For the Bahasa Indonesia language version of this report click here

For the Bahasa Indonesia language version of this report click here

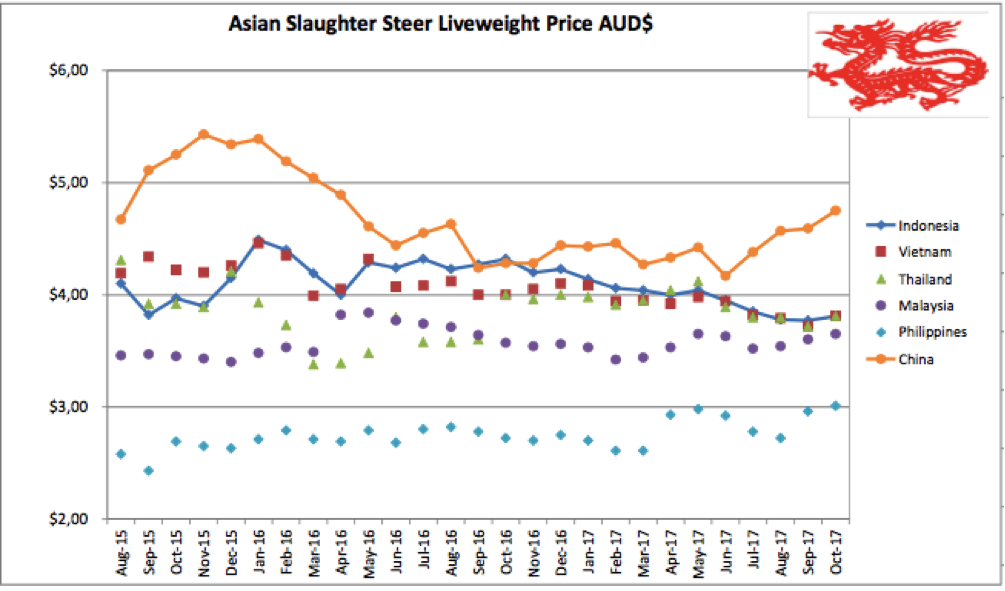

Indonesia: Slaughter Steers AUD $3.81/kg live weight (Rp 10,500 = $1AUD)

Slaughter steer prices are weakening even further although I am still using Rp40,000 per kg for this month’s indicator price as the lower prices (down as low as Rp39,000 per kg) tend to be targeted discounts.

In addition to these aggressive price reductions, some importers are also resorting to extended credit terms for butchers in order to get cattle moving out of the feedlot.

In the past, credit to small, individual butchers has often resulted in an ultimate failure to pay, demonstrating just how desperate some importers are.

When feedlot cattle reach their target weight and fat level they simply have to be sold or they begin to reduce in value while increasing their overall cost. Some feedlotters just have too many finished cattle on feed, leaving them with only unsatisfactory options. Others have serious cash flow needs that can only be met by sales at any rate.

Weakness in the fresh meat retail sector is being experienced in both wet and supermarket outlets. As with last month, demand is so weak that even with discounts and credit, the numbers being sold are disappointing.

Only four small shipments arrived in October with a similar number expected for November, so this will help to take the pressure off feedlot inventories. October is traditionally a slow market month with religious festivals concluded and Christmas only two months away.

Negotiations between the Government of Indonesia (GOI) and the importers regarding the 1:5 breeder import formula are continuing although it seems likely that a resolution to this issue is at least several months away.

With cold storage space at a premium, PT Suri Nusantara Jaya opened its new 30,000 ton capacity facility outside Jakarta this month. This will assist with the management of frozen imports that were struggling to find a cold place to sit prior to sale.

In an ironic twist, the state owned agricultural conglomerate Berdikari, which operates several feedlots (as well as many other agri-businesses) has reported ongoing losses in its feedlot business as a result of the competition from Indian buffalo beef.

