![]() To read Bahasa Indonesia version of this article click here

To read Bahasa Indonesia version of this article click here

Key Points

- October imports still having strong negative impact on Indonesian market.

- The Philippines slaughter cattle prices continue their meteoric rise.

- Northern Territory feeder prices collapse as wet season fails.

Indonesia: Slaughter Steers AUD $3.90/kg live weight (Rp10,000 = $1AUD)

Overweight cattle from October 2018 imports continue to push the market lower as buyers resist low yielding slaughter animals and importers reduce their rates even further to encourage sales.

The indicator rate for February is Rp39,000 down Rp500 from last month. A further frustrating consequence of this slow output is that imports from subsequent months are now stuck in the queue behind the remaining October cattle with November imports (46,000) likely to also trending overweight by the time they finally reach the abattoir.

Forecasts for March suggest prices will move even lower although this is likely to represent the bottom of the cycle as the October imports should have all been slaughtered by the end of this month.

Official import numbers are now available for January with a little over 40,000 entering the feedlots. Unofficial figures for February indicate that despite the major disruption associated with the Townsville and western Queensland flooding, total imports for February are likely to be close to 40,000.

This relatively high number, considering the difficult weather conditions is good news for importers and Indonesian consumers as these cattle will form the basis of the feedlot output for the peak demand period of Ramadan and Lebaran (4th May – 10th June).

Given that imports during March onwards will be leaving the feedlots during the traditionally low demand post-Lebaran period, it seems likely that importers will keep their monthly volumes in the 30,000 to 45,000 range as the memory of excessive monthly imports last year are still fresh in their minds.

The signing of the Indonesia-Australia Comprehensive Economic Partnership Agreement (I-A CEPA) on the 4th of March is generally good news for the future of the industry with the elimination of the 5 percent tariff most welcome. Unfortunately, importers businesses are so far into the red that a 5 percent life-line probably doesn’t appear a lot to cheer about knowing that sale prices are fixed by the government.

As of the 8th of March, the rates for feeder steers delivered Darwin had crashed to around AUD$3 per kg live weight, representing a greater than 10 percent fall during late February as a direct result of the failure of the Northern Territory wet season.

In the short term, the northern Australian cattle industry is in very bad shape with massive losses of cattle and infrastructure from the north Queensland floods now combined with the Northern Territory staring at a possible annual wet season failure for the majority of the cattle breeding areas. Feeder cattle are already being presented to the market in large numbers at cheap rates with buyers hard to find at any price. Industry observers suggest that the current situation represents the worst widespread seasonal failure in living memory.

I was late (11am) visiting this market in Yogyakarta earlier in February so there were only a few stalls still open. Prices were the same as elsewhere in Indonesia, Rp130,000 for the best cuts, Rp110,000 for lesser cuts and Rp60,000 for skin including the face.

Vietnam: Slaughter Steers AUD $4.36 / kg (VND16,500 to $1AUD)

Prices remain firm despite the end of the Tet festival with feedlots back down to about 70 percent capacity. 500kg Steers in the south are bringing Dong 68-70,000 while similar cattle in the north attract D71-76,000. Bulls in the south are D73 to 74,000 while those in the north bring D73-76,000. I have kept the indicator rate steady at Dong72,000. ASF has recently been officially reported in a number of sites in Vietnam. This disease has the potential to create havoc in the local pig production industry as it has already done in neighbouring China.

Sorry about the quality of this photo but I thought the content was very interesting. This Vinmart, Ho Chi Minh City Supermarket product, slaughtered by Vissan, is labelled with “theo tieu chuan ESCAS” which translates to “according to the ESCAS standard”, something I have never seen on a label before. The knuckle on the left is selling for Dong302,000 or AUD$18.30 per kg.

