With seismic shifts occurring in the volume of trade into traditional export markets like the US at present, who will Australia’s beef export customers be in the next five years?

With seismic shifts occurring in the volume of trade into traditional export markets like the US at present, who will Australia’s beef export customers be in the next five years?

Industry analyst Peter Weeks posed the question and tried to provide some answers last week during a presentation at the Eidsvold Meat Profit Day.

He outlined a large basket of influences that could have an impact on the outcome including population and income growth, price changes, market competition, currency movements, consumer trends, safety concerns and market access.

“By far the most important of these are likely to be population growth and income growth, along with market access, which distorts trade now and is likely to continue to do so,” Mr Weeks said.

Market access would have a big influence over which customer countries Australia services, at least over the next half-decade.

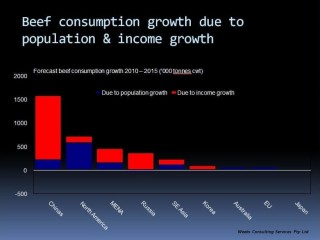

The first graph on this page illustrates the likely world beef consumption growth, based on both population and income changes, by 2015.

Not surprisingly, China obviously dominates, not because of population growth (one child policy) but because of income growth, on what is already a very large population base. The data suggests 1.5 million tonnes growth in overall beef consumption between 2010 and 2015, provided there is no substantial price rise for beef.

Surprising to some, North America is second largest, tipped to rise by about 700,000t by 2015, due mainly to population growth, particularly Hispanics, who live eating meat.

The Middle East/North Africa region rates third, and Russia, fourth – again because of increases in income, more than anything else.

Much smaller is the potential beef consumption growth in Southeast Asia, the EU, Korea and Japan, with the Japanese actually in negative growth, due to declining population.

North America growth target

Of the potential growth markets listed above, North America is likely to be Australia’s biggest growth market, according to Mr Weeks. Trade could expand by 115,000t over the next five years, he suggested.

“That really represents a recovery, back towards traditional levels of trade out of Australia to the US. The main drivers will be quite strong demand growth, but also falling domestic beef supply which is not likely to change significantly over the next five years,” he said.

It is also anticipated that there will be a fall in the A$ (or more accurately, a rise in the US$) over the next half-decade, making Australian exports more attractive.

In the Middle East/North Africa region, Mr Weeks’ graph suggested trade out of Australia could grow by 40,000t by 2015, closely followed by Australian domestic demand growth, and Southeast Asia (although that could be influenced substantially by events in Indonesia).

Beyond that group, China is not as prominent as many stakeholders might have expected, based on the earlier chart showing overall demand growth. Mr Weeks has an expansion figure of just 24,000t by 2015, held back by trade barriers and the likelihood of a greater proportion of the trade going to South American suppliers rather than Australia.

Equally surprising are predictions of trade retraction with both Russia (down 21,000t, linked to trade barriers and competition out of Brazil) and Japan (down 26,000t, due to stronger US export competition and weak demand).

“It should come as no surprise that the biggest demand out of Australia’s expanded trade into the US will be in 90CL manufacturing beef for the hamburger trade. But there will also be significant growth in cuts into the US, both grainfed and grassfed. There is certainly a trend towards more demand for grassfed chilled product among US consumers,” Mr Weeks said.

The Middle East/North Africa region perhaps represented the biggest opportunity at the higher-end of Australia’s product spectrum, for grain and grassfed chilled cuts. However it will also grow across a range of product including manufacturing and frozen cuts.

Southeast Asia remains the big question-mark. Indonesia, alone, could represent 75pc of trade into the region by 2015, but that depends very much on trade barriers and live export restrictions.

Live export alone is likely to represent the equivalent of 16,000t shipped weight growth in beef, plus 20,000t of boxed beef over the five-year timeframe – mostly frozen manufacturing and cheaper cuts.

Modest growth likely to be experienced into the Chinas is likely to be spread across manufacturing, cheaper cuts for food service, and some chilled beef for the supermarket and restaurant trade.

Korea is another market that holds solid growth opportunity for Australia in the better chilled beef trade, particularly grainfed. Falls in Japan are likely to be predominantly in forequarter cuts used in Yakiniku barbecue restaurants, gyudon chains and discount retail stores, rather than in supermarkets and restaurants.

South American beef prices

During question time, Mr Weeks was asked about the strong price rises seen in product out of South America, relative to Australian export prices.

“It is due in part to the rapid appreciation of the South American currencies, as well as strong internal domestic demand and lower supply,” he said.

“But I think Australia, over time, will again see a premium for its beef over that from South America. It’s only a short-term phenomenon that we are seeing price levels so similar.”

Asked about the prospect of the A$ value easing, he said at some point, the US economy would start to recover to some degree, and US interest rates would again climb to higher levels. That would strengthen the US currency, and in turn make Australian beef exports more competitive.

Quizzed about why US exports were now so competitive in Japan and Korea, given the high livestock prices being paid to US beef producers, he said while US supply into Korea this year was up 60pc on 2010, Australia’s were up 13pc.

“The fall has really occurred in domestic Korean meat production, because of the FMD outbreak, not imports. There has also been an increase in consumption in the Korean market. While Australia has in fact picked up some trade, it has lost market share to the US, but we always knew that would happen.”

“Currently Australia supplies 50pc of the imported frozen beef into Korea, and 70pc of chilled. But the reason why the US product gets into Korea more naturally is because of the Koreans’ fascination with just two cuts: shortrib and brisket, which is basically all that the US sends to the market.”

“They are cuts that have little demand in the US, where they are quite cheap, and Australia does not have the capacity to supply them in the quantities that the Koreans demand,” Mr Weeks said.

“I’m actually quite pleased with Australia’s performance in Korea, in the face of strong US competition. The market remains very promising for Australia, because in coming years, US supply is going to get tighter.”

-

Click on the graphs here for a clearer view