A SECOND risk management tool has been added to the hedging options available to the Australian beef industry, following the launch of a Manufacturing Beef Swaps product by Macquarie Group this week.

The new Swaps product, for 65CL and 85CL beef trimmings commonly used for grinding beef, follows the launch in late 2022 of feeder cattle swaps by Stonex.

The new product follows the recent launch of weekly reporting on Australian 65CL and 85CL trimmings prices and an index by commodity reporter, Argus Media.

Stonex said it already had a number of interested parties that would look at using the new beef swap to hedge their risk for product moving overseas, while also using the existing feeder cattle swaps product to hedge against livestock price movements.

Macquarie’s new manufacturing beef swaps product was launched during an Argus export price risk management seminar in Brisbane this week.

One of the challenges in the launch of the new beef swaps product in Australia was the size of the participation pool, a stakeholders told Beef Central.

“It’s a lot smaller than the potential audience of participants for feeder cattle swaps,” he said. “The number of parties engaging in that kind of product out of Australia is quite limited.”

Australian beef still in transition

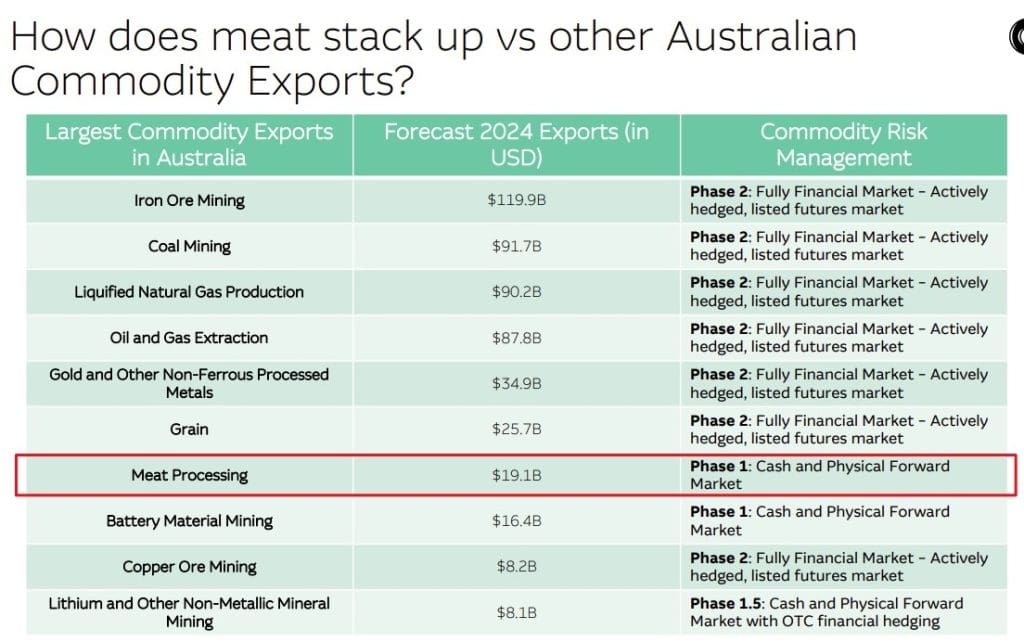

Australian beef clearly still has a long way to go in terms of risk management, as seen in a comparison with other large commodity groups below.

Macquarie Group managing director of commodity markets and finance, Filipe Moscoso told this week’s seminar that the Australian cattle and beef market was still transitioning from a physical spot/cash market to a position with a financial futures contract listed on an exchange, positioning the sector between phases one and two, as shown below.

“I would say the Aussie beef industry is still in phase one,” Mr Moscoso said.

“The majority of business is still a cash spot market with some bilaterally negotiated forward contracts. The next phase that we typically see commodities take is accurate and adopted and price fixings for the underlying commodity – now being delivered via Argus’s Cattle Index and the more recent 65-85CL Beef Index.”

The subsequent steps were a move to OTC financial commodity instruments being traded, and lastly, a futures contract listed on an exchange.

Beef ranks poorly among major export commodities for risk management

In a list of the ten biggest exporting industries in Australia (see table above), the red meat industry ranks poorly for commodity risk management.

“The pool of risk in the beef industry, a $20 billion a year industry is massive,” Mr Moscoso said. “A 20pc up or down price movement represents almost $4 billion that can be added or subtracted from the revenue of the industry.”

“That, for us, screams that the industry needs help.”

Macquarie’s Filipe Moscoso

The Australian meat industry had historically had few tools to manage these risks, he said, but the Argus cattle and meat prices indices offered a first step in the creation and adoption of financial risk management tools, which could be used to protect margins, lower cash flow volatility, enhance customer offerings and open up new markets.

“A robust risk management framework will be essential in the beef industry’s transition from phase one to phase two,” Mr Moscoso said.

So why do players in other industries use commodity price risk management tools?

Mr Moscoso offered five main factors.

- The first was financing. Banks typically liked to see borrowers have adequate protection from market movements, and stable returns. The more stable the returns, they more money they are inclined to lend

- The second was cash flow. Corporates typically wanted to stabilise their cash flow so they could play around with them. Derivatives can change the timing of certain cash flows and exposures through rolling risk from oneend of the curve to the other

- The third was stability, for those with ambitions large enough to get a credit rating

- The fourth was competition. Locking in a good margin could help an entity out-perform competitors.

- The last was flexibility. It’s not having to lock yourself in to one particular client or market. The markets that the Australian beef industry sells into internationally are quite liquid – they move around for a number of reasons. This allows users to forward sell, or at least lock-in certain prices, without wedding them to one client or one market, whuich may change, beyond their control.

“Margins in the beef industry in Australia seem to be quite wild. Imagine what it would have meant to lock in a few of those margins in the last 18 months, versus now,” he said.

“Long-term pricing is advantageous in a consolidating industry, and that’s a trend we are definitely seeing in the Australian beef industry,” Mr Moscoso said. “In 20 years time there will probably be fewer, but larger players, and the ones that adopt price risk management will typically be the ones that not only survive, but can expand.

He said the goal of hedging was not to make or lose money.

“Nobody can predict commodity prices, with any sort of accuracy over time. Instead, hedging is about identifying and stripping-out unwanted risks from ‘wanted’ risks in a business.”:

“However good risk management strategy also allows firms to leverage in-house trading and commodity expertise. There’s probably some of the most experienced commodity traders in Australia, if not the world, in this room.”

“Despite the volatility seen in the beef sector, the Australian industry continued to thrive, which was a testament to each company’s core risk management skills in trading commodities.

“But the advent of derivative price risk management tools simply provide more avenues to express those views, protecting and enhancing opportunities within a business.”