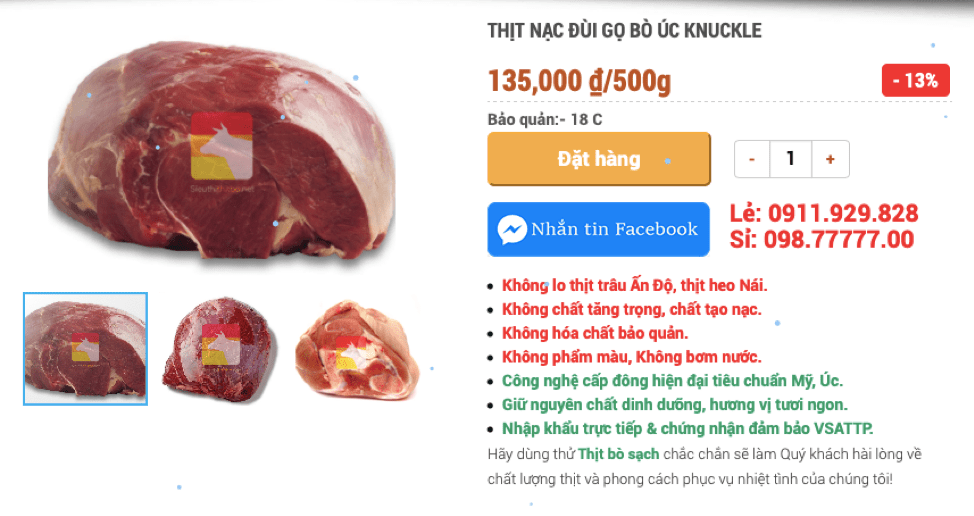

Vietnamese are very strong on internet beef sales and certainly make an impressive presentation with lots of discounts to attract buyers.

Knuckle selling at discount prices on the internet – Dong 270,000 per kg. See one of the many websites below.

http://www.sieuthithitbo.net/thit-bo-uc/nac-dui-go-bo-uc-knuckle

China: Slaughter Cattle AUD $5.56 / kg (RMB 4.80 = AUD$)

Slaughter rates in RMB remain relatively stable with currency fluctuations creating the majority of the AUD price increase noted above. African Swine Fever (AFS) continues to be a huge factor in the Chinese red meat industry with the full impact yet to be reflected in the pig supply chain.

