WHILE Australian beef continues to struggle for competitiveness in international markets due to shortage of slaughter stock, high cattle prices relative to other international suppliers, and cost-to-operate in the processing sector, some further relief is being experienced in the latest round of tariff adjustments in key export customer countries.

January 1 signalled another cycle of annual tariff and quota relaxations on red meat exports in customer countries like Korea, China and the US where Free Trade Agreements are in action. Reductions under the Japan-Australia FTA will take place a little later, from April 1, in line with the new Japanese financial year cycle.

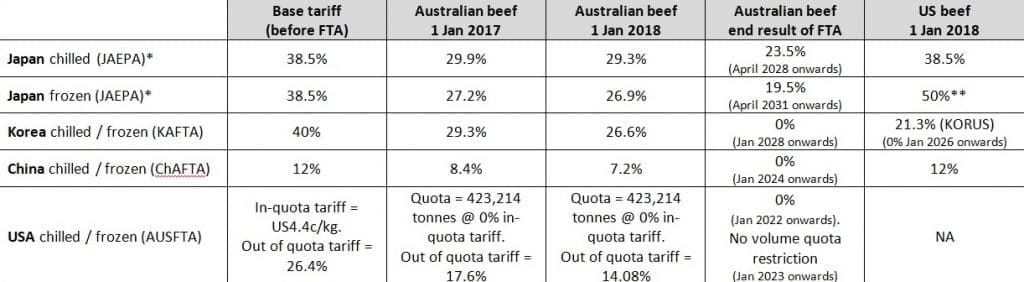

2018 tariffs/quotas applicable to Australian beef

In Japan, Australia’s largest beef export market by volume and value, tariffs paid on Australian imported chilled and frozen beef continue to decline as part of the Japan-Australia Economic Partnership Agreement (JAEPA) which came into force on January 1, 2015. JAEPA is by far the most liberalising trade agreement Japan has ever concluded.

As outlined in the table published above, from April 1, our chilled beef exports to Japan will be tariffed at 29.3pc, a further 0.6pc reduction on last year. In comparison, US beef exporters, without the benefit of an FTA, will continue to pay the MFN (base) beef tariff into Japan of 38.5pc. This year, it provides Australian exporters with a 9.2pc tariff advantage over the US.

Our frozen exports to Japan will fall even further, attracting a tariff from April of 26.9pc, down another 0.4pc on last year. That represents an 11.6pc advantage compared with the 38.5pc tariff to be paid by the US.

To make matters worse for the US, in the current Japanese beef trading year ending March 30, the US has been forced to pay an even higher 50pc tariff on frozen beef exports to Japan, after the country’s frozen safeguard market protection mechanism was triggered last August. The safeguard, which applies to all supplier countries not covered by an FTA, remains in place until the new Japanese financial year. Crucially, Australia is not impacted because of the JAEPA agreement.

While Australia’s tariff adjustments from year to year into markets like Japan may appear to be small, it is the accumulation of those ‘small gains’ over the period of the enactment of the FTA that is important. By the end of the Japan FTA implementation period in 2028, Australia’s tariff on chilled beef to Japan will have dropped to 23.5pc, while frozen will have dropped to 19.5pc. The reason for the difference is that the imported frozen beef market is considered less impactful to Japan’s own domestic beef production than chilled imports.

China similar

A similar competitive advantage for Australia is emerging in the China market, where Australia’s 2015 ChAFTA agreement sees this year’s beef exports attracting a tariff of 7.2pc, versus 8.4pc last year. This compares with a tariff of 12pc imposed on US and Brazilian exporters to China, neither of which yet enjoy the benefit of an FTA trading agreement.

Tariffs on Australian beef into China, which in pre-agreement days ranged from 12pc for fresh beef to 25pc on some value-added products, will be eliminated altogether into China within six years. Ten percent tariffs on live cattle and sheep disappear after year four of the China agreement, while offal and hides tariffs will also gradually recede.

Different circumstances in Korea

Australia’s beef trade competitiveness into South Korea are somewhat different, because the US’s KORUS trade agreement with Korea pre-dates Australia’s own KAFTA agreement by two years, guaranteeing that the US will continue to enjoy a tariff advantage over Australia for some years to come.

This year for example, the US pays a tariff of 21.3pc for chilled and frozen beef into Korea, while Australia’s own schedule of reductions – two years behind the US – will see our tariff at 26.6pc. As time goes by, however, that competitive gap will narrow: the US will pay no tariff whatsoever on beef from 2026 (now only eight years away), while the same will apply on Australia from 2028.

Prior to the trade agreements being struck with Korea, both exporting countries paid a tariff of 40pc on chilled and frozen beef.

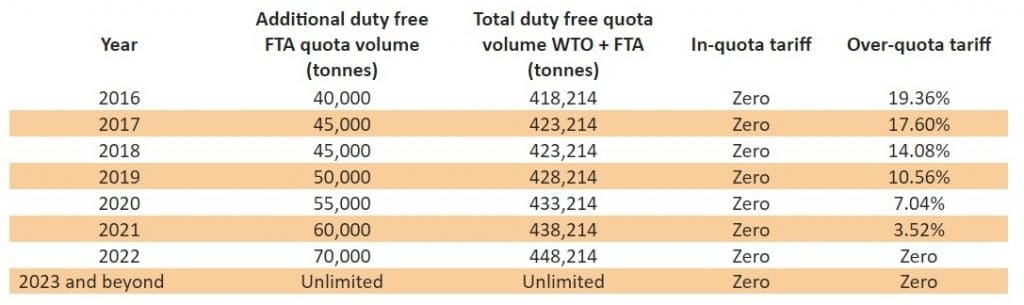

Australia’s US quota unchanged this year

Unlike other export customer countries listed above, Australia’s access to the US market is limited primarily by duty-free volume quota, rather than tariff. Since the AUSFTA agreement was struck 13 years ago, our US beef quota has gradually risen from about 350,000t, to 423,214t last year. That figure does not change in 2018, but expands again next year, adding an additional 5000t of duty-free quota, to 428,214t (see table below).

The gradual yearly increase in the US quota allowance for Australia reduces the risk of hitting the quota trigger point, after which a tariff of 17.6pc would be paid (highly unlikely while Australia’s beef herd is still recovering from 20 year lows).

Prior to Australia’s FTA with the US being activated in 2005, we paid an in-quota tariff of US4.4c/kg and 4-10pc for processed beef.

From 2023, the volume of duty-free quota into the US will be unlimited.

For other exporting countries like Brazil, however – just starting to penetrate the US chilled and frozen beef market after decades of exclusion due to FMD concerns – the tariff and quota levels into the US are of significant concern. Brazil has no formal FTA with the US, and is currently forced to export to the US under the ‘other country’ quota of just 64,800t. It shares that quota with several other exporting countries.

In order to shift larger volumes of beef into the US, Brazil would be forced to pay the full MFN (base) beef tariff of 26.4pc. While Brazilian exports to the US are currently suspended due to last year’s food safety and corruption issues, Brazil has high expectations of regaining US access this year.

Some analysts says Brazil may be prepared to absorb the full MFN tariff of 26.4pc in order to gain access, because of the competitiveness of Brazilian beef on the world stage.