118th Edition: November 2023

Key points:

- Outcome of Indonesian delegation to Australia tour still unknown.

- Asia Beef Network builds economic cooperation between Australia and Vietnam.

- Indonesia gears up for national election. Philippines ends a local one.

Regional Trends and Overview

A delegation from Indonesia travelled to Australia in late September as part of the joint lumpy skin disease (LSD) investigation program to inspect the previously suspended live export quarantine yards. Within the industry, there were hopes that the tour would lead to further relief from the challenging skin lesion issue, which has resulted in a high number of cattle being rejected for the Indonesian market. To date, there has been no public feedback on the tour or its outcomes.

Thanks to a project funded by the Australian Department of Foreign Affairs and Trade (DFAT), the Asian Beef Network has been revitalised. With a strong focus on the trade in Vietnam, the network is in the early stages of collecting data from beef and cattle traders in the region and compiling it into useful resources (www.asiabeef.network).

The main limitation of data collection in the region is that it is confined to either official data or anecdote. The issue with official data is that it does not capture the flow of animals outside recorded channels, which often influences prices or poses a disease risk. Anecdotal trade numbers, meanwhile, cannot be verified.

Regarding regional livestock movement, the trade of cattle from Laos to Vietnam was officially halted at the beginning of this year in response to the detection of the Beta-2 agonist salbutamol in pigs and cattle. This crackdown also enforced the existing regulation on cattle movement into Vietnam, which requires quarantine in accordance with long-standing Circular No. 27/2009/TT-BNN from 2009. Since then, it is understood that intensified crackdowns on the use of the prohibited substance have led to a decrease in cattle imports from Thailand to Vietnam throughout the year. Coupled with the reduced movement of cattle into China from Vietnam, we are potentially at the start of a significant shift in regional trading patterns.

Due to animal welfare regulations, the trading of cattle into China via Laos is improbable. Nevertheless, there remains demand and opportunity to aggregate healthy, consistent, and large-framed cattle from the region into this official trade route. This would likely be the best outcome for the region, ensuring a consistent off-take of live cattle and having the most significant impact on commercial vaccination programs for LSD and foot-and-mouth disease (FMD). To date, I am not aware of any significant funding from regional disease response organisations being appropriately channelled into this.

More information on the FMD and LSD situation in Indonesia can be found at the end of this article.

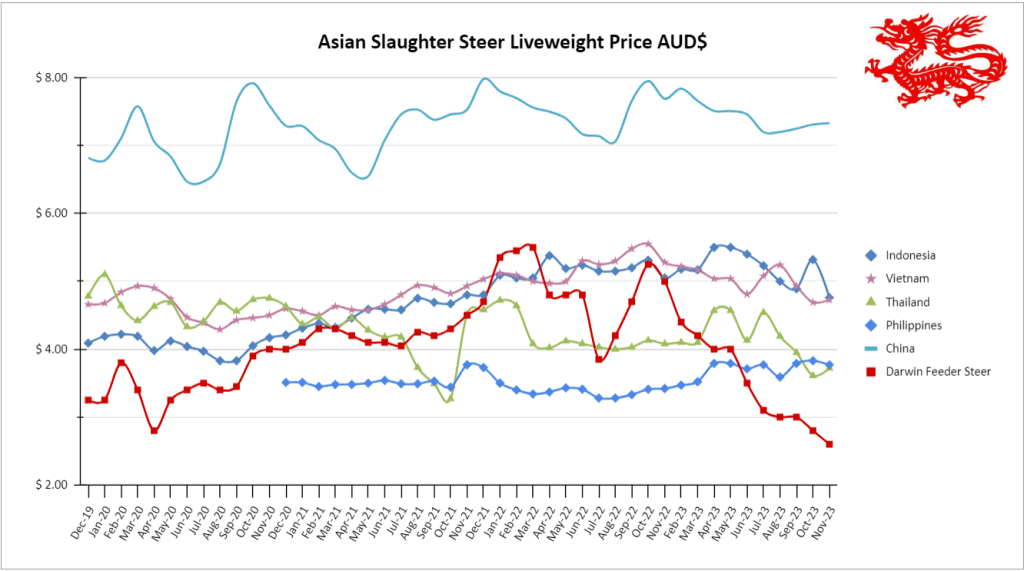

Indonesia: Steers AUD $4.76 / kg live weight (IDR 10,084.85 = 1 AUD)

