A CONSIDERABLE easing in buy-price for feeder steers used as part of our regular 100-day grainfed trading budget formula has failed to stem the bleeding in results produced from our latest calculation performed this morning.

A CONSIDERABLE easing in buy-price for feeder steers used as part of our regular 100-day grainfed trading budget formula has failed to stem the bleeding in results produced from our latest calculation performed this morning.

While outcomes have improved a little in our forecast for a typical 450kg feeder steer entering a typical Darling Downs feedlot today, and closing out after 105 days on March 30 next year, the outcome remains well into the red, at -$73 a head.

Our previous budget compiled on October 19 forecast a loss of $75 on the trade, which followed back-to-back losses of $114 forecast in August and September.

There’s been movement in several variables which has softened the result just marginally in today’s calculation.

Feeder steer price eases 15c

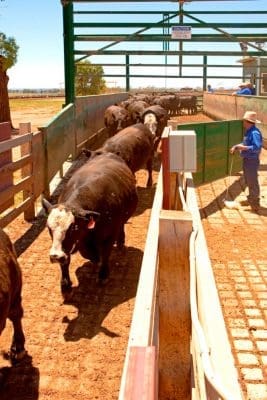

Feeder steer pricing applied in today’s report eases 15c/kg to 335c/kg liveweight, with typical cattle meeting our spec 450kg flatback trading this week anywhere from 330c to 340c/kg in the market. There was a modest increase in flow of cattle since our last report, with changing seasonal conditions, a few oats cattle moving, and a consequent reduction in both slaughter and feeder grids.

The very patchy start to summer, hot weather and uncertain outlook heading into January-February hasn’t helped. It’s somewhat surprising how quickly the seasonal outlook has changed: from ‘solid’ only a month or six weeks ago to ‘uncertain’, at best, in today’s language.

At their high-point in our reports this year, feeders ‘officially’ got as high as 360c, but during periods between trading budget reports, rose to as high as 370-375c for periods during August.

Lighter cattle are still very popular with lotfeeders due to cost-of-gain advantage (see references below), with the better light cattle still commanding a 30-40c/kg premium over our ‘stock standard model’ used for the budget. Certainly there is still strong competition for those lighter cattle down to the low 300s from both lotfeeders and some restockers. True restocker/weaner type cattle are still commanding a good 10-20 percent premium over the heavy feeders described here.

Given that lotfeeders are now heading into a period of limited cattle supply over the next month or so, much will now depend on where the summer season goes.

One would assume – given the way the market has been reacting over the past 12 months – that the strong appetite to compete for cattle remains, and if seasonal conditions do improve, we could well see a price increase again – possibly back to levels seen only seven weeks or so ago of 350c/kg or better.

The resilience of the restocker is not be under-estimated, it seems, because while feeder prices have definitely come back, the restocker cattle at the better end continue to sell north of 400c/kg. There does appear to be solid competition continuing for those cattle, despite the drying conditions, on the back of industry optimism and tight cattle supply.

On the flipside, if it stays dry (SOI in early December was hanging in the balance just below 0, and BOM has now officially cancelled its call on La Nina), it would appear that feeder prices may stay in a band higher than what the industry has seen traditionally – but just not as high as earlier this year.

One factor to consider is that there are now a lot more empty pens in feedlots across eastern Australia, and as the market drifts back, some of those yard managers may become more aggressive in their buying strategies, while others that dropped out of the market altogether may return, given drier conditions.

The reference to empty pens may also colour thinking in terms of feeding lighter weights, as pen occupancy becomes less of a consideration.

All in all, 2016 has been a difficult year to grainfeed cattle in Australia. Coming of an unbelievably strong 2015 year, some feeders appear to have changed their attitude, and became increasingly willing to tolerate empty pens as the year ended. As more recent quarterly surveys have shown, spec cattle have tended to drop off, with many yards retracting back to core program-business only.

December quarter survey results, when they are released on mid-February, are likely to reflect that, unless dry weather interjects.

