![]() See Bahasa Indonesia translation/versi Bahasa Indonesia

See Bahasa Indonesia translation/versi Bahasa Indonesia

87th Edition : February 2021

Key Points

- Australian cattle prices continue to smash all-time price records

- Import numbers drop sharply in both Indonesia and Vietnam

- This is the first edition translated into Vietnamese

Indonesia: Slaughter Steers AUD $4.38/kg live weight (Rp10,970 = $1AUD)

Slaughter steer prices continue their steady climb with my indicator rate rising from Rp46,500 per kg live last month to Rp48,000 for February.

This figure was produced from a range of reported rates from as low as Rp46k in Lampung to as high as Rp49,000 in Java.

Despite this increase in live slaughter cattle prices, the rates for fresh beef in the wet market remains steady at Rp130,000 per kg.

In contrast, supermarket rates in Jakarta are discounted in two of the major chains with fresh knuckle down from the usual price of about Rp160,000 per kg to Rp129,000 at the end of February.

Even Australian imported knuckle was discounted to Rp139,000 per kg in the Giant supermarket chain.

Frozen Indian buffalo meat (IBM) has gone in the opposite direction with a new supermarket rate of Rp95,000 per kg, an increase of more than 18% since January.

Bulog, the State Logistics agency has been given the task to import 80,000 tons of IBM to ensure adequate supplies of beef are available for the festivals of Ramadan, Lebaran and Qurban with the first day of Ramadan on the 12th of April. A spokesman for the agency said that the imports would be conducted in stages in accordance with the market demand in order to stabilize the price without harming local farmers. Current stocks of IBM are reported to be 13,600 tons. The same spokesperson also suggested that the recent beef price hikes were caused by speculators or cartels. They also doubted that the sole reason for domestic beef price increases were due to the increase of livestock prices in Australia. Last year Bulog was given import permits of 100,000 tons but only imported 37,000 tons of product for the 2020 calendar year.

The recent proposals for alternative live cattle imports from Mexico don’t appear to have make any significant progress with new reports that Brazil might be a more cost-effective source of live cattle although their Foot and Mouth Disease (FMD) disease status (free with vaccination) is way below that of Mexico so the risks associated with a Brazilian shipment would be much greater than one sourced from Mexico.

Buffalo imports have increased dramatically during 2020 compared with the previous year as lot feeders try to reduce the overall cost of their imported stock. The total rose from 3,377 head in 2019 to 6,252 during 2020. 2021 has kicked off with strong numbers again with 777 head exported to Indonesia in January and a reported 523 head in February.

So why import live buffalo when it is possible to buy much cheaper frozen Indian buffalo meat? The simple answer is that fresh buffalo meat from locally slaughtered animals is a totally different product to frozen Indian buffalo as these animals are culled for advanced age from the Indian dairy herd and in most cases lose a great deal of weight between the time they are culled and slaughtered. By contrast local or imported buffalo are fed up in order to maximise their slaughter weight and meat quality prior to slaughter in Indonesia. It is also well known that fresh meat has superior eating qualities to frozen product.

Indonesia has commenced vaccinations for Covid 19 with over a million people having received their first dose of by the end of February.

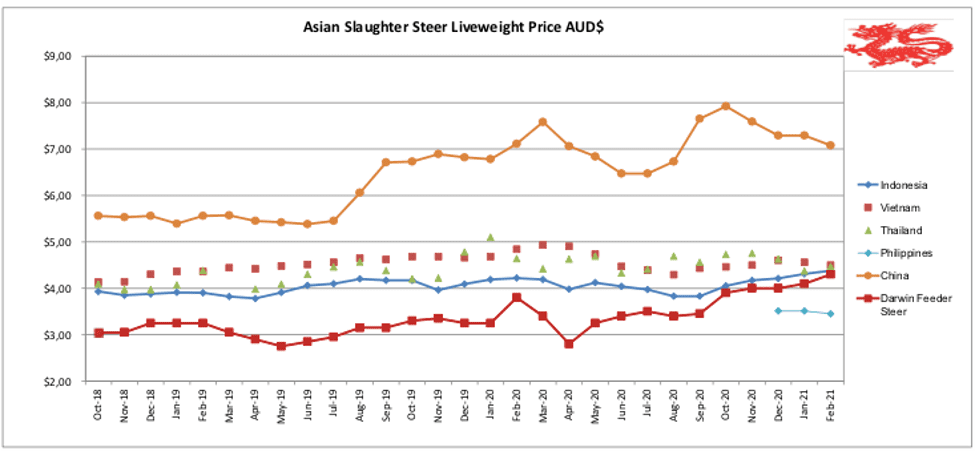

Darwin feeder steer prices have hit a new all-time high with the current rate sitting at AUD$4.30 per kg live weight with prices as high as $4.40 reported for small numbers. These rates will give Indonesian importers no joy with the resulting CIF price at USD$3.90 per kg live landed Jakarta. Import numbers for January were about 35,000 while February figures are expected to be closer to 20,000 (15,217 head left the port of Darwin in February for Indonesia). The consensus amongst market specialists is that this price is likely to hold for another month or so with the first chance for a fall in rates linked to the observation that a number of areas in the north of Australia have still not had an adequate wet season. Prices of slaughter cattle in the Townsville area are hovering around the $3.80 to $4.00 region with the ongoing lack of a satisfactory season in large parts of Central Queensland looming as a potential trigger for a fall in rates.

