The depth of the live export market impact from Indonesian import permit and liveweight restrictions and subsequent market closure is clearly evident in financial year shipment data released today by Livecorp and MLA.

The depth of the live export market impact from Indonesian import permit and liveweight restrictions and subsequent market closure is clearly evident in financial year shipment data released today by Livecorp and MLA.

Australia’s live trade with Indonesia was down 36 percent for the fiscal year ended June 30, declining from 718,074 head a year earlier to 459,186 head.

Live cattle exports to all markets eased 16pc from a record 957,533 head in 2009-10 to 806,855.

In percentage-of-trade terms, there was a 30pc decline in trade into Asian destinations, but this was offset by a 61pc increase in (relatively smaller) trade to Middle Eastern/North African countries, and 113pc rise in the ‘other’ category.

Other Asian live export markets to record declines in trade last fiscal year included China (mostly dairy heifers) down 4pc to 50,944 head, and Japan (F1 Wagyu feeders) down by 20pc to 12,737 head.

Lesser Asian markets registering improvement included Malaysia, showing a four-fold increase from 5500 to 20,580 head; the Philippines, up 7pc to 15,858 head; and Vietnam, up 200pc to 1405 head. Most of these rises were due to attractive prices due to the slowing in Indonesian trade and weight limitations.

The big growth market for Australian live exports in 2010-11 was Turkey, leaping from just 1230 head a year earlier to 104,355 head, due to strong economic growth, feedlot expansion and big domestic beef shortages. Israel also performed strongly, taking 53,352 head, a 46pc rise on a year earlier, as did Saudi Arabia, up 154pc to 19,508.

Egypt on the other hand – historically an erratic customer for Australian live cattle – declined 31pc to 23,090 head. Jordan also fell dramatically, declining 66pc to 9328 head. Libya disappeared entirely in 2010-11, after taking 19,200 head a year earlier.

The ‘other’ region category was dominated by trade with the Russian Federation, with a 95pc increase in live trade out of Australia (mostly breeding stock) to 18,402 head.

Turning to monthly shipment activity for June just completed, the MLA/Livecorp report indicates Australia’s overall live export business slipped to its lowest monthly point in both in value and volume terms in at least three years.

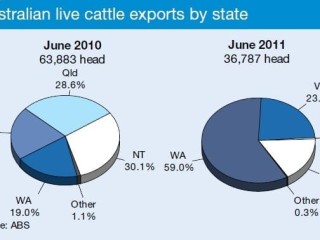

June shipments from all ports reached 36,787 head, little more than half of the trade seen in June 2010. Within that, trade to Indonesia (suspended on June 8 due to accusations of animal cruelty in slaughtering facilities) slowed to 19,426 head, a 41pc decline on year-earlier trade.

China’s June intake also slowed, down 59pc to 2784 head, while the Philippines was down 29pc to 2362 head.

The only importer to show a monthly improvement, year-on-year, was Turkey, up from 833 head to 9180 in June this year.

Wyndham was Australia’ busiest port for the month, shipping 9084 head, followed by Broome, 8741 head, and Portland, 7432 head. There were just 4953 head shipped through Darwin, traditionally Australia’s busiest live export port, down from 38,069 cattle a month earlier.

HAVE YOUR SAY