A DRAMATIC contrast has emerged in cattle price trends between Australia and the rest of the beef exporting world, where the impact of coronavirus and the slowdown in demand from China has pushed many livestock prices sharply lower.

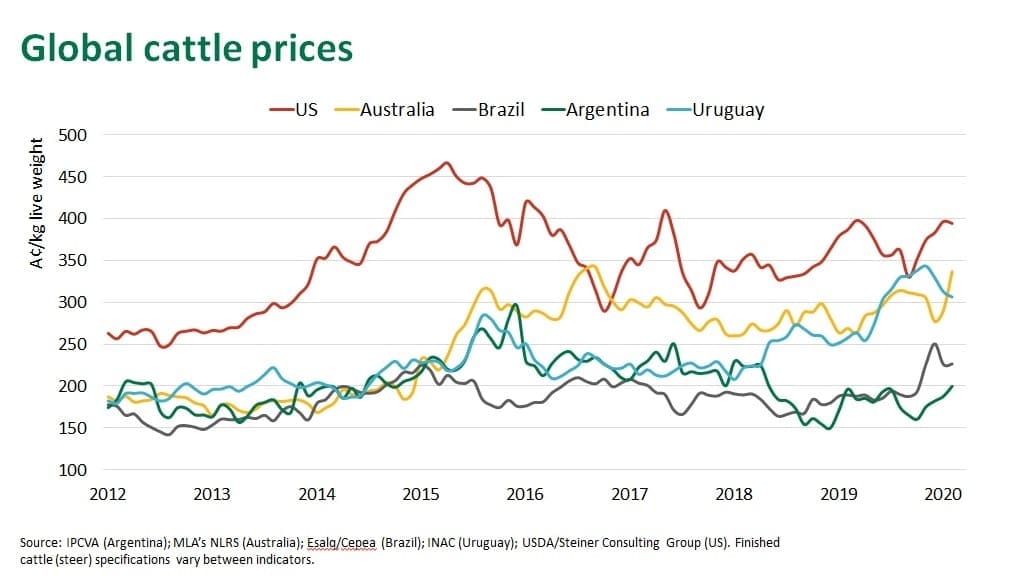

While Australian slaughter cattle prices have surged to dramatic all-time highs over the past two months following rain, in most other major beef export countries, prices have moved sharply in the opposite direction, as can be seen in this graph provided by MLA.

That’s been driven by direct and indirect demand impacts caused by coronavirus, with trade into China slowing dramatically, and buyers in other beef importing countries now wary about the prospect of economic slowdown and poor consumer demand in their own countries, in response to the disease’s spread.

The food service and tourism industries, particularly, are under threat in many regions of the world, and may remain disrupted through the first half of the year. Exporters told Beef Central on Tuesday that flatness in beef demand out of Japan this week, for example, was directly related to coronavirus impact on people movement, and the fact that 50pc of Japan’s overseas tourists normally come from China.

International meat traders now expect a very difficult second quarter for beef trade right across Asia, due primarily to flat demand as consumers choose not to travel, and not to eat out, for fear of catching the virus. Additionally, as economies slow, which they clearly appear to be doing, many consumers will have less discretionary spending on dining out, or buying beef.

These conditions have bought on some quite dramatic changes in cattle prices in North and South America, and to a lesser extent, New Zealand.

Argentina, which now sends about 70pc of its beef exports to the China market, has seen cattle prices fall 15pc in recent weeks. Sales of Argentine beef to China fell almost one-third during January. Brazil’s cattle prices have dropped 10pc since December, hit by declines in Chinese demand.

Coronavirus is also dampening anticipated demand for US meat, with cold storage facilities across the country reported to be filling up with animal protein intended for countries hammered by the epidemic.

US fed cattle futures have dropped 16pc since mid-January on fears of slowing beef demand.

In his monthly column published yesterday, US commentator Steve Kay said the coronavirus-induced collapse meant US cash live prices were down nearly US$5 per cwt from the average of the prior week. Dressed prices were down more than US$5 per cwt. “The cruel irony of the collapse was that it was caused by external forces out of cattle feeders’ control, and came after prices the week before last had at last stabilised after a three-week decline,” he wrote yesterday.

The cattle price trends overseas are now raising questions about how sustainable current record cattle prices in Australia are. Australian price movements since January have defied the meat demand signals overseas, being fuelled almost entirely to this point by the rapid decline in cattle availability after recent rain.

“Our cattle prices are now way out of step with overseas. Something has to give,” one beef trader told Beef Central this morning.