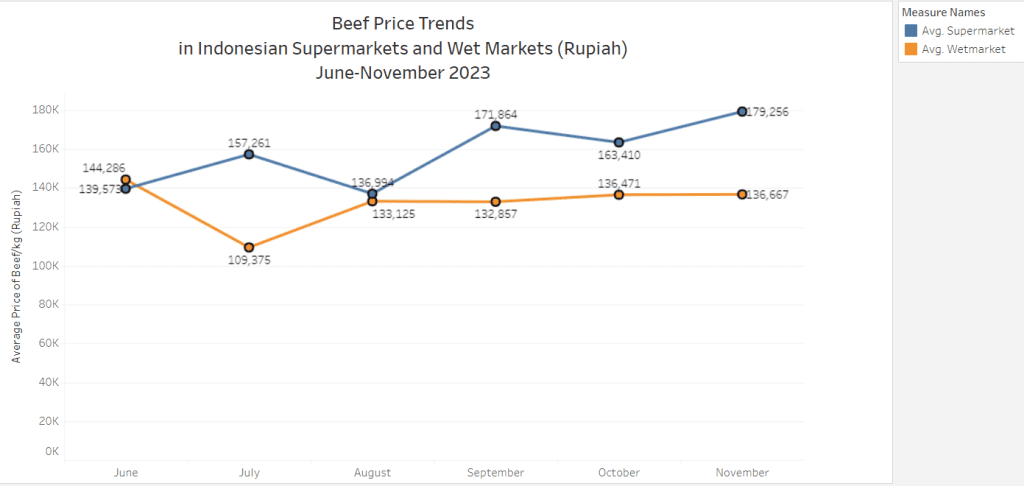

The beef price in the market remains stable, and in some wet markets, it has decreased slightly. Carcass beef sold out of abattoirs is approximately IDR 93,000/kg in the cities around Java Island. Early this November, the beef price in the wet market has stabilised at IDR 136,667/kg live weight, despite the rising prices of other commodities such as chilli and rice, which are staple foods in most Indonesian households. Beef prices in Indonesian supermarkets have increased in both Java and Sumatra.

International Trade Projections and Indonesia’s Presidential Candidates

The upcoming Indonesian presidential election is poised to influence the nation’s international trade policies.

The three prominent candidates – Ganjar Pranowo, Prabowo Subianto, and Anies Baswedan – present distinct economic visions. It’s essential to recognise that actual trade outcomes may evolve, influenced by the dynamic political landscape and global developments. For those unfamiliar with Indonesian politics, it is more eventful than Australian politics, with significant discussions around alliances and endorsements.

Ganjar Pranowo champions a pragmatic approach to economic development, focusing on sustainable growth and social welfare. Should he secure the presidency, Indonesia is likely to continue its current trade policies, prioritising regional partnerships and open markets.

Prabowo Subianto has historically supported protectionist measures, which could lead to trade restrictions or a more self-sufficient economic strategy. Such a shift could affect international trade relationships and potentially create tensions with key partners.

Anies Baswedan advocates for an innovation and technology-driven economic growth. His leadership could promote closer collaboration with global tech giants, potentially enhancing Indonesia’s digital economy and its international trade in tech-related sectors.

Another recent development in Indonesian politics is the reappointment of the Minister of Agriculture. President Joko Widodo (Jokowi) has reinstated Amran Sulaiman as Indonesia’s Minister of Agriculture (Mentan), effective from October 25, 2023. Amran previously served in this role during Jokowi’s first presidential term from 2014 to 2019. His reappointment follows Syahrul Yasin Limpo’s resignation amid a corruption case.

Amran’s return is based on his extensive ministerial experience, ensuring a smooth transition and the rapid implementation of agricultural policies to tackle current challenges. His immediate focus is on enhancing rice and paddy production to mitigate the high prices of staple foods, a pressing concern for Indonesian consumers. Amran’s past achievements include meeting agricultural production targets in 2017 and 2021, demonstrating his capability. He has pledged to continue valuable initiatives like the ‘Save the Swamp and Improve Farmer Welfare’ – Selamatkan Rawa Sejahterakan Petani (Serasi) program, which aims to support and uplift farmers. However, Amran’s new term will not be without challenges, which include attaining food self-sufficiency, enhancing biosecurity in light of the FMD and LSD outbreaks, and addressing the environmental and social implications of the Food Estate project.

