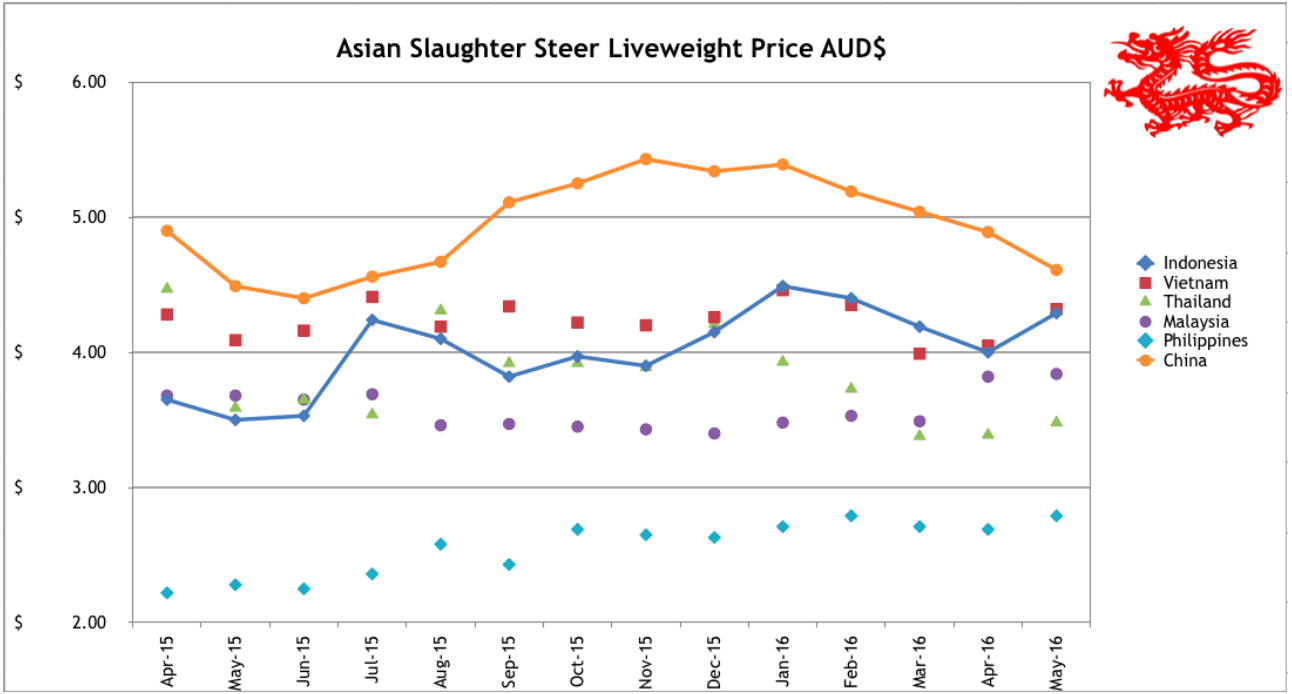

Indonesia: Slaughter Steers AUD $4.29/kg live weight (Rp9,800 = $1AUD)

Prices for slaughter cattle have increased slightly towards the end of the month to about Rp42,000 per kg in the Jakarta area and held firm at about Rp44,000 in north Sumatera.

Quite a few shipments have arrived since the T2 import permits were released on about the 12th of May but my sources tell me that feedlots are generally still at only around 50-60% capacity.

Failure to have relatively full feedlots prior to the beginning of Ramadan (6th of June) suggests that wet market prices will experience strong upward pressure when the peak demand is experienced at the end of Ramadan – beginning of Lebaran – period in the first and second weeks of July.

This relative shortage results from a combination of a limit on import permit numbers for T1 and exceptionally high prices for feeder cattle in Australia during the recent wet season.

Short supplies in North Sumatera were highlighted when the wet market price in Aceh for the first day of Ramadan shot up to Rp150 (Bandar Aceh) to 175,000 per kg (Lhokseumawe).

