change to 450kg maximum average for shipments looks like being a total failure.

I have been advised (unofficially) that the government has no intention of changing the existing rule that cattle must be kept for 120 days in the feedlot before being eligible for leave for sale.

For the same reasons as outlined above, heavy animals retained in the feedlot for extended periods gain significant levels of fat and therefore attract large discounts from the butchers. It makes no sense for a feedlotter to import a cheap slaughter weight animal then hold it in the feedlot for 120 days at which point it will be grossly over fat and almost certainly a loss making proposition.

While the government continues to claim that the price of imported cattle will decline by AUD$1 per kg live weight (through the policy change to 450kg), the 120 day rule will ensure that this potential opportunity remains out of reach.

The government has been “encouraging” supermarkets to include buffalo beef in their meat retail departments.

Carrefour, one of the largest supermarket chains in Indonesia, now has frozen buffalo in its meat sections in both Java and Bali.

The photo below shows one of their packs of 500 grams of beef pieces suitable for making rendang. Other packs contain mince and pieces of other cuts.

The fact that the product is presented in a single small freezer box within the meat section would suggest that they might not be expecting sale volumes to be very high. There were certainly no buyers in sight when I visited several outlets during March.

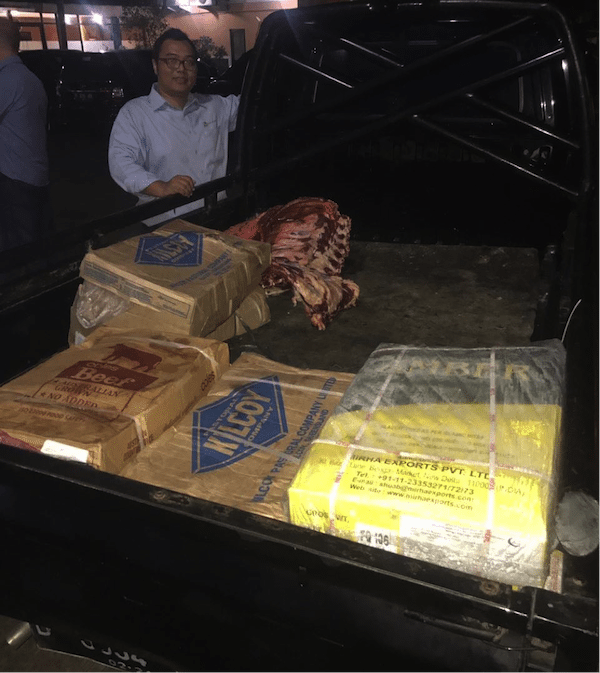

The photo below shows an interesting scene in Java where a combination of fresh and frozen product is on its way to the wet market.

Most wet markets still prefer to sell only fresh product to their retail customers but in the small number of cases where they do sell frozen product they almost invariably mix both frozen and fresh product, especially offals, to give their customers a choice.

The frozen products below are from Coles and Kilcoy (Australia) while the yellow box in the bottom right of the photo is from Mirha Exports P.L. from New Delhi in India.

Distribution of Indian beef is a problem in some areas as some regional governments are refusing to allow entry of the product in order to protect their local farmers.

These areas include East Java, Central Java, Bali, East Nusa Tenggara and Lampung.

These regional bans are not always effective as I have seen the product in the photo above in the Carrefour supermarket in Bali. A certain level of small scale smuggling is also occurring in most areas. The price spread between buffalo beef and local fresh product is just too attractive to some entrepreneurs to resist.

The meat industry is also the focus of the Indonesian tax department at the moment with the government claiming that while imports have gone up, taxes collected from importers have gone down. I am told tax auditors have been busily examining the books of all beef and live cattle importers during the last month or so.

Given the current attitude of the government toward the beef and cattle importers at the moment, I would not like to be the one to get caught cheating on my import taxes.

Anyone feel like coming to Indonesia to invest in the beef industry?

Vietnam: Slaughter Steers AUD $3.95/kg (VND17,350 to $1AUD)

No significant changes this month with prices remaining relatively steady in a weak market. I have used Dong68,500 again for my indicator price this month.

Importers continue to find the going difficult with prices of Australian cattle remaining stubbornly high while their retail customers refuse to pay more.

