Australia’s beef exports to the United States have exploded during February, under the accumulated weight of US drought during 2011 and a 40-year low in the US national beef herd.

Figures released by DAFF this morning show total February exports to US East and West coast ports reached 23,340 tonnes.

That’s more than double the level of trade seen in January (11,774t), and not that far off double the corresponding monthly shipments in February last year (13,262t).

It’s the single largest monthly increase in exports to the US in recent memory, key trade contacts said this morning, and represents the largest monthly tonnage into the US market since June 2010. June is traditionally a strong month for trade into the US, given Australian cattle turnoff patterns.

As discussed on Beef Central earlier, there has been clear evidence of diversion of lesser primal cuts like rounds and chucks into the grinding meat market to keep pace with current US demand, especially while traditional markets like Korea and Japan are so subdued.

Another emerging logistics problem is enough frozen cold storage space (as opposed to chilled storage) in the Brisbane region to keep pace with the big volumes of 85s and 90s being shifted.

Record prices

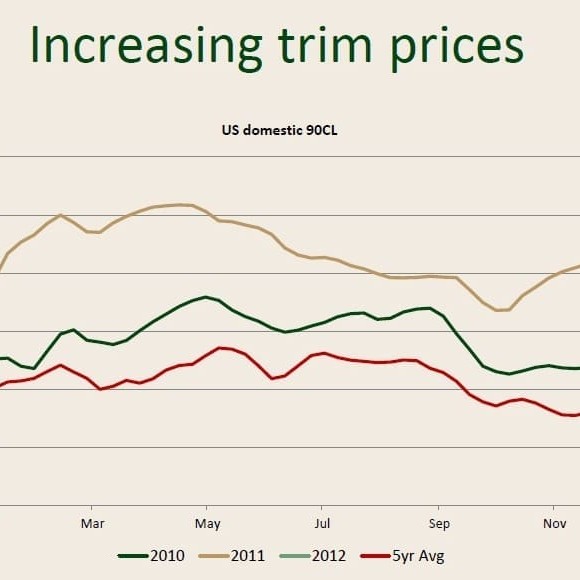

Making the February trade result with the US even more remarkable is that it is occurring despite all-time record prices being paid for imported grinding beef, in US$ terms.

Making the February trade result with the US even more remarkable is that it is occurring despite all-time record prices being paid for imported grinding beef, in US$ terms.

Last year, beef imports into the US declined sharply, particularly in the first half of the year on very limited Australian supplies. However imported supplies have improved substantially compared to a year ago, albeit still lower than 2009 levels.

US Customs data for February reports that total imported beef arrivals (all suppliers, not just Australia) reached 79,500t, about 10pc higher than the previous year.

In part this reflects strong shipments last December but also much higher prices in the US market for lean grinding beef and fewer production disruptions this year in Australia.

But even as Australian supplies have improved, imports from Canada remain below year ago levels, down 2pc so far this year while imports from New Zealand were down 25pc. Imports from Mexico, which shipped a significant amount of beef to the US in 2011, continue to track modestly higher versus year-ago levels, and imports from Central America are on par with last year.

“One would expect the higher imported supplies should ease the tight US beef supply situation and help moderate prices, especially the price of lean grinding beef,” said CME analyst Len Steiner this morning.

“So far, that has not happened, an indication that US demand for imported beef remains strong.

The reason for the shift in demand for imported beef is because the US domestic cow market has dried up,” he said.

“US cow/calf producers appear to have a bit more feed and with calf prices at record highs they want top dollar for their cows. US cow and bull slaughter last week was down about 8pc from the comparable week a year ago.

US domestic 90CL boneless beef, the key benchmark for lean grinding beef, currently is trading at almost $2.20/lb, compared to $1.93 a year ago (+14pc). Surprisingly, the price of imported beef is trading not very far behind ($2.16/lb).

Strong demand for US beef in other markets has limited the supply of grainfed beef available to the US consumer and has pushed cattle prices to record high levels.

Those high cattle prices in turn have caused the price of calves and feeder cattle to explode to record highs and given an extra inducement to cow-calf operators to hold on to their cows, if their feed situation allows.

Despite the recent inflows of more imported beef, it has so far been unable to fill the gap, Mr Steiner said.

“We also continue to see a shift both at retail and particularly foodservice towards less expensive beef items, such as hamburgers, dressed-up fancy or sold in fast food joints. This has increased overall demand for grinding beef. As a result, even the smallest supply disruptions, such as the recent drop in domestic US cow kills, tends to have a notable impact.”

Finally, the reason why countries such as Australia are shipping volume again to the US is in part due to the fact that the US is once again paying ‘top dollar’ for imported beef.