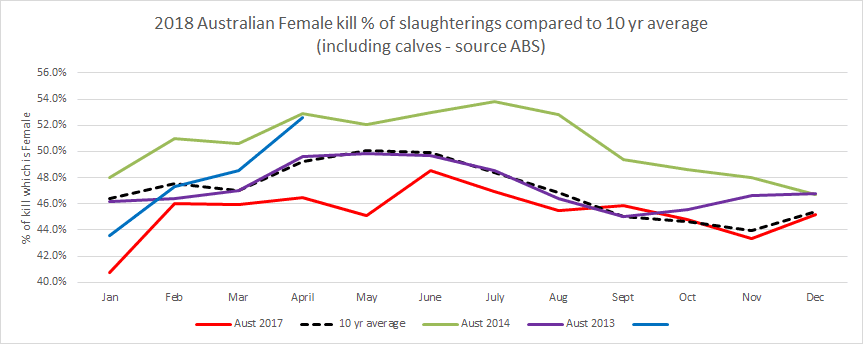

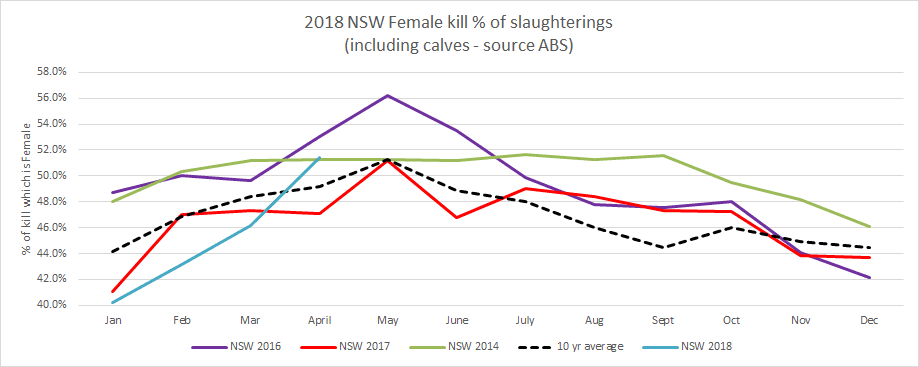

EASTERN Australia’s drought conditions have now reached a critical point, whereby for the first time since 2014, ABS slaughter figures released last week show the female kill reached 52.6 percent of the total adult slaughtering in April.

This, I believe, is stage-one of a potential liquidation process, and is historically a level at which previous drought liquidations have occurred.

The last time Australia reached these liquidation levels was in 2014/15, 2009 and 2003 – all major drought events which saw the Australian cattle herd fall on average by 1.15 million head over the following 12 months.

An important point to note is how long the high female kill lasts. The longer it persists, the bigger the reduction in herd size. In the three drought periods mentioned above, female kills remained above 52.6pc for 2-5 months on each occasion.

What is different with this drought is that should liquidation continue, it will be starting from a low base herd size of only 28.32 million head, and should the current drought resemble previous periods, then a fall in herd size of greater than one million head would be feasible. That outcome would put the herd back to the similar lows of 2016, when the herd size sank to just over 27 million head, but more importantly, also saw record cattle prices in Australia.

Other indirect indicators of drought

There are many other anecdotal indicators in Australia of herd liquidation commencing, such as the current higher slaughterings of pregnant females and the increased volume of foetal blood being collected by processors – both of which are being reported across all three largest beef producing states of Queensland, NSW and Victoria.

Another interesting indicator that I have not measured before has been the falling number of macropods (kangaroos and wallabies) in drought years. Surveys suggest kangaroo numbers fall dramatically during drought due to the biological makeup of the species, and their unique ability to breed when seasonal conditions are right, and switch-off when they are not. These populations are measured through satellite imagery, commercial slaughterings, surveys and even roadside kill counts. In 2017, macropod numbers were measured to be extremely low across several states with QLD and NSW numbers falling by 23pc since 2013. As one farmer put it, “Even the kangaroos know how bad it is.”

Australian exporters in recent months have shown an amazing ability to cope with increased production and exports and highlights the strong ability to export lean beef to new destinations globally, due to current strong global demand.