Vietnam: Steers AUD $4.73/ kg live weight (VND15,799.90 = 1AUD)

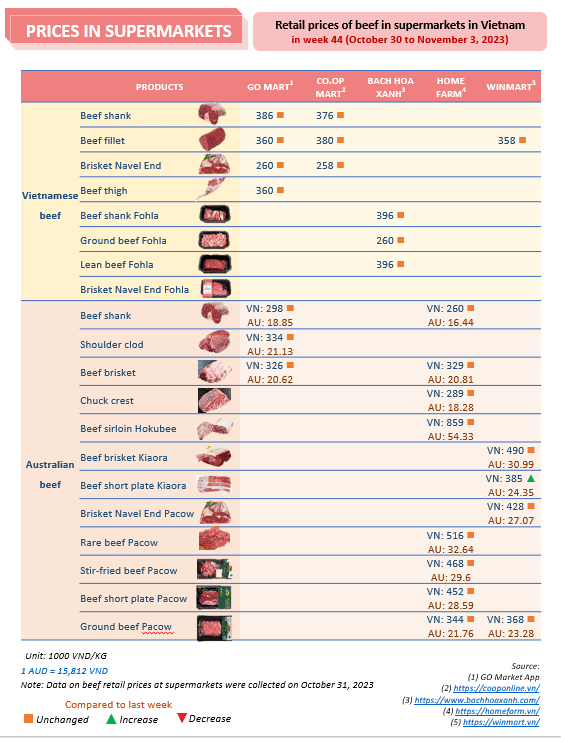

The price of Australian cattle delivered to Vietnamese abattoirs remains competitive, undercutting local cattle and imports from neighbouring Thailand and Laos. Steer prices have decreased to VND 73,000 per kg liveweight, while bull prices are slightly higher at VND 74,504.50 per kg. In the wet markets, the wholesale price for hot beef hovers around VND 205,000 (approximately AUD $13) per kg.

As we reflect on the impact of the pandemic, which now seems like a distant memory, Vietnam is showing signs of economic recovery with the potential for a surge in beef exports in 2024. A significant trend is the growing consumer preference for imported beef over local produce. Australian exporters are faced with the fortunate dilemma of pursuing the currently profitable U.S. ground beef market or fostering new relationships in Vietnam. The latter requires a focus on building sustainable trade relations and educating consumers and businesses on the value and use of different beef products. Finding trusted partners can be challenging because in my experience their entrepreneurial nature means that every person in the industry either is or could be a meat trader.

Philippines: Slaughter Steers AUD $3.77 / kg liveweight (P. 36.34 = 1AU)

In the Philippines, the beef market has maintained its status quo over the last month, with prices remaining stable. In wet markets and supermarkets alike, beef knuckle has been trading at P. 560/kg and P. 600/kg, respectively. Local cattle prices in Mindanao are still pegged between P. 130-145/kg liveweight, and the hot carcass meat price is approximately P. 260/kg. It is important to note that these figures pertain to cattle bred and traded within Mindanao, not Australian imports.

The country’s political landscape has been vibrant with the recent conclusion of village council elections. These elections are the bedrock of the Philippines’ political system, with implications far beyond their modest setting. Held across 42,000 villages nationwide, the barangay (village) elections are a fundamental aspect of Philippine democracy, often seen as a springboard for political careers and an opportunity for establishing vital grassroots connections that feed into higher-level politics.

The electoral process, however, is not without its challenges. Historically, these village elections have been marred by violence, and the most recent ones were no exception, albeit on a smaller scale. The government deployed over 300,000 police officers and soldiers to safeguard the polling stations. The elections were significant enough that the authorities took no chances, especially given that past elections have been delayed due to violence and the resulting security concerns.

Despite these challenges, the elections have been described by my Filipino contacts as ‘peaceful’, a positive sign that indicates a trend towards greater political stability. This stability is critical, as it plays a direct role in shaping economic conditions and the livelihoods of the populace. When political tides are steady, it usually translates to a more predictable economic environment, which can benefit the beef market among others.

Thailand Steers AUD $3.72 (THB 23.12 = 1 AUD)

Thai live cattle prices increased slightly to Tb 86/kg ($3.72 AUD). The common problem of high feed input costs continues to impact the local industry.

We are actively looking for people to support the reporting on what is happening in the Thai market for meat and livestock. If you or your contacts are able to share some insights and knowledge about the Thai market then we would love to talk more to you.

Feeder Steers Darwin $2.60 Townsville $2.30

The northern export feeder steer price continued to slide over the last month. Producers are still battling with the changed specifications for cattle exported to Indonesia, with large numbers of cattle that would normally have shipped at this time of year being either held for next season, or shifted to alternative markets, with additional trucking time and cost.