If these high prices weren’t causing enough pain for exporters, the Australian government has just announced a possible price rise for export fees and charges of over 400% over a 3 year period from July 2021. The Australian government operates a cost recovery system for export certification fees and claims that if exports continue as they are then the following estimates of fee rises may be the result :

Exporters hope to negotiate a range of administrative efficiencies which will assist to reduce the level of charges levied by the federal government. The problem that exporters face is that some of the bureaucrats they are negotiating with will potentially lose their jobs if they cooperate and make the export certification system more efficient. Good luck with that.

Vietnam: Slaughter Steers AUD $4.50 / kg (VND18,020 to $1AUD)

Slaughter rates have stabilised this month with no increase over January prices. The indicator price per kg live weight remains at Dong81,000 although the AUD conversion above has changed slightly due to the appreciation of the Aussie currency during the month. This average is compiled from rates for slaughter steers ranging from 78 to 80,000 Dong per kg live weight in the south to 81 to 86,000 Dong in the north.

Wet market fresh beef prices have also remained the same as last month although there has been a significant increase in the price of knuckle in the supermarkets surveyed (Ho Chi Minh City) from Dong 282,000 per kg in January to Dong 314,000 per kg this month. See photo below from VinMart in Ho Chi Minh City. Where possible, all beef prices quoted in this report are based on the knuckle (also called the round or quadriceps muscle).

The wording on the label above confirms that this product is produced by a supply chain which is compliant with ESCAS (Exporter Supply Chain Assurance System). ESCAS was established to allow exporters to demonstrate that animal welfare standards were complied with throughout the exporting, importing, handling and slaughter process with full traceability of all individual animals throughout the supply chain backed up by independent auditors.

Numbers imported during January were around 23,000 with shipments for February and the following months predicted to be substantially lower as Vietnamese demand collapses in the face of the consistent price rises in Australia. The main port which services Vietnam is Townsville in north Queensland where prices have risen rapidly during the latter half of 2020 to around AUD$3.80 per kg live weight for slaughter cattle with recent reports of up to $4.00 per kg. Australian livestock are sold in a free market system with no government intervention so prices are determined purely by demand and supply. The key factors driving the Australian cattle market at the moment are generally good seasonal conditions following a long drought with farmers retaining females to commence herd rebuilding while domestic restockers are aggressively buying feeder cattle to utilise vast areas of plentiful pastures.

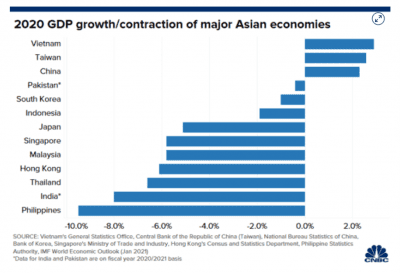

While Vietnamese importers are under pressure at the present time, the longer term view of the Vietnamese market is very positive with Vietnam delivering one of the best economic performances during the Covid 19 year of 2020. See the table below showing Vietnam leading the region with a 2020 GDP growth of 2.9% while the majority of Asian economies produced a negative result. Analysts have predicted Vietnamese GDP growth for 2021 of between 6 and 9% which would almost certainly maintain its position of the fastest growing economy in Asia. Factors noted for this optimistic view include the extremely effective management of the Covid 19 pandemic along with a continued migration of manufacturing industries out of China and into Vietnam. The very important tourism industry is also expected to recover later in 2021.

Despite this optimistic view of the Vietnamese economy there are still plenty serious issues facing the domestic food producing industries. The ongoing African Swine Fever (ASF) epidemic has resulted in a large illegal trade selling Vietnamese pigs across the border into China where prices are almost double local rates. This has the potential of seriously reducing supplies in the north of country and driving prices up further.

H5N6 Avian Influenza has been reported in a Quang Minh commune in North Vietnam while the outbreak of Lumpy Skin Disease which commenced in cattle in the Loc Ha district is still spreading to other districts despite the government’s control measures.

Photo from CanTho Online showing a local farmer raising cattle with support from the government poverty alleviation program in Tra Vinh province in the Mekong Delta.