As stated in previous reports published in this series, I do not believe there will be any ‘fire sale’ of Australian beef as there was in previous droughts. This is best reflected in shipments to the US, which normally go up in drought to 30pc or higher of Australia’s global shipments due to the ability to take large volumes of lean manufacturing meat. In recent months, the reverse has happened, with May shipments producing a fall in US global percentage from 23pc to 21pc –reversing the usual trend and again highlighting the strong demand from other markets and the ability to place lean meat away from the US at premium prices.

In short, if you were to be in drought and have an increase in production and exports, now is the time to do it with strong global prices and demand.

It should be noted that this is only stage-one of the herd liquidation process and with a large rain event on the eastern seaboard, it’s likely that herd rebuilding would recommence very quickly. My thoughts and views in this article are based on ongoing dry conditions that BOM is forecasting over the next 3-5 months. Of particular interest for southern/western regions with mediterranean conditions.

The commencement of herd liquidation in previous years would have raised the alarm bells for both sellers and buyers both within and outside Australia, but I am of the opinion that due to strong global demand and the relatively small size of the Australian herd, that increased exports will be absorbed quickly into an environment of strong global demand and prices. Unlike earlier droughts, there has to date been (and there will not be) no ‘fire sale’ of meat out of Australia for these exact reasons.

Medium to long-term impact

It is the medium to long-term impact of this drought that I am more interested in, and the potential for an Australian herd that could be reduced quickly back to a level of 27 million head by mid to late next year, should these dry conditions prevail.

This low herd size saw record cattle prices in Australia in 2016, and it is not unreasonable to assume that Australian cattle prices could rebound quickly if and when rain occurs after this potential liquidation period.

The fortunes of both the livestock and meat processing sectors is like a roll-a-coaster, and I do not begrudge processors for making money now, because the challenges of 2016 and the financial difficulty in that period for processing could be repeated next year, should rain relief occur.

Equally the current difficulty faced by livestock producers in holding onto livestock now, the high cost of feed and the lower cattle prices being experienced due to high rates of turnoff is truly challenging. In the short-term, it is likely to get worse if the dry prevails, but for those who can ‘hold on’ during this drought event, I believe they will see strong returns when rain comes. Those returns could well be similar to the record high returns experienced in 2016.

The challenge for farmers is in holding on, and for processors to ‘make hay while the sun shines’, as it could be short lived.

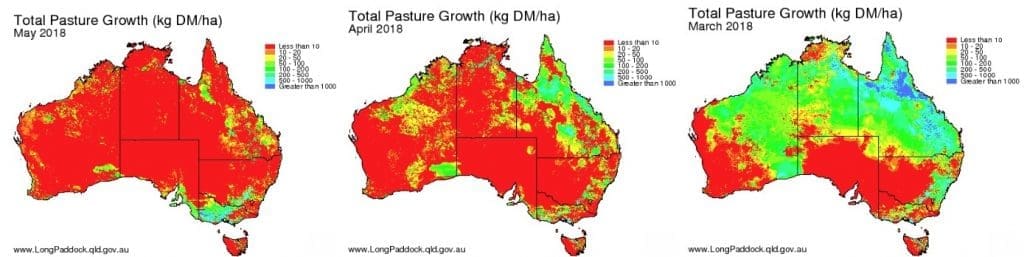

Australian pastures are deteriorating quickly

The following pasture maps (https://www.longpaddock.qld.gov.au/aussiegrass/) tell the story of how quickly the pastures have deteriorated across Australia in recent months, which is reflected in the high female kills and overall slaughterings. Queensland, WA and NT have been the most dramatic in terms of pasture deterioration due to dry conditions. Total standing dry matter (TSDM) is the best measure of pasture deterioration and the map below compares this to the last 60 years of data QLD, NSW and VIC are are all suffering on a long term relative basis. Given this, its ironic to note that the QLD government has reduced its drought declaration in May from 66.27pc of the state being drought declared to 57.4pc, with several coastal regions been taken off the drought register. It has been noted that there there is a lag period in the drought declaration process, and that the entire central QLD and Southern QLD regions still remain drought declared, which are areas heavily populated with cattle.

Australian Female kills are now significant

The following graph highlights to me the changing fortunes of the Australian cattle industry and as stated above, the latest April ABS female kill reinforces the belief that Australia has commenced stage one of herd liquidation. 2017/18 was a transitional year which saw the Australian herd move from a rebuilding stage for the first half of the year, then to a holding pattern, and from March starting to move into early stages of liquidation. ABS’s figure of 52.6pc female kill for April is identical to that of April 2014 drought year.

