CONNECTIVITY issues remain one of the key reasons why the extensive cattle industry lags behind other forms of Australian agriculture in technology uptake, a national survey suggests.

ABARES this week released a comprehensive report on how information, communication and technology (ICT) is used in Australian agriculture. The report also identifies the key differences in adoption between farm sectors and between small and large farms.

The report presents findings from 2200 face-to-face conversations with farmers across Australia.

Ninety six percent of Australian farmers own and use ICT, and they are investing in technologies that suit their production systems, the report found. ICT includes all digital technologies used for the electronic capture, processing, storage and exchange of information. Examples used on farms range from computers and telephones through to tools like GPS-guided harvesting equipment and remote sensing technology.

Ninety six percent of Australian farmers own and use ICT, and they are investing in technologies that suit their production systems, the report found. ICT includes all digital technologies used for the electronic capture, processing, storage and exchange of information. Examples used on farms range from computers and telephones through to tools like GPS-guided harvesting equipment and remote sensing technology.

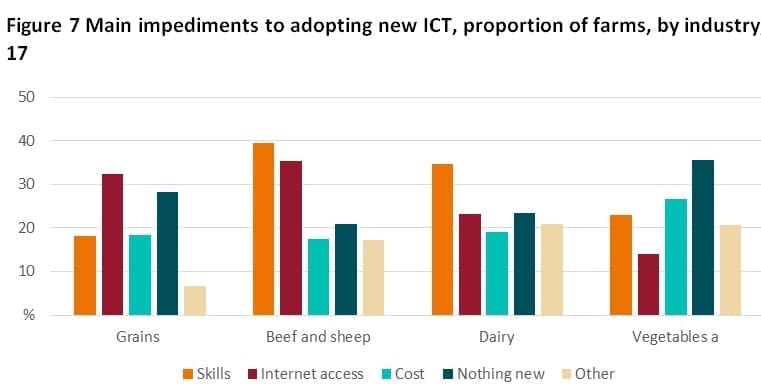

Reported obstacles to adoption of ICT included skills, internet access, cost and availability of useful new technologies.

“It is evident that new equipment and the data it generates are changing how farms are managed,” ABARES executive director, Dr Steve Hatfield-Dodds said during the report’s release.

“New ICT will be fundamental to the next wave of productivity growth in Australian agriculture. The use of digital ag in Australia has the potential to increase productivity through optimising input use, more timely decision-making, labour savings, genetic gains and improved market access,” he said.

Key findings

Some of the report’s key findings were:

- The overwhelming majority (96pc) of Australian farmers owned and used ICT assets, and 95pc were connected to the internet.

- Farmers used ICT for production activities, internet commerce, obtaining information and household purposes.

- Larger farms were more likely to invest in and use ICT than their smaller counterparts.

- ICT assets represented a relatively small share of total capital assets on most farms—this technology likely performs an enabling role to make other assets more productive and lift overall business efficiency.

- ICT applications on farms varied between industries. For example, GPS-enabled technologies are widely used on vegetable and grain farms, and electronic identification and herd management tools are commonly used on dairy farms.

- The availability and quality of internet services influences farmers’ access to and use of ICT. Farmers in relatively remote areas using mobile phone or satellite-based internet connections were more likely to report inadequate internet access as an impediment to their use of ICT and to the operation of their businesses more generally.

New ICT equipment and the data it generates are changing how farms are managed, the report said.

Quantifying the effects of these changes is difficult, however. It has been estimated that fully implementing all currently available digital technology could increase agricultural production by up to 25pc compared with 2014–15 levels.

Triggers to investment

“Realising the benefits from digital technology requires farmers and graziers to adopt and use these tools,” the report said.

“Farmers invest in ICT, like they do in other technologies, when they perceive that benefits exceed costs. Complexity and uncertainty about the benefits generated by new tools tends to slow adoption, because it reduces the expected value of benefits until sufficient learning can be done to obtain the required information.”

Currently, many ICT applications on farms appear to be characterised by high complexity and uncertainty, largely because these technologies are in relatively early stages of development in Australia and globally, the report said.

