Rain-driven supply issues overwhelmed demand-side market sentiment last week as continent-wide weather conditions impacted on processing operations from Central Queensland to southern Victoria.

Rain-driven supply issues overwhelmed demand-side market sentiment last week as continent-wide weather conditions impacted on processing operations from Central Queensland to southern Victoria.

While the decline in processing numbers can be expected to be much greater in this current week’s figures, processors in all eastern and southern states started to struggle to maintain numbers towards the back-end of last week.

Some NSW processors are currently reporting difficulties getting staff to work, let alone cattle, as road and even rail access grinds to a halt.

This will inevitably reflect in lots of ‘dark days’ at NSW plants in the current weekly kill roster, contacts say. Plants like Wagga are known to have dropped shifts this week, and large physical cattle sales like Forbes and Wagga were called-off yesterday as flooding spread.

The Eastern Young Cattle Indicator last week staged a remarkable rally against broader demand-side market sentiment, finishing on 390.5¢/kg on Friday, up about 8.5c for the week.

The trend has been widely interpreted as being driven solely by heavy rain across the eastern states curtailing cattle movements, pushing competition in the physical markets as buyers attempted to fill orders.

The number of cattle included in EYCI calculations fell 12pc last week, typified by a rain-reduced Roma market which saw 26pc fewer cattle from Queensland included in the indicator. The rain has also re-invigorated restocker demand.

Supply across Queensland saleyards markets fell 34pc week-on-week, with some sales, including Longreach cancelled. When compared to the corresponding period in 2011, saleyards supply was down 39pc, so it was little wonder the state’s slaughter numbers were back a little.

The Eastern States cattle slaughter report for the week ended Friday showed numbers back about 4 percent across the five reported states from a week earlier, to 127,509 head. Declines were recorded in all states, but were largest in NSW and South Australia, in percentage terms.

Despite the return to killing operations at Borthwicks’ Mackay plant, Queensland’s beef kill last week was back 1pc, as access to killable stock started to shorten. The state’s tally of 67,876 head was still down 12pc on this time past year, during a period when international demand was still very strong.

Export processor rates in southeast Queensland were unchanged to 5c dearer last week, not due to any significant change in market sentiment or international buyer demand, but simply an attempt to flush-out a few more cattle as weather started to impact supply arrangements later in the week.

One exporter’s grids went up 5c last Wednesday for grassfed ox and cow, taking 0-2 tooth heavy steers to 345c/kg, and best cow, 325c/kg. Other processor grids remain at 340c/kg and 325c/kg for the same articles.

One of the few positives on the horizon for exporters is the slight easing in the value of the A$, this morning back to US106.69c on the strength of lowered economic growth projections out of China.

In NSW, last week’s kill fell 8pc to 28,597 head, and much worse results can be expected in this week’s tally.

NSW cattle yardings at physical markets fell 6pc last week, as heavy and in places flooding rain disrupted southern sales later in the week. Seasonal prospects during autumn look excellent, however, with beef producers state-wide having a strong feed base and ample water storages heading into winter. Saleyard numbers in the north of the state were generally higher, with producers moving cattle after wet weather prevailed for most of February.

NSW export processors were prepared to pay more to secure cow supplies in saleyards, driven by short supply and the current record prices for global manufacturing meat.

In Victoria, last week’s kill also suffered from the effects of rain, falling 7pc to 19,005 head. South Australia’s kill declined 8pc to 7394 head, while Tasmania contracted 4pc to 4157 head.

International outlook

One the international meat demand front, exporters expect to see little demand out of Korea for some weeks, as the country will activate its Free Trade Agreement with the US on March 15, effectively lowering import tariffs on US beef by 2.6pc overnight. Korean importers will be keen to lower their inventories in advance of the start of the FTA, to maximise any price advantage in ‘new’ US beef, to Australia’s disadvantage.

It will also be interesting to monitor whether Korean importers push for lower prices out of Australia, to keep pace with the tariff relief gained out of competing US beef.

US imported beef prices were generally firm last week, but volume was light. Market participants indicated that volume was relatively good earlier in the week but that there continued to be plenty of push-back from end-users caught off-guard by the rapid rise in the price of both domestic and imported product.

US domestic 90CL boneless beef closed on Friday at a near-record US$2.20/lb, up almost US20c from the beginning of the year. Imported CIF values were quoted as high as US$2.11/lb.

End-users continue to be cautious, in some cases holding hope for a break in prices further into March. This meant they did not want to buy expensive imported beef for delivery in April when they could get the chance to put away some domestic product at a few cents lower. Others probably have concluded that prices will likely trade at elevated levels for some time, at least until US cow supplies improve.

Still, they are far from chasing the market and are buying only on as needed basis, analysts say.

US analysts say there is an expectation that the sharp increase in the price of US domestic grinding beef and higher imported beef prices may encourage Australian export processors to bid-up for cattle, increase kills and ship more beef to the US.

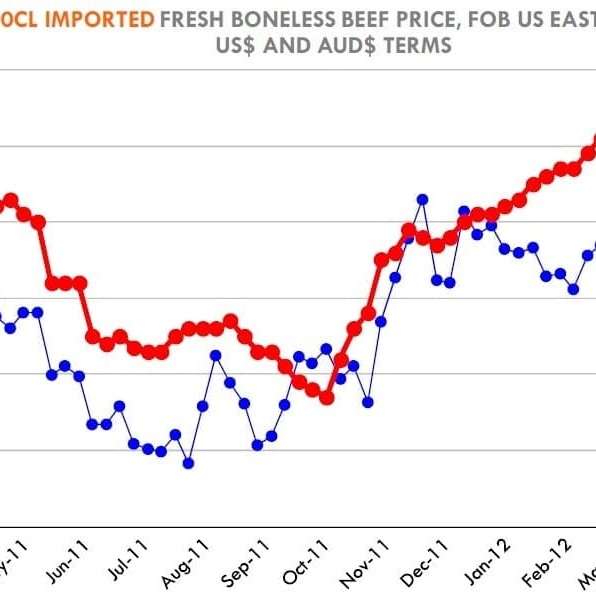

As illustrated on Beef Central a fortnight ago, the chart here shows that much of the gains in the price of imported lean grinding beef in US$ terms have been erased by the rise in the value of the A$.

As illustrated on Beef Central a fortnight ago, the chart here shows that much of the gains in the price of imported lean grinding beef in US$ terms have been erased by the rise in the value of the A$.

Since the beginning of the year the price of imported lean beef is up US10c/lb or 5pc. When converted into A$ equivalent, however, the Australian processor is making basically the same amount.

If that is the case, why is Australia shipping more beef to the US compared to last year? After all, the data for the month of February showed Australian processors shipped 23,340t of beef to the US market, 70.8pc more than a year ago and 21.6pc more than the five-year average for February (see Beef Central’s Friday story "Explosion in grinding beef trade to the US").

In part the cattle supply situation this year has been much better than a year ago when flooding plagued the early part of the year. Also, Australia is finding US prices, flat as they are due to the currency, relatively competitive with other markets.

On items like 85CL trim, Asian markets continue to pay a premium and there is very little product available in the US. On the leaner trims, however, the US market has become more competitive.

Still, the currency issue is a concern since it would amplify any possible decline in imported beef prices.

So while Australian processors are shipping more product to the US so far this year, that growth remains fragile, US analysts say.

Reports continue to persist this week about shortage in frozen cold storage capacity in the Brisbane region, by far the largest accumulation point for beef exports to Asia and North America, as a result of the current focus on frozen manufacturing beef exports.