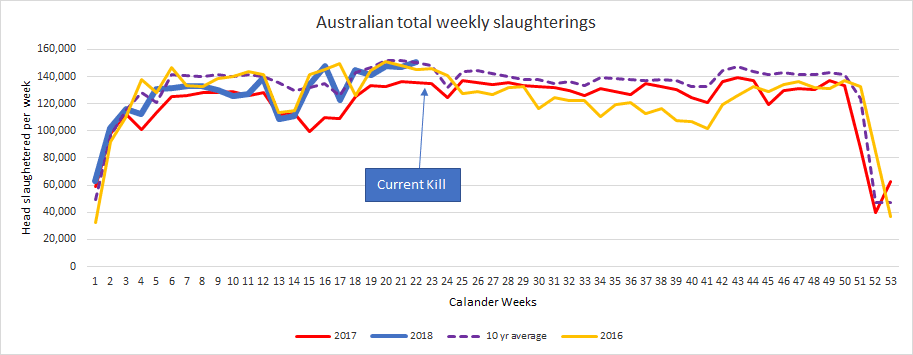

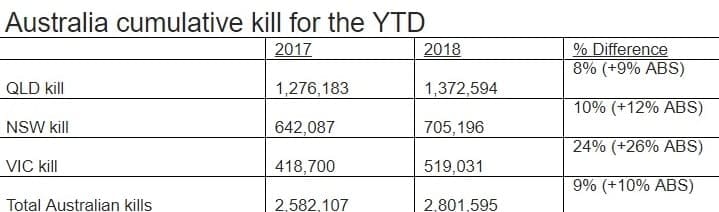

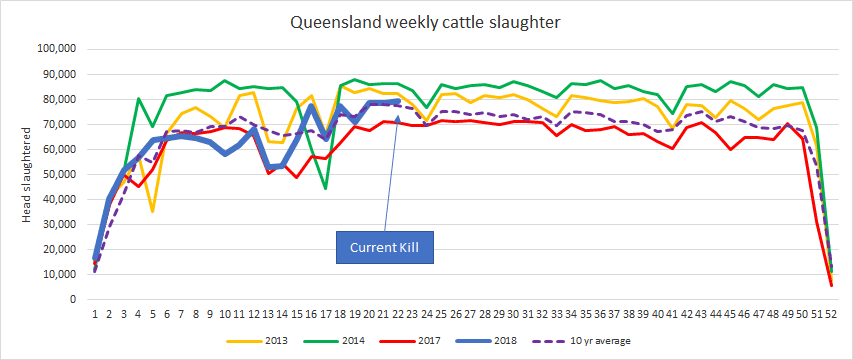

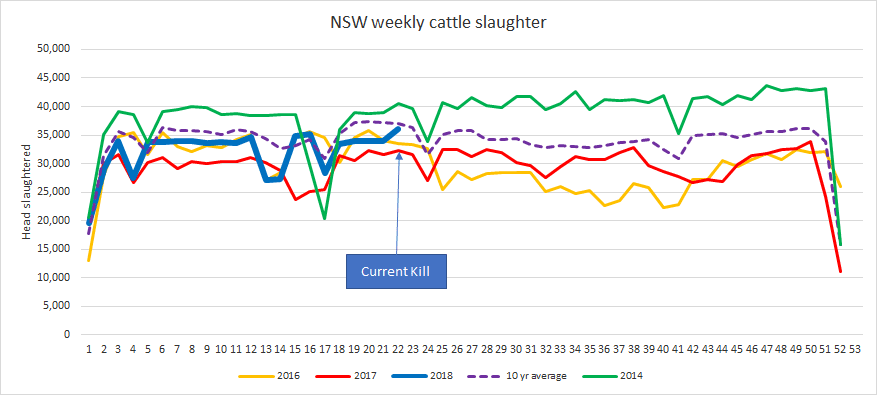

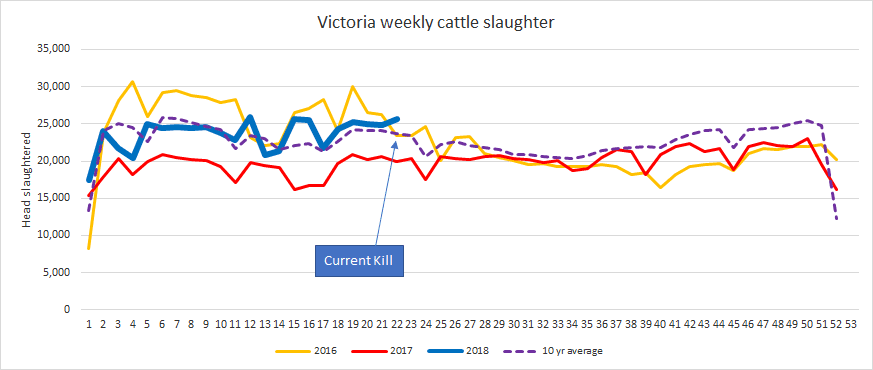

The year to date monthly kills for Australia are 9pc higher than last year, are starting to move above the ten-year average. Note that these MLA weekly kills are estimates only, and normally are below the ABS actual kills recorded so are used more as a guide to slaughter trends. The ABS figures, while carrying some lag, are actuals, and are therefore critical in analysis of liquidation and/or rebuilding of the herd.

ABS kills for Australia in comparison are 10pc higher than last year for Jan-April, with QLD 9pc higher, NSW 12pc higher and VIC 26pc higher year-to-date. That indicates a more severe situation in each state than MLA kill data.

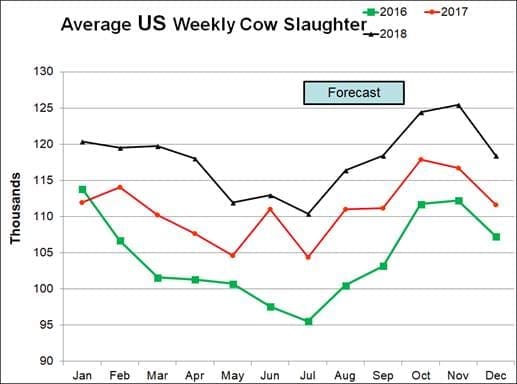

I have revised my forecasts for Australian adult slaughterings in 2018 which are now estimated at 7.65 million head (200,000 head lower than my previous estimate). These are 200,000 head higher than MLA’s latest 2018 projections. I would expect that should the drought remain in play, the average weekly kills will remain well above the ten-year average.

