IN CONJUNCTION with analyst Matt Dalgleish from Episode 3, Beef Central this week launches a new quarterly series looking at trends in the beef producer’s share of the retail consumer’s spend on beef products.

A similar analysis was launched and compiled by MLA for some years, but was discontinued back in December 2016. Beef Central sought, and gained MLA’s approval to resurrect the series, based on clear reader interest. The same formula is used to compile the new set of results as originally used by MLA (see explanation at base of page).

Episode 3 and Beef Central will jointly publish a report each quarter, soon after ABS quarterly retail beef price data is released. This typically happens around 4-5 weeks after the quarter ends – ie early August, early November, early February and early May.

The exercise sees national saleyard cattle prices in carcase weight terms being converted into an estimated retail weight equivalent and compared to average retail beef prices, as reported by ABS.

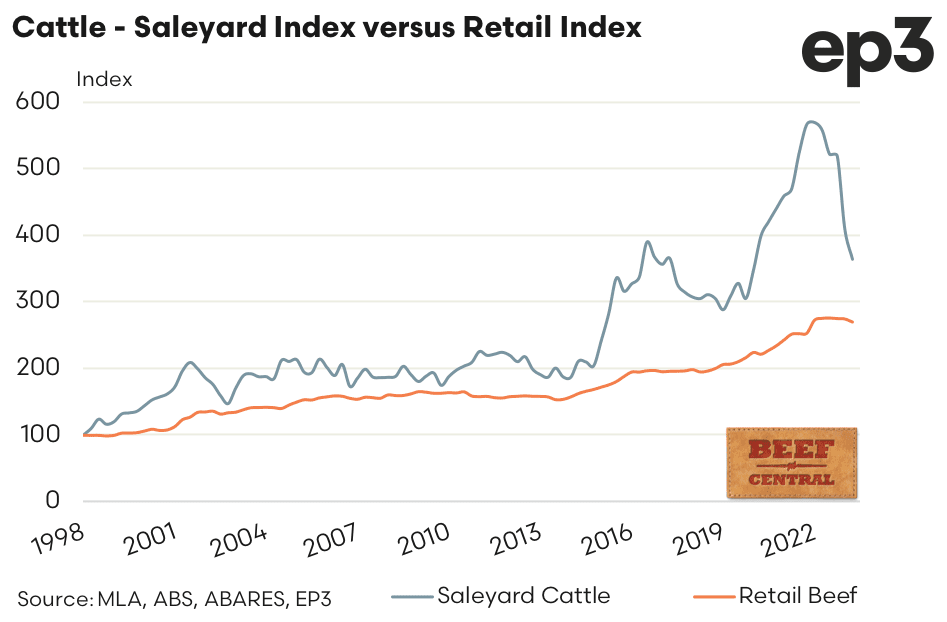

Analysis of the saleyard cattle index versus the retail beef index (see graph above) highlights that since the Q1 2022 peak of 570, the cattle index has slumped 36 percent to 364. In contrast the retail beef index has shaved off just 2pc, easing from 275 in Q3 2022 to 269, presently.

The sharp drop in saleyard cattle prices compared to the marginal price adjustment at the retail level for beef products signals that cattle producer’s share of the retail spend on beef has contracted sharply.

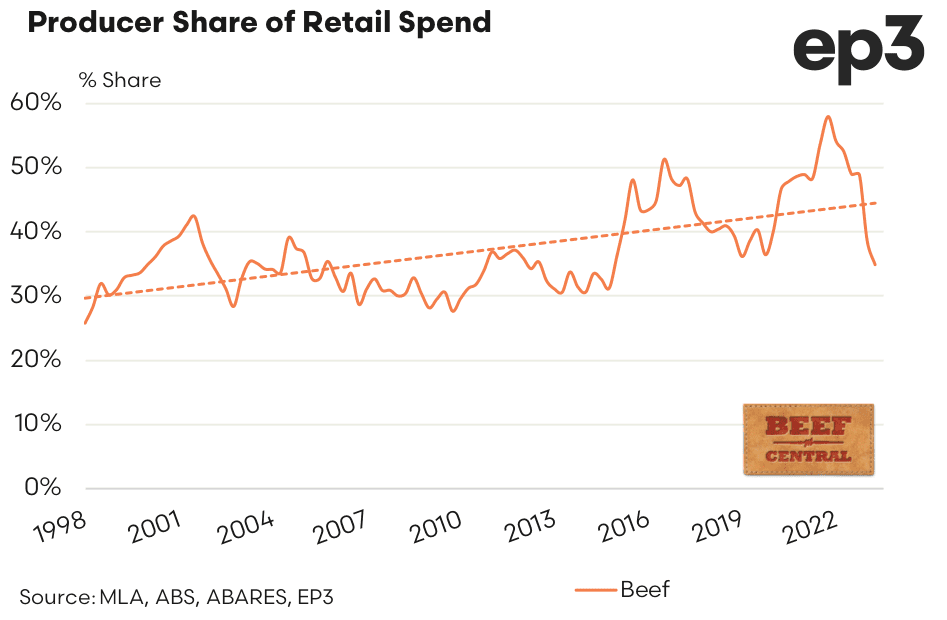

Indeed, producer share of the retail spend for beef has eased from a record peak of 57.9pc in the last quarter of 2021 to sit at 34.9pc as of the June quarter of 2023.

This is the lowest that cattle producers’ share of the retail spend has been since the end of 2014.

An assessment of the longer-term pattern for cattle producers’ share of the retail spend highlights that for much of the 1998-2014 period, the share range from 30pc to 40pc. During this time, the average share was 33.3pc, so it could be suggested that the industry is reverting back to the long-term mean.

However, the trend line since 1998 shows that beef producers’ share has grown from 30pc to around 45pc in more recent years, and from 2015 to 2023 the share has mainly ranged from 35pc to 55pc.

The average share from 2015 to mid-2023 sits at nearly 45pc, so it is understandable why beef producers may be feeling a little ‘dudded’ at present.

About the producer share of retail calculation

The beef producer share of the retail dollar is calculated using a range of assumptions. The national saleyard trade steer indicator is used as the benchmark livestock prices, representing animals suited for the domestic market. Livestock prices are collected by MLA’s NLRS. Converting the carcase weight price to an estimated retail weight equivalent price is achieved using a retail meat yield for beef of 68.7pc.

The indicative retail meat prices are calculated by indexing forward actual average beef prices during each quarter, based on meat subgroup indices of the Consumer Price Index, provided by ABS. These indices are based on average retail prices of selected cuts (weighted by expenditure) in state capitals.

The producer share is calculated by dividing the estimated retail weight equivalent livestock price by the indicative retail price.

Episode 3 (EP3) is an independent, data-driven market analysis service that provides premium insights and reports to the agriculture industry, food manufacturing sector and their associated markets. Through robust analytical assessment, EP3 assists agricultural stakeholders to make better, more informed decisions that drive profitability. The company is experienced in producing high-quality reports used by government, RDC’s and corporate entities. In addition, EP3 is available on a retained basis with clients to provide on-going and bespoke information to assist in their sales or purchasing process. Click here to access the Episode 3 website.

Episode 3 (EP3) is an independent, data-driven market analysis service that provides premium insights and reports to the agriculture industry, food manufacturing sector and their associated markets. Through robust analytical assessment, EP3 assists agricultural stakeholders to make better, more informed decisions that drive profitability. The company is experienced in producing high-quality reports used by government, RDC’s and corporate entities. In addition, EP3 is available on a retained basis with clients to provide on-going and bespoke information to assist in their sales or purchasing process. Click here to access the Episode 3 website.