Australian cattle enterprises are likely to experience an overall cost increase of just over 0.5 percent this financial year as a direct result of the carbon tax introduced on July 1, an analysis by the Australian Farm Institute suggests.

Australian cattle enterprises are likely to experience an overall cost increase of just over 0.5 percent this financial year as a direct result of the carbon tax introduced on July 1, an analysis by the Australian Farm Institute suggests.

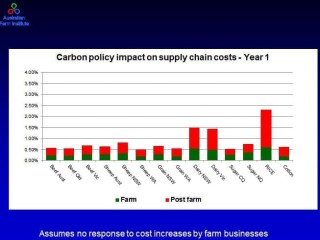

The AFI has used modelling based on data from the Australian Bureau of Agriculture and Resource Economics and Sciences to track the likely impacts of the carbon tax at farm level and at post-farm level.

AFI executive director Mick Keogh told a Westpac Beef Forum in Sydney last week that beef producers were unlikely to experience a significant increase in direct costs in the first year of the tax, due to their low relative electricity usage.

The modelling showed that farm supply chains that used large amounts of energy would be impacted more heavily, such as dairy and rice production.

While a number of larger meat processors and packers will endure significant cost increases under the tax, the overall impact for producers was not likely to be significant in year one.

“There will be additional costs at the processor level as a consequence of the carbon tax and that will be seen at farm level, but in many respects the beef industry is not too bad,” Mr Keogh explained.

“By the time you add both on-farm costs – and not to many beef farms use large amounts of electricity – and post farm costs, you see an overall cost increase per unit of production of around about 0.5pc.

“It is not going to blow anyone out of the water you would hope, but it is another pressure that needs to be thought about.”

However the industry is likely to face a heavier burden from 2014 when the carbon tax is expected to apply to fuel used for heavy transport, which will add to the cost of all agricultural inputs and outputs.

The AFI analysis suggests that overall costs for beef producers will increase by 1.5pc in year three, if the tax is applied to on-road fuel in 2014 as anticipated.

HAVE YOUR SAY