QLD drought/pasture/kill status

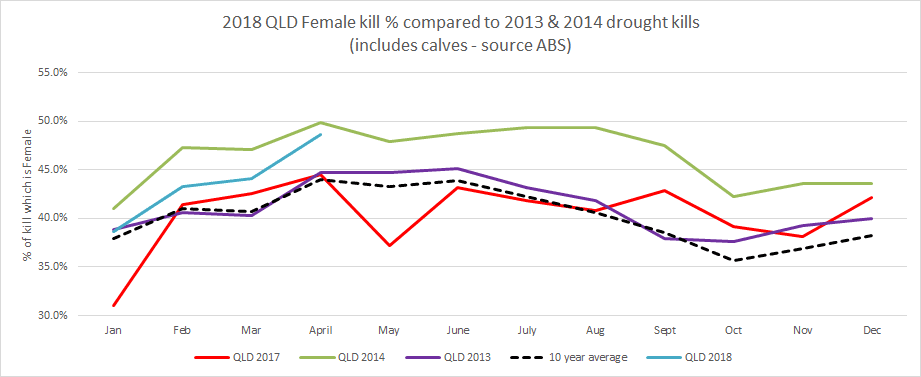

Each state is at a different drought stage in the liquidation cycle. QLD has been experiencing drought conditions for longer than VIC and NSW, but the severity has waxed and waned with reasonable coastal rain and central QLD rains assisting in February and March. But this has changed quickly, with little to no rain in April and May and warm conditions. QLD’s female kill for April is at 48.6pc and looks to be trending higher – this is well above the ten-year average of 44pc. The last time this occurred was back in drought years of 2003 and 2014/15 which saw QLD herd fall 1.068m head and 2.387m head respectively. The pasture maps below highlight how quickly these pasture conditions have changed in the last three months. Total standing dry matter (TSDM) for QLD is showing dry matter is low for the state when comparing 60 years of historic data.