This is a special case however because of a religious tradition in the Aceh region in which younger family members are expected to purchase some beef for their parents and older relatives to celebrate the first day of the fasting month.

Numbers remain very low in North Sumatera despite very large permit allocations in T2 which will have no affect on supply during the peak festival period.

It appears unlikely that any imports will be available from India in time to impact on festival period prices because even if the political and administrative hurdles can be overcome there is simply not enough time from now until the beginning of July to physically deliver the product.

The usual quantities of smuggled Indian buffalo beef are available in the Medan market with prices at around Rp85,000 per kg.

My sources in the Jakarta area have been unable to identify any Indian beef being offered for sale in the local wet markets.

As an additional measure to take the pressure off prices, the government has issued more permits for processed beef during the middle of May.

Unfortunately, due to government regulations, this will have little impact on domestic wet market prices as much of this product is legally restricted primary cuts for supply to hotels and restaurants only.

State Owned Enterprises (SOE’s) have also been issued permits to import additional secondary cuts but once again the logistics involved in getting these products into the market will probably mean that only a limited proportion of the permitted amounts will arrive in time for Lebaran and therefore are unlikely to exert significant downward pressure on the retail wet market prices.

The Indonesian government continues to encourage the feedlot industry to reduce their selling prices in order to force wet market prices down to their preferred level of Rp80,000 per kg during the festival period.

Despite the apparent logic of their argument, feedlotters have been unsuccessful in their attempts to convince the government that lower prices for slaughter cattle at the feedlot gate will have zero impact on the downstream wet market retail rates.

My advice is that the feedlotters have agreed to hold their prices at current rates through to and including Lebaran.

By doing so it should be an easy method of proving (or disproving) to the government that the wet market price is set further down the supply chain from the feedlot loading ramp.

We won’t have to wait long to find out if their argument is valid or not.

The government plan to import large numbers of breeders this year is starting to look a little doubtful as no tenders have been let as yet and it is already June.

The ideal time for imports of pregnant heifers has already passed so once again we enter the wrong half of the year when breeder imports from northern Australia are at their most difficult and most expensive.

Earlier in May I visited the Martapura wet market near Banjarmasin in southeast Kalimantan.

At the meat stall in the photo below the price of knuckle was Rp125,000 per kg or about AUD$12.76. The meat is derived from domestic cattle “exported” by sea from Surabaya, East Java.

This butcher told us that his group of butchers import 75 head per month just for their local customers.

Local sources estimate that about 20,000 head per year are imported from East Java to supply the Banjarmasin area. This is yet again an indication of the shortage of domestic stock in Indonesia as this market would have traditionally been supplied by local cattle (mainly Bali cattle) from Sulawesi and the Eastern Islands.

Vietnam: Slaughter Steers AUD $4.32/kg (VND16,200 to $1AUD)

Rates remain subdued with the AUD price rise above due to currency movements only.

In Hanoi prices vary with Bos Taurus selling for Dong 68,000 per kg, imported steers for D70k, and heavy bulls for D72,000 due to their better carcase yield.

In Ho Chi Minh City imported steers are selling for D70,000 while local cattle are bringing D68,000. I have used D70,000 for the price on the graph above.

The main theme of the market remains oversupply with too many fat cattle competing for too few customers.

Strong competition is also being provided by processed beef importers.

See the online advertising by the Dinh Phong company below promoting the benefits of high quality Australian chilled imports. And free home delivery! Black Angus, what a great example of effective branding.

Quality issues are very important for the Vietnamese consumer as the very high incidence of processors and retailers caught with adulterated meat is a consistent and highly publicised aspect of the domestic meat market.

From recent chemical treatment of rotten beef “to make it fresh again” to treatment of pork with chemicals and beef blood to make it look like beef, consumers are very wary of low priced beef sellers.

Vietnamese online advertising of high quality product offering home delivery. HACCP and Halal, chilled Black Angus beef – hard to beat as a marketing edge.

