IT’S taken at least six months longer than what many had expected, but demand for Australian lean beef trimmings in the United States is now really starting to take off, as US domestic rates of slaughter continue to wilt.

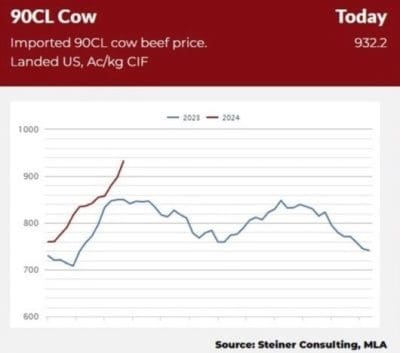

As the graph below lifted from our home page Industry Dashboard shows, the 90CL lean frozen imported trimmings market – the basis for the ever-popular American hamburger – has this week hit A932c/kg CIF.

Apart from a brief spate of panic buying in the US and/or China in early 2022 and again in 2019 when COVID-related issues disrupted supply chains, the latest imported lean cow trimmings price is among the highest in history, when measured in Aussie dollar terms.

This time last month, our lean frozen trimmings exports to the US were making A78c/kg less than today (a 9pc difference), while at the start of the year, prices were A175c/kg or 23pc lower than this week.

The recent price trend is also being underpinned by an Aussie dollar value that’s stayed stubbornly low this year (US65.6c this morning, and in the 64s for long periods in the first quarter).

In US$ terms, the current price rise in not quite as dramatic due to currency factor, but is growing rapidly, nonetheless. Quotes this week suggest imported 90CL is trading around US270c/lb CIF. People in the trade are now talking of the prospect of the price reaching US300c/lb – which has only been seen for brief periods earlier due to COVID distortions.

While the earlier brief COVID-related spikes in demand in 2019 and 2022 saw prices for Australian trim hit US300c/lb, current prices are certainly ‘heading into rarified air, and look likely to go higher,” one trade contact said this morning.

“Aussie beef trim is absolutely flying at the moment, and promises to go even higher as the US beef shortage starts to take full effect,” he said. “There’s fundamentally strong demand coming out of the US, which is being supported, to some extent by reasonable demand out of Japan and Korea.”

There’s not yet any evidence of US imported muscle meat prices following the same trajectory as sharp rises seen in trimmings, but as US beef kills continue to wane, its anticipated that interest in imported muscle cuts will also continue to grow. That’s especially so as cold storage inventory in the US (and across parts of Asia) is now quite low, and entering a rebuilding phase.

“There’s been a few false dawns in this widely-anticipated cycle over the past year, but this time it does appear to be a genuine change in sentiment out of the US, and a genuine uplift in value for Australian meat,” one trade source said.

We’ve reached out to trade sources this morning to try to get a better read on what’s driving the trend.

Clearly, declining beef kills in the US due to the national herd declining to 40-year lows due to drought are starting to have a significant effect, as is the sheer cost of domestically produced US meat.

However there are some other factors at play, Beef Central was told:

Cost of living pressure:

The whole meat-consuming world is struggling under cost of living pressure at present, and when that happens, there is always a natural migration out of higher-value steak cuts to cheaper hamburger beef.

The risky next step in that pattern, however, is that if ground beef prices get too high in the US and elsewhere, consumers elect to drop beef altogether, in favour of chicken or pork.

“If lean imported trimmings in the US get to US300c/lb CIF, I think we will see demand start to stumble,” one trade contact said. “The challenge is, what is the tipping point where prices start turning the consumer away from our product? We don’t know yet.”

“The US has suffered badly from cost of living pressure over the past year – everything from a taxi to a bottle of water has shot up in price.”

Import-domestic spread:

One contact said part of the recent price surge may be due to the fact that the price spread between US domestic trimmings and cheaper imported product had “just gotten too large.”

One theory is that imported trimmings have lost relativity to US domestic this year because of the surge in imported supply out of Brazil, which tends to be cheaper than Australian product, pushing the domestic-export gap wider.

