Discovering and embracing emerging international beef markets will continue to be one of the fundamentals in JBS Australia’s future operations, an agribusiness audience in Brisbane was told this week.

Discovering and embracing emerging international beef markets will continue to be one of the fundamentals in JBS Australia’s future operations, an agribusiness audience in Brisbane was told this week.

Chief executive Iain Mars was making a presentation to the Australian Agribusiness Association on Tuesday.

He told the gathering that how the company positioned itself in the global environment and where it sold its product was having an increasingly important impact on JBS Australia’s business.

The big contrast between JBS’s operations in Australia and those in North and South America was the high level of dependence Australia had on the international market.

“Brazil historically had a very strong export base, but its domestic market has become incredibly strong, and is really driving that business. The US operation also, is driven by the domestic trade, and the US really only exports its surplus. Here in Australia we export 60-70pc of all the meat we produce, due to population size,” he said.

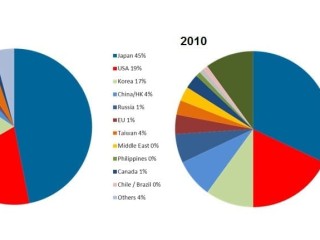

Mr Mars presented the pie charts appearing on this page, to illustrate the changing emphasis in export destination for JBS Australia’s beef exports.

When the company started in Australia in 2007, just three markets were taking more than 80 percent of its output – Japan, Korea and the US.

Since then, considerable diversification had taken place in the company’s export effort, building a much stronger business along the way, he said.

Over the same period, through acquisition and more than $400 million investment in developing existing infrastructure, the company’s turnover in Australia had nearly doubled, to A$3 billion a year.

“It’s been a great success by our team to diversify the base where we are selling our meat,” Mr Mars said. “While Japan, Korea and the US remain vitally important markets to JBS Australia, it is really the developing markets elsewhere that are really driving the business forward.”

Mr Mars said cattle prices in Australia would be ‘much lower than they are today’ if the reliance on Japan, Korea and the US was as heavy as it was back in 2007.

“We really need to be very agile and aware of where the opportunities are in the world where we can sell our meat,” he said.

As the 2010 pie chart illustrates, just one of the growth areas for trade has been into Brazil and Chile in South America.

“When we started business in Australia in 2007, there was an underlying concern in some quarters that JBS was going to take away Australia’s traditional export markets and hand them to Brazil. In reality, quite the opposite has happened: we have actually opened up a lot more markets for Australian beef. For example we now have regular shipments from plants like Beef City and Dinmore to Brazil and Chile,” Mr Mars said.

“People ask: how can an Australian exporter compete in that market, given the amount of beef it efficiently produces itself? It’s all about positioning, and the price of that product (principally, Pichania, or rump cap) competes very favourably for Australia with what could be achieved in a traditional market like Japan,” he said.

“It also has the benefit of taking away an over-reliance on a narrow basket of customer countries, which is a good strategy in any business.”

Other markets that had grown considerably over the past four years included the Middle East, Russia and Indonesia.

The beef market was changing quite rapidly throughout the world, Mr Mars said.

“One of the issues back in 2007 was the perceived threat of Australia being overwhelmed in export markets by Brazilian beef. But what has happened since then is that cattle price in Brazil has gone higher than Australian prices; beef demand growth in Brazil itself has been tremendous due to economic growth; and that has opened up opportunities for Australian beef in markets like the Middle East where Brazil has traditionally been strong.”

In response, JBS had recently opened an office in Dubai, (manned by well-known sales and marketing team member, Jamie Ferguson, who formerly ran JBS’s southern brand programs like King Island and Tasmania Beef.)

“That is really about positioning ourselves in a new market, rather than simply relying on the ‘old three customers’ by trying to diversify where we sell our beef,” Mr Mars said.

“As the saying goes, when times are tough, it’s time to try new things, and I would suggest JBS is well ahead of that, exploring new markets and products and building from the synergies we have with our operations in Brazil, Argentina and the US.”

“As the saying goes, when times are tough, it’s time to try new things, and I would suggest JBS is well ahead of that, exploring new markets and products and building from the synergies we have with our operations in Brazil, Argentina and the US.”

So where will the growth in beef opportunities come from over the next decade?

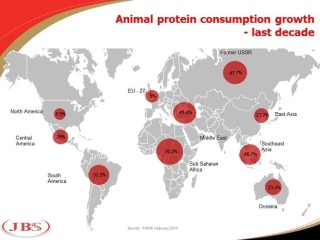

Mr Mars displayed a second slide (pictured here) showing growth in animal protein worldwide over the past ten years. The larger the circle, the larger the region’s growth (in percentage terms, not outright volume) from year 2000.

“What it illustrates is that expansion is happening at a much more rapid rate in developing regions, rather than traditional export markets. The focus is very much on Brazil, Russia, the Middle East, Africa and Southeast Asia,” Mr Mars said.

“The old traditional markets of Europe and the US are still there, but growth is going to come from those emerging regions.”

“That expansion in protein consumption will continue in coming years, and it really is the future of our business here in Australia,” he said.

“That means positioning a meat business very carefully, and in the right way in those emerging markets, which can be more difficult environments in which to operate.”

Monday on Beef Central: Iain Mars discusses cost pressures in Australian processing, relative to international competitors

- Click on the slides here for a larger view