As the technologies mature and uncertainty is reduced, benefits and costs will become clearer for farmers to assess. Similarly, as the costs and benefits of access to this technology become clear, investors and others will be in a better position to solve constraints such as access to telecommunications infrastructure.

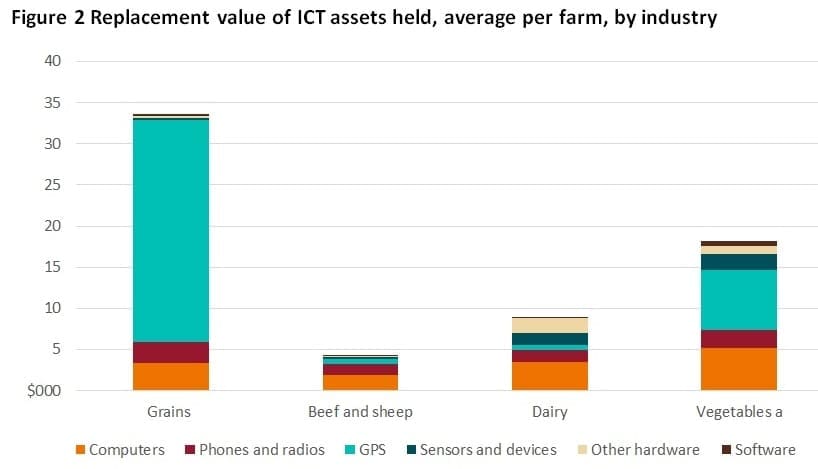

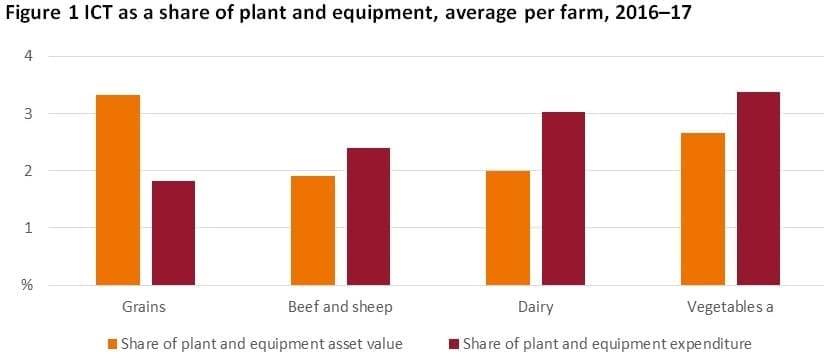

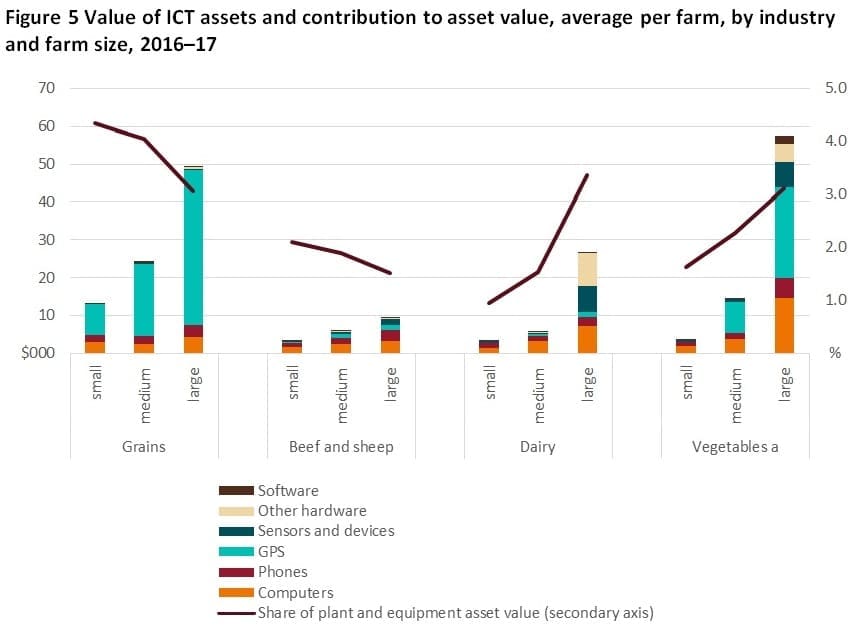

The intensity of ICT ownership varies across industries. ICT assets accounted for 3.3pc of plant and equipment capital on grain farms, 2.7pc on vegetable farms, 2pc on dairy farms and 1.9pc on livestock farms

