The widening price disparity between imported Australian 90CL grinding beef and domestic US 90CL has not gone unnoticed by Beef Central readers in recent weeks.

The widening price disparity between imported Australian 90CL grinding beef and domestic US 90CL has not gone unnoticed by Beef Central readers in recent weeks.

Former Australian Meat Industry Council chairman Terry Nolan suggested recently that the topic deserved some scrutiny, and almost as if on cue, US analyst Len Steiner last week provided some insights as to what might be going on.

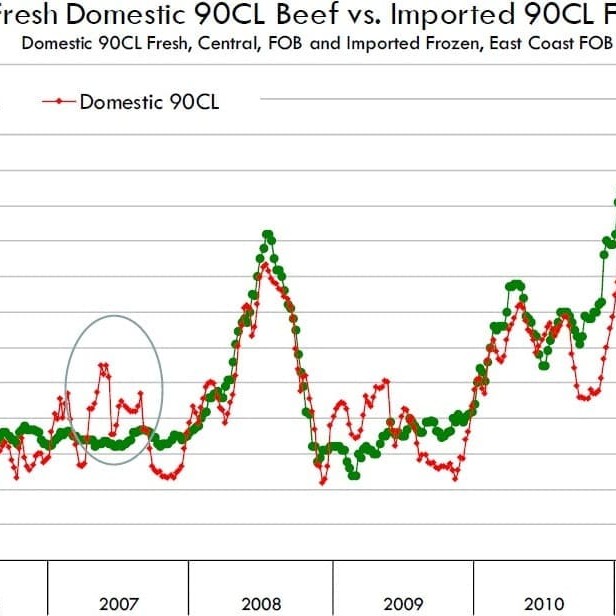

As the graph here clearly shows, imported 90CL frozen grinding beef has historically sold at a premium against domestic US fresh 90CL, at least since at least mid-2009, before moving strongly against that trend since February this year.

In Steiner Consulting Group’s latest US market report, to says imported grinding beef prices remain under pressure on limited demand from US end-users, adequate supplies of product in the spot market and generally a ‘soft undertone’ for frozen imported grinding beef.

The chart shows that domestic 90s product is currently trading at a significant premium to imported beef, which is reminiscent of the situation in years before 2008.

Based on prices late last week, the spread between domestic and imported 90CL beef is as much as US25c/lb when comparing FOB Central US versus FOB US East Coast, and US35c/lb when considering that it takes as much as 11c/lb to move product from Central areas of the US to East coast.

Steiner Consulting identifies a number of factors which it says are driving the current wide spread between domestic and imported 90s.

Primarily, it sees the difference being caused by demand out of the US retail sector as opposed to food service, and the considerable decline in the use of Lean Finely Textured Beef. Len Steiner says US retailers are aggressively chasing fresh domestic lean and extra lean beef trimmings. Frozen imported beef is generally not part of retail ground beef formulations in the US.

Primarily, it sees the difference being caused by demand out of the US retail sector as opposed to food service, and the considerable decline in the use of Lean Finely Textured Beef. Len Steiner says US retailers are aggressively chasing fresh domestic lean and extra lean beef trimmings. Frozen imported beef is generally not part of retail ground beef formulations in the US.

As a result, when Lean Finely Textured Beef (see Beef Central’s earlier LFTB article, “US grinder collapses under weight of LFTB woes”) was removed from retail shelves earlier this year, the only way to replace it was with domestic fresh lean beef, he said.

“Foodservice operators also had to replace LFTB with lean beef but the rate of replacement there was not the same as with retailers,” Mr Steiner said.

“Some of the large foodservice operators already had stopped using LFTB and were using lean beef trimmings. Sales at retail over the recent Memorial Day holiday weekend were generally good, although not spectacular. But again, because of the limited amount of imported beef going to retail, the seasonal demand tended to support domestic rather than imported product,” he said.

Somewhat disturbingly for Australia, Steiner’s assessment is that the US imported grinding beef business is not in very good shape. Large fast food chains had diversified their product offerings:

- The number one sales leader in the category, McDonalds, now offers a large number of premium chicken items on its menu as well as salads and other offerings. “The 75CL meat-block is currently running around US1.67c/lb compared to chicken breast at US1.45c. And the spread between the beef meat block and chicken patty will likely get larger after September,” Mr Steiner said.

- The number-two ranked food service operator in the category, Wendy's, specifically advertises its product as ‘Fresh, never frozen beef”, which would seem to preclude imported beef completely.

- The number three category leader, Burger King, recently revamped its menu and is currently offering a new line of product in addition to its regular hamburger offerings. New product offerings support overall sales growth, but they cannibalise sales of traditional items, such as hamburgers.

- New hamburger chains have opened, with considerable success, such as ‘Five Guys’, which was rated as the fastest growing restaurant chain in the US. Five Guys markets premium hamburgers that do not use frozen imported beef.

“In all, demand for imported beef has not increased as robustly as that for domestic product,” Mr Steiner said.

“Keep in mind, however, that we still are trading imported beef in the US at above US$2/lb, above year-ago levels. The large spread between domestic and imported reflects where the demand growth for lean beef stands at this time.”

- Friday's MLA market news noted that domestic US 90CL beef continued to trade at a significant premium to imported beef. Imported lean grinding beef prices eased to 195.5US¢/lb CIF (or 404.9A¢/kg FAS) as US end-users stayed on the sidelines. Domestic US lean beef prices also eased 5.2US¢, to average 228.3¢/lb. Despite the decline in the US imported 90CL indicator, prices in A$ terms remained 51.4¢/kg stronger compared with the same period last year, MLA said.

HAVE YOUR SAY