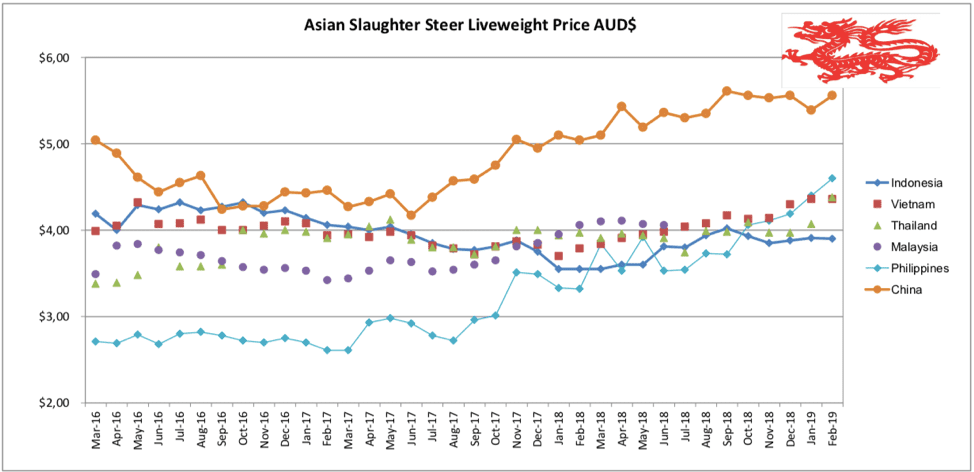

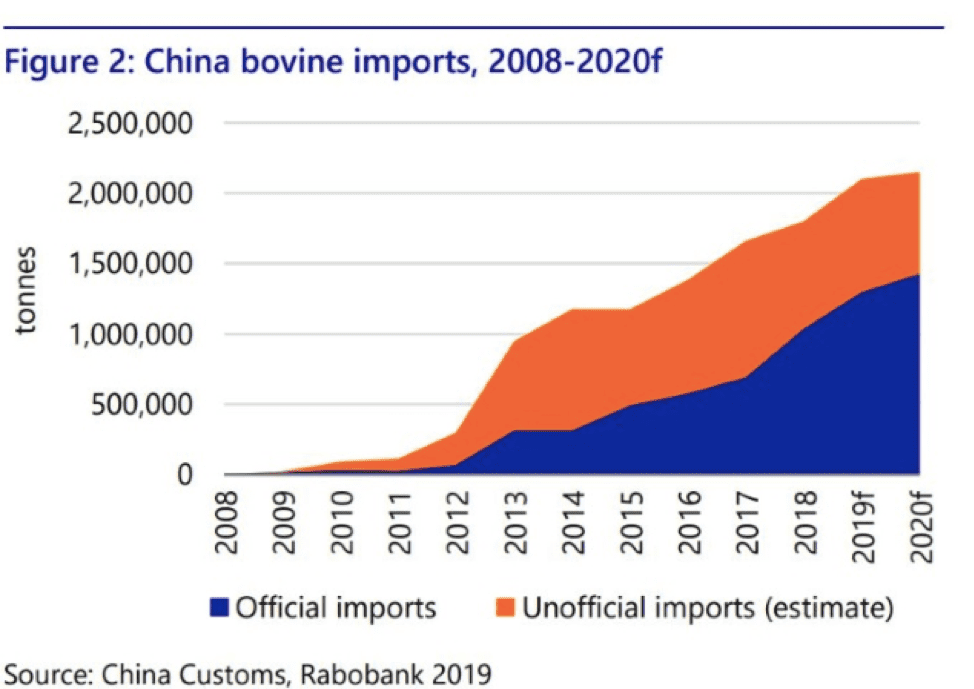

The graph presented by Rabobank below shows how unofficial import volumes have remained fairly static over the last four years while tonnage of official imports has risen sharply. Despite the total volume of imported product rising 400 percent from about 500,000 tonnes in 2012/13 tonnes to 2 million tonnes in 2018/19, the price of live slaughter cattle continues its steady climb.

See slaughter price graph at the top of this report showing how steer prices have been rising strongly in the face of these massive increases in processed beef imports. My interpretation is that this is demonstrating that fresh, locally slaughtered beef is still an entirely separate market segment with its price driven by supply and demand of locally available slaughter cattle rather than the competition presented by imported processed beef. With local cattle production static, live imports severely restricted (by health protocol issues) and consumer demand constantly rising, live slaughter cattle prices are likely to continue to increase.

In the face of rising beef prices, the Chinese government first move was to allow official imports to begin with Australian and other suppliers commencing imports in 2013. Other import sources were then permitted including Europe, USA and South America. Despite the reports of government crackdown on grey channel imports it appears from the graph below that volumes remain at more than 600,000 tons. After beef imports increased from virtually nil to more than 2 million tons over the last 10 years, Chinese beef prices remain amongst the highest in the world. Check the prices for wet and supermarket beef in the table attached to this report. What is their next move? Relax restrictions on live slaughter cattle imports? 1 million live slaughter cattle imports would only represent an approximate equivalent of 200,000 tonnes of processed product, less than 10 percent of current beef imports.

Philippines: Slaughter Cattle AUD $4.60 / kg (Peso 37.0 to AUD$1)

Local slaughter cattle prices have risen again this month from Peso 165 to Peso 170 per kg live weight. This rise combined with the strengthening Peso against the AUD has rocketed the AUD price to $4.60, second only to China. This phenomenal rise only began in late 2017 when the Philippines was consistently the lowest price in the region at less than $3 per kg. My agent reports that this is a simple matter of a shortage of supply from the domestic herd combined with strengthening demand from consumers enjoying solid economic growth combined with general social and political stability not seen in the Philippines from a very long time.

Thailand: Slaughter Steers AUD $4.38 / kg (Baht 22.4 to $1AUD)

Prices have risen sharply for both bulls and steers this month. Bulls are now 100Baht while steers are selling for 96Baht per kg live weight. I have used 98 Baht as the indicator price for this month, up from 92 last month.

Thailand is one of the most popular destinations for Chinese tourists which is great for their economy on the one hand but presents a huge risk factor in the context of African Swine Fever.

Between 21st January and the 3rd February, the Australian government conducted a trial on pork products that were seized or declared by incoming passengers at Sydney and Melbourne airports and mail arriving through the Sydney and Melbourne mail depots.