NSW drought/pasture/kill status

NSW is the last state to move into the liquidation stage, which occurred in April which saw the female kill at 51.4pc. Unlike VIC and QLD which have been liquidating for 3-5 months, it is still very early days in NSW. When discussing the current drought conditions with NSW farmers and extension officers, the issue is the lack of subsoil moisture, particularly in Northern and Southern NSW.

Central coastal regions have fared OK but many areas say a good last spring was there saviour. But there was little to no late summer or autumn growth and the unexpected hot autumn saw the ‘feed tap turn off’ in late February/March particularly, in the New England area – with availability of better feed drying up, secondary feed (such as cotton trash and sugar cane tops) is starting to be used due to the lack of quality feed and/or its high cost – all key indicators that the drought is getting worse in many regions. Total standing dry matter (TSDM) for NSW is showing dry matter is low for the state when comparing 60 years of historic data – the coastal regions are in better shape than the western regions and might in part explain why NSW has only just moved into the liquidation stage.

VIC drought/pasture/kill status

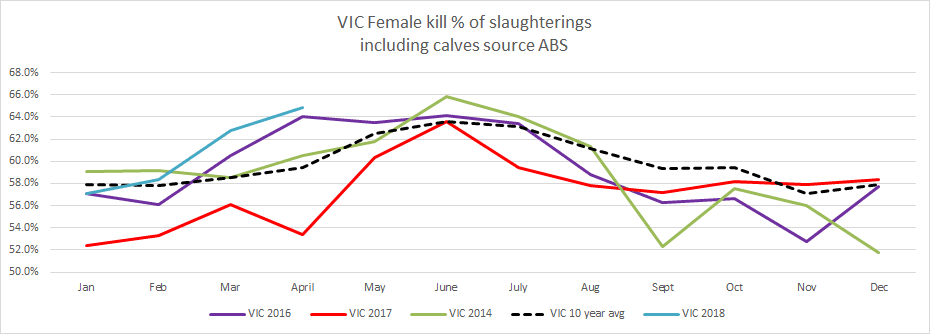

Victoria to me is the state that is potentially the most severe, though its duration has been shorter than Queensland. The severity is reflected in the jump in April’s female kill which is at 64.9pc in Victoria – the last time this was seen was back in 2014, 2008/9 and 2002 – all severe drought years for the state. It should be noted that VIC female kill is distorted by the high dairy cull cow kill which is not differentiated in the ABS kill statistics – but even with this allowed for, the kill is 5.4pc above the ten-year average and is reflecting other drought years. Again it is the lack of subsoil moisture that is the real concern, with local feed experts saying that September and October are the worry months for VIC farmers, as the forecasts are pointing to a below average start to spring and a hotter than normal October which could kill off any pasture growth. Without subsoil moisture feed could be in critical short supply.

Total standing dry matter (TSDM) for VIC is showing dry matter is low for North and East of the state when comparing 60 years of historic data – the recent pasture map does not show the real state of affairs I believe with the TSDM showing how low dry matter is in these ‘green’ regions across the state.

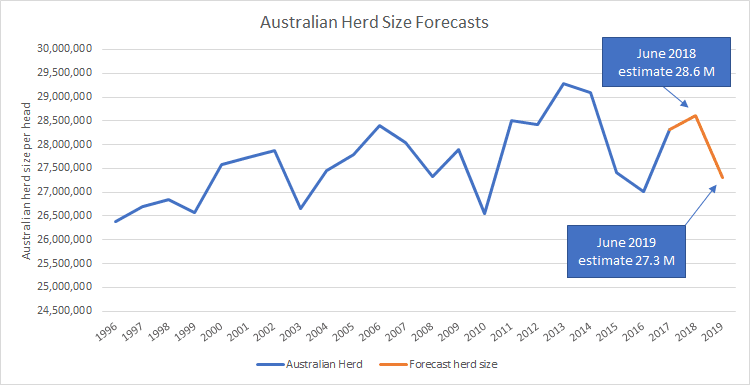

Australian herd size likely to fall next year

Australia’s herd rebuilding had barely got going since the recent low of the herd size in 2016 of 27.01m head (based on the EVAO of $5000) which has jumped by 1.3m head to an estimated 28.32m in 2018 (ABS actuals will be released in Jan 2019) should the severity of this drought continue this herd size, I expect, will fall by about 1.15m back to 27.3m head in 2019/20.

