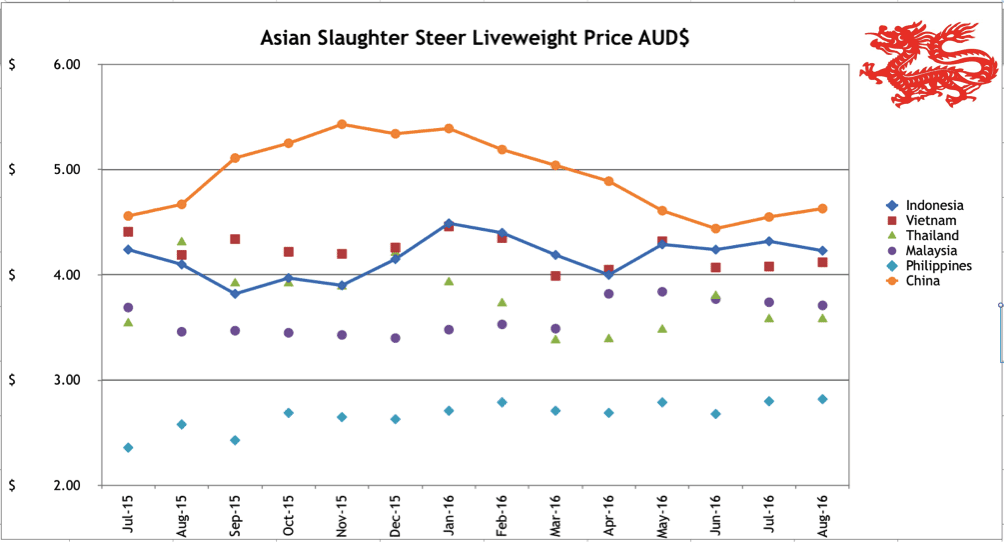

Indonesia: Slaughter Steers AUD $4.23 / kg live weight (Rp10,050 = $1AUD)

Live steer prices remain unchanged at Rp42,000 to Rp43,000 per kg live weight so I will use Rp42,500 again for the monthly published price.

Importers report that they dare not increase their prices for fear that the government will punish them.

The T3 allocation of import permit recommendations have been released by the Ministry of Agriculture for 141,000 cattle but are now with the Ministry of Trade who will make the final decision on who gets what and when.

Advice over the last 48 hours suggests that the Trade Ministry is waiting until all importers have put in their breeding cattle proposals before the T3 feeder permits will be issued.

It appears that quite a few importers are yet to send in their breeder project details. The permit numbers are quite low compared with the figures applied for by the importers but even this low number will be difficult for Australian exporters to supply given both supply shortages and rising prices.

My information is that CIF price for new permit shipments in T3 will be in the order of 20% higher than for T2.

This suggests a landed price for a feeder of close to Rp47,000 per kg with the Minister’s “preferred selling price” at Rp42,000 (or less). Only outstanding feedlotting performance and efficiencies will allow importers to make a profit at these buy and sell numbers.

On the 27th of August President Joko Widodo completed a major cabinet reshuffle. While the current Agriculture Minister retained his portfolio there is a new Minister for Trade, Dr Enggartiasto Lukita with a long history in business and politics. Dr Lukita and other Ministers wasted no time in announcing a number of new initiatives including (the comments in “..” are direct quotes from press reports) :-

- “The government agreed imposing a system to determine the purchase price and the highest retail price for the 4 main food commodities in the upcoming two weeks, in order to overcome high prices in the market. The 4 main food commodities are rice, sugar, shallots and beef. The government will delegate BULOG (State Logistics Agency) to buy the entire supply of food commodities from farmers. Afterwards, it will be sold through PD Pasar Jaya wet markets – where the commodities are sold to the consumer based on the ceiling price.”

- “One of the requirements is to make obligation for feedlotters to conduct breeding business… The feedlotters needs to provide a plan or roadmap in order to obtain import quota.”

- “Importers are also obligated to make a statement letter that their assets will be taken by the government if it does not meet their proposal investment. For live cattle importers, they have to propose a plan to invest in breeding to obtain a longer extension period of import permit and bigger quota.”

