DRIVEN by lower livestock input costs, typical beef processor margins have returned to levels of profit this year, after almost three years in Siberia.

Analyst Matt Dalgleish from Episode 3 has developed a Beef Processor Profitability Index, based on a typical set of processor numbers.

The new BPPI index figures was first reported back in April, and re-calculated this week.

The new BPPI index figures was first reported back in April, and re-calculated this week.

“How times have changed for the sector during 2023,” Mr Dalgleish said.

“In April we noted that after many months of negative margin that the BPPI had moved back into positive territory. As the local cattle price has continued to slide through the year, the profitability of beef processors, according to the index modelling, has continued to improve,” he said.

33 months in Siberia

Ep3’s average BPPI for September has come in at 1.69, which is the highest the index has been on record – although this comes after spending 33 months in negative territory.

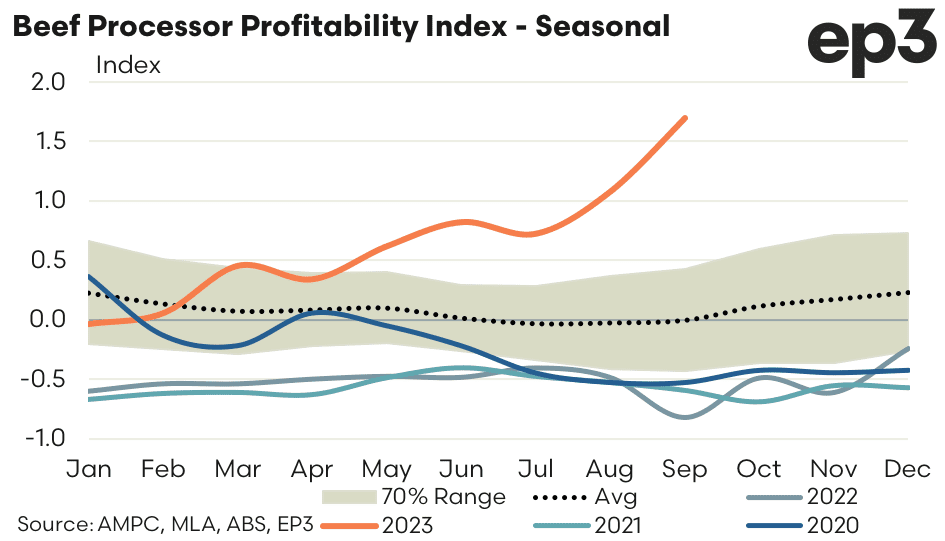

As the seasonality chart below shows, the BPPI was stuck squarely in the negative range since early 2020 (dark blue line), and indeed deeply negative during 2021 (light aqua blue line) and 2022 (grey line), before edging back into positive territory early this year (orange line).

“You would have to go back to late 2019 or early 2020 to have seen some consistent, above average profits being achieved,” Mr Dalgleish said.

“So it has been a long time between drinks for the nation’s beef processors – at least according to this index calculation.”

Mr Dalgleish said it was important to note that the BPPI calculation is based on a theoretical processor margin model, and is a simple representation of the Australian beef processing sector.

“A BPPI in negative territory does not suggest that all processors are losing money. Similarly a BPPI in positive territory doesn’t suggest that all processors are making money. A more useful reading of the BPPI would be that a negative index suggests a tougher processor trading environment, versus a positive BPPI which is reflective of a more beneficial processor trading environment,” he said.

Additionally, there had been recent labour cost increases to the red meat processing sector. One recent factor has been the application of the Pacific Australia Labour Mobility (PALM) scheme which the current modelling process doesn’t take into account, as data availability limits what the BPPI modelling process can utilise.

Additionally, there had been recent labour cost increases to the red meat processing sector. One recent factor has been the application of the Pacific Australia Labour Mobility (PALM) scheme which the current modelling process doesn’t take into account, as data availability limits what the BPPI modelling process can utilise.

Discussions with processors suggest a PALM labour unit is more expensive than a domestically-sourced labour unit – for a wide range of reasons, including accommodation.

Additionally, there are higher general labour costs as limited abattoir workforce numbers means that more overtime is being utilised and the raising of the TSMIT (Temporary Skilled Migration Income Threshold) in July of 2023 has increased broader wage costs in meatworks. This means that the more recent index profitability levels may be somewhat overstated, Ep 3 warns.

As the seasonality chart highlights, the BPPI moved back into positive territory during the first quarter of 2023. Quarter two demonstrated some moderate growth in profitability with the index moving from an average of 0.34 in April to an average of 0.82 in June.

Meanwhile, the third quarter of 2023 has seen a strong lift in the index from an average of 0.73 in July to 1.69 during September.

