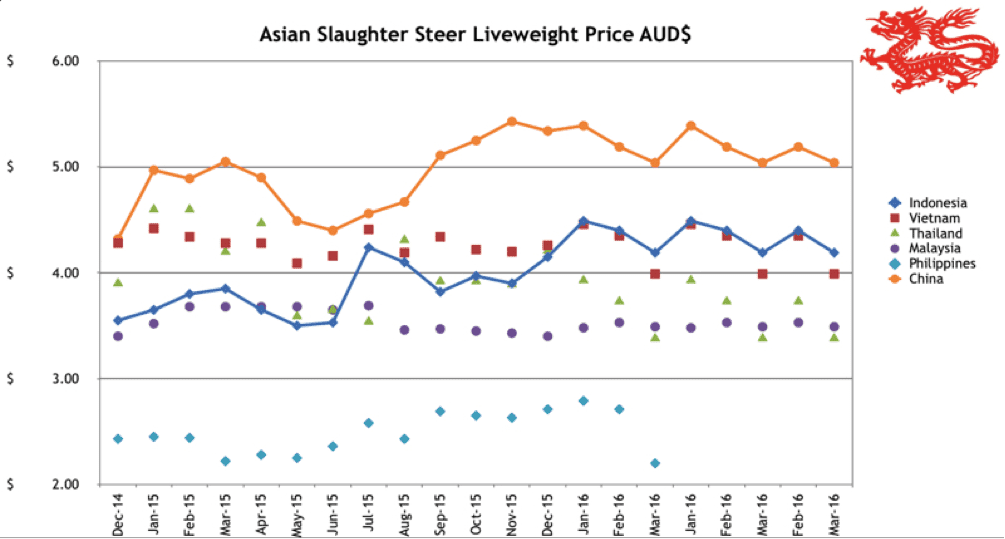

Indonesia: Slaughter Steers AUD $4.19/kg live weight (Rp9,900 = $1AUD)

Importers remain hostage to high-priced imported feeder cattle while the domestic slaughter market continues to weaken as the majority of consumers refuse to pay prices for fresh beef that will allow importers any chance of breaking even. Weakness in the domestic price is being further impacted by increasing volumes of smuggled Indian beef as well as discounted imported Australian secondary cuts. The government has allocated import permits to State-Owned-Enterprises (SOE’s) to purchase secondary cuts (mainly from Australia) which are wholesaling at about 30% less than locally produced product allowing them to capture supermarket customers from the local abattoir trade.

Reports of Indian buffalo beef in the Jakarta market have risen dramatically this month with prices quoted in the order of 50% of domestic wet market product. Most feedlots have now received the majority of Trimester 1 imports, providing pressure to discount fat cattle onto the market at whatever price is necessary to get them moving. As at the end of March that price was between Rp40,000 an Rp41,000 in West Java, well short of break-even.

My information on North Sumatera last month was incorrect, as the Medan prices still remain higher than those in the south Sumatera or Java. Numbers on hand in Medan are extremely low however with several feedlots with no stock on hand at all so their current price of around Rp44,000 per kg live weight only reflects the situation in the Medan area. Unless additional permits are provided for Medan their future looks quite grim.

The reports about the very weak economy in Sumatera, especially Medan were quite accurate so the general outlook at the present time is depressing.

The government continues with its plans to import Indian buffalo beef providing more bad news for domestic producers and the entire live cattle trade.

The only bright spot in the Indonesian market is in Bali where the tourist numbers are now fully recovered from the disruptive influences of last year’s volcanic eruptions and markets for locally produced product for the hotel and restaurant trade are strong.