State Owned Enterprise, PT Wira Carma has announced its intention to import 16,000 head of cattle from Australia to East Java in 2018 including 6,000 head of breeders and 10,000 head of feeders. Given the poor slaughter cattle prices in East Java at the moment (Rp39,000 per kg live weight), this target appears to be extremely optimistic.

This Queensland heifer has only been in Indonesia for about 12 months and on this palm plantation for about nine months. These cattle are cell grazed under palms with movements every day so they very quickly become accustomed to constant human contact as you can see. About half the cattle in this group of 250 head are this quiet. I think this cow was thoroughly enjoying my scratching in her ear as I was inspecting her for ticks.

Vietnam: Slaughter Steers AUD $3.81/kg (VND17,600 to $1AUD)

Top prices are dropping with the best bulls only reaching a maximum of Dong73,000. Heavy steers ex Townsville are selling for D71,000 while slaughter steers from the feedlot can achieve 68-69,000 Dong per kg. Slaughter cows are down to Dong62-63,000.

Vietnamese importers remain in a serious bind, as there is no sign of a price reduction coming from Australia despite the sharp downturn in Indonesian demand. Thai cattle are too expensive and over fat while indigenous cattle from Laos and Cambodia are very small and their numbers are so low that there is no chance that they can make a serious contribution to Vietnamese domestic demand.

Photo from the Vientiane Times. Laotian indigenous cattle are very small and poor performers in the feedlot.

An article in the Vientiane Times on the 10th of October explained that government forecasts for live cattle exports to exceed 2016 levels were unlikely to be achieved with last year’s numbers around 110,000 and Vietnam as the major destination.

Considering the size of these cattle is close to half the mature size of an Australian bovine then this number of exports translates to more like 50,000 head. The government hopes to increase the cattle herd from about 1.8 million to 2 million in the next few years to facilitate increasing levels of exports.

With Cambodia a net importer of meat products, the chances of any significant level of indigenous live cattle exports to Vietnam also seem remote.

Thailand: Slaughter Steers AUD $3.81 / kg (Baht 25.7 to $1AUD)

Nothing to report from Thailand as the market remains flat and steady.

Malaysia: Slaughter Steers AUD $3.66 per / kg (RM3.28 to $1 AUD)

No change in Malaysia either with only currency fluctuations moving the live cattle prices recorded.

Philippines: Slaughter Cattle AUD $3.01 / kg (Peso 39.9 to AUD$1)

This market continues its upward trend along the general lines of national economic improvement. The Peso strengthening is primarily responsible for the indicator price of live cattle breaking through the AUD$3.00 barrier for the first time since this market report commenced almost 4 years ago. Despite this milestone, the Philippines still has the lowest price for live slaughter cattle of all the countries monitored in this report.

China: Slaughter Cattle AUD $4.75 / kg (RMB 5.14 = AUD$1)

Something significant appears to be happening in the Chinese live cattle and fresh beef markets.

I have expanded the table below from last month by including October’s reported prices which continue the steady climb of rates seen for most of the last 8 months. Significantly, beef prices in both the wet and supermarkets have also begun to rise in both Beijing and Shanghai although not as fast as the live price.

The logical explanation that I am receiving from my agents is simply that the supply is falling while demand continues to expand. Unfortunately, the finer details of the trade dynamics remain a mystery so we will just have to wait to find out if and when this supply and demand imbalance can drive the market to a point where live exports from Australia finally make economic sense.

Despite the healthy price rises described below, this point certainly hasn’t been reached as yet with the current live cattle shipment from southern Australia strictly an expensive trial run for the Chinese importers.

| Month | Beijing Slaughter price | Shanghai |

| March 2017 | 22.5 RMB per kg live | 18 |

| April | 22.5 | 19.2 |

| May | 22.5 | 20 |

| June | 21.5 | 22 |

| July | 23.2 | 23 |

| August | 24 | 24 |

| September | 24 | 24 |

| October 2017 | 24.4 | 24.7 |

Market price table for October 2017

(All prices converted to AUD)

