The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is turning its spotlight onto the agricultural banking sector with public hearings in Brisbane this week and more scheduled for Darwin next week.

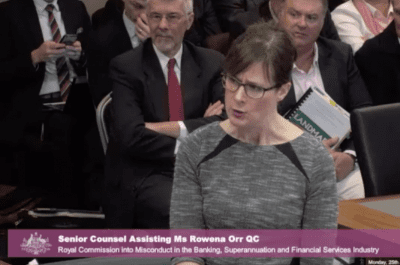

Of the 2892 submissions lodged with the commission Australia wide so far, only 268, related to agricultural finance, Senior Counsel assisting the commission Rosemary Orr said in her opening remarks.

Of the 2892 submissions lodged with the commission Australia wide so far, only 268, related to agricultural finance, Senior Counsel assisting the commission Rosemary Orr said in her opening remarks.

Despite the small percentage of submissions received relating to agriculture, she said the agricultural sector was a significant contributor to the Australian economy, generating $51.5 billion in value in 2016-17, or approximately 15pc of the value of Australia’s merchandise trade.

She noted the sector was particularly sensitive to weather extremes and variations in climate, pest and disease threats, fluctuating global commodity prices and exchange rates, and also regulatory risks, such as the 2011 live cattle export ban – the impact of which would feature in a number of case studies to be examined in detail by the commission this week, she said.

Brisbane was chosen as the location for this week’s hearings because the Queensland cattle industry in particular had a high concentration of consumers affected by the conduct of the agricultural finance and natural disaster insurance sectors, Ms Orr said.

A further round of public hearings into agricultural lending practices will be held in Darwin from Monday to Friday next week.

There had been some controversy leading up to this week’s hearings because very few of the 268 people who lodged submissions related to ag lending practices have been granted leave to appear before the inquiry.

However Commissioner Kennth Hayne QC and Ms Orr both stressed that every submission has been given close consideration, and that the commission will delve into specific case studies this week – five related to agricultural lending and four related to natural disaster insurance.

In her opening remarks Ms Orr said submissions from farmers and rural financial counsellors had raised three key issues about rural banking practices:

- That banks had initiated non-monetary defaults through a revaluation of property or security assets which altered loan to value ratios

“Banks then rely upon these deteriorated loan to value ratios to trigger non-monetary defaults,” Ms Orr said.

“Submissions relating to non-monetary default issues also refer to customers being given unreasonably short time frames to repay substantial proportions of their loans.”

- Farmers having difficulty accessing appropriate banking services and support, because of distance from local branches and difficulties contacting their business manager particularly during times of financial hardship.

Ms Orr said some submissions also highlighted the failure of financial services entities to take into account the cash flow impact of seasonal productivity and drought or other natural disasters on agribusiness ventures when making decisions about calling in loans or acting upon loan defaults.

- Changes in conditions of lending, such as changes to interest rates or access to facilities such as overdrafts or changing other conditions in a way that was unfavourable to the customer.

“A number of submissions referred to modifications in lending conditions as a result of structural or ownership changes to the lending institution, and each of these changes has the potential to result in financial hardship,” Ms Orr said.

Conduct of receivers will not be considered

Submissions had also called for the commission to examine the conduct of receivers.

However, Ms Orr said receivers would not be considered by this inquiry because they were outside its terms of reference.

Insights into rural banking in Australia:

Statistics obtained by the Commission provided some fresh insights into rural banking in Australia:

- There are 84 515 farming businesses in Australia with estimated value of agricultural operations of $40,000 or more;

- Approximately 27pc of Australia’s agriculture, fishing and forestry businesses sought debt or equity finance in 2015-2016, according to August 2017 ABS data;

- Of this, 95pc involved debt finance, and 12pc involved equity finance (the types of financing sought are not mutually exclusive);

- Almost 85pc of debt finance was sought from banks;

- As at June 30 last year total rural debt in Australia was $71.7 billion;

- This was equivalent to around 2.3pc of net loans and advances held as assets by all ADIs (Authorised Deposit-taking Institutions) in Australia;

- The share of rural debt held by banks has increased over the last decade: in 2007, banks’ share of rural debt was 89pc; in 2017, it was 96pc;

- The most common types of new or additional finance in agriculture in 2015-16 were:

- new loans with a term of more than one year 42.5pc

- new capital or finance for hire purchase agreements 34.7pc

- new bank overdrafts 30.3pc

- increases in amount of existing credit facilities or limits 21.7pc, and

- new mortgage loans 17.1pc.

- Primary reasons for seeking finance were:

- business expansion 34pc;

- to maintain short term cash flow or liquidity 32.7pc,

- to replace upgrade or purchase additional non-it equipment or machinery 29.1pc, 28,18pc and 26pc respectively, and

- to ensure survival of the business 25.4pc.