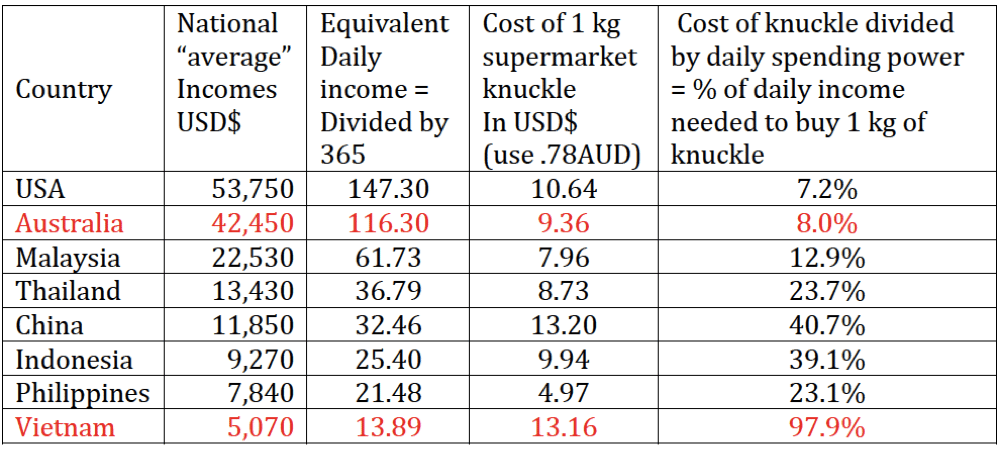

The Vietnamese continue to pay the highest price in Asia (and possibly the world) when their annual income level is taken into consideration. See the table below where I have converted average annual salaries (March 2015) and beef prices into USD$ in order to compare the real cost of beef in each country in comparison to average incomes. As you can see, Vietnamese consumers pay the highest percentage of their wages to buy beef and by a very wide margin. No wonder they are refractory to retail prices being forced even higher!

Supplies of live cattle from neighbouring Thailand and Myanmar (via Cambodia and Laos) are steady but expensive. At least they are all lean bulls so their meat yield is excellent allowing for their slightly higher live price to translate into a similar beef price.

The government of Vietnam has also recognised the importance of rebuilding the national herd with the establishment of a wide range of local, regional and national breeding cattle initiatives especially in the small holder area.

One very attractive and sensible initiative is providing affordable, state sponsored insurance for cattle to protect small farmers from the potentially massive loss when 1 of their only 2 or 3 cows dies.

Thailand: Slaughter Steers AUD $3.95/kg (Baht 26.6 to $1AUD)

Domestic prices remain steady with the only changes due to the currency movements.

On the 7th April the Burmese KNU (Karen National Union) held elections with success going to the “government friendly, pro-business” faction. This may help facilitate an increase in the cattle trade across the Myanmar/Thai border in the medium term.

The China trade through the northern Thai border area remains subdued as a result of numerous restrictions placed on sale cattle by the Chinese buyers. I am not sure what they are although there are some suggestions that Beta agonists are involved.

This leaves local producers with a steady domestic market and a modest number of exports to Vietnam.

No scope for any new feeder exports from Australia in the short and medium term future.

Malaysia: Slaughter Steers AUD $3.44 per/kg (RM3.39 to $1 AUD)

No change once again for this with the exception of the Indian buffalo price which has jumped up to Rg19.50 per kg after an extended period at 18.60. This is the highest price recorded since I began collecting records of buffalo beef about 12 months ago.

Philippines: Slaughter Cattle AUD $2.61 / kg (Peso 38.3 to AUD$1)

Prices of live slaughter cattle remain constant but prices in the wet market have risen between 3 and 7pc. Supermarket prices are the same but quality has slipped. The main news in the market is a sudden rise in pork prices following low domestic production and restricted imports.

Zero prospects of any improvements in live cattle demand from the Philippines in the foreseeable future.

China: Slaughter Cattle AUD $4.27/kg (RMB 5.27 = AUD$1)

A small weakening in the Beijing live price to Y22.5 but a significant rise in the Shanghai price to Y18 (from Y16.4).

My agent from Shanghai reports that the abattoir staff who provide the data for this report say that it is becoming more difficult to source both feeder and slaughter cattle in their region. It will be interesting to see if this is the beginning of a new recovery in prices or just a short term blip.

Argentina beef continues to be marketed at significant discount to other imported products (Y51.6) while Aussie and local product is selling for Y74. Brazil product was absent for a while during the meat scandal episode.

Australia : the lucky country – for beef.

I was back in Australia last week and enjoyed going to the supermarkets and butcher shops to see the many offerings of beef.

Aussies don’t realise how lucky they are to be able to select from such a huge range of products including MSA (Meat Standards Australia) beef at their local outlets at some of the lowest prices (considering income) in the world. Magnificent beef with eating quality virtually guaranteed by the MSA process.

I’m getting a beef craving just writing about it!

MSA Rump @ $21per kg & Scotch fillet @$33 in Woolies in Darwin. The green sticker is the identifier of MSA certification. Magnificent.

