WITH United States domestic lean beef prices now trading at record levels due to local cattle supply challenges, Australian, Brazilian and Uruguayan beef is now flowing into North America in much larger volumes.

But while greater volumes from Australia was widely anticipated as Australian beef production has ramped-up this year, it’s been the extent of growth in Brazilian exports in 2024 that has taken some observers by surprise.

Australia’s exports to the US for the year to the end of August have reached almost 235,000t, up 96,000t or 69pc on the same seven-month period last year, and the highest number since 2015. August shipments reached 41,000t, 59pc higher than last year.

At the same time, for exporters like Australia, the rising demand out of the US comes at a time when demand from China, the top beef buyer in the world, has slowed due to economic challenges.

Australia’s exports to China over the past eight months are at 121,000t, 8pc lower than last year. Much of the displacement has headed into the US.

Last week the value of domestic 90CL boneless manufacturing beef in the US averaged US$374/cwt, 21pc higher than a year ago.

“Record lean beef prices combined with the strong US dollar have encouraged global beef suppliers to accelerate shipments to the US market,” Steiner Consulting said in yesterday’s Daily Livestock Report briefing.

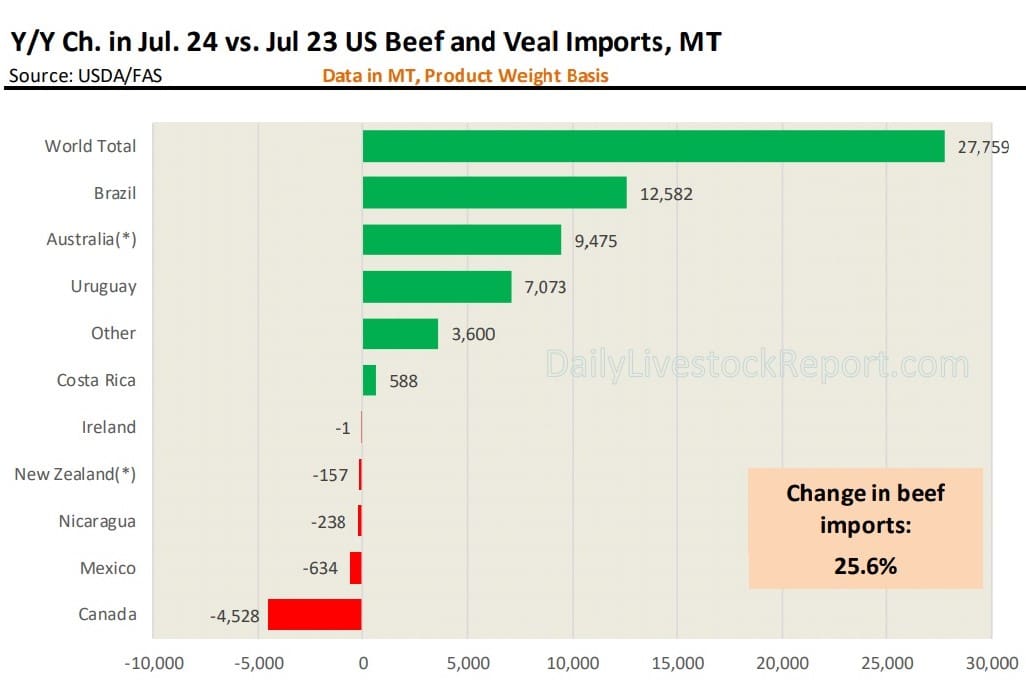

“US imports of fresh, frozen and cooked beef in July were 25pc higher than a year ago, while year-to-date imports are up almost 19pc compared with a year ago, and 27pc higher than the five year average,” Steiner said.

The reduction in imports from other North American countries has opened the door to more beef coming from Australia/New Zealand and South America. Australia is currently the top beef supplier to the US, by volume, the report said.

“At a time when US cattle numbers have declined, cattle inventories in Australia have expanded, making more supply available for export,” the DLR report said.

Source: Steiner Consulting

“The asynchronous cattle cycle in North America and Oceania explains why this is the highest volume of beef imported from Australia since 2015,” the report said.

Steiner said it did not appear that imports from Australia would slow any time soon. The current pace of slaughter in Australia and uneven demand from Asian markets suggested that export shipments will continue at the current pace for the remainder of the year.