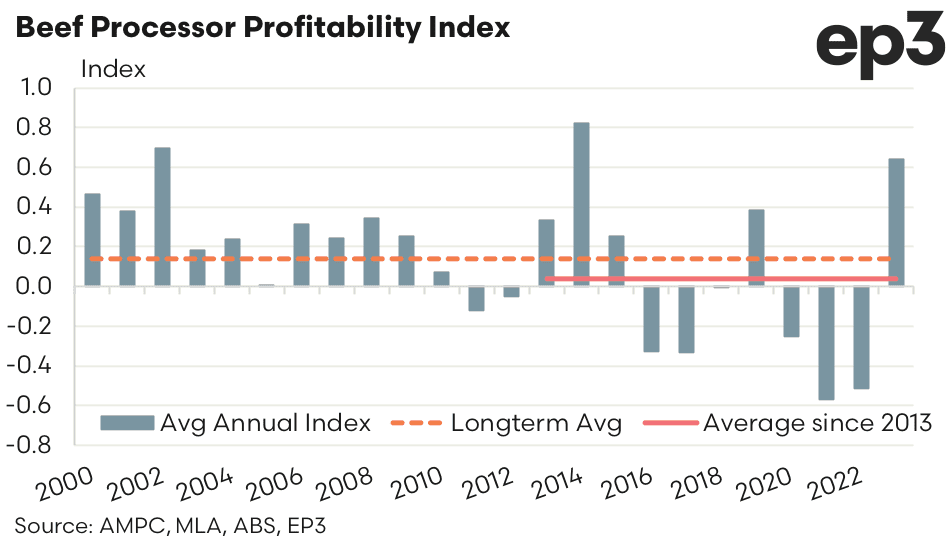

The annual average BPPI figure for the 2023 processing season now sits at 0.64, which is below the annual average peak of 0.82 that was achieved during 2014.

The long-term average BPPI calculated from 2000 to 2023 sits at 0.14 (represented by the orange dotted line on chart).

Analysis of the average BPPI achieved since 2013 shows that the last decade has been ‘pretty bleak’ for beef processors with a BPPI of just 0.04. Since 2018 the average BPPI has been -0.05, so the current improved environment is providing an opportunity for beef processors to claw back some of the more recent losses incurred, Ep3’s Matt Dalgleish said.

‘Boom and bust’ pendulum swings

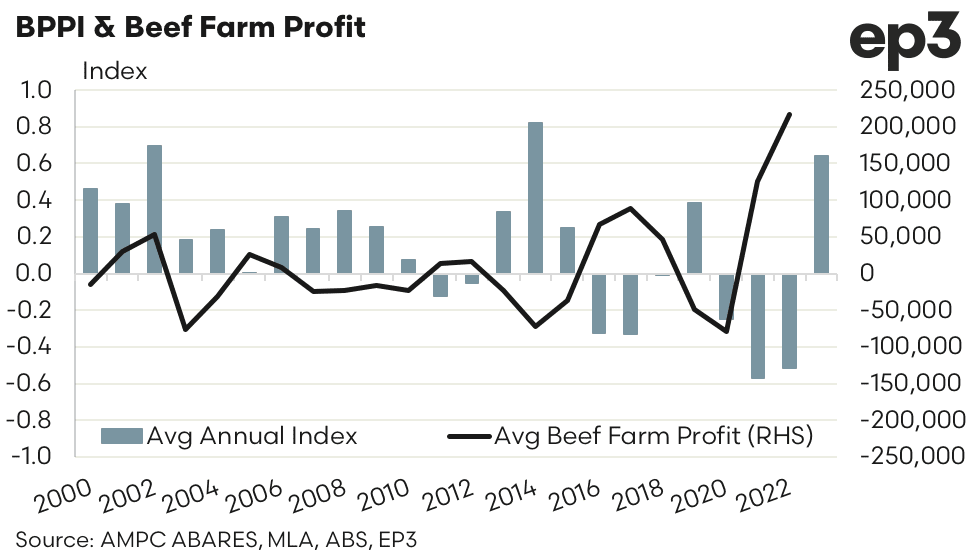

Episode 3’s comparison of ABARES annual beef farm profitability data compared to the BPPI index highlights that the pendulum of profitability has indeed swung in favour of the processor into 2023.

“ABARES is yet to release its calculations for 2023, but given the pattern set over the last decade it is fair to assume that beef farm profitability will be down from the record peak seen in 2022,” Mr Dalgleish said.

“Historically, beef farm profitability often takes a hit when the BPPI turns positive. Similarly, when beef farm profitability improves it usually coincides with a tougher trading environment for the beef processing sector. Like many commodities, there is a cycle of boom and bust and the beef sector is no exception. It’s just that the beef processor and the beef farmer are at opposite ends of the price cycle.”

Direct consignment offers hold ground

After further 10-20c/kg drops in many grids across eastern Australia last week, direct consignment price offers are for the most part stable this week.

Many processors are now heavily booked with slaughter cattle until well into November with a price attached, and rapidly filling with unpriced space-only slots through to Christmas closures.

With less than nine weeks’ operations remaining for many processors in their 2023 seasons, some are now warning producers about leaving sale decisions too late, if kills are deemed necessary within this year, due to seasonal or animal welfare pressures. January/February kills still look a long way off for areas where cattle are now under serious challenge.

Direct consignment grids in Southern Queensland this week are currently sitting at 355-370c/kg on heavy cows and four-tooth grass heavy steer with an implant anywhere from 415-450c (some sheds offering 10c more for no HGP). Some operators are again not offering quotes at all, happy with their current bookings through to Christmas closure.

Some plants in Central Queensland this week remain are on the same rates as processors in southern parts of the state.

Processor grids further south are also largely unchanged this week, while others have withdrawn quotes signifying they are already-well covered. Southern NSW this week has offers of 405c on four-tooth ox and in eastern parts of South Australia, 370c/kg top cell on cows and grass four-tooth ox 425c.

Kills ease

Last week’s public-holiday shorted working weeks in NSW and Queensland had a significant downward impact on national processing throughput, with adult cattle slaughter down 11pc week-on-week to 111,125 head, the smallest kill since early May. NSW slaughter fell 10pc to 27,862 head, Queensland fell by 19pc to 54,925 head and South Australia fell 16pc to 3388. Numbers in Victoria and Western Australia rose.

Protected industrial action is also limiting throughput at one large Queensland plant this week.