- As at June 30, 2017, broadacre farm debt stood at an average of $616,900 per farm, while dairy farm debt $926,700 per farm;

- There were 49,000 Farm Management Deposit accounts in Australia as at April 30, holding $5.17 billion.

Dispute resolution shortfalls

Ms Orr said small to medium farming enterprises can access assistance for disputes with financial services entities through the Financial Ombudsman.

However, the ombudsman cannot deal with disputes where the value of the claim exceeds $500,000 or the dispute is about debt recovery against a small business in relation to a credit facility of more than $2m.

The amount of compensation the ombudsman can provide is limited to $323,500.

Changes are on the way however: the Financial Ombudsman and Credit Investment Ombudsman are due to be replaced by a new external dispute resolution body, Australian Financial Complaints Authority, from November this year.

ACFA will be able to consider claims of relating credit facilities of up to $5m and will have an expended compensation cap of $1m for small business and $2m for primary producer.

Call for more uniform national Farm Debt Mediation

Currently only three states – NSW, Victoria and Qld – have legislated farm debt mediation schemes in place

SA and WA operate voluntary farm debt mediation schemes.

Farm Debt Mediation is “a structured, negotiation process that involves a neutral and independent mediator assisting a farmer and the creditor to try to reach agreement about current and future debt arrangements”.

The legislated farm debt mediation schemes make it compulsory for banks and other creditors to offer mediation to farmers before taking enforcement action against farm property, which includes the farm itself and farm machinery.

Ms Orr told the commission several financial services entities have told the inquiry they would support a uniform farm debt mediation act either of national application, or at least uniform among those states that presently have mandatory farm debt mediation legislation.

Disclosures and admissions from financial services entities

Ms Orr said 13 financial services entities had made submissions to the commission, providing information on their ag lending operations and in several cases acknowledging cases where “misconduct and conduct falling below community standards and expectations in relation to those customers” had occurred.

Examples of disclosures made by some banks according to Ms Orr included issues such as staff engaging in inappropriate sales practices in an effort to increase incentive payments; over-charging of fees; underpayment of interest on term accounts; verbal approval of loans by managers above their designated lending authority, later resulting in a customer successfully bidding on a property but having their loan application declined; failure to make appropriate inquiries and verifications as to loan serviceability and security values prior to the approval of loans which later became non-performing loans; failure to respond appropriately to claims by a customer that her husband had forged her signature to secure a loan approval; and examples where some staff had amended documents after they had been executed by a customer or had not declared their a conflict of interest in loans to clients with whom they had a commercial arrangement.

Banks also disclosed to the commission the percentage of agricultural clients who currently had one or more loan facilities in default, which typically fell in the range of 1-3pc (more detail below).

In the vast majority of cases where disputes had been referred to the Financial Ombudsman, the ombudsman had found in the banks’ favour.

Further details disclosed by Ms Orr included the number of agricultural clients reported by each bank to the commission:

ANZ: As at 31 March 2018 ANZ told the commission it had 19,577 agricultural clients, a decrease from 26,150 as at end of 2009, with agricultural lending of $9 billion as at June 30, 2017, of which $7.6b was outstanding. As at March 31, 2.24pc of ANZ agricultural clients had one or more facilities in default.

BANKWEST: As at June 2017 Bankwest told the commission it had 3738 agricultural customers of which 1600 were agricultural lending customers. As at June 30, 1.71pc of Bankwest’s agricultural clients were in monetary default and 1.66pc were in non-monetary default.

Bendigo and Adelaide Bank and Rural Bank: Bendigo Bank told the commission it had 2637 agricultural clients and Rural Bank had 8150 agricultural clients. As at March 31 2018 an average of 1.06pc of Bendigo Bank agricultural clients and 3,91pc of Rural Bank agricultural clients had one more facilities in default.

CBA: As at May 27 2018, CBA told the commission it had 25,261 agricultural client relationships and 4999 agricultural lending relationships. Currently approximately 144 of CBAs agricultural clients are in regulatory default.

NAB: As at June 30 2017, NAB told the commission it had 20,997 agricultural clients. In June 2017 in all mainland states and territories, less than 0.5pc of its agricultural borrowers had a loan which was more than 90 days past due. As at June 30 2017 1.06pc of NAB agricultural ciients had one or more facilities in default.

RABOBANK: As at 31 December 2017, Rabobank told the commission it had 33,970 agricultural clients and 21,436 agricultural client groups. Of these, 11,050 agricultural clients and 8750 agricultural client groups had active loans. As at 30 June 2017, 0.69pc of Rabobank agricultural clients had one or more facilities in default.

The hearings continue in Brisbane until Friday.