Brazil unexpected

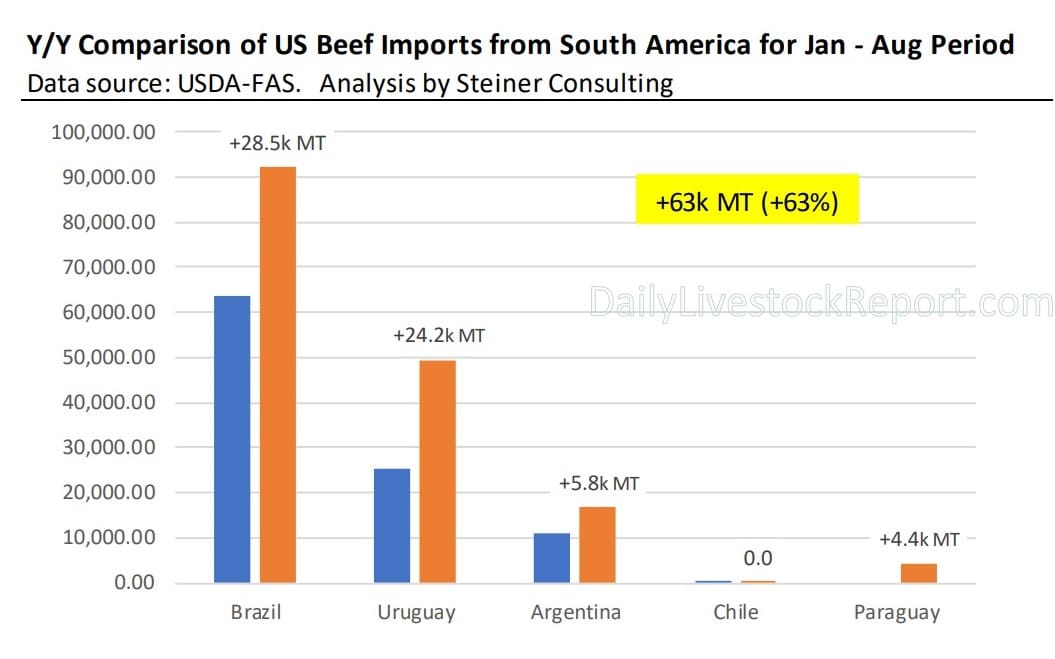

If the increase in imports from Australia was ‘somewhat expected’ considering the steady increase in cattle inventories there, the surge in US imports from South America has been far bigger than most expected, Steiner said.

Different from Australia that no longer faces a significant tariff penalty (free trade agreement), US imports from South American suppliers are subject to Tariff Rate Quotas (TRQ).

Argentina and Uruguay operate under a country-specific quota of 20,000t/year, while Brazil operates under the “Other Country” quota, totalling just 65,000t.

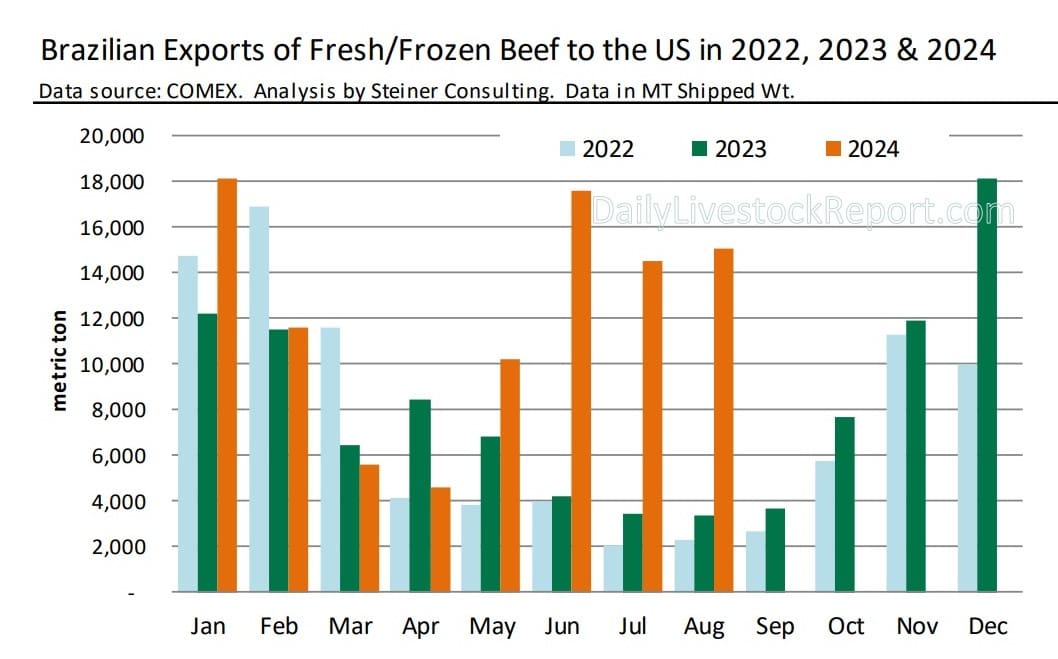

The rapid rise in trade this year meant Brazil (and others) filled the 2024 ‘Other Country’ US quota way back in March, meaning shipments for the remainder of this have been exposed to an out-of-quota tariff of 26.4 percent on all beef shipments, reducing their competitiveness against other exporters like Australia and New Zealand.

“This has not proved to be a significant impediment to Brazilian shipments,” Steiner said in yesterday’s report.

US imports from Brazil through July were 92,000t, while Brazilian shipments in July and August were 14,500t and 15,000t respectively. Imports from Uruguay, which has its own 20,000t US quota, were 49,500t through July and there is also more beef from Argentina and Paraguay entering the US market. As Steve Kay reported last week, the US is now Uruguay’s largest export market by volume, surpassing China.

“Imported beef shipments from Brazil will likely accelerate at the end of the year as suppliers know the quota available is likely to be filled in the first couple of months of the year,” Steiner’s DLR report said yesterday.