BIG losses have again been forecast in Beef Central’s latest 100-day grainfed trading budget calculated this morning.

Record high feeder steer values have overwhelmed a softening ration price, and a lift in finished grainfed cattle forward contract prices to deliver a $164 loss – coincidentally the same figure as our previous budget a month ago.

Results are based on our typical flatback 450kg feeder steer, going on feed today and closing-out after 105 days on feed on 6 February (see our standard set of variables at base of page).

The business of feeding and marketing grainfed cattle is complex enough at the best of times, but the recent COVID-19 environment has brought a suite of new challenges to bear that grainfed stakeholders have not previously contemplated. That’s reflected in some substantial changes in variables since our previous report on 24 September.

Feeder prices enter record territory at 400c

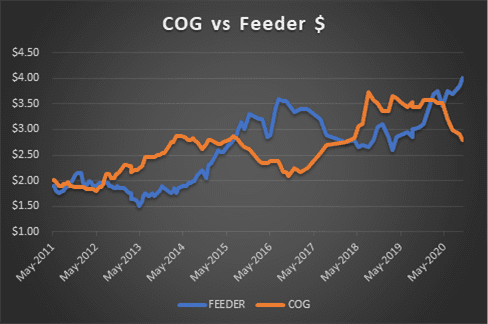

For today’s budget, we have allocated a feeder steer purchase price of 400c/kg a 15c rise from our previous budget this time last month and up 30c/kg since July. That’s a new record high in our trading budget series dating back to Beef Central’s launch in 2011, as can be seen in the blue line in the graph published here.

For today’s budget, we have allocated a feeder steer purchase price of 400c/kg a 15c rise from our previous budget this time last month and up 30c/kg since July. That’s a new record high in our trading budget series dating back to Beef Central’s launch in 2011, as can be seen in the blue line in the graph published here.

This time last year, feeders in our trading budget were making 305c, representing a rise of almost a dollar a kilo since, as young cattle numbers have dried up.

The underlying cause is the desperate shortage of heavy feeders, and young cattle generally this year, after two years of extensive drought across eastern Australia.

The better flatback feeders were making up to 420c/kg at Roma store sale on Tuesday, and there are certainly some bids above 400c for flatback heavy feeders in the market today.

A 400c/kg feeder steer this week values our steer at a whopping $1800, another $68 higher than our previous report a month ago, and $428 a head dearer than this time last year.

Ration price continues to soften

Helping stem some of the bleeding in high feeder value, finished ration prices continue to soften, as the industry heads deeper into new-season grain.

Current representative ration prices in downs feedlots is $380/t, down another $10/t in last month’s exercise. For yards still exposed to grain and other commodities bought earlier, there are still ration prices north of $400/t.

The use of barley versus wheat is also impacting current ration prices, with a big $50-$60/t spread opening up between barley and wheat prices recently. Depending on where each yard’s grain position is, some yards are now moving more heavily into barley, Beef Central was told.

Forecast wet weather over parts of eastern Australia over the next week during harvest could have a bearing on grain values, however, with downgrades a possibility if rain sets in.

Current grain prices ex downs are somewhere around $250/t on barley and bids $300-$305t wheat.

More on the apparent swing to barley-based rations in yards in a separate story in coming days.

Also taking pressure off ration price is new season straw, which is helping offset some very expensive roughage accumulated during the drought cycle.

Worth noting is that the time last year, during the depths of the drought demand for feeding space, our trading budget ration price was $460/t. We were still quoting finished ration prices at $480/t as recently as February this year, and $475/t in May, as the drought cycle ended.

Today’s ration price is the lowest seen since April, 2018. At its low-point around Christmas 2016/17, ration quotes slipped to around $300/t.

Today’s ration price at $380/t delivers a total feeding cost over 105 days of $595, and total production cost (feeder price plus feeding cost) of a near record $2510, up another $53 on last month.

Improved cost of gain

One of the key features worth noting in today’s budget is cost of gain, which continues to improve with the decline in ration prices, as can be seen in the graph at the top of this page. The figure today is calculated at 284c/kg, down another 7c/kg since our previous budget, and almost 60c lower than this time last year. Today’s breakeven is the lowest seen in this series since February 2018.

This trend (see graph) is encouraging some large commercial yards to induct more younger, lighter cattle for 100-day programs, to extract the gain cost advantage. Everybody evidently has a different strategy, but there are clearly more sub-350kg feeders going into 100-day pens at present. This also helps a little with feedlot occupancy levels, while numbers are low.

This trend (see graph) is encouraging some large commercial yards to induct more younger, lighter cattle for 100-day programs, to extract the gain cost advantage. Everybody evidently has a different strategy, but there are clearly more sub-350kg feeders going into 100-day pens at present. This also helps a little with feedlot occupancy levels, while numbers are low.

Anecdotally, commercial feedlots in Queensland and NSW continue to lighten off numbers under the tough trading conditions, which should be reflected in the September quarterly feedlot survey when it is released in mid-November.

All that leaves today’s breakeven figure on our standard beast today at 712c/kg, up from 697c a month ago, and just short of our record of 719c in March. This time last year it was 624c.

In our very first trading budget calculation back in June 2011, the breakeven figure was just 387c/kg. It fell as low as 349c/kg in May 2013 – considerably less than half today’s figure of 712c – just seven years later. Back in May 2013, the forward contract price was 350c, and feeders were worth just 150c/kg, meaning there was modest profit attached.

Finished grainfed steer contract prices rise to 665c/kg

Forward contract prices on 100-day ox offered by competitive Queensland processors for February delivery have lifted recently, due mostly to currency and a little more post-COVID grainfed beef demand.

February often sees the new season slaughter market still establishing a level, but processors will be wary of not providing enough incentive to have grainfed numbers in the pipeline, given the likely meagre overall slaughter cattle supply early next year.

February often sees the new season slaughter market still establishing a level, but processors will be wary of not providing enough incentive to have grainfed numbers in the pipeline, given the likely meagre overall slaughter cattle supply early next year.

For today’s budget we have quoted 665c/kg for forward contract cattle exiting the feedlot early February, a 15c rise on last month, but still behind the recent record high of 680c/kg in June.

Given our breakeven figure of 712c/kg calculated above, today’s forward contract bullock slaughter price represents a loss of $164 on our standard steer gaining at 2kg/day – exactly the same outcome as seen a month ago.

For better performing feeders gaining at 2.2kg/day instead of our standard 2kg/day, the breakeven drops to 690c/kg – still delivering a loss of $89/head.

Current cattle

For 100-day grainfed cattle being processed this week, competitive processors buying requirements on forward contracts back in July were paying 670c/kg. Today the spot market for 100-day grainfed cattle is perhaps 10-20c/kg higher than that at 680-690c, meaning processors are at least $35-$70 a head behind, on forward contract cattle negotiated earlier, for slaughter this week.

Beef Central’s regular 100-day grainfed trading budget scenario is based on a standard set of representative production variables, ex Darling Downs. The trading budget summary is built on a feeder steer 450kg liveweight, fed 105 days; 356kg dressed weight at slaughter; ADG of 2kg; consumption 15kg/day and a NFE ratio of 7.5:1 (as fed); $25 freight; typical implant program. Bank interest is included. It is important to note that variations exist across production models (feed conversion, daily gain, mortality, morbidity, carcase specification); from feedlot to feedlot; and between mobs of cattle. Equally, there can be considerable variation at any given time in ration costs charged by different custom-feed service feedlots. Click here to view an earlier article on this topic. For a more specific performance assessment on a given mob of cattle, contact your preferred custom feeder.