Buffalo exports from Darwin to Vietnam have continued at a steady rate with 3,825 shipped in 2019 and 3,994 sent during 2020. This places Vietnam as the second biggest importer of live Australian buffalo with Indonesia the largest receiving 6,252 in 2020. Buffalo are generally caught in the wild and held in yards for extended periods while they are acclimatised to close handling, dehorned and processed for export. The market price for buffalo is cheaper than cattle although there are a number of additional costs associated with the shipment of buffalo including additional space requirements on ships that increase their landed costs in the importing country.

The Rum Jungle abattoir south of Darwin plans to kill up to 420 buffalo per week or around 16-17,000 during the 2021 season. Northern Territory buffalo producers and harvesters are fortunate to have multiple sale options including live export (feeder and slaughter weights), local slaughter and retention of younger females for domestication programs.

Slaughter buffalo on a live export ship. They must be allocated more space than cattle of the same weight and provided with bedding as in the photo above.

This is the first time that this report has been translated into Vietnamese. The translation has been kindly funded by the Northern Territory Buffalo Industry Council, an organisation which promotes the interests of all those involved in the buffalo industry in the Northern Territory which is the only part of Australia that has large wild and domesticated herds of buffalo. These animals were originally imported from Indonesia in the 1860’s to support one of the early settlements on the north coast of Australia and were later released into the wild when the settlement failed. Since then these resilient animals have thrived and multiplied in the north coast sub-tropical environment. We hope that a translation into Vietnamese will widen the audience of this report and provide our customers with a better understanding of the trade. If anyone wishes to make any comments or suggestions they would be most welcome.

For more information on the Australian buffalo industry see their web site at www.buffaloaustralia.org

China: Slaughter Cattle AUD $7.08 / kg live weight (RMB 5.04 = AUD$)

Slaughter cattle prices in local currency have moved downwards for the first time in many months with rates in Beijing down to Y36.2 while the price in Shanghai was depressed even further to Y35.2 per kg live weight at the end of February. My advice is that prices are expected to rise again as the demand remains strong with supplies of imported product reduced as a result of the pandemic. Pork prices rose again in Beijing but were steady in Shanghai. The Chinese economy appears to be on the rise again now that the pandemic seems to be under control and vaccination programs are well under way.

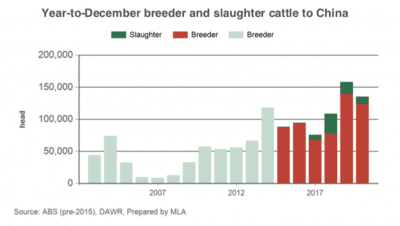

Live exports of beef slaughter cattle continue at insignificant levels with the annual total for 2020 at 10,895 head. During the same year 124,000 breeding cattle, mainly dairy cows, were exported live to China.

Philippines: Slaughter Cattle AUD $3.45 / kg (Peso 37.7 to AUD$1)

Rates are unchanged from last month at 130 Peso per kg live weight for slaughter steers in Mindanao. The good news is that Covid 19 vaccinations have commenced in the Philippines with the population eager to get their shot and hopefully get back to normality as soon as possible. The photos below are from the S&R supermarket in Davao where the reporter noted that the beef demand was normal but there appeared to be a shortage of chicken as the price has gone up 10% since last month and supermarket shelves are cleared of product less than one hour after stocking.

Quality Meat brand T-bones are selling for Peso 515 per kg while the Montana brand T-bones in the photo below are priced at Peso 738 per kg.

Thailand: Slaughter Steers AUD $4.47 / kg (Baht 23.5 to $1AUD)

I have set the indicator rate at Baht 105 per kg live weight which is up by about 4% from last month. This average is calculated from the February prices of 100THB for fat cattle 450-500kg and 108-110THB for fat cattle 600kg and over. Feeder cattle are selling for 120 THB per kg live weight. My agent reports that feed costs are increasing while supplies of Myanmar cattle have almost dried up and Vietnamese importer demand is declining. The general sentiment is of a market expected to decline in the coming months. The first doses of the Sinovac vaccine have arrived from China last week. Everyone will be offered the vaccine in the usual order of priority, including expatriates and foreign workers.

The Moei river is the official border between Myanmar and Thailand in the area of Mae Sot, north west of Bangkok. On the far bank are the quarantine sheds managed by the Karen ethnic rebel group which controls this part of the Myanmar border region. After quarantine checks and a vaccination, cattle and buffalo are walked through the river to the Thai side where they are further quarantined and given a second vaccination for Foot and Mouth Disease before being allowed “informally” to enter Thailand. This “grey” route, which has been in operation for decades, was originally closed during 2020 as a result of the pandemic. It’s not clear if the recent military coup will have any impact on the activities at this type of border crossing. This photo was taken in February 2015.