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle / Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Indonesia | May 17 | 13.43 | 15.35 | 2.93 | 4.04 |

| Rp10,125 | June 17 | 13.83 | 19.95 | 3.95 | 3.95 |

| Rp10,400 | July 17 | 12.50 | 14.71 | 3.84 | 3.85 |

| Rp10,575 | August 17 | 12.29 | 14.47 | 3.50 | 3.78 |

| Rp10,600 | Sept 17 | 12.26 | 19.05 | 3.25 | 3.77 |

| Rp10,500 | October 17 | 12.57 | 19.23 | 3.33 | 3.81 |

| Philippines | May 17 | 8.67 | 8.94 | 3.66 | 2.98 |

| P 37.7 | June 17 | 8.22 | 8.49 | 3.66 | 2.92 |

| P39.5 | July 17 | 7.85 | 8.10 | 3.54 | 2.78 |

| P40.5 | August 17 | 7.40 | 7.40 | 3.46 | 2.72 |

| P40.5 | Sept 17 | 7.41 | 7.53 | 3.28 | 2.96 |

| P39.9 | October 17 | 7.69 | 7.64 | 3.46 | 3.01 |

| Thailand | May 17 | 9.41 | 10.90 | 2.74 | 4.12 |

| THB 25.7 | June 17 | 9.34 | 10.89 | 2.72 | 3.89 |

| THB 26.3 | July 17 | 9.12 | 10.65 | 2.66 | 3.80 |

| THB 26.3 | August 17 | 9.12 | 10.65 | 2.66 | 3.80 |

| THB 26.3 | Sept 17 | 9.13 | 10.65 | 2.66 | 3.72 |

| THB 25.7 | October 17 | 9.34 | 10.89 | 2.72 | 3.81 |

| Malaysia | May 17 | 9.40 6.27 | 9.40 | 2.13 | 3.65 |

| MYR 3.25 | June 17 | 9.85 6.77 | 2.30 | 3.63 | |

| MYR 3.35 | July 17 | 9.55 6.57 | 10.15 | 2.53 | 3.52 |

| MYR 3.39 | August 17 | 9.44 6.49 | 10.03 | 2.51 | 3.54 |

| MYR 3.33 | Sept 17 | 9.60 6.60 | 10.21 | 2.34 | 3.60 |

| MYR 3.28 | October 17 | 9.76 6.71 | 10.36 | 2.07 | 3.66 |

| Vietnam HCM | May 17 | 14.83 | 17.92 | 7.12 | 3.98 |

| D17,250 | June 17 | 14.49 | 17.50 | 6.96 | 3.94 |

| D17,800 | July 17 | 14.04 | 16.97 | 6.74 | 3.82 |

| D17,950 | August 17 | 13.93 | 15.60 | 5.57 | 3.79 |

| D18,000 | Sept 17 | 13.89 | 15.55 | 6.94 | 3.77 |

| D17,600 | October 17 | 14.20 | 13.92 | 7.22 | 3.81 |

| China Beijing | May 17 | 11.79 | 14.93 | 3.73 | 4.42 |

| Y 5.16 | June 17 | 12.01 | 14.73 | 3.68 | 4.17 |

| Y5.3 | July 17 | 11.70 | 14.72 | 3.58 | 4.38 |

| Y5.25 | August 17 | 11.62 | 14.48 | 3.61 | 4.57 |

| Y5.23 | Sept 17 | 11.85 | 14.53 | 3.63 | 4.59 |

| Y5.14 | October 17 | 12.45 | 15.18 | 3.69 | 4.75 |

| Shanghai | May 17 | 14.14 | 19.25 | 4.40 | 3.93 |

| June 17 | 14.34 | 18.99 | 4.65 | 4.26 | |

| July 17 | 13.58 | 17.74 | 4.53 | 4.34 | |

| August 17 | 15.04 | 18.66 | 4.95 | 4.57 | |

| Sept 17 | 15.29 | 18.44 | 4.78 | 4.59 | |

| October 17 | 15.95 | 19.07 | 4.86 | 4.75 |

HAVE YOUR SAY