- “The Trade Ministry will implement specific measures to prevent illegal stockpiling aimed at manipulating the price of goods in the market. The government will issue a regulation, hence the government is able to do a sudden inspection, conduct an audit and make the necessary measurement to the stockpilers.”

I am told that these “policy announcements” are actually general statements which are yet to be officially confirmed as policy pending further consideration and consultation. For the sake of the Indonesian feedlot industry I hope that most of these measures end up being rejected by government as they spell only disaster for private enterprises importing live cattle.

One can only imagine the reaction of feedlotters when they read these new potential “policies” in the local press.

How can a feedlot business survive when it must buy its feeder cattle from a rapidly rising Australian market but then sell their production at a low price fixed by the state?

How can these businesses afford to lose money on breeder projects when they can’t make any from their principle enterprise fattening feeders?

If they can only obtain quota by agreeing to a plan to invest in breeders while at the same time signing over their assets to the government if they fail then this must all add up to checkmate for lot feeders.

A feedlot business will get no return from its asset if it stops operating and many costs will continue. The question is, how much will it lose if it continues to operate under the new “policies” and will this be a greater loss than simply shutting down the enterprise? Not much of a choice. Either way the business is in serious danger.

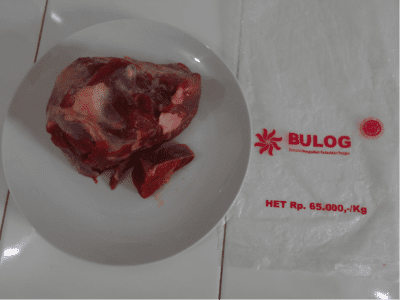

The first shipments of frozen Indian buffalo beef have actually arrived in Indonesia.

The first product became available for retail sale on Monday 5th August at the BULOG warehouse in Jalan Gatot Subroto in Central Jakarta. They open from 9am to 7pm with minimum sales of 1 kg offered for Rp65,000 per kg.

I bought 1kg for Rp65,000 or AUD$6.50 on Tuesday the 6th September and I was probably one of the early buyers. BULOG advises that it is in the process of arranging for a large number of retail outlets to sell the product so they expect it will be widely available in about 2 weeks time.

The Ministry of Agriculture recently announced that “To support self-sufficiency, government will also import 10,000 breeders from Mexico.”

Australia has recently sent its first shipment of beef breeder cattle to Mexico. The reason for the commencement of this commercial trade is that the Mexican herd is severely depleted and they are so short of breeders and the local prices are so high that they can justify buying the very expensive Australian breeders AND shipping them all the way across the Pacific Ocean.

Given that Mexican breeders are hugely expensive even by Australian standards, the cost of these breeders plus the massive freight bill to bring them back across the Pacific will make them a very costly item on arrival in Indonesia.

Vietnam: Slaughter Steers AUD $4.12/kg (VND17,000 to $1AUD)

Domestic prices have edged up a little over the month with top prices in the south rising to as high as Dong71,000 while northern rates have hit D74,000 for the first time in about a year. I have used D70,000 for this months report price.

Bottom prices in the north of Vietnam were around D69,000 while lower quality stock in the south were selling for as low as Dong65,000.

The Vietnam market is approaching a crossroads as the landed price has been quite steady for almost the two years.

The recent price rises in Australia were not passed on by exporters because they had ships to move and were forced to sell at the old price and lose less than paying demurrage for a ship without a cargo.

During the last month or so, a significant number of ships have ended their time charter obligations. Most exporters now have the “luxury” of only conducting business if there is a profit involved!

The difference between the old CIF price (last 2 years) and the new current rate required to earn a margin on the sale is roughly 20%.

The Vietnamese industry is not used to such sharp rate rises and as we know from experience in other markets, sudden increases meet with serious consumer resistance for 2 to 4 months at least before they come back and decide to pay extra for their favoured product.

This process is likely to cause chaos in the market although it is not clear how quickly it will develop as the exact timing of the end of a large proportion of long term charters is a little difficult to factor in with any accuracy.

The reduced Indonesian import quotas for T3 will be a nice gift for the Vietnam trade as there will be only limited competition from Indonesian buyers for the shrinking pool of feeder and slaughter cattle left in northern Australia.

