Cow prices have followed a consistent five-year script through winter, but several conflicting factors could result in a departure from normal trends this spring.

Cow prices have followed a consistent five-year script through winter, but several conflicting factors could result in a departure from normal trends this spring.

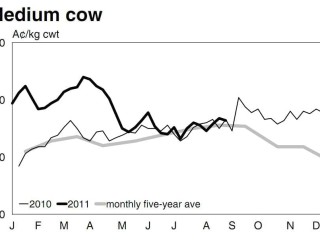

For the past five years the benchmark medium cow indicator has traded within a narrow 260-280c/kg band from June through to August, and prices have followed a similar – if not slightly stronger trend – this year.

However, with spring a lot can change.

Cow prices have typically fallen away after winter over the past five years, a reflection of the drought years that dominated eastern Australia until 18-24 months ago.

Last year however the medium cow price indicator shot up with the arrival of spring as demand for breeders spiked in response to the widespread seasonal improvement.

Breeding cattle have since been in strong demand with older females normally destined for processors retained for an extra year to accelerate herd rebuilding.

A number of conflicting factors are weighing on cow prices as spring approaches, according to market analyst Peter Weeks from Weeks Consulting Services in Sydney.

Mr Weeks said cow prices had been underpinned by the tight global supply/demand balance that currently exists for manufacturing grade beef.

The only factor keeping cow beef prices from record levels was the high Australian dollar, he said.

Upward pressure on manufacturing beef prices was being driven by lower export supplies from Australia, New Zealand and South America, and rising demand from the still strong economies of South America, China, the Middle East, Korea and South East Asia.

Contributing to stronger demand for manufacturing grade beef was a ‘trading down’ to cheaper cuts and take away foods – especially hamburgers – in Japan and, to a lesser extent, the US.

“So demand for cow beef is strong, with prices for 90CL in US$ terms are close to all time record levels,” Mr Weeks said.

“Of course, the good season in the east, despite a dry winter, has also kept cow kills low and restocker demand high for breeding cows.

“The A$ is the main factor offsetting this, and the only factor preventing cow prices in Australia from being at record highs right now.”

While supplies of quality cows to market have been tight, one issue that could effect the supply/demand equation is the potential earlier than usual turnoff of older females that could move from northern Australia back onto domestic markets as a result of the recent live export ban.

An earlier than normal turnoff of older cattle is anticipated from the north as producers look to offload stock to make space for the larger numbers of younger cattle still unsold as a result of the live export suspension.

The majority of this turnoff is expected to make its way to Queensland processors over the next 12 to 18 months, but there are also reports of increasing numbers of cows moving to southern states.

“It has been happening since the live export ban started,” Alice Springs livestock agent Jock McPherson from Territory Rural McPherson said.

“There has been a number of cows from some of the bigger stations coming this way for agistment and then moved onto slaughter in the South Australian and Victorian meatworks.

“And there has been one meat company in particular that has been pretty active.

“A lot of the cows have been older type cows that have been a little bit light, but because of the seasonal conditions here they have moved them here first before going south .”

With lower yardings evident across most NLRS sales last week, a 4-6c improvement was reported in cow prices at several large sales including Dalby, Roma, Dubbo and Wodonga.