AT A recent Agribusiness Australia event, Queensland Investment Corporation’s Global Private Equity principal, Phillip Cummins, highlighted the sector’s potential as a new focus for institutional investors, something he sees developing significantly over the next five years.

Until then, it’s likely that the few early adopters currently active in this space will continue to set the scene.

In his presentation, Mr Cummins spoke of the challenges institutional investors need to be aware of in order to fit agribusiness into their portfolios, the case for agribusiness as an opportunity for structured growth and advice on how it can be moulded to fit within an existing portfolio.

Much of his discussion was contextualised within QIC’s investment in the North Australian Pastoral Co. As a fund manager, QIC has learnt a lot from its engagement with NAPCo, and used the relationship as an example of how agribusiness could become a viable investment target, and should within the coming years.

While largely focusing on an Australian context, Mr Cummins also noted that there are positive trends globally when it comes to major institutional investments in agriculture. Notable institutional investors in Europe, North America, and Asia are among some of the early adopters, and New Zealand Super recently reported it has a 2 percent allocation reserved solely for agribusiness which will result in an additional $700 million being invested in agriculture.

Overall, agribusiness still remains a very small part of investment portfolios for many investment institutions, a fact that’s likely to change as people realise how they can make these opportunities work for them.

Why are some institutions still hesitant over agribusiness investments?

So far, the broad approach to agribusiness investment has been an opportunistic one, which means when it does occur, it’s rarely defined by a pre-set strategy. So while investors are acknowledging that agribusiness expenditure can yield attractive returns, they aren’t always creating normalised frameworks that allow it to become an ongoing focus.

This is often compounded by the fact that opportunities in the agribusiness sector rarely meet the scale that these investors are looking for. It’s a trend investors will have to take some action over, namely by consolidating other purchases.

Globally there has been a significant investment in passive farmland, however there is an increasing trend by institutions wanting to pursue an active strategy. For agribusiness to become an attractive option for funds of this size, there needs to be a clear strategy to turn largely farmland businesses into active pursuits.

The widespread reporting on public failures in Australia can also put some Australian institutional investors off agribusiness investment and encourage them to stay within other sectors that are known quantities. Mr Cummins noted that there is an overwhelming trend towards investors being incredibly risk-conscious. It’s a good sign that they’re making an effort to be abreast of the various challenges the agribusiness sector may present, but they aren’t always familiar with what it takes to mitigate them.

Finally, once investors have overcome the risks or found an opportunity that meets the desired scale, the challenge is that it isn’t always clear how an agribusiness fits into an established portfolio.

These are traditionally divided up by categories such as equities, real estate, infrastructure, private equity or fixed income and so on. But an agribusiness is often composed of elements of more than one category, further adding to the challenge of finding a place for it.

For example, typically an agribusiness has a real estate component, an operational focus and also a commodities component, so it isn’t easy to simply add it to a portfolio, especially considering it will often encompass such a small part of the overall fund.

Making the case for agribusiness investment

From Mr Cummins’s meetings with institutions in Europe, North America, and Asia, he has found that there is universal buy-in to the food and agriculture investment thesis with the key drivers being food security, rising middle class in Asia and changing diets.