The sharply higher Australian CIF prices will focus even greater Vietnamese attention on alternative sources of supply of live cattle with South America their most likely option.

Vietnamese continue their enjoyment of beef whether it is in a bowl of traditional soup or in modern beef restaurants which are springing up in large numbers in the bigger cities. This clear preference for beef as a superior food item augers well for the capacity of consumers to pay more for their fresh beef in the future.

This delicious looking steak is an from a press article describing a new steak house in Hanoi logically called “Hanoi Steak”. Marinated in sea salt, fresh herbs, pepper and French wine for two hours before being grilled on charcoal. Makes my mouth water!

Thailand: Slaughter Steers AUD $3.58/kg (Baht 26.5 to $1AUD)

Local live cattle prices remain exactly the same as last month as does the exchange rate. Domestic rates still can’t get past 95 Baht per kg live weight.

If the Australian delivered prices take the predicted 20% leap in Vietnam during the next few months then this should produce an excellent opening for Thai slaughter cattle as they are effectively the next best alternative to Aussie cattle today but are just a little more expensive right now given their high logistics and facilitation costs coming overland through two international border crossings. Burmese cattle remain relatively scarce and their delivery costs into Vietnam involve 3 border crossings.

Malaysia: Slaughter Steers AUD $3.71 per/kg (RM3.07 to $1 AUD)

The exchange rate and cattle prices have remained very similar to last month.

I spent a week in Sarawak in late August working with Australian breeders in a palm plantation on the Sarawak – Indonesian (Kalimantan) border.

The dynamics of the beef and cattle trade in the capital city of Kuching are driven by a combination of ethnicity, species preference and price. While Kuching has a population of a population of about 330,000 people, the majority are ethnic Chinese who prefer pork to beef. The Department of Agriculture reports that the slaughter of live cattle in the Kuching area for the wet markets averages about 2 head per day!

There is plenty of frozen beef available in the supermarkets with origins mainly from Australia and New Zealand.

Beef tail for AUD$10 per kg and $8.80 for tendon.

