ABARES’ latest farm performance modelling which predicts hefty falls in farm cash incomes this financial year will not come as news to many, but beyond the self-evident findings are some more positive glimpses for the year ahead as well.

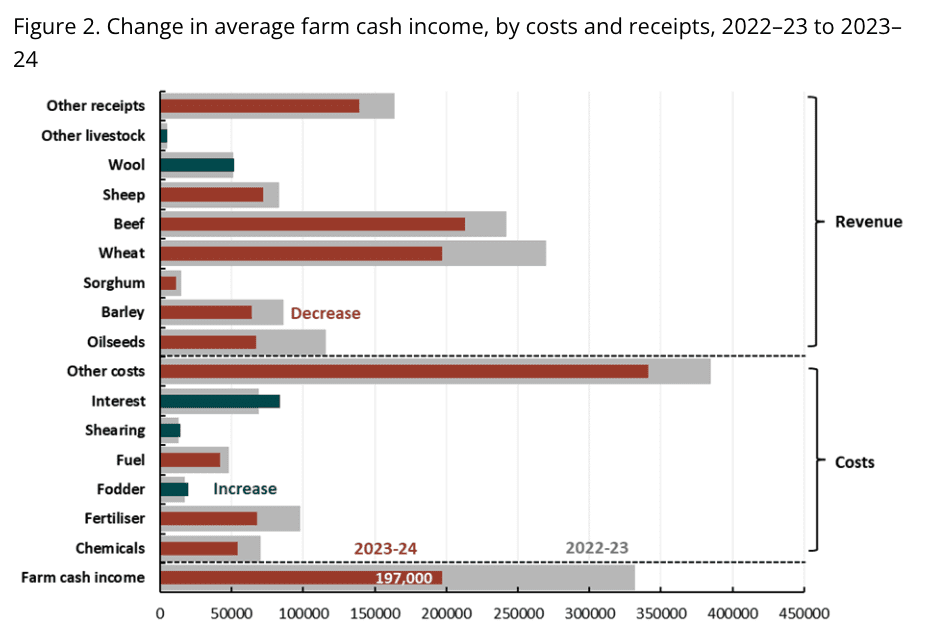

Among them is ABARES’ forecast that a number of major farm inputs costs such as fertiliser, chemicals and fuel are set to fall in 2023-24.

The extent of those cost reductions will not match the overall hit to farm cash incomes from lower commodity prices, but should serve to partially offset some of the expected financial impacts of lower market returns.

The price of many major farm inputs was driven sharply higher in 2021-22 largely due to severe impacts on availability caused by Covid pandemic-related disruptions to supply chains.

Considerably higher fertiliser prices were one of the biggest contributors to higher farm input costs during that period.

However, in 2023–24, fertiliser prices are forecast to ease, ABARES says, contributing to a reduction in farm input costs as supply chains stabilise post-Covid.

However, in 2023–24, fertiliser prices are forecast to ease, ABARES says, contributing to a reduction in farm input costs as supply chains stabilise post-Covid.

Additionally, anticipated drier conditions are projected to lead to reduced use of inputs and consequently lower overall costs.

While total farm costs are forecast to decrease, some input costs will increase, including fodder (due to drier conditions) and interest payments (due to rising interest rates).

Receipts for major crops (wheat, sorghum, barley and oilseeds) are forecast to decrease in 2023–24, primarily due to a decrease in production driven by forecast drier conditions.

After a period of favourable climate conditions, cattle herds have been restocked, and livestock sales are forecast to increase in 2023–24.

However, falling sheep and beef prices are forecast to offset the expected increase in sales and lead to an overall decrease in receipts.

