THE beef producer share of the retail dollar for domestic beef has exceeded 50 percent for the first time since record-keeping started in 1998, latest Meat & Livestock Australia data shows.

Producer share of the retail dollar averaged 51.25pc in the September quarter, as the surge in cattle prices has heavily outpaced any price increase at the domestic retail level.

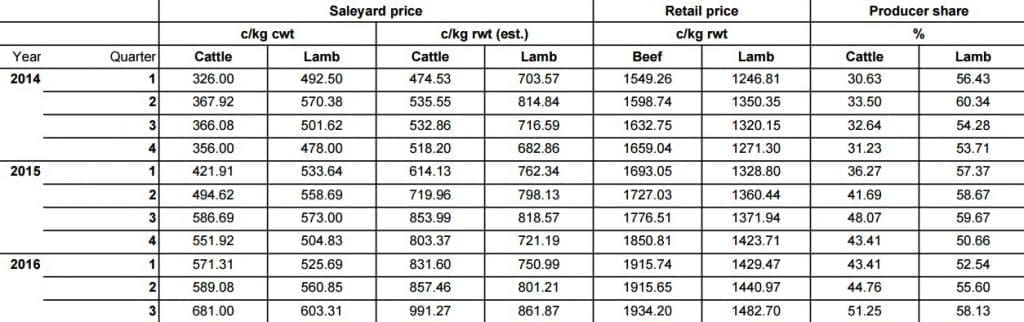

As the table published below shows, the producer share has surged a dramatic 67pc since early 2014, when the figure was just 30.63pc. (Click here to access a larger version).

Over the same two-year period, retail beef prices have increased from $15.49/kg retail weight, to $19.34/kg – a rise of 25pc.

Placing pressure on retail beef has been the record breaking run of cattle prices throughout 2016 – albeit they have eased off since the end of the September quarter. Through saleyards across the country, the national trade steer indicator averaged 681¢/kg carcase weight in the September quarter, up 16pc year-on-year.

It should be noted that while over-the-hook prices did lift over this same period, they did not reach the same peaks as saleyard cattle, which attracted additional support from restocker demand.

After taking a breather in the June quarter, retail beef prices edged higher in the three months ending September, partly due to pressure from record breaking cattle prices.

Cheaper pork, chicken

Calculated using ABS Consumer Price Index data, indicative retail beef prices averaged $19.34/kg retail weight in the September quarter – up 19c/kg on the previous quarter and $1.58/kg above this time last year.

Cheaper pork and chicken prices ($11.86/kg, and $5.30/kg respectively) continue to place competitive pressure on red meat, MLA said in a report issued this afternoon.

So far this year, indicative retail beef and lamb prices have averaged a multiple of 3.6 and 2.7 times the prices of chicken, respectively – above the pre-2016 ten-year average of multiples of 3.0 and 2.4.

How is the producer share of retail calculated?

The beef producer share of the retail dollar is calculated using a range of assumptions. The national saleyard trade steer indicator is used as the benchmark for livestock prices, representing animals suited for the domestic market. Livestock prices are collected by MLA. Converting the carcase weight price to an estimated retail weight equivalent price is achieved using a retail meat yield for beef of 68.7pc.

The indicative retail meat prices are calculated by indexing forward from actual average prices of beef prices during December quarter 1973, based on meat subgroup indices of the Consumer Price Index, provided by the Australian Bureau of Statistics. These indices are based on average retail prices of selected cuts (weighted by expenditure) in state capitals. The retail price calculation has principally been made by ABARES; however, in some instances, the most recent calculation has been made by MLA.

The producer share is calculated by dividing the estimated retail weight equivalent livestock price by the indicative retail price.

Source: MLA