Thailand: Slaughter Steers AUD $3.48/kg (Baht 25.9 to $1AUD)

Local prices are weak again as there appear to be new problems holding up the Mekong river trade.

The AUD price above appears consistent with previous reports but this is mostly due to currency movements.

The Thai government has commenced a campaign of testing beef for illegal BetaAgonists following accusations that some local feedlot product was contaminated with dangerous levels of illicit chemicals.

Malaysia: Slaughter Steers AUD $3.84 per/kg (RM2.97 to $1 AUD)

Prices and the currency remain steady once again this month.

Philippines: Slaughter Cattle AUD $2.79/kg (Peso 34 to AUD$1)

The currency has strengthened with the election of a new President who claims he will “end crime and corruption and give priority to the people who work for a living, especially farmers and labourers…”.

With a 6 year term, at least he has plenty of time to get his promises delivered.

Recent rains have broken the drought and allowed farmers to plant their annual crops. Beef prices in the wet market have strengthened a little while most other prices are steady.

China: Slaughter Cattle AUD $4.61/kg (RMB 4.77 = AUD$1)

Live cattle prices have declined in both Beijing and Shanghai this month.

In Beijing, prices have dropped sharply from Y24 last month to a range of Y19 to Y23 during May.

The Shanghai price has eased further to Y16.5 I have used an average of Y22 for this month’s graph price.

My Shanghai agent reports that the regional government is determined to reduce pollution so they are discouraging the breeding of livestock within their administrative area. This has led to some smaller dairy farmers closing their enterprises and selling their cows to slaughter which might account for the further reduction in the local live slaughter cattle prices. No explanation as to the sudden drop in Beijing.

Cambodia: First live cattle exports from Australia this month

The owner of the new feedlot and abattoir complex near Sihanoukville in southern Cambodia has advised that they expect their first shipment of Australian feeder and slaughter cattle in the middle of June.

I have been invited to visit their facility in the next few months and produce a detailed article about this exciting new development.

The Phnom Penh Post has reported an outbreak of Foot and Mouth Disease in Kampong Thom in central Cambodia. Water shortages from the ongoing El Nino event are exacerbating the affects of the disease.

Taiwan: Exchange rate AUD$1 = 23.8 Taiwan New Dollars.

I was in Taiwan last week and visited a local Carrefour supermarket. See photos below of both Australian and US imported product presented for sale. Black Angus brand was prominent once again although the overall selection of beef was quite limited. This Angus striploin below converts to AUD$41.60 per kg while Australian product is only AUD$15.97 per kg. Quality pork was selling for less than AUD$10 per kg while broiler chicken was AUD$4.20 per kg.

This Aussie beef has been repacked so I am not able to confirm what cut it is but the price of AUD$15.97 looks pretty cheap by comparison to the US product above.

Morocco

My sister Lynn took these photos while on holiday in Morocco during May.

The butcher shops/wet market stalls identify the species of meat that they have on sale by displaying the head of the animal of origin for all to see. $1 AUD will buy 7.1 Moroccan Dirhams so I assume that the camel cuts below are selling for about AUD$6.50 per kg or more likely it’s $65 per kg if the unit of sale is per 100 grams. Any advice from an Arabic speaker?

Dr Ross Ainsworth’s monthly South East Asian reports are first published exclusively on Beef Central. To view more of Dr Ainsworth’s previous Beef Central articles click here. To visit his personal South East Asia report blog site, click here.