Of 162 seizures, 283 samples were tested for ASF with 40 samples positive for ASF virus fragments. Even more frightening, two samples were also positive for Foot and Mouth Disease virus.

If this is the situation in Australia, imagine how much infected product is entering China’s next door neighbours via their tourists and business travellers not to mention cross border smuggling which is a popular local pastime.

George Black is back in Ethiopia

February 2019 price table

These figures are converted to AUD$ from their respective currencies which are changing every day so the actual prices here are corrupted slightly by constant foreign exchange fluctuations. The AUD$ figures presented below should be regarded as reliable trends rather than exact individual prices. Where possible the meat cut used for pricing in the wet and supermarket is Knuckle/Round.

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Indonesia | Sept 18 | 12.15 | 14.95 | 3.37 | 4.02 |

| Rp10,700 | Oct 18 | 12.15 | 18.60 | 3.27 | 3.93 |

| Rp10,650 | Nov 18 | 12.21 | 14.84 | 3.57 | 3.85 |

| Rp10,300 | Dec 18 | 12.62 | 10.58 | 3.69 | 3.88 |

| Rp10,100 | Jan 19 | 12.87 | 15.64 | 3.76 | 3.91 |

| Rp10,000 | Feb 19 | 13.00 | 14.70 | 3.80 | 3.90 |

| Philippines | Sept 18 | 8.85 | 9.36 | 3.59 | 3.72 |

| P38.2 | Oct 18 | 9.95 | 10.47 | 3.66 | 4.06 |

| P38.2 | Nov 18 | 10.99 | 10.73 | 3.80 | 4.11 |

| P37.5 | Dec 18 | 11.20 | 10.93 | 3.87 | 4.19 |

| P37.5 | Jan 19 | 11.20 | 11.20 | 3.73 | 4.40 |

| P37.0 | Feb 19 | 11.35 | 11.35 | 3.78 | 4.60 |

| Thailand | Sept 18 | 9.36 | 11.91 | 2.98 | 3.98 |

| THB23.5 | Oct 18 | 9.36 | 12.34 | 2.97 | 4.09 |

| THB23.9 | Nov 18 | 8.37 | 11.72 | 2.92 | 3.97 |

| THB23.3 | Dec 18 | 8.58 | 12.02 | 3.00 | 3.97 |

| THB22.6 | Jan 19 | 8.85 | 12.39 | 3.10 | 4.07 |

| THB22.4 | Feb 19 | 8.93 | NA | 3.13 | 4.38 |

| Vietnam | Sept 18 | 18.45 | 16.61 | 8.04 | 4.17 |

| D16,700 | Oct 18 | 18.56 | 16.71 | 8.08 | 4.13 |

| D16,900 | Nov 18 | 18.34 | 17.87 | 7.69 | 4.14 |

| D16,500 | Dec 18 | 18.78 | 18.30 | 7.88 | 4.30 |

| D16,500 | Jan 19 | 18.79 | 18.30 | 7.58 | 4.36 |

| D16,500 | Feb 19 | 18.79 | 18.30 | 7.58 | 4.36 |

| China Beijing | Sept 18 | 12.55 | 18.12 | 4.05 | 5.55 |

| Y4.95 | Oct 18 | 12.53 | 15.76 | 3.64 | 5.45 |

| Y5.02 | Nov 18 | 12.75 | 15.94 | – | 5.48 |

| Y4.90 | Dec 18 | 12.65 | 16.32 | 4.08 | 5.61 |

| Y4.87 | Jan 19 | 12.32 | 15.61 | 4.11 | 5.65 |

| Y4.80 | Feb 19 | 12.92 | 16.67 | 3.75 | 5.73 |

| Shanghai | Sept 18 | 17.00 | 21.86 | 4.66 | 5.67 |

| Oct 18 | 16.16 | 21.82 | 4.44 | 5.66 | |

| Nov 18 | 16.73 | 21.51 | 4.98 | 5.58 | |

| Dec 18 | 17.55 | 22.04 | 4.90 | 5.51 | |

| Jan 19 | 17.25 | 22.18 | 4.52 | 5.13 | |

| Feb 19 | 18.33 | 22.08 | 5.00 | 5.42 |