Ridley’s biggest mill is located in Wellsford near Bendigo. Photo: Fairbrother

AUSTRALIA’S largest stockfeed miller Ridley Corporation has reported a net profit after tax of $21M for the half year ending 31 December 2022, a drop of 1.6pc or $1.6M on its HY22 result.

The company’s earnings before interest, tax, depreciation and amortisation grew by 12.8pc to $44.1M in HY23.

Ridley’s packaged feeds and ingredients segment, which includes bagged poultry, dairy, dog, horse and lifestyle-animal products as well as the aquafeed operations, showed the strongest results contributing an EBITDA of $33M, up 21.9pc.

The bulk stockfeeds EBITDA fell by 3.9pc or $700,000 from HY22, at $17.9M.

The segment, featuring both ruminant and monogastric animal feeds, took a hit from the wet weather experienced in the first quarter of the half which provided for a challenging transition to the new crop.

Overall, monogastric volumes were up 2pc and ruminant quantities rose by 9pc, driven by new dairy customers.

Ridley managing director and CEO Quinton Hildebrand said the company expects the bulk stockfeeds segment will recover these losses into FY23.

He said the challenges, such as flooding and COVID-19, have largely eased.

“I am pleased to advise that since we have had plentiful new season grains, our margins have improved,” Mr Hildebrand said.

Organisational restructure

In addition to the results, Mr Hildebrand announced that Ridley will be reorganising its business structure to further streamline the three different operations.

“We have announced internally within the business a transition to a new organisational structure which will sharpen our focus on the execution of this growth plan.”

He said the monogastric segment, which includes pig and poultry feed, accounts for about 75pc of the bulk stockfeed operations, with most of the sales going to large corporate customers.

“In order to better service these customers, we are going to place our five large-volume monogastric mills into a dedicated monogastric business unit, which is to be led by a new COO with monogastric experience.

“We expect that this business unit will continue expanding as the customers grow.

“We are facilitating this growth with three de-bottlenecking projects in FY23 that will increase our capacity by more than 10pc.”

Mr Hildebrand said the ruminant sector, servicing the dairy, beef and sheep industries, will be managed alongside the packaged and aquafeed segments.

“The remaining eight mills split into Victoria, New South Wales and Queensland will be focused on growing our ruminant sales, and here we are also de-bottlenecking two of our largest ruminant mills to accommodate this growth.

“The regional restructure of the ruminant business unit will absorb the packaged products and the aqua businesses and be run by our former bulk stockfeeds COO.

“This makes sense because the packaged and aqua products are produced by the mills within this business unit.

“By bringing together these packaged logistics operations, we also expect to deliver some supply chain benefits to Ridley and our customers.”

Mr Hildebrand said the ingredient-recovery operations would not be impacted by these changes.

He said this segment is “making good progress on the growth plan”, with Ridley recently securing access to a tallow-storage facility and an additional meal-storage site with blending capacity.

Capital projects in pipeline

As part of Ridley’s FY23-25 growth plan announced in May last year, the company has launched “Project Boost”, a series of small projects costing approximately $15M.

Ridley chief financial officer Richard Betts said when fully implemented, these projects were expected to deliver an annualised earnings benefit of $9M.

“Good progress has been made in relation to the delivery of these projects with a total of $14.2M or 95pc of the forecasted expenditure now approved and $8.2M spent to date.

“Pleasingly, of the projects approved, the expected annualised benefits are $8.7M, which will be delivered as part of our growth plan.”

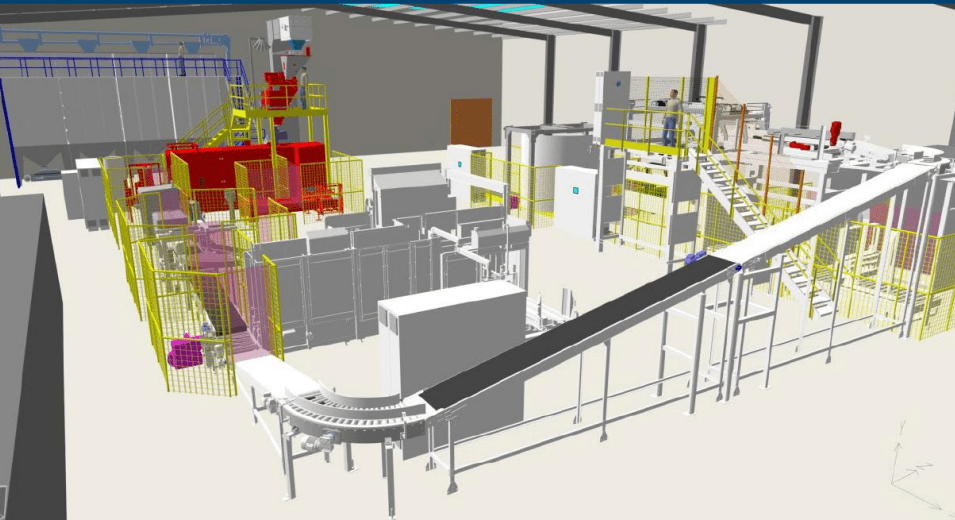

An artist’s impression of the new Narangba packing-line project. Source: Ridley

New packing plant under construction

Mr Hildebrand said there has been strong results in the pet-food market, building on gains from previous financial years.

He said from mid-2022, Ridley commenced supplying products for a house brand of a large retailer.

This is on top of the high volumes resulting from the long-running Pet Stock contract.

He said the new agreement has made it necessary to build a new packing plant.

“It has assisted us in investing in a packaging plant in our Queensland extrusion plant.”

He said this new plant, combined with the large-scale extruder, will give the company “a strong competitive base in dry pet-food production”.

The new packing plant is on track to be commissioned in mid-2023.