IT’S often said that the international cattle hides market is a good barometer of the state of the global economy.

When economic times are good, and businesses and individuals are feeling confident, hide and leather prices tend to follow suit. Consumer rewards, like leather car-seats, lounge suites, shoes and handbags grow in popularity.

But despite the booming economy now being experienced in the US, Japan and other parts of the developed world, it’s not being expressed in Australian or global cattle hide values at present.

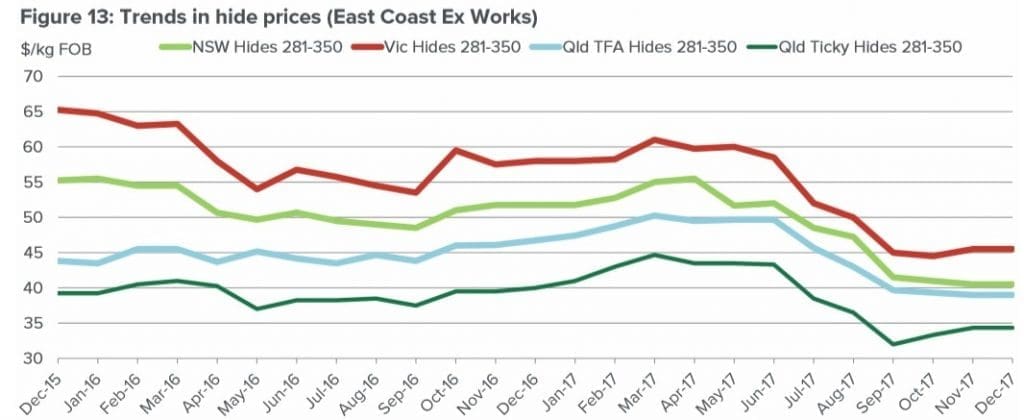

In fact in the graph published below, it’s evident that cattle hides today are at or near record lows for the past two years. Australian hides of various types and qualities have declined by between 12 and 24 percent in value over the past 12 months, and even more over a two-year cycle. Best quality Victorian hides, marked in red in this graph, have slipped from $65 (FOB, ex-works) to $45 in the two years to December last year – a drop of more than 30pc.

Hides and other co-products contribute to the overall ‘salvage’ value an Australian beef processor realises when they buy a beast from a cattle producer. A lower hide price ultimately impacts on how much a processor can justify paying for a slaughter or feeder animal.

So what’s behind the current poor price levels for cattle hides?

One theory doing the rounds of the Australian beef industry is that prices may be related to buyer cartel activity.

Today, an estimated 75 to 85 percent of Australian cattle hides go to China, where they are cured, tanned and processed into leather.

A crackdown by Chinese authorities over environmental standards in the tannery industry has seen myriad small leather producing businesses closed down in recent years, replaced by a much smaller number of large players. That may have created an opportunity to establish price-fixing for hides, several Australian sources suggested to Beef Central.

While there is no clear evidence of such activity, hides price levels like those currently being seen have raised suspicions among Australian processors and hides traders over the past six months.

Another processing sector stakeholder suspected China did not yet control a large enough slice of the world hides market to exert such control. He suggested that alternatives to leather may be at least partly to blame for current poor hides prices.

“Five or so years ago, hides shot up in value, some worth close to $100,” one contact said.

“That prompted some customers in China to fast-track the development of synthetic leather, which now competes much more vigorously with real cow-hide leather. There may well be some buyer cartel activity happening also, but the strong progress of synthetic leather is definitely having an impact,” he said.

Plentiful supply of hides out of North and South America, where national herd size and slaughter numbers have grown rapidly in the past two years, may also partly explain current hides price levels. The high current value of the A$ was also offered as having a dampening effect on hides prices.

In its recent January monthly co-products report, MLA said the current hides market remained ‘subdued’, blaming prices on poor demand and plentiful supply.

“There is very little interest from tanners looking to buy forward,” MLA’s report said.

In 2015, the Australian Competition and Consumer Commission and the National Development and Reform Commission of the People’s Republic of China (NDRC) signed a memorandum of understanding, paving the way for increased engagement between the watchdog agencies on international cartel investigations affecting Australian and Chinese markets.

We are a meat processor and have several salted cow hides.

Where do i look to sell these hides?

There are players in the industry who are taking steps to make sure they get as many of the good hides as possible, meaning more of the lower grade hides going to their competitors. They are doing this by using hide identification and traceability. If you can trace where the good and bad hides come from, it gives the cattle buyers a tool to go a bit further to secure the cattle with good hides, as they know the value is there. As David Foote said, the $20 million a year is a considerable prize. However waiting for government to legislate the problem away has been proved not to work. Businesses innovating and using available technology to overcome or avoid the problem is the answer.

Tassie hides most valuable in Aust as no fire brands no ticks and less barb wire. These hides are followed by South WEst Wa for similar reasons

The shift from Europe and concentration of tanneries in China, is very similar to that of the transition of wool scours and milling which at that time was due to a combination of cost to operate and environmental regulation. Others may comment on whether this transition was a positive or negative for the Australian wool producer. What the graph continues to highlight is the price differences between not only the north, central and the south, but between tick free and tick. At consistently around $5 between TFA and Ticky it is relatively easy to see that outside of direct tick management costs – which are certainly not insubstantial, the impact of ticks on hide values was around $10million for Queensland producers last year alone. When compared to NSW hides ( and the likely impact of firebrands and ticks this loss of opportunity from hide value doubles to around $20million per year. Surely its a big enough “prize” and time to review how to recapture this available value.

Thanks for your comment David – all excellent points. Do readers have views on how we ‘recapture’ some of this lost value? Is it time for Queensland, which produces roughly half of the cattle hides in the nation, to re-think mandatory cattle branding legislation? Editor