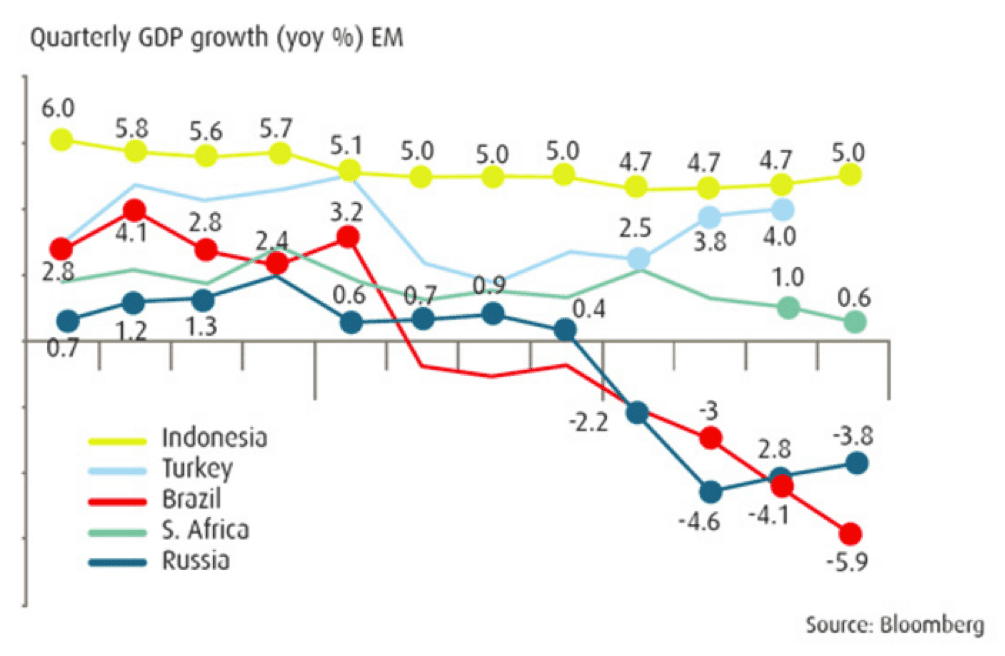

While some parts of Indonesia are in recession (North Sumatera and parts of Kalimantan) some other regions are doing well e.g. Sulawesi is booming. The net result however is that the Indonesian economy is doing very well compared to its colleagues in the BRIC countries and many others with GDP growth holding at around 5% – See graph below from Bloomberg:

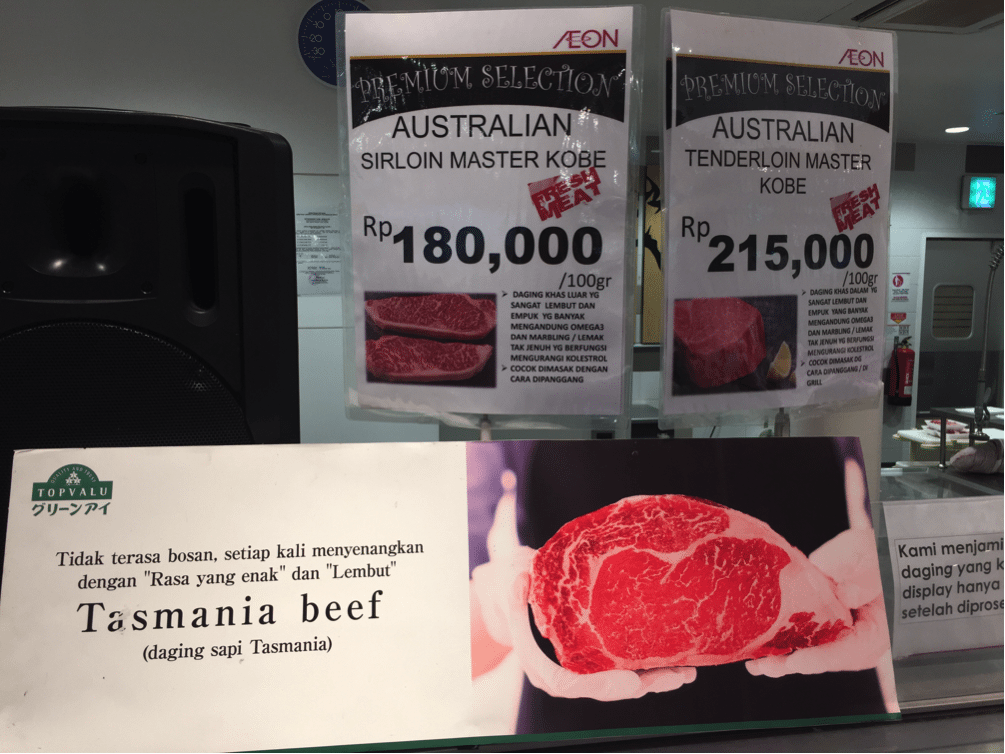

Perhaps the continued growth shown above is why some customers in Jakarta might be prepared to pay AUD$215 per kg for the Tasmanian Wagyu Tenderloin advertised in the picture below.