This reduction is based on liquidation levels in 2014/15, 2009 and 2003 – which were all major drought events and saw the Australian cattle herd fall on average by 1.15m head over the following 12 months.

The ramifications of a 27.3m herd are significant if there is drought-breaking rain in 2019 – as global meat prices have improved by 6.4pc since 2016, and with rain, the benefits of strong global prices will likely be passed back to farmers.

Australian beef shipments for 2018

One of the critical indicators in the past of drought has been the impact of leaner cows and steers and the increased production of lean meat from Australia. As touched on briefly above, the US market has been traditionally one of the few destinations for lean meat which saw the percentage of global shipments that went to the US increase to 30pc and higher during drought years.

This phenomenon I believe has changed, whereby global demand is so strong that lean cuts now have a viable destination outside of the US, and has seen the US proportion of global shipments fall to 21pc from 23.5pc of the two previous years – even with drought and leaner animals being processed.

As I have highlighted, in my previous drought update in January – there will be no fire sale of meat from Australia during 2018 and 2019 due to strong global demand and the figures below lay testament to this, as well as the strong global prices we have seen in Q1 this year.

Australia’s YTD shipments to May 2018 were up 15pc compared to last year and this is due to increased YTD kills of 10pc, but this increase has really ramped-up in May, whereby shipments jumped 24pc from April. This, to me, is yet another strong indicator that April was a critical turning-point in stage-one of the herd liquidation phase, with a dramatic increase in production and shipments occurring and points to May females kills being of an equal, if not higher ratio of the kill.

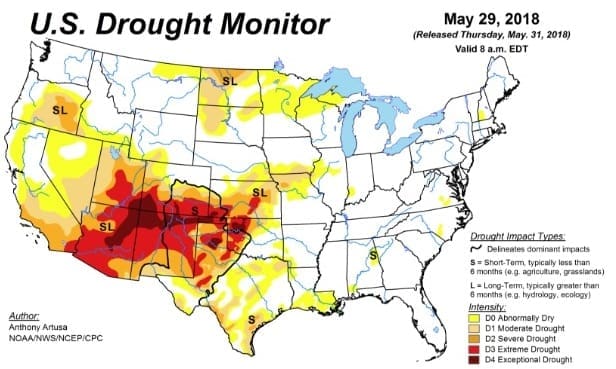

US potential drought conditions

Australia is not the only country where drought may impact on herd size over the next 12 months. The view by many US analysts is that the US herd has stopped expanding and is in a holding pattern and with continued dry conditions, could see some mild liquidation late this year or early next year.

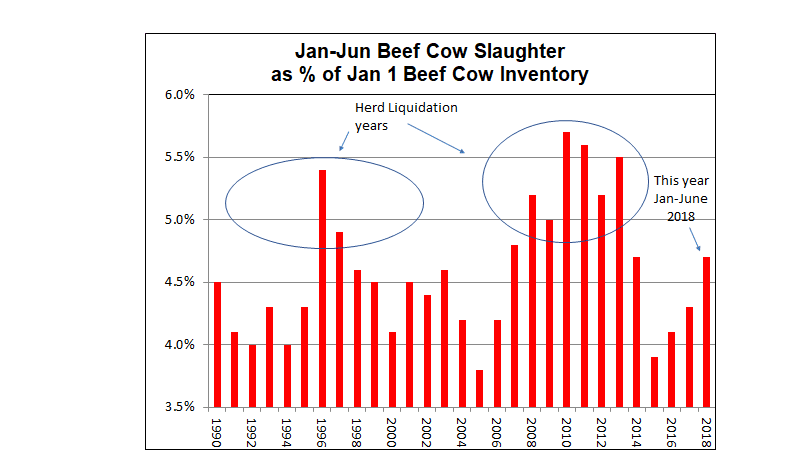

When looking at the January-June period and the percentage female kill to US inventory, the kill has been at 4.7pc against a herd of 94.4m head (a different way of measuring liquidation than Australia). In the past, it has needed to be at 4.9pc or greater for liquidation – this was seen in 1996/97 and 2008-2013.

The US has not reached this stage, but is getting close, and should the drought get worse it will potentially see the herd move from the current stabilised ‘on-hold’ position to liquidation.