In 2016–17 investment in ICT on grain farms was not as intense as in the past—ICT’s share of investment was lower than its share of assets. In contrast, other industries appear to have invested more heavily in the survey year than in the past – ICT made up a larger share of capital investment than the share of capital assets already owned. This difference is likely to reflect greater investment in ICT by grain farmers in earlier years and is also reflected in the replacement value and age of ICT assets held.

Farmers own technologies to suit their production systems

The type and value of ICT assets that farmers owned varied by industry, reflecting the specialisation of technologies to particular production systems. The most striking example of this was on grains farms, where investment in GPS-guided equipment and harvest monitoring technologies is widespread. In 2016–17 grain farms held ICT assets with an estimated replacement value of $34,000 on average, with 80pc of this value in GPS equipment.

In contrast, beef and sheep farms reported the smallest replacement value of ICT assets. There is limited uptake of precision agriculture on these farms, where production systems often rely on extensive pasture grazing. Digital technologies are increasingly available to manage livestock, such as electronic identification systems combined with satellite monitoring, but adoption of these technologies remains concentrated in more intensive livestock industries such as dairy.

Larger farms tend to invest more in ICT than other farms. On average, large broadacre, dairy and vegetable farms (defined as those with receipts over $1 million) held ICT assets with a replacement value of around $34,000. Medium-sized farms (those with receipts between $400,000 and $1 million) held just over $11,000 in ICT assets, while small farms (less than $400,000) held about $4000 in ICT assets.

One reason for greater investment in ICT on larger farms is that these farms generally have higher profits, which may increase their capacity to fund investment. Larger farms can also spread new technologies over more inputs and outputs, increasing the benefits from adoption.

Reflecting these factors, new technologies may also be marketed more towards larger farms because they are more likely to adopt them, increasing the likelihood of sales for technology developers, the report found.

Use of ICT assets

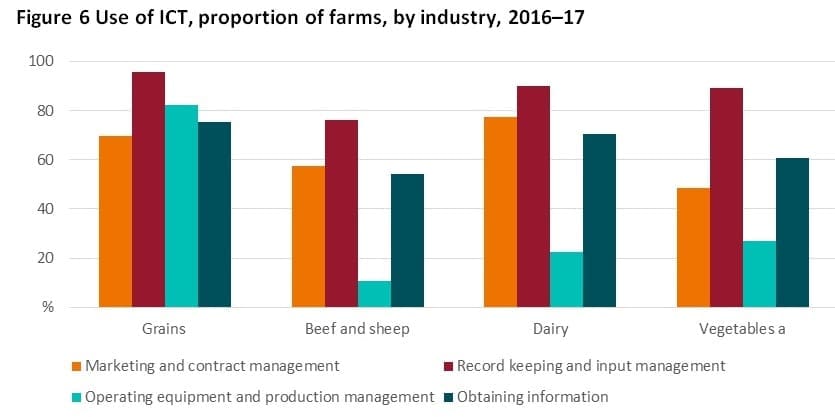

Farmers were asked about their use of ICT assets across four broad categories—marketing and managing contracts, record keeping and input management, operating equipment and managing production, and gathering information. Results are shown below.

Across all industries, record keeping was the most commonly reported use of ICT assets, with 80pc of farms now using ICT for this purpose. Electronic records can make it easier to capture information, generate reports and share data with service providers and customers. Nonetheless, some businesses still preferred to keep manual records. On average, farmers not using ICT for records management and book keeping tended to be older or operating smaller farms.

The majority of farmers (61pc) also used ICT for marketing and managing contracts, although face-to-face marketing also occurs widely in all industries. Grain and dairy farmers were more likely to use ICT for this purpose than other farmers, likely reflecting the relatively homogenous nature of these commodities, which facilitates online marketing.

Information gathering with ICT was also widespread across all industries (61pc of farms). The use of ICT to access information was correlated with farm size—larger farms were more likely to report using ICT for this function.