The recent fires in Australia have added further concern to eligibility of many cattle for live export markets in Australia’s north. The lack of any updates from the recent Indonesian delegation to Australia means that producers are still in a state of anxiety as to what they can do with many of their cattle. For the last few months Australian cattle have been rejected from live export shipments if they have any skin blemishes as it increases the risk of being mistaken for lumpy skin disease (LSD) in Indonesia.

Live Export Statistics Year to September 2023

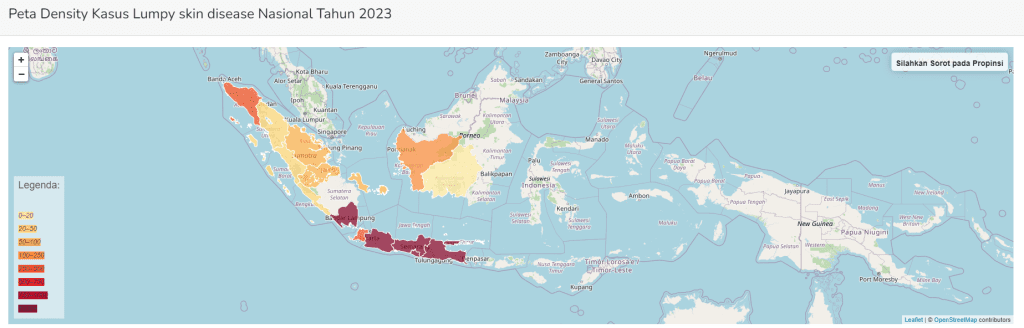

LSD and FMD in Indonesia

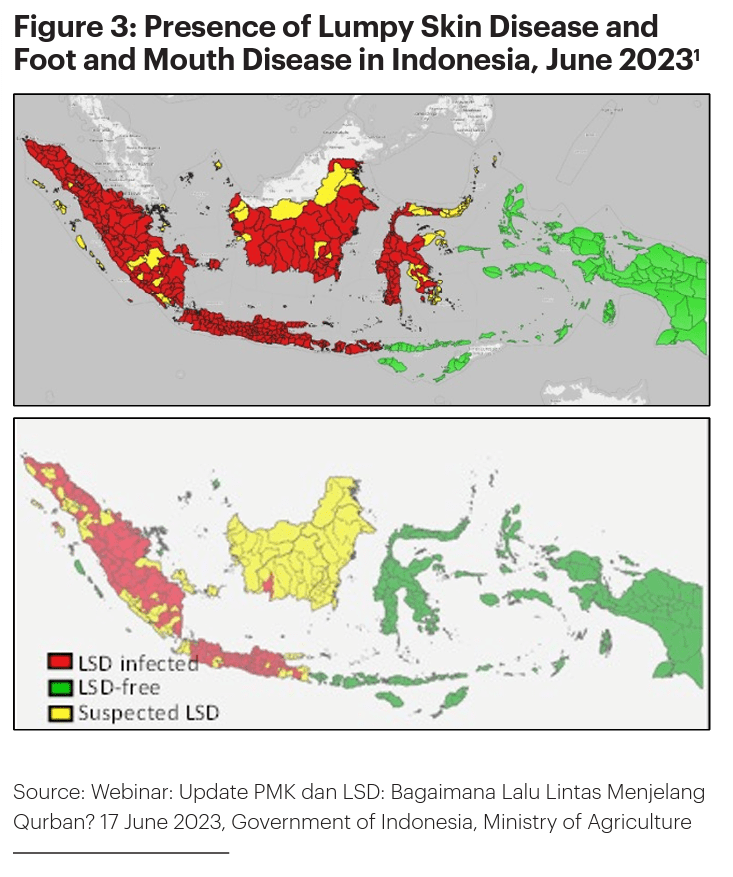

LSD and FMD continue to be highly prevalent and a concern in Indonesia. At this stage LSD has not been seen in Bali or further east. A major issue is that while the vaccine is available, it can still only be used if an outbreak is actively occurring. This clearly limits its ability to prevent further spread through the islands and towards Australia.