Equity ratio buffer

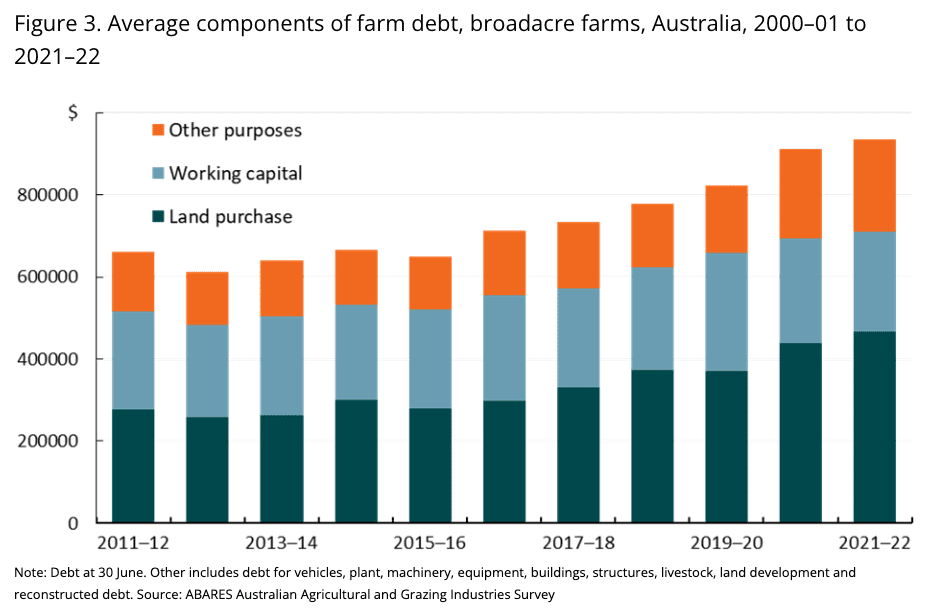

Farm debt has increased substantially in recent years as strong incomes and low interest rates improved debt affordability.

Most of the increase in debt in recent years has been for purchases of land – as the below chart shows:

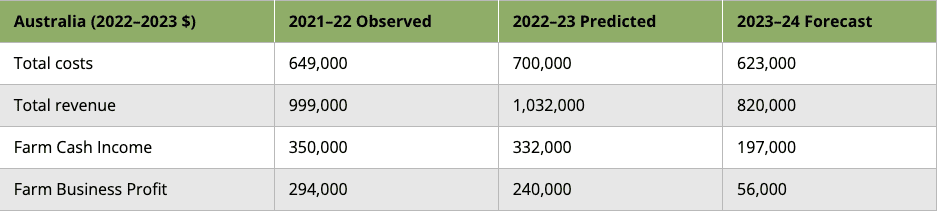

Falls in average farm cash incomes will affect the ability of some farms to service their debt in the year ahead, ABARES notes, with the proportion of income consumed by interest payments is projected to increase to 30 percent in 2023-24 (that compares to just 7pc in 2021-22 and 17pc in 2022-23).

This would be the highest level seen in over a decade, however the impact will vary significantly across farms.

ABARES also points out however that after three years of high incomes many small to medium farms have built up their liquid assets to provide a buffer against short term downturns in income.

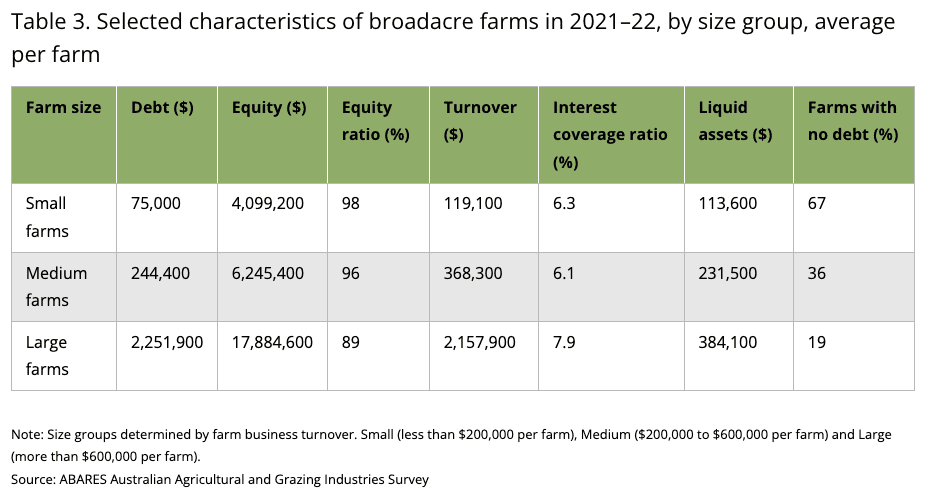

For example, in 2021-22 small and medium sized broadacre farms were, on average, estimated to hold liquid assets in excess of (in the case of small farms) or almost offsetting (medium farms) their debts.

Also, many small to medium sized farms are currently debt free – an estimated 67pc of small broadacre farms held little or no debt in 2021-22, while 36pc of medium sized broadacre farms and 19pc of large farms were also largely debt free – see table below.

Strong increases in land values boosted farm equity ratios of small and medium-sized broadacre farms to historically high 98% and 96% respectively in 2021-22.

In contrast, large broadacre farms (farms with an annual turnover of more than $600,000 per farm in 2021-22) collectively accounted for an around 88pc of total broadacre sector debt in that year.

However, large farms tend to be more profitable than small and medium sized firms, and their debt servicing burden in 2021–22 (8pc) was only marginally higher than that of small and medium sized farms (6.3pc and 6.1pc respectively).

Overall the ABARES farm performance modelling suggests that reduced prices for agricutural commodites and lower crop production will result in average farm cash income for broadacre farms decreasing by 41pc to $197,000 per farm in 2023–24.

The modelling was performed by ABARES as part of the Drought Early Warning System (DEWS) project.

The ABARES farmpredict model is linked to BoM seasonal weather forecasts and related crop and pasture growth estimates.

For more information and latest modelling results visit the ABARES website here