Photo taken last week in an upscale supermarket on the outskirts of Jakarta. Prices displayed are per 100 grams i.e. AUD$18 and $25 per 100 grams of each.

Indonesia’s conflicting import policies hard to understand

The Indonesian government has announced that it intends to import 50,000 breeding cattle for distribution around the archipelago during 2016. While this is a vital initiative to commence the rebuilding of the national herd, it is hard to understand how this makes sense in the context of opening up the meat market to Indian buffalo beef. History shows very clearly that when all of the other South East Asian countries commenced imports of cheap Indian beef their domestic breeding herds declined sharply due to poor profitability. The moment Indian buffalo beef arrives legally in Indonesia these breeders and the entire national herd will be worth about one third of their previous price and nobody will want to own a single loss-making specimen.

Vietnam: Slaughter Steers AUD $3.99/kg (VND16,800 to $1AUD)

Prices of slaughter cattle continue to be depressed by multiple factors with rates in the north down to Dong 68 to 71,000 per kg live weight while rates in the south are closer to Dong 67,000. Supply pressure is coming from some of the larger feedlotters needing to push their fats onto the market, some hangover from the Foot and Mouth disease culling and some feedlots in the south being forced to sell unfinished stock due to severe water shortages caused by the continuing El Nino.

The good news is that the Foot and Mouth Disease (FMD) outbreak that has been affecting mainly the north of the country since December/January is now resolving quite quickly as control measures have finally beat the spread. FMD did actually reach south Vietnam during March including some of the southern feedlots but its impact was minor and short lived.

Some meat traders continue to be caught in the act of disguising buffalo meat and pork as beef.

The focus of many importers remains on breeder cattle with some advertising breeders for sale at Dong 111,000 per kg live weight or using D16,800 as the conversion rate AUD $6.54 per kg live.

Thailand: Slaughter Steers AUD $3.38/kg (Baht 26.6 to $1AUD)

Slaughter cattle prices have weakened further to around Baht 85 to 90 per kg live weight for domestic slaughter as the export trade to China remains closed. Both government and private enterprise continue to promote breeding cattle although the progress has been very limited to date.

Malaysia: Slaughter Steers AUD $3.49 per/kg (RM3.03 to $1 AUD)

Prices were generally weak in Malaysia this month while the Malaysian Ringgit made a strong recovery.

Philippines: Slaughter Cattle AUD $2.71/kg (Peso 35 to AUD$1)

March included the Christian festival of Lent in which followers reduce their consumption of some luxury items which certainly include beef. The result was a short-lived drop in prices of beef and a spike in rates for fresh fish which appears to be the preferred food at this time.

Government officials have discovered another consignment of 12 containers of smuggled pork suggesting that the tide is turning against illegal imports which have plagued the pork industry in the recent past.

China: Slaughter Cattle AUD $5.04/kg (RMB 4.92 = AUD$1)

Beijing prices for live slaughter cattle rose slightly this month while rates in Shanghai declined. The reports from Shanghai suggest that the heavy cull of dairy cows continues at the same time as warmer weather traditionally reduces the seasonal demand for beef dishes.

I asked my China agents for some comments on the market and their two primary observations were:

- The Chinese beef cattle herd continues to shrink;

- The only resistance to high beef prices is coming from the poorest end of their consumer base while middle to upper income earners are continuing to buy – from hotpot dishes to the top flight steaks – regardless of the price.

Victoria Market – Melbourne’s “wet market”.

My sister visited the iconic Victoria market last week and sent me the photo below.

This display of first class Aussie beef is a clear demonstration that Australian consumers pay far less for quality beef than all of our South East Asian customer countries despite the fact that our incomes are significantly higher. This dream run of low prices for Aussie consumers is coming to an end very soon.

Dr Ross Ainsworth’s monthly South East Asian reports are first published exclusively on Beef Central. To view more of Dr Ainsworth’s previous Beef Central articles click here. To visit his personal South East Asia report blog site, click here.