Pricing today’s feeder steer at 335c/kg values him at $1507, back from around $1440 this time last year. Our previous report seven weeks ago valued the same steer at 1575.

Ration price rises to $300/t

On the strength of recent grain price movements, we have lifted ration price $20/tonne in today’s budget to $300/t.

The grain market has clearly rebounded from the low harvest pressure-point, and depending on where feedlots are in terms of their grain position, ration asking prices have generally lifted, with $300 common in competitive downs yards. Selling out of the paddock during harvest often delivers a more aggressive sale-point, but once it goes into the silo, the urgency to sell is not so great, and that’s reflected in today’s pricing.

Today’s ration price is still still one of the lower ration costs we have quoted since early 2013. In July last year, for example, ration price hits its peak of $385/t.

The $300/t ration price in today’s budget delivers a total feeding cost of $470, up $32 since our previous October report.

Cost of gain has lifted a little in response to the ration price movement, rising to 224c/kg – but it remains extremely attractive compared with the purchase price of feeder cattle, and clearly explains why some yards are happy to induct lighter feeders. In our previous budget, COG was even more attractive, at just 213c/kg.

Total production cost in today’s budget was $2084, down from $2122 last time.

Breakeven moves lower to 591c

The variables described above deliver a breakeven figure in today’s budget of 591c/kg. While that’s marginally better than our previous October report (600c), it still reflects very tough lotfeeding conditions.

Grainfed forward price grids from large grainfed processors this week for delivery in late March next year have dropped 10c/kg to 570c/kg. That means that today’s trading budget delivers a loss on our current proposition of $73 a head – just a $2 improvement on the previous calculation.

That forward price perhaps reflects just how over-valued Australian beef has been on global markets during 2016, especially in the face of abundant, cheaper supply out of the US and Brazil. Currency has not helped in the competitiveness stakes, and it was clearly reflected in yesterday’s summary of November beef exports.

Recent slaughter price easing has definitely improved the weekly trading positions for export processors, but it’s still some way from returning to positive margins, Beef Central is told.

Globally, Australian beef is arguably still more over-valued than it has ever been, in comparisons with other suppliers. In the US, for example, fed cattle prices are now at ten-year lows, as cattle herd numbers have recovered.

Australia can continue to argue that near-record high cattle prices are justified, given 20-year lows in herd size. But given our 74pc exposure to export markets, we still must remain competitive with alternative suppliers. The only other alternatives to re-balance the equation are a major depreciation in the currency (unlikely, it seems), or a sharp rise in export meat prices (equally unlikely, given supply and conditions out of North and South America).

Spot market comparisons

Looking at 100-day grainfed cattle heading for slaughter this week, that went onto feed in late August, forward contracts written on those cattle were priced around 580c/kg.

There’s a big range evident in spot price grid offers on 100-day cattle for southeast Queensland slaughter for this week and next, although that’s not unusual at this late stage of the year. Current grainfed processor offers range from 565c all the way through to close to 600c, depending on the cattle and earlier commitments.

That suggests that depending on where they are headed, cattle being killed this week on contract positions are perhaps 30c/kg ($106) ahead, to line-ball, with spot market purchases at present, for the processor.

- Beef Central closes for its traditional Christmas/New Year break on Friday, December 16. Our first grainfed trading budget for the 2017year will appear after our return week commencing January 9.

Beef Central’s regular 100-day grainfed breakeven scenario is based on a standard set of representative production variables, ex Darling Downs. It is built on a feeder steer of 450kg liveweight, fed 105 days; 356kg dressed weight at slaughter; ADG of 2kg; consumption 15kg/day and a NFE ratio of 7.5:1 (as fed); $25 freight; typical implant program. Bank interest is included. It is important to note that variations exist across production models (feed conversion, daily gain, mortality, morbidity, carcase specification); from feedlot to feedlot; and between mobs of cattle. Equally, there can be considerable variation at any given time in ration costs charged by different custom-feed service feedlots. Click here to view an earlier article on this topic. For a more specific performance assessment on a given mob of cattle, consult with your preferred custom feeder.