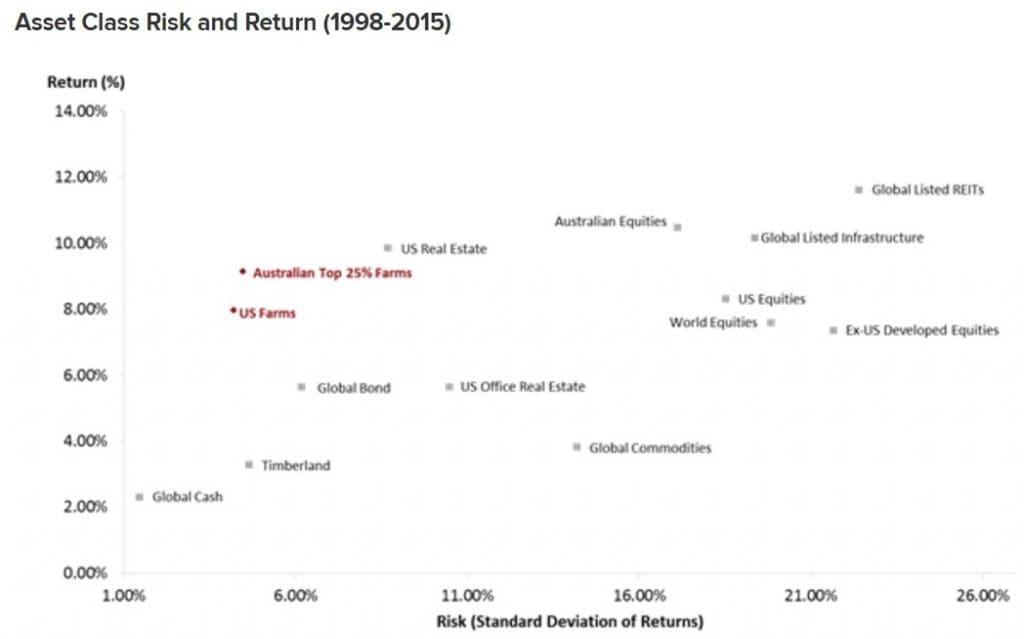

In the current investment environment with global uncertainty, negative interest rates and values for other asset classes at the high end, the returns offered by agriculture are compelling (refer to graph below, demonstrating that Australian farms offer favourable risk adjusted returns).

Furthermore, agricultural investment offers important diversification for portfolios.

For one, there is currently not a lot of agricultural investment in portfolios and in cases where the majority of other assets may have volatile and fluctuating values, agribusinesses are often either stable or have prices that are moving in the opposite direction. This negative correlation means they’re a valuable consideration for portfolio attention, and reinforces their status as a point of diversification.

The current challenge for institutions investing in agriculture is implementation.

There have been limited investment opportunities available. It is currently easier to put money to work in infrastructure, real estate and private equity which offer trillions of dollars’ worth of opportunities, and have established and familiar investment structures – something that agribusiness can’t yet boast.

As it becomes a more attractive opportunity for investment in the coming years, investment managers will develop and begin to provide this much needed supporting infrastructure.

A further challenge for institutional investment in agriculture is that since the Global Financial Crisis the bar for institutional investment generally has risen dramatically. Investment decisions now involve the investment team, legal team, compliance team, regulatory team, investment committee, and Environment Social and Corporate Governance team. Decision making is very complex and there are a lot of reasons not to make an investment.

As investors find ways to overcome the challenges in the coming years, Mr Cummins is predicting an increased focus on agribusiness as a viable option for institutional investors. However, he is also aware that there is significant competition for investor attention. Essentially, potential agribusiness investments need to fight for their place in portfolios.

Where do agribusinesses fit in an investment portfolio and the appeal of NAPCo?

Due to decision-making being a complex process for institutional investors, conversations regarding new opportunities can take between 12 to 18 months, so potential investments that don’t fit easily within established frameworks are often overlooked in favour of those that do.

To satisfy the concerns that many investors have over fitting agribusiness into their current portfolio, Mr Cummins drew heavily on QIC’s experience investing in NAPCo, giving valuable real-world context to what is still a theoretical concept for many.

Building on QIC’s approach to NAPCo, Mr Cummins said the conclusion was that agribusiness investment fitted best within private equity. A key investment criterion was that there was a need for scale given the need to put significant amounts of capital to work.

Further, with NAPCo there was the opportunity to grow the business with additional investment in the current business and within the beef value chain. QIC noted that the value chain for the business was highly fragmented both horizontally and vertically, so there is room to grow larger enterprises in the market.

QIC also had a need to manage the risks which without deep industry experience and operational expertise within QIC the best way to do so was via a company. The deep management expertise of NAPCo is expected to contribute to higher returns in the long term. QIC also saw real value in taking a business-building approach to managing and growing this investment, citing some of the overarching trends associated with the beef industry as key points of motivation.

Mr Cummins also noted that the way agribusiness investments fit into a portfolio has potential to evolve over time as well. With activity expected to ramp up over the next five years or more, it may even grow to the point of being considered its own asset class by institutions that exhibit a strong focus on these opportunities.

Focusing on the future of agribusiness investment

Although the short- to mid-term focus on agribusiness investment will still be the realm of early adopters, there is the potential for these opportunities to attract significant attention from institutions in the future.

Mr Cummins’s account of QIC’s experience with NAPCo provides valuable context to how interested investors can overcome some of the challenges associated with agribusiness, such as how it fits into a portfolio and how it can support other asset classes.

While there are still challenges, the appeal of a diverse asset portfolio and opportunity to get ahead of the curve should encourage larger institutions to invest, despite the fact these assets might not fit as easily into a portfolio as more traditional options such as real estate and infrastructure.

Source: BDO

HAVE YOUR SAY