“The international meat market outlook is as bad as we have seen it in years,” a large multi-site, multi-state processor told Beef Central. “Flat demand and low prices has wiped off $400 a head in revenue on our adult cattle, since December,” he said. “We had the benefit of some forward-bought cattle until recently, but have run out of those cattle now and are into some horrible numbers this week. Processor losses are minimum $250 a head on adult cattle – cows or steers – this week, on the spot market.”

All this suggests a big pullback by processors soon, and it might happen sooner than many expect. That may ultimately push grids lower at some point, but processors spoken to for this report said grids ‘could not stay where they are,’ given the international meat market they are currently selling into. Asked what price would reflect a viable ‘breakeven or small loss’ proposition given current meat trade challenges, the processor suggested a northern four-tooth ox needed to retract to 80c/kg to 570-580c/kg, and a cow to 460c. That’s a big drop from 650c and 550c currently being offered.

In its latest weekly imported US beef market report, Steiner Consulting says the imported beef market had been in turmoil the past couple of weeks, and the situation had only became more confused in recent days.

“Panic in equity markets spilled over in physical markets on buyer anxiety about positions currently on the books and extreme uncertainty about future demand,” Steiner said

“On their part, overseas sellers are trying to put on a brave face and the gains in the value of the US$ have, for the moment, help offset some of the lower bids,” it said. “But trying to get people to bid on product remains a challenge.”

The recent developments could not have come at a worse time for New Zealand packers, as seasonal cow slaughter is due to quickly ramp up during March.

Port conditions may be easing in China

Some exporters told Beef Central this week that Chinese buyers are slowly returning to the market, although it was hard to say whether this means simple inquiries or actual firm bids for Apr/May shipments. “Not big volumes, by any stretch of the imagination, but little bits and pieces,” one trader said. “Price expectations are low.”

Reports suggest congestion in some at Chinese ports is slowly subsiding, with the Chinese Government apparently waiving some port charges.

But the world’s largest potential market for beef is clearly shrinking under the strain of cornonavirus. Private surveys indicated China’s manufacturing activity slumped dramatically in February. One index – called the Caixin/Markit Manufacturing Purchasing Manager’s Index – was recorded at 40.3 for February – the lowest figure since the survey was launched in 2004.

“The food service side in China is still diabolical, as is manufacturing, with very few factories properly back to work yet,” one meat trader said. “In contrast, retail remains strong, especially for home-delivery.”

Some prices were back to levels last seen in 2017, because such little volume was moving, he said.

What remained unknown at this time was the level of imported beef demand in China in the second quarter, Steiner’s report this week said.

Much of this would depend on foodservice sales in the next three months. Reports from a number of large food service chains operating in China indicated that sales were down as much as 40pc.

“Will this decline persist if the number of coronavirus cases in the country starts to subside?” Steiner asked. “No-one really knows, but it is clearly a source of anxiety, and this is reflected in the price levels currently in the US imported market. Imported beef values declined between US2-5c/lb across the board last week, on light trading and eroding bid levels.”

While US food service business was strong in January, uncertainly surrounds what trade may be like in coming months, if Coronavirus spreads across the US.

“Early indications are that foodservice business may be significantly impacted should the disease spread throughout the US,” Steiner said. “But it is important to stress that much of what is going on is highly speculative.”

US equity markets dropped at the fastest pace since the financial crisis of 2008, signalling the seriousness of the situation. “But it would be foolish to ignore the signals in the market – fed cattle futures have dropped 16pc since mid-January on fears of slowing demand,” Steiner said.

What lies ahead for cattle prices?

The stark contrast in cattle price trend between Australia and other beef producing nations poses questions about what lies ahead.

“It may take some Australian beef processing plants have to shut down for a period, to take some of the demand-side out of the equation, until the sums start to add up again,” one export trader said this morning.

“It’s happening already, to some extent” he said. “Last week’s eastern states kill was below 120,000 head, which was remarkably low, given what we have recently been through.”

Prices now plateauing

MLA’s senior analyst Adam Cheetham made the point that finished cattle prices in Australia were now showing signs of ‘plateauing,’ after earlier sharp rises.

“There has to come a point where we start to see producers and lotfeeders stacking up what the likely returns will be in two, three orfour months’ time. A lot of that now has to factor-in what’s happening in global meat markets, and especially since the arrival of coronavirus, and its likely impact on global economies,” Mr Cheetham said.

“But certainly while we have seen Australian finished cattle prices continuing to increase, globally, some of the South American and US cattle prices are falling. New Zealand lamb prices are easing this week, and much of it is to do with economic and demand concerns around coronavirus.”

The more exposed some of the supplier countries are to China – Argentina last year sent 70pc of its export beef to China, alone – the greater the likely impact on their livestock prices.

“Nobody realistically knows where all this is going to end up, but meat markets are in a very fluid state,” Mr Cheetham said.