Market price table for March 2016

(All prices converted to AUD)

| Location | Date | Wet Market

AUD$/kg |

Super market

$/kg |

Broiler chicken

$/kg |

Live Steer

Slaughter Wt AUD$/kg |

| Jakarta | October 15 | 13.27 | 16.32 | 2.85 | 3.98 |

| Nov 15 | 13.00 | 19.00 | 3.00 | 3.90 | |

| Dec 15 | 13.00 | 19.00 | 3.50 | 4.15 | |

| Jan 2016 | 13.26 | 16.32 | 3.26 | 4.49 | |

| Feb 2016 | 12.95 | 19.69 | 2.90 | 4.40 | |

| March 16 | 12.83 | 18.18 | 2.93 | 4.19 | |

| Medan | October 15 | 11.73 | 12.24 | 2.65 | 4.08 |

| Nov 15 | 10.50 | 11.00 | 3.30 | 3.70 | |

| Dec 15 | 10.00 | 11.00 | 2.20 | 4.10 | |

| Jan 2016 | 12.24 | 10.61 | 2.45 | 4.29 | |

| Feb 2016 | 11.92 | 10.36 | 2.54 | 4.14 | |

| March 16 | 11.11 | 10.50 | 2.12 | 4.49 | |

| Philippines | October 15 | 6.29 | 6.77 | 3.67 | 2.69 |

| Nov 15 | 6.47 | 6.88 | 3.61 | 2.65 | |

| Dec 15 | 6.90 | 7.02 | 3.65 | 2.63 | |

| Jan 2016 | 7.53 | 7.23 | 3.70 | 2.71 | |

| Feb 2016 | 8.24 | 7.50 | 3.82 | 2.76 | |

| March 16 | 8.00 | 7.28 | 3.57 | 2.71 | |

| Thailand | October 15 | 9.41 | 10.98 | 2.75 | 3.92 |

| Nov 15 | 9.34 | 10.89 | 2.72 | 3.89 | |

| Dec 15 | 9.19 | 10.73 | 2.68 | 4.21 | |

| Jan 2016 | 9.84 | 11.02 | 2.76 | 3.93 | |

| Feb 2016 | 9.02 | 10.98 | 2.75 | 3.73 | |

| March 16 | 9.39 | 10.52 | 2.63 | 3.38 | |

| Malaysia | October 15 | 9.12 Indian | 11.72 | 2.25 | 3.45 |

| Nov 15 | 9.06 Buffalo | 11.33 | 1.78 | 3.43 | |

| Dec 15 | 9.00 | 11.25 | 1.99 | 3.40 | |

| Jan 2016 | 9.18 | 11.47 | 2.13 | 3.48 | |

| Feb 2016 | 10.00 | 11.67 | 2.17 | 3.53 | |

| March 16 | 9.90 | 11.55 | 1.91 | 3.49 | |

| Vietnam | October 15 | 15.53 | 17.39 | 8.07 | 4.22 |

| HCM City | Nov 15 | 15.43 | 17.28 | 7.41 | 4.20 |

| Dec 15 | 15.43 | 17.28 | 7.40 | 4.26 | |

| Jan 2016 | 15.82 | 17.72 | 8.86 | 4.46 | |

| Feb 2016 | 15.52 | 17.39 | 8.07 | 4.34 | |

| March 16 | 14.88 | 16.66 | 7.74 | 3.99 | |

| China | October 15 | 15.32 | 19.69 | 4.38 | 5.25 |

| Beijing | Nov 15 | 15.22 | 21.65 | 4.34 | 5.43 |

| Dec 15 | 15.38 | 19.57 | 4.27 | 5.34 | |

| Jan 2016 | 15.86 | 19.91 | 4.35 | 5.39 | |

| Feb 2016 | 15.11 | 19.49 | 4.26 | 5.19 | |

| March 16 | 14.23 | 18.61 | 4.07 | 5.04 | |

| Shanghai | October 15 | 19.69 | 21.44 | 6.13 | 3.83 |

| Nov 15 | 19.56 | 20.87 | 5.65 | 3.80 | |

| Dec 15 | 18.37 | 20.94 | 5.98 | 3.84 | |

| Jan 2016 | 19.56 | 21.73 | 6.09 | 3.91 | |

| Feb 2016 | 17.87 | 21.70 | 5.96 | 3.72 | |

| March 16 | 14.63 | 18.21 | 5.69 | 3.45 |