A standoff currently exists in the meat and livestock marketplace, with exporters accepting that there is no point in killing cattle if they can’t sell the product, and producers putting up the shutters to cattle prices that reflect that processor attitude.

A standoff currently exists in the meat and livestock marketplace, with exporters accepting that there is no point in killing cattle if they can’t sell the product, and producers putting up the shutters to cattle prices that reflect that processor attitude.

Meat & Livestock Australia chief economist Tim McRae says producers are using the abundant feed reserve at their disposal to bide their time, looking for signs of improvement in the cattle prices.

“There were a couple of significant Queensland sales that were cancelled this week – while that’s not unprecedented, it reflects the general mood of the market at present,” he said.

While it is still very early times, Beef Central is picking up some vibes from processor/wholesaler contacts that the backlog of beef currently clogging the system due to flat demand in key export markets is starting to clear, which if true, would help the supply/demand equilibrium no end.

While export volume figures for the month of June just completed looked sound, the value return on a lot of that product would not make pleasant reading, Mr McRae said.

“There was still 32,000 tonnes shipped into Japan last month, but processors are just not getting the money for the product they need, to make it viable,” he said.

Another factor was a pronounced swing from chilled and better quality table cuts into manufacturing beef.

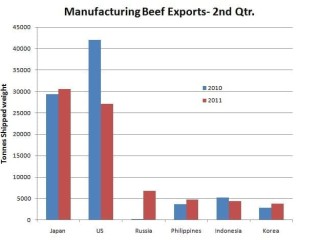

This was clearly evident in data released this week on manufacturing beef exports for the second quarter (April 1 to June 30). For only the second time in 12 years, Japan went past the United States as Australia’s largest manufacturing beef market, for the quarter.

As the accompanying graph shows, Japan took 30,589t of manufacturing beef for Q2, while the US figure was 27,087t, reflecting the toughness of selling Australian product into the US based on currency movements.

The Japanese Q2 figure has drifted upwards over the past three years, possibly explained by more Japanese consumers taking the ‘cheap burger option’ a little more frequently, rather than going to the family restaurant for a steak or yakiniku.

The Q2 figure for manufacturing exports to the US represented just 55pc of equivalent Australian exports to the US in Q2, 2009, records show, reflecting the overall shift in reliance on the US market overall.

Displacing that was some major upwards movements in manufacturing beef trade to Russia (6762t for Q2 this year, compared with just 227t last year; Korea 3776t this year up from 2828t in 2010; and even Saudi was up from 396t last year to 1737t in Q2 comparisons. )

“It is starting to look like the 2008 pattern, where cheaper, lower quality product is much easier to sell than higher quality, including chilled, younger and grainfed beef,” Mr McRae said.

“Any prime or higher-end product is proving very hard to move at the moment.”

Comparisons between steer prices and Japanese market indicators for grain and grassfed fullsets, show a remarkably similar declining pattern, since the peak of the recent market in late January.

Grassfed and grainfed fullset indicator process have fallen 15-19pc in six months, since the January peak. Similarly, the heavy steer price is now at the lower end of the five-year price average range.

Another aspect worth exploring in the current market complex is the stability that the A$ has demonstrated over the past six to eight weeks, trading in a fairly narrow range around US105-107c.

“To exporters, stability is second only to the actual level of the currency in terms of importance,” Mr McRae said. “Any time there is relative stability in the dollar is a good thing, because it provides a level of certainty at what exporters are locking-in at. Looking back at when the A$ was close to US60c, there was a lot of fear around, because the currency was in fact very volatile at that time.”

But the current dollar stability is only a small positive in an otherwise tough market. At US107c, there was no escaping the fact that currency is still very high, by historic standards.

“It needs to be closer to or below parity with the US$ to have any real impact,” Mr McRae said.

- Click on the graph image here for a larger view