“That’s all speculative – none of us truly know for sure – but certainly domestic beef supply in the US has gotten a lot more expensive as their cow kill has declined this year,” one veteran meat trader said.

“There’s certainly less domestic lean in the system, but it is really subjective whether Brazilian mean has forced the imported beef spread to be greater.”

Aussie kills still reasonably modest

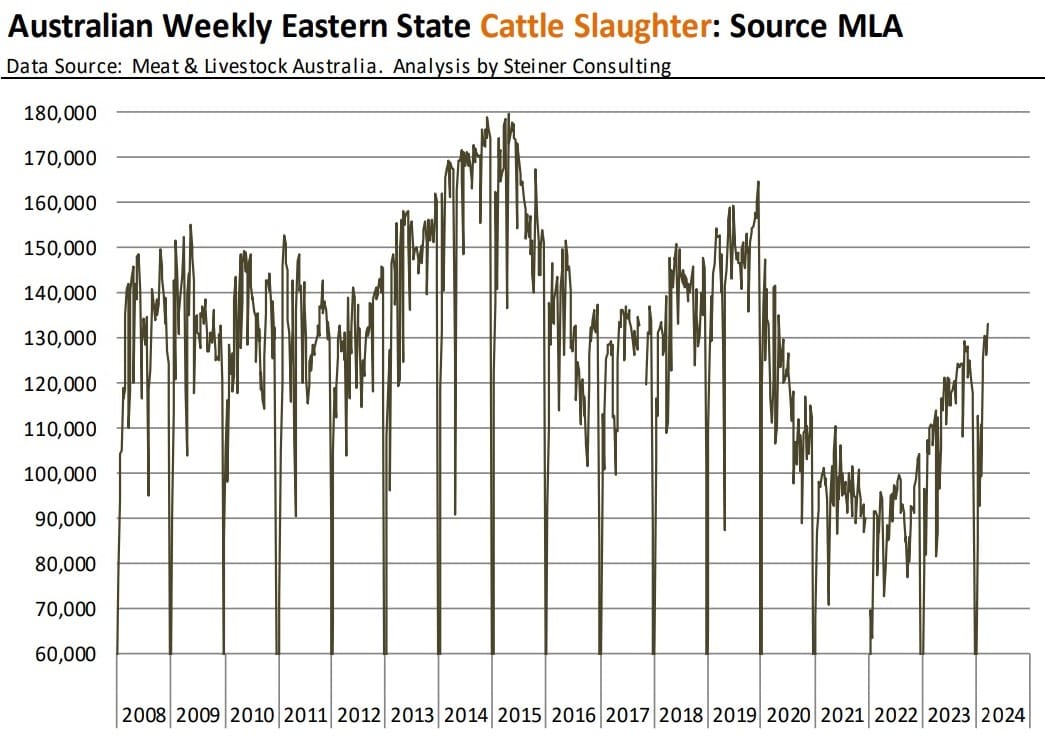

While there has been a recent lift in rates of slaughter in Australia, production volumes (132,000 head last full week before Easter) are still miles away from the heady days of 2014-15 and 2019-20 (see graph) when weekly kills routinely topped 175,000 head a week. That means there is still nowhere near the meat in the system that there was in times past.

“Under these circumstances it’s only natural that if export demand for trimmings is increasing, we are going to see a price increase in the product,” a trade source said.

Cuts diversion likely

With the rapid rise being seen in trimmings values for hamburger production, there’s now expectation that more muscle cuts (especially those harvested from cows) will now go into the grind.

“Once trim prices start to get to these levels, there will certainly be some lower-value lean cuts – like bolar blades, outside flats and potentially knuckles – that will be directed into frozen export trimmings packs,” one trader contact told Beef Central.