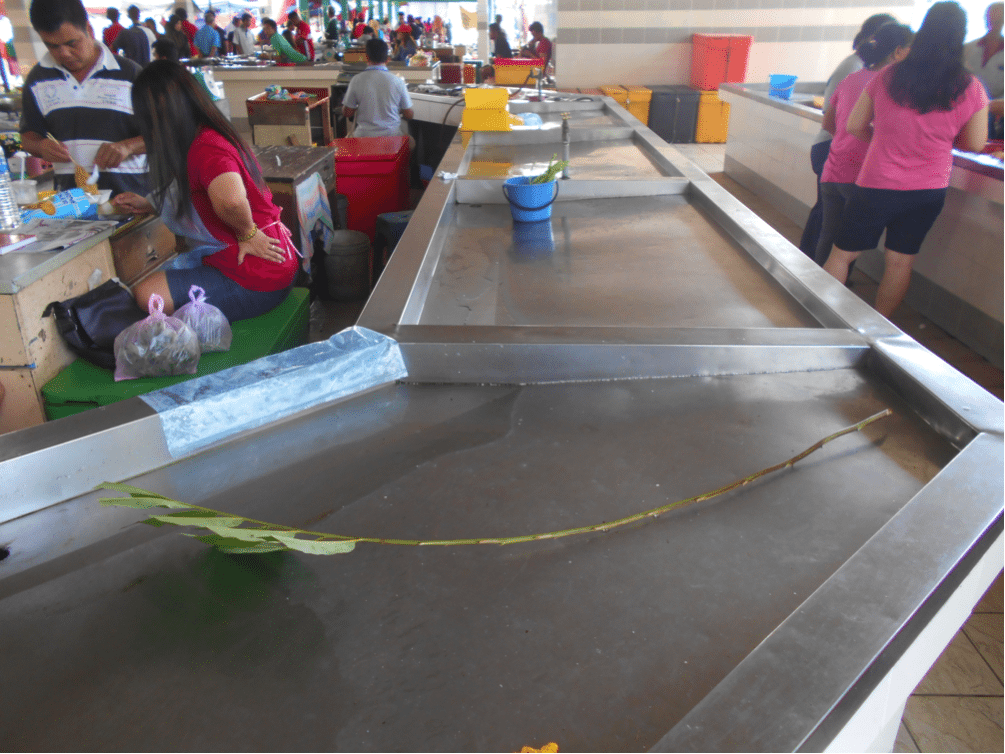

The Lundu wet market in south west Sarawak near the Kalimantan border. This is the best designed wet market I have ever seen with stainless steel, easy to clean tables for each trader. Taps supply clean water to every bay with good drainage from the table well down into an efficient underground drainage system. Brilliant.

Philippines: Slaughter Cattle AUD $2.82/kg (Peso 35.5 to AUD$1)

The live cattle price movement is slightly up due to the currency affect with a very positive report coming from my local agent. His story revolves around more business activity especially in the food area where there is more food available, prices are steady or increasing (wet market and supermarket beef are up) and the malls and wet markets are full of buyers.

He states that wages haven’t risen for quite a long time but there are less poor people so his assessment is that more people have created their own jobs with an entrepreneurial spirit that appears to be working.

Cambodia (Cambodian Riel (KHR) 3,130 to AUD$1)

David Tea, one of the owners of the new SNL feedlot and abattoir complex in southern Cambodia has kindly offered to provide market information for our monthly reports.

Knuckle is selling for KHR35,000 or AUD$11.18 in the wet market while topside is selling for around AUD$20 in the supermarket.

David Tea (centre) with journalist Darren Gall and David’s wife Alyssa Chao in the chiller of their new abattoir in southern Cambodia. The bodies are from the first shipment of Australian cattle which arrived last month.

SLN have introduced an innovation to traditional Asian wet market retailing by selling their beef as vacuum packed cuts in chillers. I am sure this will give their wet market customers great confidence that their beef has been produced with the highest standards of hygiene and quality. David reports that his new product has so far been well received by local consumers.

Chicken sells in the wet markets for around R12,000 per kg which converts to $AUD3.83 which puts it at a similar price range to most other SE Asian countries except Vietnam where rates are extremely high.

The live cattle price for SLN is essentially the Australian CIF price which is a confidential matter between the importer and the exporter so I won’t be reporting on this aspect. Given that the freight and type of cattle delivered to Cambodia is generally similar to Vietnam then the Ho Chi Minh price would probably be a fair indication of the indicative live price in southern Cambodia.

China: Slaughter Cattle AUD $4.63/kg (RMB 5.07 = AUD$1)

Live cattle prices are very slightly higher in Beijing but lower in Shanghai.

The heavy cull of dairy cows continues to dominate market supply especially in the south of China. Summer in China is traditionally a time when consumption of beef is at its lowest. My agent in southern China believes that this factor combined with the oversupply of cull dairy cows is the reason why the Shanghai price continues to slide so far below the rest of the country.

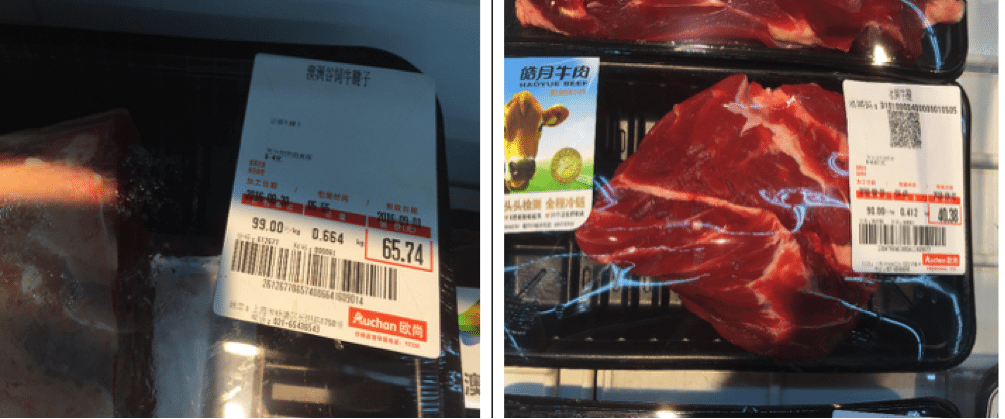

At the same time Australian product is being presented in the market at prices similar to local beef. See photo below. Given the high opinion Chinese customers have of Australian food products and the serious suspicion surrounding production methods of many local Chinese foods, this makes selling Chinese beef a very tough proposition.