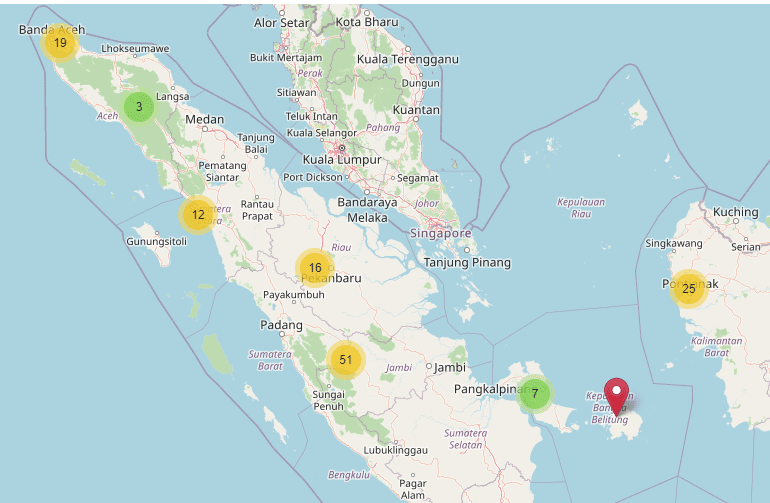

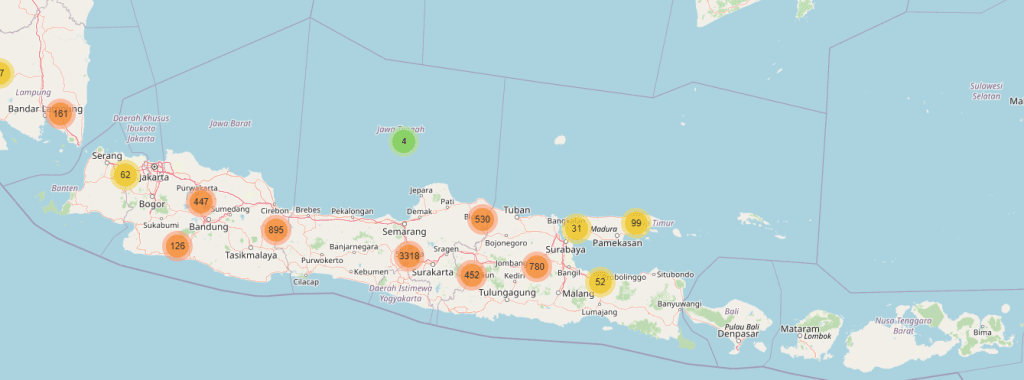

Density Maps of LSD infected cattle in 2023

Source: iSikhnas, 2023

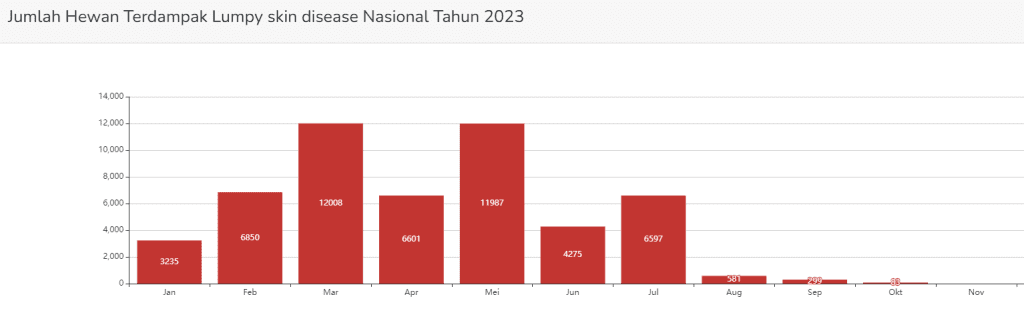

Number of animals infected by LSD in 2023

Source: iSikhnas, 2023

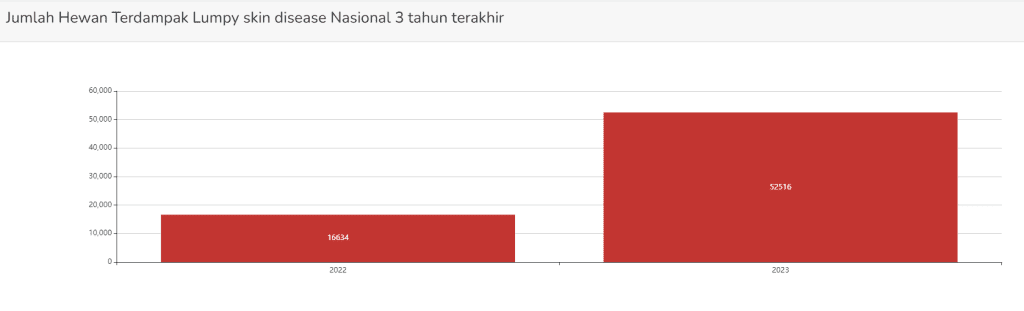

Number of animals infected by LSD in the last three years

Source: iSikhnas, 2023

Source: Ministry of Agriculture 2023