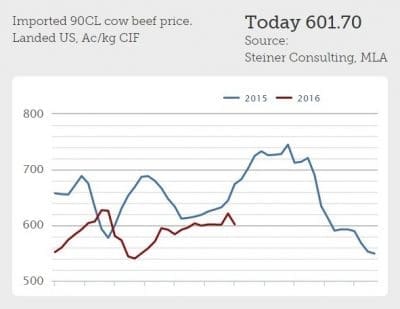

AFTER an encouraging surge in imported 90CL manufacturing beef prices in the US in late July, the 90CL imported cow beef indicator this week dropped A16.4c, to 601.7c/kg CIF.

The higher Australian dollar, this morning sitting above US77c, has exacerbated that change.

The higher Australian dollar, this morning sitting above US77c, has exacerbated that change.

As this 90CL graph from our home page shows, the market has found a level around A600c/kg for the past three months at least.

There was reportedly very little trade in the spot and short-term US imported beef market last week, with low interest from buyers forcing Australian and other exporters to drop their asking prices.

Veteran meat trader Stuart Hanna, from Sanger Australia, said there had been a ‘real standoff’ evident in the market, with lack of supply in Australia, and exporters asking plenty of money because of what cattle are costing. On the other side, the Americans continued to have plenty of domestic fed production at their disposal, and were about to go into their annual cow cull, lifting volumes further.

“We’ve had that standoff in place, and it’s probably fair to say that the Americans have won, a little bit. If an Australian exporter had to move meat at the moment, that would probably be taking 8-10c/lb less than what they would want to,” he said.

“Adding to that, the A$ value is up 300-400 points on where it was a fortnight ago. That’s not helping, so there are a few things conspiring against Australian exporters at present.”

“It’s the worst of three worlds: Australian cattle are incredibly dear, the dollar is higher, and the US market is back.”

Sanger Australia senior meat trader, Stuart Hanna

Mr Hanna said the gap between domestic US and imported lean trim was not showing as a big spread on the sheet on 90s. “They are reasonably close together. Imported has drifted back a little to a parity level this week. Bud I’d suggest the real CIF level is a fair bit lower than domestic again, at the moment,” he said.

“Between what the report is for out-front deliveries (what people are quoting) and the price that would have to be taken on the spot market, should somebody need to sell, you’re probably writing 10c/lb less than what the Yellow Sheet is showing at the moment.”

Mr Hanna agreed that it was hard to be too bullish about any upside in the US manufacturing beef market for Australia at present.

“The recent jump in price was only short-lived. We keep showing the US customers less volume, but the last holiday of the US summer season, Labor Day, is about to happen (high demand period), and the US has had a strong herd rebuild over the past two years, and are heading back into a normal cow-cull season.”

That does not auger well for Australian exports over the next three or four months, at least.

“But the real issue in the US at the moment is competing proteins,” Mr Hanna said. “Pork is just ridiculously cheap, and production capacity in the US combined with cheap grain prices is struggling to cope with the number of pigs coming forward.”

Steiner’s weekly US imported beef report last week said most categories in the imported market were cheaper, particularly at the lean end of the spectrum, while some cuts were not traded enough to generate a quote.

“Prices for imported beef in the US market were lower last week, as US end-users appeared to take a break from chasing the market,” Steiner said.

Prices for domestic lean grinding beef continued to soften and seasonally, ground beef business at this time of year tended to be slow, it said.

Prices for domestic lean grinding beef continued to soften and seasonally, ground beef business at this time of year tended to be slow, it said.

A clear indication of the weaker demand is the sharp correction in the price of domestic 50CL beef, which in early July was trading above US90c/lb, and last week closed at around 71c, back 21pc.

The decline in the value of domestic fat trim had come even as US packers have reduced the pace of steer/heifer slaughter in the last three weeks, Steiner said.

“All this is largely a seasonal move, but it highlights some of the headwinds for the imported beef market going into the northern hemisphere autumn,” it said.

“Overseas supplies are far from burdensome, with slaughter in New Zealand at seasonal lows and Australia kills down by more than 30pc in the last reported week.”

But as stated earlier in this report, the challenge for the US beef market in general and particularly for the grinding beef market, is the over-abundance of other competing meats and the dramatic correction in both the pork and chicken market.

August hog prices in early June were priced by futures markets participants at near US90c/lb. Now they are priced at 68c and December is priced at around 55c.

“There is a glut of pork here already and it will get even worse in the coming months, with a real risk of running out of packing capacity,” Steiner said.

“This has seriously negative implications for the beef/ cattle complex even beef prices for the moment are benefiting from features planned last spring.”

Other grinding meat markets

In other markets that would otherwise compete with the US for Australia’s 90CL type product, some concerns have been raised about the Indian buffalo meat effect in Indonesia, and what it will potentially do to the market for Australian beef.

China continues to operate at a level, but all exporters to the China market are showing some resistance on price.

Exporters like Brazil, which has made great inroads into the China market over the past 12 months, is now looking for alternative customers, because China is being ‘particularly difficult on price’ at the moment.

This week’s World Beef Report suggests Brazil’s sales to China sunk to just 3500t in July, the lowest volume in the trade since June of last year, when China reopened its market for Brazilian fresh beef. A rising Brazilian currency was partly to blame, in addition to a reluctance among Chinese importers to accept the prices asked by Brazilian exporters, and improvement in other alternate markets.

Brazil access to US ‘not so dramatic’

How much could resumption of Brazilian beef imports into the US impact the market for grinding beef in the US?

Steiner thinks the impact will not be as dramatic as some expect.

“Brazil already has ramped up its beef exports this year thanks to very strong demand in the Chinese market and the Middle East,” it said. “However, the US market still is paying some of the highest prices for lean beef in the world, so it will not be difficult to pull some product that currently is going to other markets.”

The initial challenges in terms of the rate of development of the new trade, in Steiner’s view have to do with:

- The fact that US end-users need to evaluate Brazilian beef and potentially include it in their purchasing specs

- It is unclear at this point if Brazilian plants will be able to meet the strict testing and lotting requirements that US has put in place in recent years

- The lack of sufficient quota. Brazil does not have a country-specific quota allocation like Australia or New Zealand. As a result, it will have to clear beef using the MFN quota of around 64,000t. So far this year about 22,000t of that quota has been used by Central American countries and Ireland.

“Given current prices in the US, we expect out-of-quota shipments from Brazil to be relatively minimal,” Steiner said.

“Our working assumption is that, if granted access next week, Brazil will ship less than 20,000t through the end of 2016. The potential for next year is 50,000 to 55,000t, but it will depend on the ability to meet USDA requirements and pricing for grinding beef in the US.”