Meat Standards Australia has notched up another record-breaking year, grading more than 1.42 million cattle for 2010-11 according to preliminary data to be finalised early next week.

Meat Standards Australia has notched up another record-breaking year, grading more than 1.42 million cattle for 2010-11 according to preliminary data to be finalised early next week.

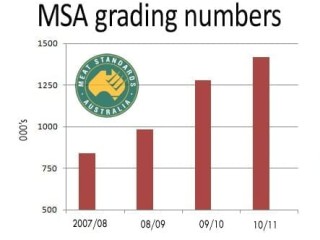

That’s up almost 10 percent, or 140,000 head of cattle on last year’s grading throughput of 1.28 million head and a rise of better than 40pc over the past four years (see graph).

MSA was on track for a grading tally above 1.5 million head earlier in the 2010-11 year, but suffered a setback during the flood and rain supply-impacted period from November to March when slaughter rates were reduced in eastern states (see Beef Central’s weekly kill graph).

Dry to drought conditions in Western Australia also curtailed potential growth in MSA grading numbers in that state this year.

The 2010-11 year’s performance contrasts with earlier years in one important area: growth has come from expansion in grading numbers through existing MSA-licensed abattoirs, rather than an expansion in the number of licensed abattoirs themselves.

In fact there have been only one or two additional processing plants added to the licensed-operator list this year, suggesting the growth in plant uptake may now have largely run its course. New additions to the MSA-licensed abattoirs list included Moe Meat Packers and Tabro Meat Packers, both smaller-scale operators in Victoria.

Where the biggest change has occurred has been in accredited producer numbers, which leapt another 2500 during 2010-11, to more than 19,000 MSA cattle suppliers nation-wide. The growth has come fairly consistently across all states, but was particularly evident in Victoria and Queensland.

“There was still a surprising number of livestock producers supplying under MSA for this first time during the fiscal year just completed,” MSA manager Michael Crowley said on Friday.

Part of the growth in producer uptake in Victoria can be explained by the adoption of MSA through JBS plants, formerly owned by Tasman Group, and other Victorian processors. All JBS beef processing sites in Australia are now MSA-licensed – a remarkable result given the consistent resistance towards the program under earlier AMH management. Similarly all Teys Brothers plants are now licensed for MSA supply.

Another important addition to MSA-accreditation last year was Nippon Meat Packers’ large Oakey export abattoir on Queensland’s Darling Downs. At this stage the factory is employing MSA only on cattle custom-killed for the Australian Agricultural Co’s 1824 brand, but it is an important first step.

Oakey has placed an increasing emphasis on the domestic market in recent years. Significantly, Nippon had two strong contenders in the RNA branded beef competition held in June – Oakey Reserve and Borthwicks Organic brands, both of which competed strongly as first-time entrants in the open, (non MSA) class.

The expansion in national grading numbers this year was obviously through a larger population of accredited producers, and more cattle being put through MSA programs by existing stakeholders, Mr Crowley said.

Premiums driving uptake

One of the motivations for more producers seeking accreditation had been consistently good livestock premiums available this year. The national average for MSA premiums across Australia last year was “a lot closer to 15c/kg than 10c/kg,” Mr Crowley said.

One of the motivations for more producers seeking accreditation had been consistently good livestock premiums available this year. The national average for MSA premiums across Australia last year was “a lot closer to 15c/kg than 10c/kg,” Mr Crowley said.

Within that, however, there was considerable variation between states, and even within state boundaries, with jumps from 10c to 20c/kg fairly common.

That reflected seasonality, and also processors being short of cattle due to weather circumstances while holding supply commitments. There were periods last year when one NSW processor had 30c/kg for MSA cattle during the flood-affected start of the year, for its supermarket supply program.

With the exception of WA, the strong seasonal conditions during 2010 and 2011 also had a bearing on results, with MSA grading compliance rates between 91 and 92pc, on all MSA cattle from JBS Townsville and Bingal Bay in far North Queensland, to Smithton in Tasmania. That figure does not include cattle eliminated on company specifications, including weight, dentition, boning group or in some cases, marbling scores.

At one point half way through the last financial year, national MSA grading compliance was running at close to 95 percent, unheard-of on a national scale previously, before settling a little during the second half.

“That was very much season driven, the result of better finished and earlier growing cattle,” Mr Crowley said.

This year there was nothing to split grading numbers between grassfed and grain finished cattle, each running at about 50pc of total numbers graded. The grass component, however, has made up a steadily increasing proportion over the past four or five years. The decline in grainfed numbers overall over the past year or two may have also enhanced the grassfed ratio.

Mr Crowley said he felt 1.5 million was an achievable MSA grading target in the new 2011-12 financial year, given the strong start to the year achieved in July, and reasonably positive seasonal outlook in the medium term.

“That would include the incorporation of plants that are not yet licensed that will come on board in coming months, and some of the really good strategies that are emerging in brand programs in further segregation among existing processors,” he said.

Export is not yet a significant driver under MSA’s export program, and that is unlikely to change in the current trading environment, where the A$ is nudging US110c in value, making our exports much less competitive.

- The official MSA throughput figure for 2010-11 will be decided by mid-week. Beef Central will publish the specific number in an upcoming news briefs post.

HAVE YOUR SAY