HAS this year’s big plunge in feeder cattle prices created a goldmine for lotfeeders?

The NLRS feeder steer indicator (saleyards-based) has dropped like a stone since the end of July, declining to 211c this week, down 110c or 35pc on where it sat at the end of July, and 224c or 52pc lower than the start of the year.

It would be easy to assume that lotfeeders have done extremely well, as a result.

But profitability on grainfeeding cattle hinges on three key inputs: feeder steer price, cost of feed, and finished grainfed steer price sold to the meatworks.

Often, the three main variables move in different directions, and that’s happening in the current point in the cycle.

Feeder steers at bargain prices

Flatback heavy feeders on the Darling Downs are this week trading at around 230c/kg, with perhaps only a 5-10c premium for Angus.

Back in February, that same 450kg heavy feeder (full description at base of page) was still making 400c/kg, and a year ago (at a peak during October 2022), the market got close to 500c. The all-time record reached around 580-590c in early 2022.

Back in February, that same 450kg heavy feeder (full description at base of page) was still making 400c/kg, and a year ago (at a peak during October 2022), the market got close to 500c. The all-time record reached around 580-590c in early 2022.

Looking deep into Beef Central’s grainfed trading budget records, the last time we could find feeder prices as low as they currently are was in November 2014.

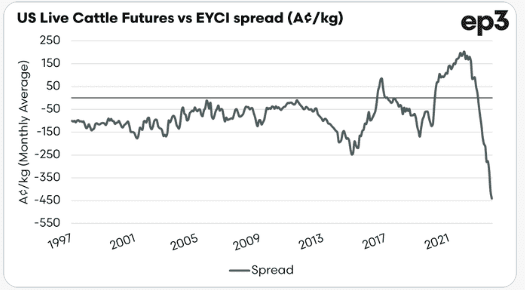

So just how severe is the current feeder price drop? This graph prepared by Matt Dalgleish and our friends at Episode 3 plots the current spread between Australia’s EYCI and US live cattle futures. While there is also a currency exchange rate factor in play, it clearly shows the extent of the current collapse, measured in A$/kg. Even the graph’s previous low-point back in 2014 (minus-250c/kg spread) pales in comparison with the current figure (minus 450c/kg).

Ration prices hit record high

Offsetting any advantage to lotfeeders in cheap feeder steer prices has been the drought-influenced surge in ration costs, impacting a wide range of ration ingredients.

For today’s trading budget discussion, we have pegged a typical downs feedlot finisher ration at $530/t – a record high for this series – compared with $450/t this time last year. The previous record high for ration costs was $500/t, realised during the 2018-19 drought when all commodities were scarce, and pricey.

A year ago, feed grain ex Downs was worth around $330/t, compared with $470-$475/t delivered downs this week. Cottonseed has more than doubled in price in some areas.

This means the cheaper feeder price is being offset somewhat by record-high ration prices.

Cost of gain, breakeven

On the current numbers above, cost-of-gain is 370c/kg, which goes a long way to explaining why sub-optimal weight feeders are currently relatively cheap, with zero financial incentive to feed light cattle over heavier ones. The cattle market clearly shows that less attractive light cattle are being heavily discounted by feeder buyers.

Based on our standard rate of gain of 2kg/day and other variables (see below), it suggests a breakeven figure of 560c/kg on our 100-day steer being indicted this week, and closing-out next February, week three. This time last year, when feeder prices were still red-hot, the breakeven was north of 830c/kg.

Forward contract price signals prove elusive

While the southern Queensland spot market for 100-day grain ox this week is anywhere from 550-620c/kg (depending on the level of processor enthusiasm to secure numbers; some supply chains not quoting this week), forward contract prices on 100-day cattle are harder to pin-down at present.

One large Queensland supply chain offering grainfed forward contracts last month filled its January delivery commitments in ‘ten days’, at around 580c/kg.

The company is not yet quoting on February 2024 delivery, but Beef Central understands from solid sources that 550c/kg is the ‘likely’ starting point. But that figure might trend down from there, we’ve been told.

However the company’s reluctance to do February business at this point suggests it is wary about jumping too soon on future grainfed beef demand and pricing – especially with large numbers of grainfed cattle falling due.

The latest June quarter national cattle on feed survey showed a number of 1.256 million head on feed, the second highest on record. With the onset of extreme dry conditions, it’s only likely that numbers on feed have grown since then, some stakeholders suggest.

With the exception of the US market where some positive beef demand signs are emerging, the other ‘big three’ grainfed beef customers (Japan, Korea, China) remain very flat, due to economic conditions, beef stockpiles and rising cost of living.

Forward contract prices for fed cattle have not been this low since 2019. In comparison, this time last year, Queensland forward contracts on 100-day ox were in the 820-850c/kg range.

If a February 2024 forward contract at 550c/kg does eventuate, as described above, it represents a 35pc slide in price over 12 months; but if February’s forward contract falls to 520c, as some anticipate, the drop in value is closer to 40pc.

Give the above calculations, a forward contract price of 550c/kg for a February 2024 close-out steer produces a 10c/kg trading loss for the owner, worth around $35/head on our typical 356kg steer carcase. If the forward contract carcase price falls to 520c, as described above, the loss grows to $106 a head.

Clearly, while the feeder steer price has come back a long way this year, the ability to buy them, feed them and sell them while generating a reasonable margin is not there.

Better performers

For better-performing 100-day cattle producing feedlot weightgain at 2.2kg/day, instead of our standard 2kg/day, the numbers look a little better.

The additional weightgain performance pushes the breakeven value lower, to 540c/kg. That suggests a profit of $35/head on a 550c/kg February forward contract, and $71 on a 520c/kg contract.

It’s also worth pointing out that many lotfeeders still have a lot of ‘dear’ cattle around them, bought 100-150 days ago at much higher prices, that are now having to be sold into flatter and flatter meat markets as the year has progressed.

- For grainfed industry stakeholders attending the BeefWorks conference in Tamworth and Killara tonight and tomorrow, keep an eye out for the Beef Central team in attendance – James Nason and Eric Barker.

Beef Central’s 100-day grainfed trading budget calculation is based on a standard set of representative production variables, ex Darling Downs. The trading budget should not be interpreted as a comment on the viability of the lotfeeding sector – it is simply a gauge of the viability of the exercise of a buying feeder steers, sending them to a feedlot for custom-feeding, and then selling them at the expected grid price at an abattoir. The opportunity costs of the exercise are often missed by producers. The trading budget summary is built on a feeder steer 450kg liveweight, fed 105 days; 356kg dressed weight at slaughter; ADG of 2kg; consumption 15kg/day and a NFE ratio of 7.5:1 (as fed); $25 freight; typical implant program. Bank interest is included.