In addition to these uses, farmers reported using ICT for business-related training and education (26pc), entertainment (24pc), off-farm business activities (17pc), and children’s education (5pc).

Impediments to uptake of new ICT tools

Farmers were asked to report the main impediments to adopting new ICT tools across five broad categories – skills, internet access, cost, nothing new of interest, and other. Results are shown below.

Skills

Approximately one-third of farmers reported that a lack of skills was a constraint on their uptake of new ICT tools. The operators of smaller farms reported skills as a constraint more often than other farmers. Across all industries, 40pc of small farms reported lack of skills as an impediment, compared with 25pc of medium-sized farms and less than 20pc of large farms. This may be because larger farms generally hire more workers and use contractors to a greater degree, making them better placed to bring in workers with the required skills, or because they have greater capacity to delegate tasks, allowing more time for training and knowledge acquisition by managers.

Acquiring skills or becoming familiar with new technologies is time-consuming and can be a barrier to adoption of innovations. In agriculture, an important means of acquiring these skills and knowledge is the use of farm advisors and farmer networks, both of which have been found to increase user-knowledge about new technologies and encourage investment.

Consistent with this, survey data revealed that farmers in industries characterised by greater engagement with external providers of knowledge and information appeared to have more of the skills required to adopt ICT. In particular, grain farmers have had a greater level of engagement with advisory services than other farmers in recent years. Relatively few grain farmers reported a lack of skills as a constraint on their adoption of new ICT, unlike livestock and dairy farmers, for whom it was the most commonly reported constraint.

Internet access

A third of farmers reported that their access to the internet was impeding uptake of new ICT tools. Internet access was the most commonly reported constraint to the adoption of new ICT on grain farms and was also commonly reported by beef and sheep farmers. On dairy and vegetable farms, lower reporting of internet access as an impediment may reflect the greater availability or reliability of internet connections in more populated areas.

Across all industries, farmers with mobile and satellite internet connections were more likely to report internet access as an impediment to their uptake of new technologies than those with digital or fixed line connections. This suggests that it is the nature of the internet connection, rather than an industry-specific connection issue, that is causing the impediment to uptake of ICT.

The extent of internet coverage over the farm was related to the perceived impediment to technology uptake. Farmers reporting an impediment from internet access on average reported a smaller proportion of their farm covered. This trend was observed across all types of internet connection.

Cost

Around 20pc of farmers reported that cost was a major impediment to the uptake of new ICT technology in 2016–17. Cost was more commonly reported as a constraint on grain and vegetable farms, which may reflect the relatively high up-front cost of ICT tools in these industries. Although relatively few grain or vegetable farms reported purchasing GPS, sensors or other hardware in 2016–17, cropping and vegetable farmers that did purchase these items spent considerably more on them than dairy or livestock farmers spent on the same items.

Internet access and use on farms

The vast majority of Australian farms are now connected to the internet (95pc of farms surveyed). This estimate is consistent with ABS data, which indicated that 91pc of agriculture, forestry and fishery businesses were connected to the internet in 2015–16, up from 66pc in 2007–08 and 18pc in 1998–99.

ABARES survey results showed that larger farms were more likely to be connected to the internet (over 99pc), as were grains farms (just under 99pc). Smaller livestock, dairy and vegetable farms were less likely to be connected to the internet. As a result, these industries had lower overall connection rates—96pc for dairy and 94pc for broadacre livestock.

Farmers tended to connect to the internet differently to other business owners, mainly because of their location. According to the ABS, the most common type of business internet connection is digital fixed line (DSL) at 62pc of all businesses in the economy. However, the majority of farmers use connection types other than DSL, such as mobile wireless (28pc), fixed wireless (22pc) and satellite (15pc) as their main type of internet connection.

The ABARES survey showed that more remotely located industries had a greater reliance on satellite and mobile internet. Broadacre farms had the greatest reliance on satellite (41pc of grain farms and 35pc of beef and sheep farms) and mobile wireless (32pc of grain farms and 26pc of livestock farms).

Source: ABARES

Dear Authors,

Do you mind sharing the data collecting tools for this paper