Coles has managed to defend its recently-won beef market share in the latest monthly national retail industry survey.

Coles has managed to defend its recently-won beef market share in the latest monthly national retail industry survey.

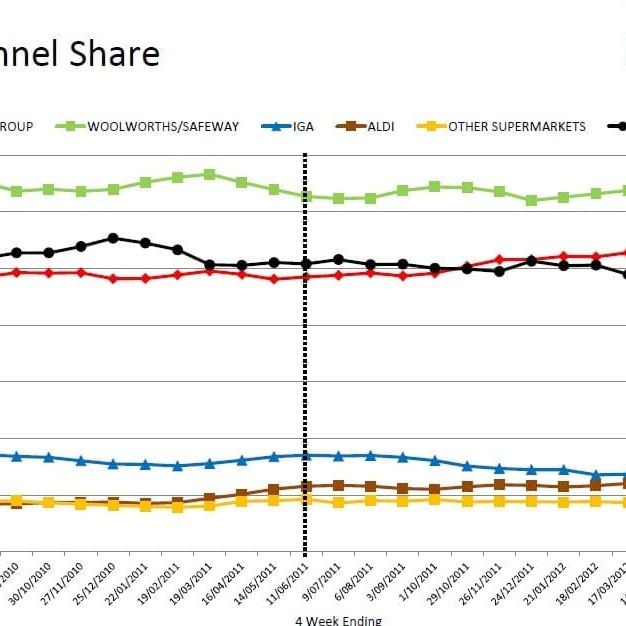

Neilsen Australia Homescan survey figures released this week by Meat & Livestock Australia show that for the rolling quarter ended July 7, Coles further consolidated its recently-improved beef market share position, lifting a further 0.3pc to 26.5pc of all retail beef sales.

As can be seen in the graph published here, that follows a big shift a month earlier, when Coles made solid inroads in pegging-back beef market share lost earlier to its ‘big three’ rivals – independent butchers and Woolworths. Back in June, Coles recorded a 2.7pc rise in beef share, its best result since January.

The outcome coincides with a renewed price discounting push among the large supermarket groups, typified by Coles current ‘Down, Down’ campaign spearheaded by 70s rockers, Status Quo, and customer loyalty programs linked to the Fly-buys program.

The result suggests a longer-term gain in share by Coles, being 0.8pc better than the company’s current average Moving Annual Total (MAT), and 2.1pc better than the MAT figure a year ago.

The retail market share difference in beef sales between Woolworths and Coles is now at its narrowest point in at least the last two years, reducing to just 3.7pc, according to Neilsen.

While it still retains top spot, Woolworths result last month was down 0.5pc to 30.2pc of retail beef sales. Woolworths has recorded a gentle slide in performance over the past four months, easing 2.5pc in beef share since April. That trend comes off a very high base, however, as the company’s April figure of 32.7pc was the highest achieved in well over a year.

Independent butchers improved a little in July, growing from 25.0 to 25.2pc. There was little change in smaller retail stakeholders with the IGA chain (7.4pc), Aldi Supermarkets (6.1pc) and ‘other’ supermarkets (4.6pc) all more or less stable from a month earlier.

The current MAT for independent butchers is down about 1pc on where it sat this time a year ago, suggesting independents are being squeezed in the current retailing wars between the majors. Effectively, Coles’ recent market share gain equals Woolworths’ share loss plus butchers’ share loss.

Australian Meat Industry Council national retail council chairman Ray Kelso said trading conditions remained tough for independent butchers, with reports suggesting recent trade was ‘patchy’, at best.

Australian Meat Industry Council national retail council chairman Ray Kelso said trading conditions remained tough for independent butchers, with reports suggesting recent trade was ‘patchy’, at best.

“Better-presented and marketed outlets concentrating on service and a quality offer appear to be holding-up best, in the face of the cautious and value-conscious buying mood of consumers,” he said.

There was some evidence of a little more retail demand momentum this month as consumers keen to watch the Olympics on TV bought product at retail to entertain at home, rather than dining out. Conversely some food service operators, particularly on the mid-range categories, have reported quieter trade since the Olympics started.

In combination, the ‘big three’ retailers (Woolworths, Coles, independents) were responsible for 81.9pc of all retail beef sales nationally during the July rolling quarter.

Retail pie continues to shrink

In other Neilsen survey results from July, the overall fresh meat category (made up of beef, veal, chicken, pork, lamb and minor proteins like seafood and turkey) experienced negative value growth compared to the same period a year ago.

Going against the trend, the beef segment (39.2pc) is up a full 1pc from June rolling quarter, and is now back to close to historically high levels seen a year ago, measured as a percentage of all meat protein sales, by value.

Lamb’s share experienced the biggest growth this quarter, being up 0.6pc percentage points compared to this time last year, largely due to decline in retail price per kilo. Chicken’s share was down 0.4pc from 2011 figures, while pork’s share remained steady. Other segments like seafood recorded bigger declines.

Prices stable for competing proteins…

Prices remained largely stable compared to the previous rolling quarter figure.

Beef prices (measured as the average $/kg value of the items in the surveyed shopping baskets, not of the overall value of beef being sold in the retail marketplace) eased from $10/kg to $9.90. Lamb prices eased a further 20c/kg to average $11.60/kg, continuing a soft decline in price seen since January. As indicated above, that is being reflected in modestly higher lamb market share.

Chicken prices continued a long-term declining trend, averaging $7.30/kg, underlining its strong price-competitive position, while pork also declined from $9.90 to $9.80/kg.

Date claimer: Coles Supermarkets general manager of quality, policy and governance, Jackie Healing, will speak at the Queensland Rural Press Club's Brisbane Show breakfast tomorrow morning. In her role, she is responsible for leading the company frameworks and compliance programs for product safety, quality, and brand integrity. Jackie specialises in the development of retail private label quality, development and sustainability programmes which are differentiating, relevant to customers, and commercially viable.

- Understanding the Neilsen Homescan data: MLA earlier this year adopted a new monthly retail fresh meat market share analysis, provided by Neilsen Australia Homescan. It replaces the previous Roy Morgan single-source data that has been used for the past ten years. To read MLA’s full explanatory notes on the changes to the monthly retail survey, click here