See below a list of fat cattle prices from northern Chinese provinces provided by my agent in Beijing:

Liaoning Province: Simmental fats : 550-650kg – 23.6 -24 Y/kg

Heilongjiang Province: Simmental fats : 23Y/kg, Holstein 20.6-21.2Y/kg

Jilin Province: Simmental 300-400 kg – 23.6Y/kg

Inner Mongolia Province: Simmental fats – 24Y/kg, Holstein fats 22Y/kg

Shandong Province: Simmental 24Y/kg, Holstein bulls 550-600kg – 21Y/kg

Heibei Province: Local fats >500kg – 23-24Y/kg

Henan Province: Local fats 600-700kg – 24Y/kg, Simmental 23.2-23.6Y/kg

Gansu Province: Simmental fats 600 – 800kg – 23-23.4Y/kg

Ningxia Province: Holstein fats – 20-22Y/kg, Simmental fats 22-23Y/kg

Peru

Bruce Wallner, previously based in Jakarta is now Austrade Trade Commissioner based in Lima, Peru.

He has very kindly sent this summary of the Peruvian beef market.

Peru

Beef is widely consumed in Peru, although per capita consumption at about 5 kg/person/year, lags well behind chicken first and fish second as protein sources. Sheepmeat is virtually absent from the coastal markets but is consumed (along with llama, guinea pigs and rabbit meat) in the Andes. Like Asia, with a strong record of economic growth and rising affluence, beef consumption is on the rise.

There are a few Peruvian signature beef dishes like lomo saltado (a marinated beef stir fry) that you will find in virtually every restaurant along with anticuchos (skewers of beef heart cooked over coals). Eating out, especially at lunch, is the norm and the food service industry is huge. In fact, the city of Lima has three of the world’s top 50 restaurants while the whole of Australia can muster only one. The standard of restaurant cuisine is generally very high and something that Peruvians take great pride in.

About 80 per cent of Peru’s 30 million population live on the Pacific coastal fringe, but there is little sign of a cattle industry near the coast as it is a lunar-landscape desert and stock feed is scarce. Beef supply is mainly imported as vacuum packaged product. The supermarkets stock beef from three main sources – Bolivia (called national product in retail outlets) which occupies the low price end of the market, US grain-fed is at the top end while Argentina occupies the middle market. Interestingly, neighbouring Brazilian product is absent from the big supermarket chains. Prices vary according to source, for example US striploin sells for AUD$40 per kg, Argentine stiploin $36 per kg and the ‘nacional’ equivalent from Bolivia is $21 per kg.

In the wetmarkets of Lima, cattle sourced from greener parts of Peru and Bolivia, are butchered and sold. Knuckle is currently AUD$ 9.60 per kg and heart sells for $6.40 per kg.

The Australian government is currently negotiating a market access protocol for beef to Peru. Importers tell Austrade that they are looking to add Australian product to their offerings, especially quality grass-fed product. There is a new ‘business friendly’ Government in Peru that took office on 28 July this year. The new administration is showing all the signs of making Peru a place to do business.

Beef Central columnist Dr Ross Ainsworth will be speaking at the upcoming BeefEX feedlot industry conference on the Gold Coast in October. Click here to access a preview. Dr Ainsworth’s monthly South East Asian reports are first published exclusively on Beef Central. To view previous Beef Central articles click here. To visit his personal South East Asia report blog site, click here.