Meat Standards Australia : www.mla.com.au/msa or contact MSA 1800 111 672.

New York beef for comparison

The photo below was taken by my daughter who lives in New York.

This is “paddock to plate” beef at an upmarket butcher shop offering at drastically higher prices than Australians are used to paying.

Prime rib roast for AUD$78.70/kg and Tomahawk steaks for AUD$116.88/kg (@ AUD75cents per $1USD).

Market price table for March 2017

(All prices converted to AUD)

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle/Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Indonesia | October 16 | 13.56 | 17.60 | 3.52 | 4.32 |

| Rp 10,000 | Nov 16 | 13.00 | 17.60 | 3.20 | 4.20 |

| Rp 9,800 | Dec 16 | 13.26 | 17.86 | 4.39 | 4.23 |

| Rp 9,900 | January 17 | 13.13 | 17.77 | 3.33 | 4.14 |

| Rp10,230 | February 17 | 12.71 | 14.96 | 2.64 | 4.06 |

| Rp10,150 | March 17 | 13.05 | 20.00 | 3.65 | 4.04 |

| Philippines | October 16 | 8.83 | 8.15 | 3.80 | 2.72 |

| P 37.0 | Nov 16 | 8.92 | 7.83 | 3.78 | 2.70 |

| P36.4 | Dec 16 | 9.06 | 8.79 | 3.84 | 2.75 |

| P37.0 | January 17 | 9.19 | 8.11 | 3.38 | 2.70 |

| P38.3 | Feb 17 | 7.83 | 8.88 | 3.39 | 2.61 |

| P38.3 | March 17 | 8.09 | 8.88 | 3.26 | 2.61 |

| Thailand | October 16 | 8.99 | 10.49 | 2.62 | 4.00 |

| Bht 26.5 | Nov 16 | 9.06 | 10.57 | 2.64 | 3.96 |

| Bht 26.2 | Dec 16 | 9.16 | 10.69 | 2.67 | 4.00 |

| Bht 26.4 | January 17 | 9.09 | 10.60 | 2.65 | 3.98 |

| Bht 26.85 | Feb 17 | 8.94 | 10.43 | 2.61 | 3.91 |

| Bht 26.6 | March 17 | 9.02 | 10.53 | 2.63 | 3.95 |

| Malaysia | October 16 | 9.40 5.64 | 10.34 | 2.44 | 3.57 |

| Rg 3.29 | Nov 16 | 9.11 5.56 | 10.03 | 1.98 | 3.54 |

| Rg 3.27 | Dec 16 | 9.17 5.69 | 10.09 | 1.99 | 3.56 |

| Rg 3.30 | January 17 | 9.09 5.64 | 10.00 | 1.97 | 3.53 |

| Rg 3.41 | Feb 17 | 8.79 5.45 | 9.68 | 1.90 | 3.42 |

| Rg 3.39 | March 17 | 8.84 5.75 | 9.73 | 2.04 | 3.44 |

| Vietnam HCM | October 16 | 14.70 | 16.47 | 9.41 | 4.00 |

| D 16,800 | Nov 16 | 14.88 | 16.66 | 9.52 | 4.05 |

| D 16,600 | Dec 16 | 15.06 | 16.86 | 7.83 | 4.10 |

| D 16,800 | January 17 | 14.88 | 17.98 | 8.33 | 4.08 |

| D 17,400 | Feb 17 | 14.37 | 17.36 | 6.89 | 3.94 |

| D 17,350 | March 17 | 14.41 | 17.41 | 6.92 | 3.95 |

| China Beijing | October 16 | 13.62 | 19.18 | 3.89 | 4.28 |

| Y 5.13 | Nov 16 | 13.41 | 19.22 | 3.89 | 4.29 |

| Y 5.07 | Dec 16 | 13.80 | 19.43 | 3.51 | 4.44 |

| Y 5.15 | January 17 | 14.34 | 24.66 | 3.84 | 4.43 |

| Y 5.27 | Feb 17 | 12.14 | 13.66 | 2.85 | 4.46 |

| Y 5.27 | March 17 | 12.14 | 14.04 | 3.41 | 4.27 |

| Shanghai | October 16 | 16.34 | 19.38 | 5.45 | 3.11 |

| Nov 16 | 17.54 | 17.54 | 5.46 | 3.12 | |

| Dec 16 | 16.57 | 19.53 | 5.52 | 3.21 | |

| January 17 | 16.69 | 19.80 | 5.44 | 3.42 | |

| Feb 17 | 14.80 | 18.22 | 4.55 | 3.11 | |

| March 17 | 13.66 | 18.22 | 4.36 | 3.42 |