Market price table for May 2016

(All prices converted to AUD)

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle / Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Jakarta | Dec 15 | 13.00 | 19.00 | 3.50 | 4.15 |

| Jan 2016 | 13.26 | 16.32 | 3.26 | 4.49 | |

| Feb 2016 | 12.95 | 19.69 | 2.90 | 4.40 | |

| March 16 | 12.83 | 18.18 | 2.93 | 4.19 | |

| April 16 | 13.00 | 18.20 | 2.90 | 4.00 | |

| May 16 | 13.27 | 18.57 | 3.06 | 4.29 | |

| Medan | Dec 15 | 10.00 | 11.00 | 2.20 | 4.10 |

| Jan 2016 | 12.24 | 10.61 | 2.45 | 4.29 | |

| Feb 2016 | 11.92 | 10.36 | 2.54 | 4.14 | |

| March 16 | 11.11 | 10.50 | 2.12 | 4.49 | |

| April 16 | 12.00 | 10.40 | 1.70 | 4.40 | |

| May 16 | 11.73 | 12.24 | 4.59 | 4.49 | |

| Philippines | Dec 15 | 6.90 | 7.02 | 3.65 | 2.63 |

| Jan 2016 | 7.53 | 7.23 | 3.70 | 2.71 | |

| Feb 2016 | 8.24 | 7.50 | 3.82 | 2.76 | |

| March 16 | 8.00 | 7.28 | 3.57 | 2.71 | |

| April 16 | 7.93 | 7.50 | 3.39 | 2.69 | |

| May 16 | 8.38 | 8.23 | 3.38 | 2.79 | |

| Thailand | Dec 15 | 9.19 | 10.73 | 2.68 | 4.21 |

| Jan 2016 | 9.84 | 11.02 | 2.76 | 3.93 | |

| Feb 2016 | 9.02 | 10.98 | 2.75 | 3.73 | |

| March 16 | 9.39 | 10.52 | 2.63 | 3.38 | |

| April 16 | 9.06 | 10.57 | 2.64 | 3.39 | |

| May 16 | 9.27 | 10.81 | 2.70 | 3.48 | |

| Malaysia | Dec 15 | 9.00 5.62 | 11.25 | 1.99 | 3.40 |

| Jan 2016 | 9.18 5.83 | 11.47 | 2.13 | 3.48 | |

| Feb 2016 | 10.00 5.74 | 11.67 | 2.17 | 3.53 | |

| March 16 | 9.90 5.78 | 11.55 | 1.91 | 3.49 | |

| April 16 | 10.06 5.87 | 11.74 | 1.85 | 3.82 | |

| May 16 | 10.10 5.89 | 11.78 | 2.02 | 3.84 | |

| Vietnam | Dec 15 | 15.43 | 17.28 | 7.40 | 4.26 |

| HCM City | Jan 2016 | 15.82 | 17.72 | 8.86 | 4.46 |

| Feb 2016 | 15.52 | 17.39 | 8.07 | 4.34 | |

| March 16 | 14.88 | 16.66 | 7.74 | 3.99 | |

| April 16 | 14.88 | 16.67 | 7.74 | 4.05 | |

| May 16 | 15.43 | 17.28 | 7.41 | 4.32 | |

| China | Dec 15 | 15.38 | 19.57 | 4.27 | 5.34 |

| Beijing | Jan 2016 | 15.86 | 19.91 | 4.35 | 5.39 |

| Feb 2016 | 15.11 | 19.49 | 4.26 | 5.19 | |

| March 16 | 14.23 | 18.61 | 4.07 | 5.04 | |

| April 16 | 14.28 | 18.69 | 4.08 | 4.89 | |

| May 16 | 14.26 | 19.20 | 4.19 | 4.61 | |

| Shanghai | Dec 15 | 18.37 | 20.94 | 5.98 | 3.84 |

| Jan 2016 | 19.56 | 21.73 | 6.09 | 3.91 | |

| Feb 2016 | 17.87 | 21.70 | 5.96 | 3.72 | |

| March 16 | 14.63 | 18.21 | 5.69 | 3.45 | |

| April 16 | 13.88 | 16.33 | 5.70 | 3.43 | |

| May 16 | 14.68 | 15.43 | 5.87 | 3.46 |

For the Taiwan market both packs of beef are from Australia. The one from Mulwarra is low grade beef shank hence the big price difference.