Market price table for August 2016

(All prices converted to AUD)

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle/Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Jakarta | March 16 | 12.83 | 18.18 | 2.93 | 4.19 |

| April 16 | 13.00 | 18.20 | 2.90 | 4.00 | |

| May 16 | 13.27 | 18.57 | 3.06 | 4.29 | |

| June 16 | 13.63 | 18.89 | 3.54 | 4.24 | |

| July 16 | 13.06 | 17.59 | 3.22 | 4.32 | |

| August 16 | 13.13 | 17.41 | 2.99 | 4.23 | |

| Medan | March 16 | 11.11 | 10.50 | 2.12 | 4.49 |

| April 16 | 12.00 | 10.40 | 1.70 | 4.40 | |

| May 16 | 11.73 | 12.24 | 4.59 | 4.49 | |

| June 16 | 11.11 | 11.11 | 2.42 | 4.44 | |

| July 16 | 11.56 | 11.25 | 2.61 | 4.42 | |

| August 16 | 11.44 | 11.14 | 2.29 | 4.28 | |

| Philippines | March 16 | 8.00 | 7.28 | 3.57 | 2.71 |

| April 16 | 7.93 | 7.50 | 3.39 | 2.69 | |

| May 16 | 8.38 | 8.23 | 3.38 | 2.79 | |

| June 16 | 8.14 | 7.43 | 3.43 | 2.68 | |

| July 16 | 8.29 | 7.72 | 3.46 | 2.80 | |

| August 16 | 8.45 | 8.17 | 3.80 | 2.82 | |

| Thailand | March 16 | 9.39 | 10.52 | 2.63 | 3.38 |

| April 16 | 9.06 | 10.57 | 2.64 | 3.39 | |

| May 16 | 9.27 | 10.81 | 2.70 | 3.48 | |

| June 16 | 8.74 | 10.65 | 2.66 | 3.80 | |

| July 16 | 8.78 | 10.57 | 2.64 | 3.58 | |

| August 16 | 8.68 | 10.57 | 2.64 | 3.58 | |

| Malaysia | March 16 | 9.90 5.78 | 11.55 | 1.91 | 3.49 |

| April 16 | 10.06 5.87 | 11.74 | 1.85 | 3.82 | |

| May 16 | 10.10 5.89 | 11.78 | 2.02 | 3.84 | |

| June 16 | 9.93 5.79 | 8.94 | 2.48 | 3.77 | |

| July 16 | 9.84 5.84 | 8.85 | 2.79 | 3.74 | |

| August 16 | 9.77 5.80 | 9.45 | 2.60 | 3.71 | |

| Vietnam | March 16 | 14.88 | 16.66 | 7.74 | 3.99 |

| HCM City | April 16 | 14.88 | 16.67 | 7.74 | 4.05 |

| May 16 | 15.43 | 17.28 | 7.41 | 4.32 | |

| June 16 | 14.97 | 16.77 | 7.19 | 4.07 | |

| July 16 | 14.79 | 16.51 | 7.10 | 4.08 | |

| August 16 | 14.70 | 16.47 | 9.41 | 4.12 | |

| China | March 16 | 14.23 | 18.61 | 4.07 | 5.04 |

| Beijing | April 16 | 14.28 | 18.69 | 4.08 | 4.89 |

| May 16 | 14.26 | 19.20 | 4.19 | 4.61 | |

| June 16 | 13.73 | 18.50 | 4.04 | 4.44 | |

| July 16 | 13.86 | 18.14 | 3.96 | 4.55 | |

| August 16 | 13.81 | 17.95 | 3.94 | 4.63 | |

| Shanghai | March 16 | 14.63 | 18.21 | 5.69 | 3.45 |

| April 16 | 13.88 | 16.33 | 5.70 | 3.43 | |

| May 16 | 14.68 | 15.43 | 5.87 | 3.46 | |

| June 16 | 18.58 | 19.79 | 5.66 | 3.27 | |

| July 16 | 15.84 | 19.41 | 5.54 | 3.21 | |

| August 16 | 15.78 | 19.33 | 5.52 | 3.16 |

Appreciate this insight, Ross. Breeders available here from the Hayfield ‘Hat Brand’, waiting for an order which has a sustainable programme that delivers quality grey Australian Brahman breeder cattle to Indonesia which meet both the desired outcomes for Indonesian cattle farmers, Australian cattle producers, exporters, importers and the Indonesian Government ‘s selfsuffiency and procurement policy

This Indonesian report clearly demonstrates to all producers and industry connections, the high degree of damage Governments can do riding on popularists agendas.