February 2021 prices

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle / Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Indonesia | Sept 20 | 12.43 | 13.55 B$7.48 | 3.27 | 3.83 |

| Rp10,500 | Oct 20 | 12.38 | 15.05 B7.62 | 3.14 | 4.05 |

| Rp10,350 | Nov 20 | 12.56 | 15.27 B7.25 | 3.57 | 4.17 |

| Rp10,700 | Dec 20 | 12.15 | 14.77 B7.48 | 3.55 | 4.21 |

| Rp10,800 | Jan 21 | 12.04 | 14.63 B7.40 | 3.52 | 4.31 |

| Rp10,970 | Feb 21 | 11.85 | 11.80 B866 | 3.56 | 4.38 |

| Philippines | Sept 20 | 15.43 | 14.86 | 3.49 | 5.85 |

| P34.6 | Oct 20 | 16.18 | 16.76 | 4.05 | 6.50 |

| P35.3 | Nov 20 | 16.43 | 16.71 | 4.67 | 7.22 |

| P36.5 | Dec 20 | 15.89 | 16.16 | 4.52 | 6.99 |

| P37.0 | Jan 21 | 13.78 | 14.59 | 4.83 | 3.51 |

| P37.7 | Feb 21 | 13.53 | 14.32 | 4.24 | 3.45 |

| Thailand | Sept 20 | 10.18 | NA | 3.10 | 4.56 |

| THB22.2 | Oct 20 | 10.36 | NA | 3.15 | 4.73 |

| THB22.1 | Nov 20 | 10.41 | NA | 3.17 | 4.75 |

| THB22.7 | Dec 20 | 10.13 | NA | 3.08 | 4.63 |

| THB23.1 | Jan 21 | 9.96 | NA | 3.03 | 4.37 |

| THB23.48 | Feb 21 | 9.80 | NA | 2.98 | 4.47 |

| Vietnam | Sept 20 | 18.56 | 15.99 | 5.15 | 4.43 |

| D16,600 | Oct 20 | 18.67 | 16.08 | 4.82 | 4.46 |

| D16,900 | Nov 20 | 18.34 | 15.79 | NA | 4.50 |

| D17,400 | Dec 20 | 17.82 | 18.97 | 4.42 | 4.60 |

| D17,770 | Jan 21 | 17.45 | 15.87 | 4.83 | 4.56 |

| D18,020 | Feb 21 | 17.20 | 17.43 | 4.77 | 4.50 |

| China Beijing | Sept 20 | 18.78 | 20.00 | 3.71 | 7.55 |

| Y4.8 | Oct 20 | 20.00 | 21.25 | 3.79 | 7.92 |

| Y4.82 | Nov 20 | 19.92 | 21.99 | 4.06 | 7.47 |

| Y4.94 | Dec 20 | 18.22 | 21.46 | 3.85 | 7.29 |

| Y4.98 | Jan 21 | 18.47 | 22.49 | 3.82 | 7.39 |

| Y5.04 | Feb 21 | 17.46 | 21.43 | 3.69 | 7.18 |

| Shanghai | Sept 20 | 20.82 | 24.08 | 3.57 | 7.76 |

| Pork per kg | Oct 20 | 21.88 | 25.00 | 3.58 | 7.92 |

| Beijing Y66 | Nov 20 | 21.83 | 24.89 | 4.11 | 7.72 |

| ShanghaiY56 | Dec 20 | 19.43 | 23.89 | 3.60 | 7.29 |

| Jan 21 | 20.48 | 24.50 | 3.57 | 7.19 | |

| Feb 21 | 19.44 | 24.21 | 3.53 | 6.98 | |

| Darwin Feeder Steer | June 19

$2.90 |

July 19

$3.00 |

August 19

$3.15 |

Sept 19

$3.15 |

October 19

$3.30 |

| Nov 19

$3.35 |

Dec 19

$3.25 |

January 2020

$3.25 |

Feb 2020 $3.80 | March 2020

$3.40 |

|

| April 20

$2.80 |

May 20

$3.25 |

June 2020

$3.40 |

July 2020

$3.50 |

August 2020

$3.40 |

|

| Sept 2020

$3.45 |

October 2020

$3.90 |

Nov 2020

$4.00 |

Dec 2020

$4.00 |

Jan 21

$4.10 |

|

| Feb 21

$4.30 |

Hi Dr Ainsworth: Regarding your quote “China: Slaughter Cattle AUD $7.08 / kg live weight (RMB 5.04 = AUD$)”, is this price for local slaughter cattle or for export price from Australia?

These prices quoted in AUD are for cattle FOB to there relative countries. Does not include shipping etc

From an NT cattle producer’s perspective it is positive that the Indonesian price is steady and sustainable over time.