“Knuckle prices are holding-up OK at present, but may soften a little heading into winter. Once trim price gets close to whole secondary primals like this, processors (especially those doing a cow kill) will be tempted to push more product into a trimmings pack. It’s already started, in a couple of plants. Either more secondary cuts go into the trimmings carton, or other export customers have to pay a little more, to ‘keep them out’ of the trim pack.”

“One of the key attractions in pushing less desirable primals into trimmings is this takes complexity out of the boning room – especially important when processing labour remains stretched, as it currently is.”

“It means a few more cattle can be processed, with the same number of personnel.”

Brazil’s extra tariff burden into the US

Another source of speculation is that at least some of the current rise in US imported trimmings prices may be due to the recent triggering of Brazil’s US export quota, meaning Brazilian beef for the rest of the year bears a 26pc additional duty. This may be forcing some US importers to push prices higher on Brazilian product, dragging Australian shipments (tariff-free) along with it.

“There’s definitely multiple factors in play here,” one export beef trader said this morning. “I wouldn’t rule that out as among factor in the mix.”

“But what we will never really know is what percentage of US imported beef customers, either food service or retail, are now prepared to use Brazilian beef. It’s very hard to determine – some, like McDonalds and Costco continue to rely exclusively on Aussie or Kiwi imported beef, but certainly an increasing number of US beef customers are now taking Brazilian, as well.”

“And that number will only likely continue to grow, as the price discrepancy between US domestic and imported beef grows. As the US beef kills continue to decline this year, there will be discussions among people in boardrooms that have never previously considered Brazilian beef, who will do so this year and next.”

Female slaughter rising

Likely in response to US trimmings price signals, some Australian processors, especially in the south, have recently lifted direct consignment prices on slaughter cows. One NSW export plant and another in South Australia have this week lifted cow offers by 20c/kg, with one plant this week offering as much as 520c/kg on better cows – just 30c/kg behind the same company’s four-tooth grass export steer offer.

The other part of that is the enormous retention of heifers over the past three years, meaning at some time greater numbers of cull females are going to be offloaded, which appears to be taking place now.

Steiner analysis

Analyst Len Steiner’s latest weekly US imported beef market report (29 March) also contains some interesting reading on recent price trends.

With US domestic lean beef prices continuing to push higher, end-users stayed aggressive with their bids last week for imported product, and prices advanced for much of the week, he reported.

Len Steiner

Based on a price chart plotting domestic US price levels over the past 15 years, Mr Steiner said current domestic US prices might be at record levels, but not yet if adjusted for inflation.

“The previous high registered in 2014 would be the equivalent of $380/cwt today,” he said.

“Could that be the target for domestic fresh prices this time around? Much will depend on slaughter levels this northern hemisphere autumn, availability of fed beef end cuts and overall demand.”

“Still, fears of prices even getting close to those levels have end-users working on maximising the amount of imported frozen product in their formulations,” Mr Steiner said.

Imported discount and lower fat trim…

The spread between domestic US fresh lean beef prices and the price of frozen imported trimmings was currently very close to a year ago, he said.

“Record lean beef values are getting a lot of attention and many are wondering how high is high in that market. But for patty manufacturers and their customers, what really matters is the value of the meatblock. When looked from that angle, current prices are indeed high but still not as high as they were last summer.”

The ‘all domestic’ 75CL meat block made with fresh US domestic 90s and 50s last week showed a price of US$250/cwt, up 10pc from the same week a year ago but still under the high of $256 registered last year.

“What’s helped is that fat trim prices have been running well below year ago levels. Maximising the amount of imported frozen beef in the formulation yields lower prices than last year,” Mr Steiner said.

In the last four weeks, US cow/bull slaughter had reached 486,000 head, 12pc lower than last year.

“Unfortunately the pullback in US slaughter is not an anomaly. The pace of US slaughter in 2021, 2022 and 2023 due to drought was not sustainable. As the culling rate returns to a more normal rate, our expectation was for slaughter in 2024 to be down 13-15pc, year-on-year. So far that projection remains on track.”